Abstract

Biotechnology companies are facing the reality that greater emphasis must be placed on delivering products to markets as companies become increasingly evaluated on their profitability. Potential risks related to markets and technologies have to be evaluated as realistically as possible to avoid mistakes. This paper discusses the features that make biotechnology marketing different from more established industries as well as the key challenges arising from those differences. This paper draws attention to issues that are distinctively important in biotechnology marketing. First, profound technological uncertainty is a key characteristic of biotechnology. Secondly, side effects emerging after the product has been in the market can cause a shutdown of an entire product line or cut down estimated market potential. Thirdly, a biotechnology product's lifecycle can also face premature death due to challenges originating from market uncertainties. A fourth issue is the threat of obsolescence that is high in a market where new innovations are introduced at a rapid rate. A fifth issue is the capability of protecting intellectual property rights. Finally, these challenges make it difficult to estimate the size of a potential market. Controlling these challenges, however, gives a solid base to make a biotechnology company a profitable business.

Similar content being viewed by others

INTRODUCTION

Maturing biotechnology companies are shifting their focus from research-and-development (R&D) to marketing in building the companies as profitable businesses selling products and generating value for the shareholders. Companies are facing the reality that even the biotechnology business is based on marketed products delivering revenue for shareholders. The valuation of a company is based on an approved product with retained economics, a significant market potential and a long patent life. Greater emphasis must be placed on delivering products to markets as the companies become increasingly evaluated on their profitability.1 Venture capital investors typically look for a company with, among other things, world-class management with a proven track record and a clear and credible business strategy.2 For a university spin-out company, the value of recruiting experienced management is even more important.3

Recent studies suggest that there are deficiencies in the marketing skills of biotechnology companies that might affect their success. Several issues have been identified as a problem for biotechnology companies. Young and small biotechnology organisations are not ‘naturally’ exposed to market knowledge.4 Biotechnology companies in general also have serious difficulties in going through the marketing process.5 They find it difficult to build their marketing and sales operations except when the products fit into niche areas that can be reached with comparatively less people.6 Biotechnology companies lack a clear market-oriented focus, as well as the commercial sense and skills to direct their organisation as a business towards the markets. Many of them have no business plans and the cooperation activities are poor.5, 7 However, there is also evidence that the managers in biotechnology companies might define marketing in a very different way compared to the managers within more established business areas.4

The aim of this paper is to discuss what features make biotechnology marketing different from more established industries. In addition, the paper discusses key challenges for biotechnology marketing arising from those differences.

MARKET AND TECHNOLOGICAL UNCERTAINTY

In biotechnology, as well in other high-technology industries dealing with emerging technologies, companies have to deal with great uncertainty related to markets and technologies. Potential risks have to be evaluated as realistically as possible to avoid mistakes.8 Moriarty and Kosnik9 have presented a framework to explain why high-technology marketing is different from marketing of a traditional product or service. This paper draws on their ideas to identify the special characteristics of biotechnology that affect the marketing activities operating in the industry.

Marketing is comprehended to be the entire business process which integrates the efforts to discover, create, arouse and satisfy customer needs.10 Moriarty and Kosnik9 found two dimensions which distinguish high-technology from low-technology marketing situations. First, there is market uncertainty, which relates to the uncertainty about the extent and type of customer needs that can be satisfied with the technology. The marketer does not know what a customer's technological needs are. Market uncertainty originates from the market, its structure, changes and dynamics. Secondly, there is technological uncertainty about the ability of the technology to satisfy customer needs. This type of uncertainty has a purely technological origin. It is the ambiguity about the functionality of the technology under consideration or the ambiguity about new technologies that might perform better than existing.

TECHNOLOGICAL UNCERTAINTY IN BIOTECHNOLOGY MARKETING

Technological uncertainty is considered to be one of the key challenges in biotechnology. It has even increased from the early days of biotechnology. Pioneering biotechnology companies in the USA started by manufacturing molecules such as erythropoietin and interferon-alpha11 which were already known at that time. Products such as Amgen's Epogen and Genentech's Nutropin were not new inventions because the molecules' functions and mechanisms were already well known.12 The novelty of these ‘discontinuous’ innovations was that their use altered patterns of production by using recombinant DNA technology and other biotechnological manufacturing technologies.11, 13 Therefore, early pioneers did not face the high risks that biotechnology companies generally do today.11 Risk is considerably higher for companies pursuing new product inventions.

First, uncertainty with regards to whether new molecules will work is extremely high. In other high-technology industries, it is the scientist who can estimate at the early stages of the R&D process whether a particular technology is going to work at all. Quite the opposite happens in biotechnology where approximately only one out of 6,000 synthesised compounds ever makes it to market. Despite the advances in genetics and molecular biology, it is still extremely difficult to predict how a particular molecule will work in humans.14 This profound technological uncertainty is the source of high technological risk.

In drug R&D it is a long and expensive process to determine if a compound is safe and effective.14, 15 The process begins with preclinical testing in animals. A Phase I trial is conducted to see if a drug is safe to use in people. In Phase II the drug is tested with a small sample of people to determine if the treatment is effective. Phase III expands the treatment to more subjects and compares it to the standard or to the current treatment. The process costs on the average some $800m for one single drug.15 Molecules for industrial use, however, need a considerably shorter time until they can be found feasible and commercialised.

The second characterising aspect is the threat of obsolescence. It originates from uncertainty regarding whether the market will replace the current generation of products with another technology. Obsolescence may occur even long after a product has found a stable market.9

The threat of new technologies that will make the original obsolete is considerable in biotechnology. As the diffusion rate is high, a new technology may take over the market in a very short period of time. For example, in 1987 Kary Mullis patented the PCR using Thermus aquaticus. Only two years later in 1989 he patented the use of Thermus thermophilus, a polymerase which was thermostable contrary to T. aquaticus.16, 17 and 18 The new polymerase made the use of T. aquaticus completely obsolete.

MARKET UNCERTAINTY IN BIOTECHNOLOGY MARKETING

Market uncertainty means that there is uncertainty about how the product will satisfy customer needs. Unfortunately, in some cases potential customers cannot be identified at an early stage of R&D. It has, however, been argued that increasing competition is forcing scientists to consider commercial and economic aspects of their research in ever earlier phases of the R&D process.19 On the other hand, in many cases the needs of a potential customer are very clearly identified.

In 1993 the Royal Swedish Academy of Sciences awarded the Nobel Prize in Chemistry to Kary Mullis for his invention of the polymerase chain reaction (PCR) method. The invention was made in 1983 when Mullis discovered how to make multiple copies of minute amounts of DNA.

The original technique to amplify DNA was slow, imprecise and expensive. These were the problems that Kary Mullis solved with the PCR technique. This was a process innovation that revolutionised the work of biologists and biochemists. Uncertainty about customer needs was low because from the very beginning it was clear what specific needs the new technology would satisfy.

For the amplification of DNA, Mullis and his colleagues at Cetus Corporation, where the technique was originally developed, initially used a non-thermostable enzyme called T. aquaticus (taq ). In the amplification process one needs to carry out a number of cycles at different temperatures. A problem with the non-thermostable enzyme was that high temperatures degraded the enzyme and it needed to be replenished at the end of every cycle. This was solved by using the T. thermophilus enzyme, which is thermostable and thus more durable.16, 17 and 18 In 1989 Science magazine named the taq polymerase ‘Molecule of the Year’. Here again, there was no uncertainty about the customer needs that the innovation would satisfy.

Secondly, high-technology marketing is characterised with uncertainty about the size of the potential market.9 The number of potential customers can be estimated in several ways. Prevalence is an accurate method of measurement when the product will be purchased on a recurring basis. It is an estimate of the number of customers at any point in time. Incidence is an accurate method of measurement if the product is purchased only once for a specific one-time need. If the customer segment can be clearly identified, estimating the exact number of potential customers is easier.20

McMurray and Jones21 have argued that established models for market analysis have several shortcomings when used for evaluating the market for biotechnology. These models have been designed to evaluate consumer markets and thus fail to measure biotechnology markets adequately. In response, McMurray and Jones presented a model specific to the needs of biotechnology marketing. The McMurray–Jones model (M–J Model) combines the traditional and high-technology parameters, strategic planning parameters and characteristics of biotechnology markets.

Product lifecycle is crucial when estimating the size of a market and future revenues. The traditional product lifecycle is bell-shaped following the Gaussian curve. In practice, it is an average model and is applicable as such in only a few industries.

The lifecycle for biotechnology products is perceived to be short. It differs greatly from the bell-shaped model. The biotechnology model has the shape of an impulse or peak characterised by a low amount of early adopters and laggards.21 The product portfolio defines how a company will manage the lifecycles of its products. The composition of marketed and pipeline products dictates the annual and long-term sales and revenue.22

The biotechnology industry is characterised by a large number of small companies. Small companies have a tendency to move from one product to the next forgetting to manage the first product for profit. Researchers almost always prefer working on new products rather than managing old ones.23 Introducing new incremental improvements or ‘next generations’ can lengthen the product lifecycle and prevent premature market saturation. Large companies are generally organised in a way that is easier for them to concentrate more on product improvement.23

The M–J Model presumes that markets for biotechnology products are used to adopting new innovations and thus the diffusion of innovation can be estimated as fast. Diffusion is also fast in a market that has some unmet needs, which a new product satisfies.21

In addition to these, the diffusion rate is also influenced by the complexity level of the innovation. The diffusion of incremental innovations that originated from existing businesses can take only five years. On the contrary, very complex systems or breakthroughs originated from R&D labs outside the industry can take from 20 to 40 years to diffuse.23

The third source of market uncertainty is the threat of substitutes. The M–J Model considers two of Porter's five competitive forces, the threat of substitutes and new entrants, to be especially important when evaluating biotechnology markets. The threat of substitutes influences the profitability of the market by initiating price competition and thus lowering prices.15 However, in pharmaceuticals there is evidence that brand name producers are able to maintain a high-price strategy by raising prices and targeting the market segment that remains loyal to the original brand. Fierce competition is found to cause lower prices of generic drugs but not to lower the prices of branded drugs.24

In biotechnology proprietary products are a crucial way to protect oneself from the threat of new entrants. The intellectual property (IP) strategy is widely discussed in recent literature and it is regarded as one of the most important aspects of the success of a biotechnology company. Pharmaceutical companies favour strong patent protection. In addition, they have used a variety of tactics to prevent generic drugs from entering the market.15 Besides using patents, a company can protect its IP using trade marks, copyrights, and trade secret protection programmes.25 Also, the original company can simply purchase the patent of a generic drug.15

The increased rate of generic copies and new generations introduced is a major threat to new innovations.19 When patents expire any company can manufacture a generic version of the original drug. Generic substitutes contain exactly the same active chemical compound as the original drug but they are marketed with a different trade name.15, 24 It is generally easy to get approval to market a generic drug. The manufacturer is required to submit data showing that the generic drug is functionally equivalent to the original drug.15

It has long been known that patents do not provide considerable protection for a very long period of time.26 Patents will be ‘invented around’ and ‘me too’ copies will be introduced shortly.19, 26

A ‘me too’ drug can also substitute for the original drug. It is a drug with improvements to an existing, patented drug. It can be similar to the original drug, but not functionally equivalent. It may have fewer side effects or a different route of administration (oral vs intravenous). For example in the 1980s Eli Lilly held a pioneer patent on a selective serotonin reuptake inhibitor (SSRI) fluoxetine, which was sold under the trade name Prozac. Soon other companies developed ‘me too’ SSRIs such as citalopram, fluvoxamine, praoxetine, and sertraline.15 The fluoxetine patent expired in 2001 and generic copies were on the market after only a few months.

The threat of new competitors entering the market originates from the low entry barriers to the industry. The technologies used to produce the active chemical entities are carried out on a small scale, and the production capacity for assembling active and inert ingredients into pills or capsules is largely flexible.24

The fourth source of uncertainty that needs to be addressed is related to the side effects of the product. One example of pharmaceuticals that gained large attention worldwide is VIOXX, which was developed by Merck & Co. to treat osteoarthritis, acute pain conditions, and dysmenorrhoea. It was approved on 20th May, 1999. In September 2004 Merck withdrew VIOXX from the market after extensive studies revealed that VIOXX elevated the cardiovascular event rate.

If we consider the side effects in products that are not used in humans, there are no side effects as such. However, in the use of a chemical compound there can emerge unpredicted limitations of use. For example, it could turn out that the compound could degrade at certain temperatures, which would limit the possibilities of use. The result of these limitations is not that drastic considering marketing. However, because of the unpredicted limitations of use, the size of potential market can turn out to be significantly smaller that estimated.

CONCLUSIONS

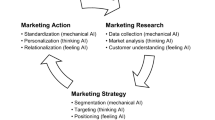

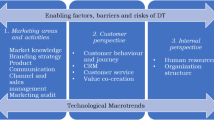

Figure 1 summarises in more detail the key challenges in biotechnology marketing discussed earlier. The list is not intended to be exhaustive, but to draw attention to the issues that are distinctively important in biotechnology marketing.

Profound technological uncertainty is a key characteristic of biotechnology. A lot of time, labour and money need to be invested in R&D processes to determine whether the technology will work as hoped for. However, financial constraints force evaluation of the market potential of developed compounds even in the earlier stages of R&D processes.

Side effects emerging even after the product has been on the market for several years can cause a shutdown of an entire product line or cut down the estimated market potential. The product lifecycle can also face premature death because of the challenges originating from market uncertainties. Small biotechnology companies face difficulties nurturing and thus lengthening the existing product line to collect all profits possible to collect.

The threat of obsolescence is high in a market where new innovations are introduced at a rapid rate. A new technology could take over the market quite rapidly compared to other high-technology markets as the customers are used to adapting to new technologies. In biotechnology, obsolescence is intertwined with the capability of protecting intellectual property rights. After a patent expires, new competitors could be on the market in just months.

These challenges make it difficult to estimate the size of a potential market. The established models for high technology or even less the traditional models for low-technology industries are applicable for biotechnology. Controlling these challenges, however, gives a solid base to steer a biotechnology company and make it a profitable business. Fazeli11 has reported that there are already signs that European biotechnology companies are picking up products with lower-risk profiles and generating their own cash enabling the companies to take bigger gambles at a later stage.

References

Grupp, R. W. & Gaines-Ross, L. (2002). Reputation management in the biotechnology industry. J. Comm. Biotechnol. 9 (1), 17–26.

Rodgers, P., Catton, D. & Duncan, G. S. (2002). Practical experiences in starting up life science companies in the academic sector. J. Comm. Biotechnol. 8 (4), 273–280.

Campbell, A. F. (2005). The evolving concept of value add in university commercialisation. J. Comm. Biotechnol. 11 (4), 337–345.

Renko, M. (2006). Market Orientation in Markets for Technology-Evidence from Biotechnology Ventures, Turku School of Economics, Turku.

Costa, C., Fontes, M. & Heitor, M. (2004). A methodological approach to the marketing process in the biotechnology-based companies. Ind. Market. Manage. 33, 403–418.

Williams, A. (2005). Corporate development in biotechnology in 2005. J. Comm. Biotechnol. 11 (3), 239–248.

Hermans, R., Kulvik, M. & Tahvanainen, A. (2005). Etla 2004 survey on the Finnish biotechnology industry – Background and descriptive statistics. Etla Discuss. Pap. 978, 1–40.

Remer, S., Ang, S. H. & Baden-Fuller, C. (2001). Dealing with uncertainties in the biotechnology industry: The use of real options reasoning. J. Comm. Biotechnol. 8 (2), 95–105.

Moriarty, R. T. & Kosnik, T. J. (1989). High-tech marketing: Concepts, continuity, and change. Sloan Manage. Rev. 30, 7–17.

Levitt, T. (1975). Marketing myopia. Harvard Bus. Rev. 38 (4), 26.

Fazeli, S. (2005). The European biotech sector: Could it achieve more? J. Comm. Biotechnol. 12 (1), 10–19.

McKenna, R. (1989). Why high-tech products fail', in Smilor, R.W. (eds.), Customer Driven Marketing: Lessons from Entrepreneurial Technology Companies, Lexington Books, Lexington, MA, pp.3–14.

Robertson, T. S. & Gatignon, H. (1986). Competitive effects on technology diffusion. J. Market. 50, 1–12.

Pisano, G. P. (2006). Can science be a business? Lessons from biotech. Harvard Bus. Rev. 84 (10), 114–125.

Resnik, D. B. (2004). Fair drug prices and patent system. Health Care Anal. 12 (2), 91–114.

Mullis, K. B. (1987). Process for amplifying nucleic acid sequences', US Patent number 4683202.

Mullis, K. B., Erlich, H. A., Gelfand, D. H., Horn, G. & Saiki, R. K. (1987). Process for amplifying, detecting, and/or-cloning nucleic acid sequences', US Patent number 4683195.

Mullis, K. B., Erlich, H. A., Arnheim, A., Horn, G. T., Saiki, R. K. & Scarf, S. J. (1989). Process for amplifying, detecting, and/or cloning nucleic acid sequences', US Patent number 4800159.

Schmid, E. F. & Smith, D. A. (2005). Managing innovation in the pharmaceutical industry. J. Comm. Biotechnol. 12 (1), 50–57.

McIntyre, L. (2002). Forecasting new product revenues. J. Comm. Biotechnol. 8 (4), 289–297.

McMurray, A. & Jones, R. (2003). A new model to evaluate the market for biotechnology. J. Comm. Biotechnol. 10 (1), 78–84.

Valentine, E. L. (2003). Business development: A barometer of future success. J. Comm. Biotechnol. 10 (2), 123–130.

Abetti, P. A. (1985). Milestones for managing technological innovation. Plan. Rev. 13 (2), 18–46.

Dalen, D. M., Strøm, S. & Haabeth, T. (2006). Price regulation and generic competition in the pharmaceutical market. Eur. J. Health Econ. 7 (3), 208–214.

Kapner, V. & Chory, J. (2002). Pitfalls to avoid when starting a biotechnology company in the USA. J. Comm. Biotechnol. 8 (4), 281–288.

Teece, D. J. (1986). Profiting from technological innovation: Implications for integration, collaboration, licencing and public policy. Res. Pol. 15, 285–305.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rajamäki, H. Anticipating and managing the challenges of biotechnology marketing. J Commer Biotechnol 14, 225–231 (2008). https://doi.org/10.1057/jcb.2008.13

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jcb.2008.13