Abstract

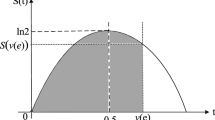

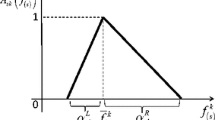

The objective of this paper is to posit a fuzzy optimal control model explicitly to derive the optimal rebalancing weights (ie dynamic hedge ratios) to engineer a structured financial product out of a multi-asset best-of option. The target function is actually the total cost of hedging (tracking) error over the investment horizon t=0 to T, which is assumed to be partly dependent on the governing Markovian process underlying the individual asset returns and partly on randomness, ie pure white noise. To derive the necessary conditions for the fuzzy optimal control, the following problem is considered: minimise ε=∫T2f0(r, v, t) dt subject to the condition drj/dt=fj (r, v, t), where r is the vector of n state variables, ie the vector of returns on the n assets underlying the best-of option, and v is the vector of m fuzzy control variables, ie the values of the replicating portfolio for m different choices of the dynamic hedge ratios. As the choice set is fuzzy, the fuzzy control vector is a subnormal fuzzy subset [p1/v1, p2/v2 … pn/v&n]; pj is the membership grade of the jth portfolio at time t.

Similar content being viewed by others

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Bhattacharya, S., Khoshnevisan, M. A proposed fuzzy optimal control model to minimise target tracking error in a dynamic hedging problem with a multi-asset, best-of option. J Asset Manag 6, 136–140 (2005). https://doi.org/10.1057/palgrave.jam.2240171

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1057/palgrave.jam.2240171