Abstract

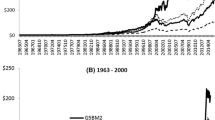

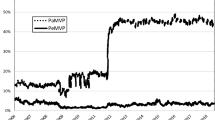

A number of investment strategies designed to maximise portfolio growth are tested on a long-run US equity dataset. The application of these growth optimal portfolio techniques produces impressive rates of growth, despite the fact that the assumptions of normality and stability that underlie the growth optimal model are shown to be inconsistent with the data. Growth optimal portfolios are constructed by rebalancing the portfolio weights of Dow Jones Industrial Average (DJIA) stocks each month with the aim of maximising portfolio growth. These portfolios are shown to produce growth rates that are up to twice those of the benchmark, equally weighted, minimum variance and 15 per cent drift portfolios. The key to the success of the classic, no short-sales, growth optimal portfolio strategy lies in its ability to select for portfolio inclusion a small number of (DJIA) stocks during their high growth periods. The study introduces a variant of ridge regression to form the basis of one of the growth focused investment strategies. The ridge growth optimal technique overcomes the problem of numerically unstable portfolio weights that dogs the formation of short-sales allowed growth portfolios. For the short-sales not allowed growth portfolio, the use of the ridge estimator produces increased asset diversification in the growth portfolio, while at the same time reducing the amount of portfolio adjustment required in rebalancing the growth portfolio from period to period.

Similar content being viewed by others

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hunt, B. Feasible high growth investment strategy: Growth optimal portfolios applied to Dow Jones stocks. J Asset Manag 6, 141–157 (2005). https://doi.org/10.1057/palgrave.jam.2240172

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.jam.2240172