Abstract

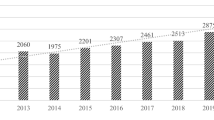

This paper proposes a methodology for compiling internationally comparable estimates of investor holdings of sovereign debt. Based on this methodology, it introduces a data set for 24 major advanced economies that tracks sovereign debt holdings on a quarterly basis over 2004–11. The increased reliance on foreign investors by most sovereign borrowers may have helped reduce their borrowing costs, but it can imply higher future refinancing risks. Meanwhile, advanced economy banks’ exposure to their own government debt has begun to increase after the global financial crisis, strengthening sovereign-bank linkages.

Similar content being viewed by others

Notes

Following the euro area debt turmoil, several studies attempted to construct cross-country sovereign investor base data sets. Among others, Andritzky (2012) compiled unconsolidated government bond investor base data for 14 advanced economies based on national sources. However, the coverage of government and debt instruments as well as valuation conventions differed in this data set. Merler and Pisani-Ferry (2012a) collected a similar data set for 11 euro area countries and the United States with similar inconsistencies.

The U.S. Treasury International Capital (TIC) reporting system data trace the U.S. Treasury securities holdings of foreign private and official investors, but no such country-specific data are available for other countries. The IMF Currency Composition of Official Foreign Exchange Reserve (COFER) data track investments of foreign central banks, but the data are limited to countries of major currencies.

Although the data set is compiled for advanced economies, the methodology can be extended to emerging markets, with a few modifications (Arslanalp and Tsuda, 2014). In this paper, we focus on advanced economies to avoid a number of technical issues, such as exchange rate valuation adjustments, and to examine asset allocation decisions of a common class of sovereign debt investors that are traditionally interested in interest-rate risk, not credit risk.

Apart from these feedback loop effects between banks and their own sovereign, the health of the domestic banking sector could be influenced by cross-border spillover effects, if the domestic banking sector holds a significant amount of debt of high-risk foreign sovereigns.

Recently, there has also been interest in portfolio balance models of government debt to explain how central bank quantitative easing policies are affecting interest rates. Addressing these issues, which requires empirically identifying the demand function for government debt, is beyond the scope of this paper.

Currency and deposits mainly represent saving certificates and retail bonds that can be redeemed before maturity, and are generally a relatively small share of total debt for most advanced economies. They are usually included in short-term debt unless detailed information is available to make the short-term/long-term attribution.

For some countries, these types of liabilities can account for a significant portion of government debt. For example, in Italy accounts payable in the forms of government obligations to Italian firms amounted to €95 billion (about 5 percent of general government debt) at end-2012. Some countries can also have large future pension fund liabilities, but there is no internationally agreed method of accounting for these obligations.

Although some countries may use the “net debt” concept by subtracting various types of financial assets from gross debt, there is no internationally recognized common definition of net debt.

Norway and Switzerland also provide government debt figures consistent with the definition of “Maastricht debt.” The data for Switzerland are on an annual basis, so quarterly figures are interpolated.

Although household or nonfinancial corporate holdings of government debt account for a sizable portion of nonbanks in some countries (Italy and the United Kingdom), institutional investors usually make up the bulk of nonbank holdings. At end-2010, assets under management of institutional investors in advanced economies amounted to U.S.$70 trillion, of which U.S.$25 trillion belonged to investment funds, U.S.$23 trillion belonged to insurance companies, and U.S.$21 trillion belonged to pension funds, according to OECD estimates.

More details on valuation principles for securities can be found in the BIS Guide to the International Banking Statistics; IMF Coordinated Portfolio Investment Survey Guide; IMF External Debt Statistics: Guide for Compilers and Users; and IMF Monetary and Financial Statistics: Compilation Guide.

External debt statistics in QEDS can sometimes differ from corresponding figures in national flow of fund (FoF) data. We stick to external debt statistics because these are based on a common compilation methodology (IMF’s External Debt Statistics: Guide for Compilers and Users published in 2003), while compilation for FoF data differs across countries. Furthermore, external debt statistics do not include financial derivatives in debt statistics, in line with our definition of government debt, while national FoF data may include them.

Although TIC data cover only U.S. Treasury securities, U.S. Federal Reserve flow of funds data indicate that foreign holdings of local and state government debt are relatively small (less than U.S.$90 billion).

Based on IMF Data Template on International Reserves and Foreign Currency Liquidity and IMF CPIS data during 2008–10, we estimated that, on average, 80 percent of foreign exchange reserves consisted of national debt securities, while the rest comprised currency and deposits with foreign banks and central banks, debts of international institutions, and equities. We also checked this assumption for Spain, which used to provide data on foreign central bank holdings of national debt, and latest official estimates were in line with our estimates.

The ECB published, on a one time basis, the country composition of SMP as of end-2012. The figures are available at www.ecb.europa.eu/press/pr/date/2013/html/pr130221_1.en.html. Our estimation approach matches closely the reported figures at end-2012.

For other countries, foreign official loans are negligible or nonexistent. Only for Norway, external loans are large, but those mainly represent repurchase agreements of the Government Pension Fund (SPU) with foreign financial institutions. These are recorded as liabilities of the SPU and hence the general government. The volume of these operations was reduced significantly after the crisis, in particular in 2011.

Specifically, we use the following sources for these countries: Australia (Australian Bureau of Statistics, Flow of Funds), Canada (Bank of Canada, Chartered Bank Balance Sheets), Korea (Bank of Korea, Flow of Funds), New Zealand (Reserve Bank of New Zealand, Table D2), Norway (Statistics Norway), Switzerland (Swiss National Bank, Banks in Switzerland), and United Kingdom (Bank of England, MFI Consolidated Balance Sheets). The data for Switzerland are on an annual basis, so quarterly figures are interpolated.

The national data for these countries have been recently collected into a database and made publicly available by Bruegel (“Bruegel database of sovereign bond holdings”), as described in Merler and Pisani-Ferry (2012a).

A more comprehensive list of statistical reclassifications can be found directly from our data sources.

At the same time, these estimates cannot attribute country origin with complete accuracy, in particular if a security is purchased by a foreign investor and held in a custodial account in another country, say, an offshore center. Put differently, these estimates reflect exposures on an immediate borrower, not ultimate risk, basis.

Specifically, we calculate z-scores for each observation, based on the 4-quarter moving average of foreign investor flows.

A notable example of this trend is the Norwegian sovereign wealth fund, which recently announced a strategy to gradually reduce the fund’s share of European bonds, while increasing bond investments in other regions.

IMF (2010) discusses some of the reasons why some investors may be more sensitive to rating actions, rather than market signals.

In particular, it would be useful to establish an empirical strategy that differentiates demand for sovereign debt of foreign investors from that of domestic investors. One possible strategy would be to characterize differentiated responses to a shock in yields or credit ratings in a model that controls for additional factors such as regulation, capital account openness and other domestic components.

The 2011 EBA stress tests suggested that major European banks may have a collective shortfall of €1.2 trillion that must be filled with liquid assets such as government bonds. Santos and Elliott (2012) estimate that European, Japanese, and U.S. banks may collectively need U.S.$2 trillion of net additional liquid assets in the next three years before the Liquidity Coverage Ratio (LCR) becomes effective in 2015. At the same time, another Basel III liquidity measure, Net Stable Funding Ratio (NSFR), scheduled to take effect in 2018, may induce some banks to reduce demand for long-term government debt.

Merler and Pisani-Ferry (2012b) argue that the interdependence between banks and sovereigns is especially strong in the euro area, due to the absence of a supranational banking resolution framework and domestic banks holding a considerable share of the debt issued by their domestic government.

The “Stockholm Principles” are a set of guiding principles for managing sovereign risk and high levels of public debt, as facilitated by the IMF and agreed by the debt managers and central banks who attended the 10th Annual Consultations on Policy and Operational Issues facing Public Debt Management on 1–2 July 2010.

References

Abbas, S.M.A., N. Belhocine, A. El-Ganainy, and M. Horton, 2010, “A Historical Public Debt Database,” IMF Working Paper 10/245 (Washington: International Monetary Fund).

Acharya, V., I. Drechsler, and P. Schnabl, 2011, “A Pyrrhic Victory? Bank Bailouts and Sovereign Credit Risk,” NBER Working Paper No. 17136.

Acharya, V., I. Drechsler, and P. Schnabl, 2012, “A Tale of Two Overhangs: The Nexus of Financial Sector and Credit Risks,” Banque de France Financial Stability Report, No. 16, April.

Adler, G., 2012, “Intertwined Sovereign and Bank Solvencies in a Model of Self-Fulfilling Crisis,” IMF Working Paper No. 12/178 (Washington: International Monetary Fund).

Andritzky, J.R., 2012, “Government Bonds and Their Investors: What Are the Facts and Do They Matter?” IMF Working Paper No. 12/158 (Washington: International Monetary Fund).

Arslanalp, S. and T. Tsuda, 2014, “Tracking Global Demand for Emerging Market Sovereign Debt,” IMF Working Paper No. 14/39 (Washington: International Monetary Fund).

Bank for International Settlement (BIS). 2011, “The Impact of Sovereign Credit Risk on Bank Funding Conditions,” CGFS Paper No. 43.

Bernanke, B., 2005, “The Global Saving Glut and the U.S. Current Account Deficit,” The Homer Jones Lecture, St. Louis, Missouri.

Blommestein, H., A. Harwood, and A. Holland, 2011, “The Future of Debt Markets,” OECD Journal: Financial Market Trends, Vol. 2011, No. 2, pp. 263–281.

Calvo, G., 1998, “Capital Flows and Capital-Market Crises: The Simple Economics of Sudden Stops,” Journal of Applied Economics, Vol. 1, No. 1, pp. 35–54.

Calvo, G., A. Izquierdo, and L. Mejía, 2004, “On the Empirics of Sudden Stops: the Relevance of Balance-Sheet Effects,” NBER Working Paper Series, No. 10520.

Calvo, G. and E. Talvi, 2005, “Sudden Stops, Financial Factors and Economic Collapses in Latin America: Lessons from Argentina and Chile,” NBER Working Paper Series, No. 11153.

Cowan, K., J. De Gregorio, A. Micco, and C. Neilson, 2008, “Financial Diversification, Sudden Stops, and Sudden Starts,” Central Bank of Chile Working Paper 432.

Das, U.S., M.A. Oliva, and T. Tsuda, 2012, “Sovereign Risk: A Macro-Financial Perspective,” Asian Development Bank Institute Working Paper No. 383.

Das, U.S., M. Papaioannou, and C. Trebesch, 2012, “Sovereign Debt Restructurings 1950–2010: Literature Survey, Data, and Stylized Facts,” IMF Working Paper No. 12/203 (Washington: International Monetary Fund).

De Grauwe, P., 2011, “The Governance of a Fragile Eurozone,” CEPS Working Documents No. 346, May 2011.

De Santis, R.A., 2012, “The Euro Area Sovereign Debt Crisis: Safe Haven, Credit Rating Agencies and the Spread of the Fever from Greece, Ireland, and Portugal,” ECB Working Paper Series No 1419, February.

Dippelsman, R., C. Dziobek, and C.A. Gutiérrez Mangas, 2012, “What Lies Beneath: The Statistical Definition of Public Sector Debt,” IMF Staff Discussion Note No.12/09.

Dornbusch, R. and A. Werner, 1994, “Mexico: Stabilization, Reform and No Growth,” Brookings Papers on Economic Activity, Vol. 1, pp. 253–316.

Ejsing, J., M. Grothe, and O. Grothe, 2012, “Liquidity and Credit Risk Premia in Government Bond Yields,” ECB Working Paper Series No. 1440, June.

Greenwood, R. and D. Vayanos, 2010, “Price Pressure in the Government Bond Market,” American Economic Review, Vol. 100, No. 2, pp. 585–590.

Hyde, N., 2012, How Safe Are The New Safe Havens? Standish Mellon Asset Management Company (Boston, April).

International Monetary Fund. 2010, Global Financial Stability Report, World Economic and Financial Surveys. Washington, October.

International Monetary Fund. 2011a, “Managing Sovereign Debt and Debt Markets Through a Crisis: Practical Insights and Policy Lessons,” IMF Board Paper (Washington: International Monetary Fund).

International Monetary Fund. 2011b, Global Financial Stability Report, World Economic and Financial Surveys (Washington, September).

International Monetary Fund. 2012, Global Financial Stability Report, World Economic and Financial Surveys (Washington, April).

Lojsch, D.H., M. Rodríguez-Vives, and M. Slaví, 2011, “The Size and Composition of Government Debt in the Euro Area,” ECB Occasional Paper Series No. 132, October.

McGuire, P. and P. Wooldridge, 2005, “The BIS Consolidated Banking Statistics: Structure, Uses, and Recent Enhancements,” BIS Quarterly Review (September).

Merler, S. and J. Pisani-Ferry, 2012a, “Who is Afraid of Sovereign Bonds?” Bruegel Policy Contribution, No. 2012/02.

Merler, S. and J. Pisani-Ferry, 2012b, “Hazardous Tango: Sovereign-Bank Interdependence and Financial Stability in the Euro Area,” Banque de France, Financial Stability Review, No. 16, April.

Merler, S. and J. Pisani-Ferry, 2012c, “Sudden Stops in the Euro Area,” Bruegel Policy Contribution, No. 2012/06.

Peiris, S., 2010, “Foreign Participation in Emerging Markets’ Local Currency Bond Markets,” IMF Working paper WP/10/88 (Washington: International Monetary Fund).

Santos, A. and D. Elliott, 2012, “Estimating the Costs of Financial Regulation,” IMF Staff Discussion Note 12/11 (Washington: International Monetary Fund).

Warnock, F.E. and V. Warnock, 2009, “International Capital Flows and U.S. Interest Rates,” Journal of International Money and Finance, Vol. 28, pp. 903–919.

World Bank and International Monetary Fund. 2001, “Developing Government Bond Markets: A Handbook,” World Bank Publications (Washington: International Monetary Fund).

Additional information

Supplementary information accompanies this article on the IMF Economic Review website (www.palgrave-journals.com/imfer)

*Serkan Arslanalp is a senior economist in the Monetary and Capital Markets Department of the IMF. He obtained his Ph.D. in Economics from Stanford University. Takahiro Tsuda is a senior deputy director in the International Bureau of the Japanese Ministry of Finance and used to work as a financial sector expert in the Monetary and Capital Markets Department of the IMF. The authors are grateful to Ali Abbas, Jochen Andritzky, Tamim Bayoumi, Fabian Bornhorst, Engin Dalgic, Udaibir S. Das, Reinout De Bock, Mark De Broeck, Selim Elekdag, Luc Everaert, Maximilian Fandl, Anastasia Guscina, Allison Holland, Anna Ivanova, Mariusz Jarmuzek, Peter Lindner, Silvia Merler, Yanliang Miao, Franziska Ohnsorge, Rafael Romeu, Miguel Segoviano, Eriko Togo, Justin Tyson, and participants at the IMF MCM Seminar for their insights and comments and Gabriel Presciuttini for excellent research assistance.

Electronic supplementary material

Appendix

Appendix

The four country groups in our sample are constructed along the following dimensions: (i) exchange rate regime (independent or currency union), (ii) reserve currency status, and (iii) perceived credit risk in 2011. In particular:

High-spread euro area includes euro area countries identified by the IMF in the April 2012 Global Financial Stability Report (GFSR) as having sovereign CDS spreads of more than 200 basis points as of August 2011 (Belgium, Greece, Ireland, Italy, Portugal, and Spain). Although spreads for Belgium have come down in 2012, it is included in this group as our analysis is mainly about trends until end-2011. Together, these countries account for nearly half of the euro area government debt market and 11 percent of the total advanced economy sovereign debt outstanding, at end-2011.

Low-spread euro area includes the other euro area countries in our sample (Austria, Germany, France, Finland, Netherlands, and Slovenia). Except for Slovenia, all were rated AAA by at least two out of the three major credit rating agencies, as of end-2011. This group accounts for 14 percent of the total advanced economy sovereign debt outstanding.

Traditional reserve countries include non-euro area countries that have traditionally enjoyed reserve currency status (Japan, Switzerland, United Kingdom, and United States). These countries have deep and liquid markets, attracting large demand from foreign central banks; as a result, they are traditional beneficiaries from flight to safety. They represent 68 percent of total advanced economy sovereign debt outstanding.

Other advanced economies include the remaining countries in our sample (Australia, Canada, Czech Republic, Denmark, New Zealand, Norway, Korea, and Sweden), some of which have recently been seen as “new safe havens.” They represent 6 percent of total advanced economy sovereign debt outstanding.