Abstract

This article analyzes the effects of compulsory insurance on the demand for self-insurance. We show that although a risk lover invests neither in insurance nor in self-insurance when insurance is voluntary, she invests in self-insurance when insurance is compulsory. On the contrary, when insurance is mandatory, a risk averter would substitute self-insurance for insurance. Economic policy implications of these antagonistic effects on self-insurance are discussed.

Similar content being viewed by others

Notes

As in Ehrlich and Becker (1972), self-insurance relates to the expenses reducing the size of the loss in case of an accident (for example, seat belts or health screening tests), while self-protection is an investment intended to reduce the loss probability.

Except when insurance prices are subsidized.

Without this assumption, a full insurance contract would crowd out all self-insurance opportunities. As shown in the Lemma 1 of Sect. 5, when facing full compulsory insurance, a decision maker, whether risk lover or risk averter, would invest in self-insurance in such a way that \({\text{SI}}^{\prime}\left( {a^{*} } \right) = \frac{1}{q}.\)

\(\frac{{\partial ^{2} {\text{EU}}}}{{\partial a^{2} }} = \left( {1 - q} \right)U^{{\prime \prime }} \left( {W_{0} - p\bar{I} - a} \right) + {\text{SI}}^{{\prime \prime }} \left( a \right)qU^{\prime } \left( {W_{0} - p\bar{I} - a - x_{0} + {\text{SI}}\left( a \right) + \bar{I}} \right) + \left[ {1 - {\text{SI}}^{\prime } \left( a \right)} \right]^{2} qU^{{\prime \prime }} \left( {W_{0} - p\bar{I} - a - x + {\text{SI}}\left( a \right) + \bar{I}} \right) < 0\).

It is worth noting that complementary insurance, if available, would eliminate this shortage. The policyholder could combine voluntary complementary insurance (Ic) with \(\bar{I}\), so as to achieve the optimum \(\left( {I^{*} = \bar{I} + I_{c} } \right)\). However, we have kept this case since it is entirely plausible that complementary insurance would be impossible to organize (adverse selection, moral hazard, narrow market, regulation, etc.). Moreover, even if provided, it would not necessarily be available to everyone.

Once \(p \ge q\), a risk lover has no incentive to invest in voluntary insurance activity.

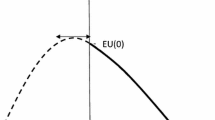

Figure 1 remains an example and many other scenarii could arise, such as full insurance or over-insurance.

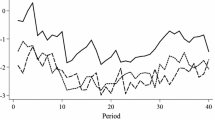

We simulated and obtained this kind of equilibrium with the following parameters: CRRA (Constant Relative Risk Aversion) utility function with a risk aversion of − 1.8, W0 = 10, x0 = 5, q = 0.2, loading rate of 30% (p = 0.26) and with a self-insurance technology characterized by \({\text{SI}}\left( a \right) = \ln \left( {30a + 1} \right).\)

At point D, the level of self-insurance is zero (a = 0) and the risk lover faces the maximum possible loss, x(0) = x0.

For ease of exposition, we focus on the case of a single maximizer of expected utility. However, our comparative statics argument, based on the single crossing property, still holds in case of multiple solutions.

This last effect would be reversed with \(\bar{I} > x_{0} - {\text{SI}}\left( {a^{*} } \right)\), an amount of compulsory insurance leading to an over-insurance coverage.

The first-order condition (3) characterizes a maximum only in the case of risk averters.

By symmetry, if there is over-insurance, the marginal cost of self-insurance is increasing, and the total effect of an increase in the insurance coverage on the marginal perception of self-insurance is not clear.

References

Akerlof, G. 1970. The market for “lemons”: Quality uncertainty and the market mechanism. Quarterly Journal of Economics 84: 488–500.

Carson, J., K. McCullough, and D. Pooser. 2013. Deciding whether to invest in mitigation measures: Evidence from Florida. The Journal of Risk and Insurance 80 (2): 309–327.

Chakravarty, S., and J. Roy. 2009. Recursive expected utility and the separation of attitudes towards risk and ambiguity: An experimental study. Theory and Decision 66 (3): 199–228.

Cohen, M., J.Y. Jaffray, and S. Tanios. 1987. Experimental comparison of individual behavior under risk and under uncertainty for gains and for losses. Organizational Behavior and Human Decision Processes 39: 1–22.

Corcos, A., F. Pannequin, and C. Montmarquette. 2017. Leaving the market or reducing the coverage? A model-based experimental analysis of the demand for insurance. Experimental Economics 20 (4): 836–859.

Crainich, D., L. Eeckhoudt, and A. Trannoy. 2013. Even (mixed) risk-lovers are prudent. American Economic Review 103 (4): 1529–1535.

Ebert, S. 2013. Even (mixed) risk-lovers are prudent: Comment. American Economic Review 103 (4): 1536–1537.

Ehrlich, I., and G. Becker. 1972. Market insurance, self-insurance and self-protection. Journal of Political Economy 80: 623–648.

Hofmann, A., and R. Peter. 2016. Self-insurance, self-protection, and saving: On consumption smoothing and risk management. Journal of Risk and Insurance 83 (3): 719–734.

Kahneman, D., and A. Tversky. 1979. Prospect theory: An analysis of decision under risk. Econometrica 47 (2): 263–291.

Milgrom, P., and C. Shannon. 1994. Monotone comparative statics. Econometrica 62: 157–180.

Mossin, J. 1968. Aspects of rational insurance purchasing. Journal of Political Economy 76 (4, Part 1): 553–568.

Pannequin, F., A. Corcos, and C. Montmarquette. 2019. Are insurance and self-insurance substitutes? An experimental approach. Journal of Economic Behavior & Organization, forthcoming. https://doi.org/10.1016/j.jebo.2019.05.018.

Peter, R. 2017. Optimal self-protection in two periods: On the role of endogenous saving. Journal of Economic Behavior & Organization 137: 19–36.

Rothschild, M., and J.E. Stiglitz. 1976. Equilibrium in competitive insurance markets: An essay on the economics of imperfect information. Quarterly Journal of Economics 90: 630–649.

Acknowledgements

The authors would like to thank Claude Montmarquette (CIRANO and Université de Montréal), Georges Dionne (HEC Montréal), Rachel Huang (National Central University, Taïwan), Valentin Baudin (ENS Paris-Saclay), and participants at the 2017 ARIA (American Risk and Insurance Association) annual meeting held in Toronto for valuable discussions and comments on the paper. The comments of two anonymous reviewers have substantially improved the paper. This work is partially supported by a grant overseen by the French National Research Agency (ANR) in the context of the “Investissement d’Avenir” program through the “iCODE Institute project” funded by the IDEX Paris-Saclay, ANR-11-IDEX-0003-02.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pannequin, F., Corcos, A. Are compulsory insurance and self-insurance substitutes or complements? A matter of risk attitudes. Geneva Risk Insur Rev 45, 24–35 (2020). https://doi.org/10.1057/s10713-019-00043-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s10713-019-00043-x