Abstract

The basis of this paper is to go beyond abstract definitions of what a cluster is, and look at a variety of measurable indicators, to see which can demonstrate the presence of a cluster. The example presented is based on the biotechnology industry in Vancouver, Canada. Biotechnology differs from conventional industries, in that there are few tangible goods or services traded, but rather the basis of value creation is primarily the sale or licensing of intangible intellectual property or the (usually pre-revenue) firms themselves. The two main questions we aim to test are (i) is there a biotechnology cluster in Vancouver, and (ii) what are its inputs, outcomes, and impact on the region? We use data provided from local and federal agencies such as LifeSciences British Columbia and Statistics Canada to compare biotechnology R&D activity across regions, and within the local economy. Our findings indicate that there is significant activity around biotechnology R&D and commercialisation in Vancouver, but no guarantee of the longevity of the innovation system.

Similar content being viewed by others

INTRODUCTION

Cluster research has its roots in economic geography and often focuses on traditional manufacturing sectors. In this manner, it is reminiscent of Adam Smith's pin factory and local agglomeration economies, in which direct competitors, suppliers, and customers are in relative proximity to each other. While the appropriately vague definitions of clusters, and sometimes regional innovation systems, do not exclude knowledge-intensive sectors, most of the research done to date has focussed on production economies. Some extant definitions of clusters are reviewed here before we look at the particular case of biotechnology.

Probably the most well-known cluster scholar is Michael Porter. He defines a cluster as ‘a geographically proximate group of interconnected companies and associated institutions in a particular field, linked by commonalities and complementarities’.1 Slightly older than his definition is a more concise one that states ‘A cluster is a geographically bounded concentrations of interdependent businesses’.2 Meanwhile, a more recent definition builds on these to state that ‘Clusters are regarded as places where close inter-firm communication, and social-cultural structures and institutional environment may stimulate socially and territorially embedded collective learning and continuous innovation’.3

In these definitions, the firms are not just in geographic proximity to each other, but there is some degree of interconnectedness between them. This may be through vertical relationships such as with suppliers and customers, or horizontal relationships such as with partners, collaborators, and possibly competitors. The associated institutions are primarily post-secondary education and government facilities, but may also include industry associations. Using the example of the biotechnology sector in Vancouver, this study explores the interrelationships between firms and associations to institutions. By and large, we find more relationships between firms and institutions, and little more than association between firms by way of the common relationships to institutions or a mutual common cause (creating value by improving human health).

METHODOLOGY

The facts and figures presented in this study are based on 50 interviews conducted in the biotechnology sector in Vancouver as of the first round of research by the Innovation Systems Research Network (ISRN), as well as data triangulated from reports by various local, regional, or national government agencies. The ISRN is a cross-disciplinary, Canadian network of researchers drawn from five regional nodes based in Atlantic Canada, Québec, Ontario, and western Canada. In 2001 ISRN launched the five-year project ‘Innovation Systems and Economic Development: The Role of Local and Regional Clusters in Canada’ funded mainly by the Social Science and Humanities Research Council (SSHRC), with some additional support from other federal and provincial agencies. This project investigated how local networks or clusters of firms and supporting infrastructure of institutions, businesses, and people in communities across Canada interact to spark economic growth. Research focused on 27 clusters across the five regions in Canada in newly emerging knowledge-intensive areas as well as in more traditional sectors. It covers large metropolitan settings located near research-intensive universities as well as rural settings. One of the objectives of the ISRN study was to develop a methodology to examine regional innovation systems and their constituent features, and to define the necessary and sufficient conditions for the continued existence of the clusters in the regional innovation systems.4, 5

The interview guide was based on the OECD Oslo Manual and Statistics Canada innovation surveys. This study draws on the 50 interviews conducted in two rounds, during the summers of 2002 and 2003, comprising 23 biotechnology firms, seven government agencies, seven contract research and manufacturing organisations, five venture capital companies, five law and consultancy firms, two research institutes, and one civic association.

INDICATORS OF A BIOTECHNOLOGY CLUSTER

Before covering the cluster indicators for the biotechnology cluster in Vancouver, a brief history of the development of biotechnology commercialisation in Vancouver is provided.

Background on the Vancouver biotechnology sector

The biotechnology industry in the Lower Mainland is composed mainly by young and small firms,6, 7 inspired by QLT Inc. (created in 1981), which is the largest (around 300 employees), privately owned biotechnology firm, and which achieved a market capitalisation of over USD $1bn dollars. At present, there are more medium-sized companies, and some are following the successful path of QLT. In 2001, there were approximately 2,500 people employed in Vancouver's biotechnology industry. In 2002, the top local companies produced approximately $170m in revenues, of which 87 per cent corresponded to QLT. Some of the better known biotechnology and health sciences companies in Vancouver got started before venture capital business was established as an avenue for financing growth, as for example MDS Metro Labs (founded approximately 50 years ago), or were pioneers in seeking larger sums of venture capital investment, as for example Neuromed (founded 1998) or Angiotech (founded 1992), both of which achieved over $1bn market capitalisation.

In 1991, a separate industry association was launched to provide a forum through which players in the sector could meet and communicate. The association was originally named BC Biotech, and recently renamed to LifeSciences British Columbia (BC). Their current website claims that ‘British Columbia is home to approximately 90 biotechnology companies making it the 7th largest cluster in North America (ahead of New York, Pennsylvania, Seattle, Florida)’.8

Subjective indicators

When asked if they consider their company to be part of a network of related firms and the existence of facilities associated with it, such as R&D labs and venture capitalists (ie they are part of a cluster), 48 per cent of the participants of the ISRN interviews replied with yes. This indicates that one cannot deny that there is no indication of a biotechnology cluster in Vancouver. Whether it is enough of a response to affirm the presence of a cluster depends on the threshold chosen by the researcher.

In asking the participants about contributing factors to them having launched their businesses in this region, 85 per cent affirmed that their location is due to the founders being from Vancouver. This does not necessarily mean they were born in Vancouver, but that their most recent occupation was also in the area. In addition to the professional benefits of starting a firm in the same region as their prior career, 18.5 per cent affirm that Vancouver is a nice place to live and provides a high quality of life. This is not only an additional reason for the founders to stay in the region, but also a potential draw for new hires.

Participants were asked to rate whether various factors commonly mentioned in cluster research contributed or inhibited the growth of their firms, as summarised in Table 1. The results confirm some traditional cluster research ideas, and demonstrate agreement with more advanced models of biotechnology clustering and commercialisation.

Co-location with other firms was an important growth factor, but most important was the existence of specialised research institutes and universities, and the accompanying factor of skilled labour they produce. Benefits of co-location usually referred to the ability to meet with others in person, often on short notice. This applied particularly to interaction between biotechnology firms and their supporting organisations, such as lawyers, government agencies, and academics. Having access to workers with particular skills was also rated as a contributing factor by most participants. This applied mostly to mid- to low-level employees, and not necessarily senior scientists or management. The factor most frequently rated as a contributing factor was access to or presence of specialised research institutions and universities. Such institutions provided many benefits, including physical facilities for labs, trained licensing officers, access to cutting edge research, and recent graduates. The last definitive contributing factors are the presence of government policies or programmes and availability of financing. Government programmes include funding to offset direct labour costs and some equipment and R&D costs. These are commonly known as Industrial Research Assistance Program (IRAP), Scientific Research and Experimental Development tax credits (SR&ED), the Natural Sciences and Engineering Research Council (NSERC), and more recently the Eligible Business Corporation (EBC) programme that allows investors to invest directly in new ventures and immediately receive a 30 per cent tax credit.

Physical infrastructure or communication infrastructure was rated as a contributing factor, but also as not applicable. Canada's telecommunication infrastructure is advanced enough that it is more than sufficient for the firms to develop. Physical infrastructure is often accessed through university labs, and transportation infrastructure is not much of an issue when there are little to no physical products being manufactured or shipped. It suffices that there is an international airport nearby for people and their knowledge to travel to the destination required (eg FDA hearings or partnership negotiations). The indifference to the presence of key suppliers or customers demonstrates that the biotechnology cluster is unlike the ideal type proposed by Porter, and fits more with the models of ‘local buzz, and global pipelines’9 or ‘channels and conduits’.10 In the latter models, localisation of the players benefits the firms up until the intellectual property (IP) reached the manufacturing, marketing, and distribution stages. During the research and development stages, the biotechnology firms communicate with multiple players (investors, lawyers, academics, equipment suppliers, etc). At the later stages, however, the smaller biotechnology firms seek out exclusive relationships with pharmaceutical companies located across the country or the globe.

Objective input indicators

The following section provides a variety of input and outcome indicators toward arguing whether there is a biotechnology cluster in Vancouver or not. The specific year of availability of the data is not as important as the consideration as to how much the type of data can reveal.

For simplicity sake, the indicators are split into input indicators and outcome indicators. Inputs being the resources provided that stimulate the growth and development of biotechnology firms. Outcomes summarise the outputs and impacts, in the short and medium term, of various sorts as a result of the activity of those in the Vancouver biotechnology cluster. To some degree they are related, since many positive outcomes promote reinvesting back into the cluster.

Employment data

As we have seen above, most of the local biotechnology firms are founded by local residents. The following tables are presented in a chronological manner from firm founding, to funding, to partnering and revenues. A study commission by the US Department of Commerce places emphasis on employment statistics.11Table 2 presents the distribution of people employed with biotechnology-related responsibilities, people employed in biotechnology firms in general, and total population for all of Canada, except the northern regions. The figures in the brackets are the distribution relative to the respective totals for Canada. From this table one can see that the distribution in employment is similar to the distribution in population, and that the Vancouver biotechnology sector, as represented by the numbers for all of BC, plays a role as the third largest region as measured by jobs directly related to biotechnology, and fourth largest region as measured by total employment in biotechnology. The larger number of jobs in biotechnology firms in the prairies (Alberta, Saskatchewan, Manitoba) are influenced by the presence of agri-biotechnology firms that are more labour intensive.

While the above results are not surprising, the ISRN research team noticed that key personnel in the local firms were often recruited internationally. A review of 44 websites in reference to their Highly Qualified Personnel (HQP) or ‘talent’12 reveals more interesting results, as presented in Table 3. While the vast majority of the founders came from the Vancouver area, some of which had attained a PhD, many of the PhDs employed in the Vancouver biotechnology sector attained theirs internationally (56 per cent) or elsewhere in Canada (14 per cent). In the flows of global talents, there is some reason why the local talent stays in the area, and foreign talent are drawn to it. It is argued that their co-location ‘to realize gains of productivity’ are the basis of clustering theories, as opposed to goals of ‘cost-minimization and firm linkages’.13 Florida argues further that in addition to the market forces that attract talent to an area, there are substantial nonmarket forces, such as ‘place-based characteristics, amenities, lifestyle options, types of people and the like’.13

Government funding for R&D

Biotechnology research and commercialisation usually involves two sources of funding, each with their own agenda. The basic research is usually funded by government agencies, while the commercialisation and business development is usually funded by venture capital or partnerships with pharmaceutical companies. In Canada, as in most countries, granting agency expenditure data is not usually des-aggregated or classified by industrial sectors or clusters, is normally presented by subject or discipline, which makes difficult to analyse the impact of R&D funding in the promotion of regional clusters and industries. A report by the Vancouver Economic Development Commission (VEDC), BC Biotech, and Discovery Parks Inc. has summarised the funds received by the region from the Canadian Foundation for Innovation (CFI) and the Canadian Institutes of Health Research (CIHR).14 Summarised in part in Table 4, the analysis shows that BC receives a proportional share of infrastructure funding from CFI (using population as the normalising factor), but less than its proportional share of CIHR funding. In addition, the three provinces where the major healthcare biotechnology clusters are located (Ontario, Quebec, and BC) account for over 80 per cent of the R&D funding for health.

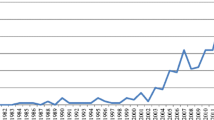

A more recent study compared federal expenditures on biotechnology research from CIHR and NSERC, and, for comparison, ICT, for major Canadian cities.15Figure 1 builds on their data and includes more cities. Note that ICT figures are multiplied by ten to show on the graph. Again, clearly, Montreal, Toronto, and Vancouver are the major recipients of those funds.

The study proposes two tests to qualify and characterise the impact of R&D funding on cluster creation and development. The first test is to determine R&D intensity (normalisation of granting agency expenditures by population), which shows the degree of R&D activity of a city. These data can be refined by receptor capacity, which is the ratio of HQP to the general labour force. By comparing the research intensity to the receptor capacity of a city as shown in Figure 2 (used with permission), they observe different situations, including:

-

i)

‘large urban centres, such as Toronto and Vancouver, with high levels of absolute R&D expenditures and large numbers of HQP in non-R&D activities, which yield non-extreme levels of R&D intensity; and,

-

ii)

“university towns” such as Kingston, where the university is a major factor in the local economy, have high R&D expenditures and low numbers of HQP, resulting in high R&D intensity which may not reflect to true state of the local economy’.15

From Figure 2 it can be easily appreciated that each innovation metric tells a different story.

Venture capital

Vancouver houses at least eight venture capital companies, both provincial and national. What has been seen recently is that a number of firms have been able to attract money from other markets (the US principally). Local Venture Capital Corporations (VCC) play an important role in the process, even as they have limited and low amounts of cash, their money acts as a leverage point, and more important, they can keep an eye on these firms, providing information to the foreign investors.

In terms of capital raised by biotechnology companies, BC gets less money than Quebec and Ontario companies in average and absolute terms.16, 17, 18 and 19Table 5 compares the provincial StatCan data to Vancouver specific data from MacDonald and Associates,14 access to financing has improved substantially for Vancouver (and some Victoria) biotechnology companies.

According to Table 9, the amount of venture capital financing, and the average investment has increased in Vancouver and does not echo the large fluctuations seen on the national or provincial levels. This trend is very important because biotechnology spin-offs do not have a bright future if they cannot access money to finance the costly and lengthy processes of drug development and approval.

Revenues

On the one hand, revenues generated by the companies can be seen as an input indicator, since they are conventionally used to continue funding further R&D and commercialisation activities. On the other hand, firm revenues are a consequence of innovation and traditionally considered as impact indicators. While many biotechnology companies are pre-revenue for their lead product, they can receive revenues from complementary sources, such as contract research, licensing, or sidecar products. Table 6 summarises data from the StatCan reports mentioned above, and indicates the difference between biotechnology revenues and total revenues declared by biotechnology firms by province.

Firm expenditures

Firm expenditures are an output in the sense that they often go towards the salaries of the employees and personal wealth creation. They can, on the other hand, be considered inputs towards the commercialisation process. Table 7 summarises data from the StatCan reports used here, and represents the biotechnology R&D expenditures. The total expenditures is represented in absolute terms, and in relation to (biotechnology or total) revenues (percentages in brackets). The data in the table show that on occasion the expenditures from the firms exceed the revenues, typical of early-stage biotechnology firms that are going through phase I, II, or III trials, prior to regulatory approval and manufacturing of their product, and thus prior to being able to receive substantial revenues. In absolute terms, BC once again ranks third behind Ontario and Quebec, and is often well ahead of the other regions.

Objective outcome indicators

While input indicators can demonstrate that there is interest or some level of intended commercialisation of biotechnology R&D, the outcome indicators complete the picture. They tell researchers and policy makers alike if the region is merely pursuing science projects, or creating value and wealth based on the scientific results. Direct outcome indicators from R&D activities are scientific publications and patents, which can be obtained short after finishing the research. Outcomes are medium-term consequences of such activities, and impacts are long-term consequences. We will not look at impacts, but certainly to outputs and outcomes, such as technology transfer via commercialisation of research (licensing) and the creation of new companies (spin-offs).

University spin-offs

In the case of biotechnology, it is quite common for the IP to have been developed in a university environment and spun-off of the university with (or without) the support of the University Industry Liaison Office (UILO). As of 31st March, 2006, the UILO at UBC (created in 1984) claims to have been instrumental in the creation of 120 spin-off companies.20 The relatively high survival rate of these firms was observed in a review of spin-off companies created in 1995–2001,21 for which partial results are reproduced in Table 8. The same study also found that in comparison to other regions, firms spun off of universities in Vancouver had a higher tendency to remain in the region. Conclusions of the study echo findings that the spin-off process is a particularly ‘effective means to transfer technology out of universities, leading to job creation and wealth creation’,22 with the addition that ‘in order for spin-off companies to contribute to economic growth, they must survive and succeed’.21

Firm creation

The biotechnology is still a relatively nascent sector, showing a steady increase in the number of firms created. In most cases, the number of firms has increased year over year in every province, with BC placing third, somewhat behind Ontario and Quebec, as shown in Table 9.

The biotechnology and total revenues can be compared, using the same sources, to the number of firms declaring biotechnology revenues or other revenues. In this case, BC biotechnology firms reporting biotechnology revenues rank third (out of seven regions) in the country ($9.6m/firm) behind Ontario and Quebec firms. The national average and rankings of total revenues per firm declaring total revenues are drastically skewed by the Alberta firms averaging $259.4m/firm. The next closest regions are Ontario at $88.3m/firm, the national average at $77.3m/firm, Quebec at $68.4m/firm, and BC at $55.6m/firm.

Patents

Patents are an important outcome of scientific and technological activity, in particular in the biotechnology sector (as opposed to the ICT sector, which often operates outside the patent system). Biotechnology firms, in particular, have close relations to universities and R&D institutions, often resulting in patent licensing arrangements. Patents can also provide a measure of knowledge spillover occurring within clusters. Another form of knowledge spillover is through labour mobility between organisations. According to a study on bio-scientists in Montreal, Toronto, and Vancouver, a high proportion of Canadian university researchers are directly related to biotechnology companies through patents or patent licensing agreements.23 The study finds that ‘what matters the most is the number and quality of patents that bio-scientists of different categories bring to those enterprises. Thus, the innovation outcome represented by patents and by patent citation constituted a real factor on employment growth’ (ibid.). In the case of Vancouver, the study concluded that in comparison to Montreal and Toronto, Vancouver had fewer biotechnology firms, more bio-scientists, a similar share in patents, more scientific publications, and more genetic sequences discovered.

A subsequent study showed that most of the researchers (57 per cent) maintain a relationship to the company through the patent, a lower number (36.5 per cent) have a seat on the board of directors, and a few (6.1 per cent) do both. Furthermore, scientists maintain different roles; some act as founders (10.4 per cent in Vancouver), more become employees (42.6 per cent), and others (31.3 per cent) maintain affiliation with both the firm and the university or R&D institution.24

By way of conclusion, the VEDC report states that ‘we do more with less’, which means that despite the low level of research activity (funding and patenting) Vancouver rates high in the commercialisation index.14 Vancouver's research index (indexed against the average of 52 American metropolitan centres) is low (0.34), while the commercialisation index is 2.50 high (ibid.). This same report uses Patscan data to generate the data reproduced in Table 10, which demonstrates that companies and UBC constitute the majority of patents held. Vancouver organisations are apparently not interested in patenting nationally (with the Canadian Intellectual Property Office), clearly demonstrating that the market for their products is mainly the US or global market.

Scientific publications

The Canadian Science and Innovation Indicators Consortium (CSIIC) briefly released a bibliometric study identifying research clusters in biotechnology in Canada (Table 11).25 In their analysis they noted that publication distributions vary if the basis of comparison is the province or the city or census metropolitan area (CMA). At the CMA level, the rankings and distributions are similar to those in the above tables.

DISCUSSION

Several factors and conditions can be attributed to the creation and success of regional clusters, such as the existence of strong university research-oriented, availability of funding by public granting agencies, an entrepreneurial spirit, and a favourable location and environment so that talented people are attracted to those places. Nonetheless, research capacity is a necessary but not sufficient condition26 for cluster development.

Vancouver seems to fulfil the requirements identified by Griller and Vigor. Once people move to Vancouver they tend to stay there. Research done at UBC is the driving force behind the biotechnology industry in Vancouver. R&D funding is important, but does not play as important a role as one might have expected. Investment in early-stage, high-risk firms in Vancouver is supported by an entrepreneurial labour force and availability of high-risk capital, offsetting potential shortfalls in government R&D funding.

The tables and figures presented here show evidence of significant activity towards R&D and commercialisation of biotechnology IP in and around Greater Vancouver. There is little to no evidence of large-scale production or manufacturing, usually done by pharmaceutical companies. A few indicators point to the phenomenon that this is an area that high quality science is done, used as the basis for a company, for which international talent is then sought to help grow, and the entire operation is eventually sold to the US or global market. This creates a volatile sector, in which people may become serial entrepreneurs, but rarely senior managers.

As a result, one of the key factors that play a role in maintaining a sustainable basis for a biotechnology cluster is the university (mainly UBC). The infrastructure and quality of professors (and staff) there draw people into the region to pursue their undergraduate or graduate degrees, occasionally leading to longer term research positions and the opportunity to commercialise their subsequent research. The UILO has since become accustomed to issues particular to biotechnology licensing and become proactive in assisting in the creation of new biotechnology ventures. Another key factor is the support received from various government agencies, which support basic research as well as high risk, early stage commercialisation. Their support has direct effects on the entrepreneurs, as well as indirect by providing a due diligence benchmark for the entrepreneurs to achieve. Other potential investors or partners can make stronger inferences about the reputation of the firm if the entrepreneur has already been validated by the government agency's due diligence process.

To help visualise the state of the biotechnology activity in Vancouver, and the role of participating layers, a Garden Metaphor is provided:

Vancouver is the beautiful garden (surrounded by mountains and the ocean in a temperate rainforest environment), the soil or nursery is the university (UBC), where seeds of ideas from faculty and students germinate, watered initially by federal research funding. The plants grow and are transplanted to individual pots watered by more money from venture capitalists and angel investors. Some of these plants are fertilized by partnerships and alliances with big pharmaceutical companies. The plants maintain roots (knowledge pipelines) in the original soil. This garden has a major attraction (QLT), which somewhat provides shade (support) to smaller plants, and is a role model for other plants (scientists and entrepreneurs). The local industry association (LifeSciences BC) acts as vendor, publicly drawing positive attention to budding plants. Government agencies play a role in certifying the quality of the plants. There are some bees acting as pollinators: key people who have founded or invested in more than one company, or participate in several boards of directors. Few plants mature and go to seed in their local soil. Usually, blooming flowers are bought by passers-by (big pharmaceuticals) who take them to their own homes. They leave some cash and trimming behind, which can take root to form new plants, and build a reputation as a customer with the locals. It is too early to know if plants wither after this, develop into major attractions in their new environment, or bloom and pollinate new plants around them.

The question remains, as to whether or not there really is a biotechnology cluster in Vancouver. Nationally, Vancouver certainly receives a generous share of inputs, and produces a substantial portion of the outputs. But do the absolute or relative quantities qualify Vancouver as a legitimate biotechnology cluster, or just an emergent cluster that still has the potential to be blown away by the next breeze? Policy in support of fostering a cluster may be very different depending on which indicator is being addressed, too. Job creation goals can differ if they are directly biotechnology related, or if they are peripheral to the science but still within the biotechnology firm. This difference in R&D funding per HQP and HQP intensity is well captured in Figure 2. While immediate tax credit programmes like the EBC program are generally well received, there is still much education to be done for investors, to help them grapple with the longer timelines to an exit event (eg acquisition or IPO). Another question that merits further research is what the cluster (if it exists) would look like if a key player was removed? For example, how would the removal of QLT impact the level of activity in biotechnology in Vancouver? Would their removal create a massive void, or are the conditions such that something else would have naturally taken their place (eg Neuromed, Angiotech, or another local star biotechnology company)?

Future directions of research may include testing the relative importance of the indicators presented here, and evaluating the growth of a cluster by looking at a larger time-frame. Some might argue that the primary outcome should be employment growth rather than cluster growth as such, usually measured by the number of firms. We propose to run multiple models to test which variables (eg public R&D funding, university spin-offs, and venture capital funding) have a greater impact on the presented outcome indicators, such as employment. Two additional variables can be considered that are not presented here: first alliances (eg the number and value of them), and secondly market capital.

References

Porter, M. E. (1998). Clusters and the new economics of competition. Harvard Bus. Rev. 76 (6), 77–90.

Rosenfeld, S. A. (1997). Bringing business clusters into the mainstream of economic development. Eur. Plan. Stud. 5 (1), 3.

Asheim, B. T. & Isaksen, A. (2002). Regional innovation systems: The integration of local ‘Sticky’ and global ‘Ubiquitous’ knowledge. J. Technol. Transfer 27 (1), 77–86.

Holbrook, J. A. & Wolfe, D. (2002). Knowledge, Clusters and Regional Innovation: Economic Development in Canada, McGill-Queen's University Press, Montréal.

Wolfe, D., Davis, C. & Lucas, M. (2005). Global networks and local linkages: An introduction in Wolfe, D. (ed.),, Global Networks and Local Linkages: The Paradox of Cluster Development in an Open Economy, McGill-Queen's University Press, Georgetown, ON.

Wolfe, D., Davis, C. & Lucas, M. (2004). Biotechnology in BC, BC Biotech Association, Vancouver, Canada.

Wolfe, D., Davis, C. & Lucas, M. (2007). LifeSciences in British Columbia, LifeSciences British Columbia (formerly BC Biotech Association), Vancouver, Canada.

Life Sciences British Columbia. (2007), About Us, http://www.lifesciencesbc.ca/About_Us/ (retrieved 14th December, 2007).

Bathelt, H., Malmberg, A. & Maskell, P. (2004). Clusters and knowledge: local buzz, global pipelines and the process of knowledge creation. Prog. Hum. Geog. 28 (1), 31–56.

Owen-Smith, J. & Powell, W. W. (2004). Knowledge networks as channels and conduits: The effects of spillovers in the Boston biotechnology community. Organ. Sci. 15 (1), 5–21.

Paytas, J., Gradeck, R. & Andrews, L. (2004). Universities and the development of industry clusters in, Economic Development Administration, U.S. Department of Commerce. Published online: http://www.smartpolicy.org/urole/ucluster2004.pdf.

Florida, R. (2005). The Flight of the Creative Class: The New Global Competition for Talent, Harper Business, New York.

Florida, R. (2002). The economic geography of talent. Ann. Assoc. Am. Geogr. 92 (4), 743–755.

Vancouver Economic Development Commission, BC Biotech, Discovery Parks Inc (2002). ‘Vancouver: A North American Biotechnology Centre', published at www.lifesciencesbc.ca/files/PDF/publications/Vancouver_Ranking_Brookings_2Oct2002.pdf.

Holbrook, J. A. & Clayman, B. P. (2006). Research funding by city: An indicator of regional technological competitiveness? Res. Evaluat. 15, 221–231.

Lonmo, C. & McNiven, C. (2007). Selected Results of the Biotechnology Use and Development Survey 2005, Statistics Canada: Ottawa, Canada Report No.: 88F0006XIE No. 006.

Raoub, L. (2004). Trends in Canadian Biotechnology Activity: 1997 to 2001, Statistics Canada, Ottawa, Canada Report No.: 88F0006XIE No. 017.

Raoub, L., Salonius, A. & McNiven, C. (2005). Overview of the Biotechnology Use and Development Survey – 2003, Statistics Canada, Ottawa, Canada Report No.: 88F0006XIE No. 009.

McNiven, C., Raoub, L. & Traoré, N. (2003). Features of Canadian Biotechnology Innovative Firms: Results from the Biotechnology Use and Development Survey – 2001, Statistics Canada, Ottawa, Canada; Report No.: 88F0006XIE No. 005.

University of British Columbia University-Industry Liaison Office, ‘UBC Spin-off Companies', http://www.uilo.ubc.ca/industry_SpinOff.asp (retrieved 14th December, 2007).

Clayman, B. & Holbrook, J. A. (2004). Surviving spin-offs as a measure of research funding effectiveness in, Centre for Policy Research on Science and Technology. Published online http://www.sfu.ca/cprost/docs/CFI%20spinoffs%20March2.doc.

Rogers, E. M., Takegami, S. & Yin, J. (2003). Lessons learned about technology transfer in Gibson, D.V., Stolp, C., Conceicão, P., Heitor, M.V. (eds.),, Systems and Policies for the Globalized Learning Economy, Greenwood Publishing Group, Westport, CN, USA.

Queenton, J. & Niosi, J. (2003). Bioscientists and biotechnology: A Canadian study. Paper presented at the Fifth Annual Meeting of the Innovation Systems Research Network, Ottawa, Canada, 2003.

Queenton, J. (2004). Knowledge markets and knowledge spillovers in Canadian human health biotechnology in Sixth Annual Meeting of the Innovation Systems Research Network, Vancouver, Canada.

Godin, B., Gendron, P. & Macaluso, B. (2003). ‘État de la recherche en biotechnologie au Canada: portrait bibliometrique par cluster', published online: http://www.csiic.ca, (retrieved 21st January, 2004), Unfortunately no longer available online.

Griller, D. & Viger, D. (2004). Where are Canada's Biotechnology Clusters? – A Synthesis of Recent Studies Commisioned by the Canadian Biotechnology Strategy and an Analysis of Cluster Activity Indicators, National Research Council and SECOR, Ottawa.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Salazar, M., Bliemel, M. & Holbrook, J. A comparison of R&D indicators for the Vancouver biotechnology cluster. J Commer Biotechnol 14, 233–246 (2008). https://doi.org/10.1057/jcb.2008.16

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jcb.2008.16