Abstract

This article discusses some selected findings related to the dynamic changes of the monthly consumption of prepaid users. The findings are derived from the analysis of data collected from a life network. The discussed results provide interesting aspects that must be considered when designing and implementing promotions and offers, therefore they are fundamental to understand the user profile in its deepest details. The article focuses on practical figures and quantified relationships, and gives hints for the application field of each discussed finding.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTORY REMARKS AND MOTIVATION

Understanding the customer behaviour is indispensible for almost all marketing-related activities and tactical initiatives. Only a thorough knowledge of this behaviour, with all associated dynamic and eventual changes, can help the marketing team optimize the pre-design, rollout and post-analysis of commercial offers and promotions.

The present article gives some insights of the monthly usage dynamic of prepaid subscribers. This dynamic represents an important characteristic of the overall usage profile, and should be taken into consideration while designing and evaluating offers and loyalty programmes, and assigning subscribers to different segments.

The presented results are based on data from a life network, and represent therefore a case study rather than a theoretical treatment of loyalty and segmentation. The results can be adapted to many other markets; furthermore, they provide the reader with ‘triggering’ aspects for specific investigations and analysis. For a theoretical background and other interesting aspects on loyalty and segmentation, the reader is referred to the references.1, 2, 3, 4, 5, 6

The analytical work discussed in the following sections was motivated by the post-analysis of a specific marketing campaign, offering participating subscribers free credit upon reaching specific usage thresholds. On the basis of their historical usage profiles, the subscribers were classified into 6 ‘Average Revenue per User’-brackets (ARPU-brackets) or groups, each group was requested to meet a certain consumption threshold in order to benefit from the free credit. The post-analysis of the campaign revealed questions on the correct interpretation of some results, and the analysis approach itself. For instance, a certain group has shown negative revenue impact of the campaign, although the requested consumption threshold was set to compensate any free credit.

In order to understand this and other similar findings, the consumption dynamic of representative samples of the subscribers’ base, and the impact of free credits on their consumption, were investigated.

In the following sections, the investigation results are discussed in a generic manner, without a direct relation to the original campaign. This discussion approach should help the reader link the presented findings to other possible application fields and scenarios.

The focus of the article is set on two different and independent effects, these are:

-

1

Usage fluctuation of individual subscribers and possible corresponding impacts at segment level.

-

2

Impact of extreme users on the post-analysis of promotional campaigns and initiatives.

In addition, practical hints are given to identify the operational areas where utilizing the effects might be helpful.

USAGE FLUCTUATION AT MACRO LEVEL

Sample characteristics

The results presented in this report are based on the analysis of a randomly generated sample, representative for the prepaid subscribers’ base, with following characteristics:

-

The sample size is 170 772. Due to the randomness, it comprises all possible user profiles.

-

All subscribers within the sample made their first call before 1 October 2011, assuring that any analysis of the spending during the considered period (from October 2011 to January 2012) will exclude any new subscribers with initial immature or ‘unstable’ usage profile.

-

Due to the exclusion of new subscribers, the sample represents a unique snapshot of the base; in other words, the identities of the subscribers are the same over the complete analysis period.

-

The subscribers are classified into different brackets according to their total monthly spending M spend . The brackets are set according to pre-defined monetary threshold values. To simplify the discussion, these brackets are given below as percentage of the average ARPU (ARPU avg ) of the total subscribers’ base:

- • Very low usage (termed hereafter VLOW)::

-

(M spend /ARPU avg ) < 76 per cent

- • Low usage (termed hereafter LOW)::

-

76 per cent⩽(M spend /ARPU avg ) < 189 per cent

- • Medium usage (termed hereafter MED)::

-

189 per cent ⩽ (M spend /ARPU avg ) < 501 per cent

- • High usage (termed hereafter HV)::

-

(M spend /ARPU avg ) > 501 per cent

Subscribers with ‘ZERO’ consumption during a certain month are included in the average ARPU calculations. This is done on purpose in order to reflect the impact of the ‘dormant users’ who are part of any subscribers’ base.

-

The ARPU values are based on the total consumed monetary values, including the free credit. That means, if the subscriber consumed the amount of x SYP, and y SYP of them were free, he actually paid at the end x-y SYP. However, the analysis considers in this case the value of x SYP as consumption, in order to reflect the sensitivity of the usage to offered free credit.

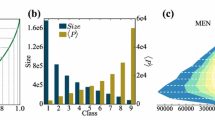

Figure 1 shows the size of each segment within the selected sample, as determined for the months October 2011–December 2011. The figure demonstrates that each segment preserves its relative size during the evaluation period. The changes of the individual segment sizes at a fixed total sample size imply a first indication for the mutual movement of the subscribers between different segments.

Figure 2 provides further details on the ARPU values of the sample. It shows how the average consumption within each segment is changing month over month, when October is taken as reference.

The important readings from Figure 2 are:

-

The fluctuation trend of the overall base is determined by the VLOW subscribers, including those who did not perform any consumption during individual months. The dominating trend of this segment results from its relative size (ca. 60 per cent) within the overall sample (see Figure 1).

-

When subscribers with ‘ZERO’ consumption are excluded from the VLOW base, the trend changes and becomes closer to that of other segments (grey line in the figure).

-

HV and MED subscribers show a slightly differentiated trend, with higher dynamic in January. However, the dynamic range is minor and does not reflect a fundamentally different behaviour in this case.

Usage fluctuation measured at segment level

Two important usage phenomena will be discussed in this subsection: The change of individual subscribers’ profiles from month to month and the dynamic range of usage fluctuation.

Identity changes within each segment from month to month

A tracking of the usage of each subscriber of the sample was performed for the complete evaluation period, and a re-assignment of each subscriber to the proper segment was carried out on a monthly basis.

Hereby, it was observed that from month to month many users change the segment they are associated with, that means the changes in their spending show a dynamic that is sufficient to position them in a different segment. The interesting point here is the fact that changes are not limited to adjacent segments; on the contrary, the usage fluctuation for many users is so high that they ‘hop’ from/to all possible segments, including hopping from VLOW to HV and vice versa.

Figure 3 illustrates this behaviour for the VLOW segment; it shows the subscribers’ movement for the months November 2011, December 2011 and January 2012, with reference to the status of October 2011. Hereby, following aspects should be noted:

-

VLOW subscribers, who are assumed to have a very static behaviour, show movements in all directions, even to HV.

-

The percentages of the subscribers who hop (compared with October) is almost the same for all three considered months.

A similar effect is shown in Figure 4 for the movement of high-value subscribers. Hereby, it is noticeable that the percentage of HV users who change their segment is much higher compared with the case of VLOW subscribers. The Figure underlines that depending on the month 37–55 per cent of the subscribers change the segment and move from HV to other classifications.

The above findings obviously raise the question: ‘How is this diffusion of the HV subscribers being compensated?’ This is an important question, because without a compensation effect a significant and steady decrease of the overall revenue values – month over month – would be noticeable.

The answer to this question is given in Figure 5, which summarizes the mutual movements between the HV and other segments. The figure represents the movements from October to November, and highlights following points:

-

A total of 2602 out of 7116 HV subscribers (ca. 37 per cent) changed their segment in November; the majority of them (1968) became MED subscribers.

-

In return, 2519 MED, LOW and VL subscribers moved into the segment, leading to a total difference of 83 subscribers (1.16 per cent) in the total segment size.

-

By comparing the subscribers who changed to other segments, and those who were new as HV during November, it becomes obvious that the identities of 35.4 per cent of the subscribers who belong to this segment have changed. This is a fundamental aspect that is worth being extra highlighted:

Although the change of the total segment size is 1.16 per cent, the change of identity within the segment from one month to the other is 35 per cent.

This type of investigation has been performed for all other segments, and the results were similar, with differences in the percentage values of identity changes.

The identity change has direct impact on the way any segmentation exercise or offer evaluation is done. Normally, any initiative is based on a pre-analysis of the subscribers’ behaviour and consequently the performance of any initiative might be heavily impacted if the subscribers, who are basically targeted by the offer, become a fundamentally different group.

These generic statements might be perceived as obvious; however, their real impact on the accuracy of results of any promotion or offer becomes much clearer once a quantification of the effect is available.

For this purpose, Tables 1, 2, 3 and 4 are considered, whereby the VLOW segment has been split up into very low users and subscribers with zero consumption, this is necessary to capture the behaviour of dormant subscribers as well.

We start with Table 1, which shows the results of the changes if the subscribers’ status in October is kept as reference and the changes in November are considered. To illustrate how the table should be read, we consider the example of the MED subscribers in October: it can be realized from the table that 9 per cent of those subscribers changed their profile to the HV segment, 60 per cent remained within the same segment, 24 per cent changed to LOW, 5 per cent to VLOW and 3 per cent were totally dormant during November. It is very important to recognize that only 56–70 per cent subscribers maintained their spending range from month to month.

The above highlighted effect is further spread over time. This is underlined in Table 2 that shows the changes when December values are compared with those of October, implying an increase of the time difference between the evaluation month and the reference month.

It is obvious that the level of changes, compared with October, is higher. For example, the percentage of HV subscribers who were in the same profile during both months decreased from 63 per cent to 53 per cent. The same decreasing trend is observed for the MED value users. For the other segments, the decrease level was minor. This again shows that the changes of spending profile are the highest among HV users.

The same type of comparison is shown again in Table 3, whereby the segment identification for the subscribers was based on their average spending during 3 months (August–October), and not only on 1 month. The 3-months average was compared with the spending in November; this emulates the scenario of legacy ‘Below The Line’ campaigns, in which subscribers are targeted with usage stimulation offers based on their usage values during the preceding months before the launch of the initiative.

By comparing Table 3 with Table 1, it becomes obvious that the values are very similar, with the exception of the dormant subscribers. This demonstrates that even if the design of any campaign is based on a pre-identified 3-months average, a considerable part of the targeted subscribers might have a very different spending volume within a single month, and consequently their response to an offer or promotion might be totally unexpected or misleading.

More consistent results in terms of target group identity preservation can be achieved, when the moving average is used to classify the subscribers and associate them to the different segments. This is underlined in Table 4, which shows the results when the average users’ spending of August–October is compared with that of September–November. For instance, the preservation level for HV subscribers increases and reaches 83 per cent (compared with 63 per cent in Table 3). This suggests that any long-term promotion or loyalty initiative should be analysed using the moving average, this assures a more consistent tracking of the subscribers’ profile.

Dynamic range of usage fluctuation

While the previous subsection focused on the number of subscribers who change from one profile to another, few comments are given below on the order of magnitude by which the usage fluctuation occurs.

It is often stated that usage fluctuation is mainly caused by seasonality effects. This suggests that the fluctuation has limits that do not exceed from 25 per cent to 30 per cent. However, a closer quantified investigation shows that the variation in terms of spending might be much higher. This is detailed in Table 5, which summarizes the relative fluctuations for those subscribers who experienced a segment change from October to November/December. For instance, the subscribers who moved from LOW in October to HV in November changed their spending by an average of 494 per cent. Similarly, all possible relative fluctuation levels can be recognized. The dynamic of the changes can reach values close to 3300 per cent, implying a consumption increase of 33 fold from month to month.

Readings from the usage fluctuations

The above-mentioned effects can be translated into concrete recommendations for daily business and marketing tasks. Therefore, Table 6 gives a summary of the discussed findings, as well as some associated working fields, where these findings can help optimize the planning and rollout of tactical market initiatives.

IMPACT OF ‘OUTLIERS’ ON PROFILE’S CHARACTERISTICS AT SEGMENT LEVEL

On the definition of outliers

Normally, an outlier is an observation that is numerically distant from the rest of the data.7 It appears to deviate markedly from other members of the sample in which it occurs. In the case of consumption analysis, outliers can be interpreted as ‘extreme users’ within one segment, and we will stick to this interpretation in the coming subsections.

The most common method to decide whether or not a data point represents an outlier is the so-called ‘z-test’, with some limitations and prerequisites as discussed in the reference list.8 In the present case, we have an exponential distribution of the monthly consumption figures, and all prerequisites to apply the z-test are fulfilled.

With reference to the data under investigation, the outliers are illustrated in Figure 6. The figure shows the histogram of the ARPU distribution, discretised in steps of 18 per cent of the average ARPU value, for a random sample of 10 000 subscribers (month: October 2011). The upper part of the figure depicts the average ARPU value and the standard deviation. The lower figure part is actually a ‘zoom’ of the upper one, whereby the vertical axis was limited to a maximum value of 10 occurrences, in order to highlight the number of subscribers with very high usage values.

If we follow the recommendations of the literature to choose the outliers as those whose values fulfil the relationship:

where Stdev. denotes the standard deviation. If we select x=3, then 214 outliers can be recognized.

Impact of outliers or extreme users on average ARPU values

In the next paragraph, we will examine how the ARPU values might change if the outliers are excluded from the averaging operation, and how sensitive is the correlation between these changes and the sample size. It is the target to illustrate the effect of the outliers in a quantitative manner.

For this purpose, four random samples were selected; the first one represents the complete group of 170 000 subscribers whose characteristics were discussed in the section ‘Sample characteristics’; in addition, three smaller random samples out of the total group were selected, comprising 10 000, 2000 and 500 subscribers, respectively. The histogram of the second sample (10 000 users) was discussed in Figure 6.

The main question within the current context is: ‘What is the quantitative impact of the outliers on the average ARPU of a sample?’

A straightforward and consolidated answer to this question is given in Figure 7, which summarizes the results for the different sample sizes by varying the parameter x.

The upper left graph in the figure shows the impact of the outliers for the different samples when x=3, both other graphs document the impact for x=2.5 and x=2. Hereby, x=3 represents the scenario with the least impact due to the minimum number of outliers in this case (by decreasing x, more high value subscribers will be excluded from the calculation of the average ARPU).

Various fundamentally important readings can be derived from the figure, for example:

-

By excluding the outliers, the average ARPU of the sample will decrease by 17–19 per cent, although the outliers represent only 1.4–2.1per cent of the investigated sample.

-

This relationship between the number of outliers, as percentage of the total sample, and the decrease of the sample ARPU is consistent and very similar among all sample sizes.

-

When keeping the criterion fixed, that is, fixed value of x, no major difference between different sample sizes is noticeable.

-

The overall trend does not change by varying the criterion.

-

It is obvious that when the value of x is decreased, the impact of the identified outliers increases.

-

From one criterion to the other, a change of 1 per cent in the percentage of outliers leads to a change of ca. 4.5 per cent in the change of the average ARPU value.

To visualize the quantitative difference between the values implied in the above-discussed data, Figure 8 gives details on the average ARPU with and without outliers, and excluding dormant subscribers. This is given for the total sample as well as for the HV subscribers within each sample.

In addition, the figure provides a comparison of the standard deviation of the ARPU of HV subscribers, compared with that of the complete sample.

It is important to notice the considerable increase of the standard deviation of the high value subscribers for the smallest sample. It documents that the sensitivity of the results to changes increases when the target segment (in this case HV subscribers) is small within a given sample size.

Readings from the outliers’ impact

Table 7 summarizes again the discussed aspects and gives some recommendations to be considered for offer design and evaluation.

SUMMARY AND CONCLUSIONS

Usage fluctuation at subscriber (that is, micro) level and extreme users can considerably affect the characteristics of certain segments of prepaid users. A thorough understanding of these phenomena is fundamental to optimize the design and post-analysis of marketing campaigns, and to be able to explain and justify inconsistent or abnormal values.

There is a fundamental difference between changes of segment's size at macro level, and changes of the identities of the subscribers with the segment (micro level). This must be taken into account when defining segment statistics and maintaining any long-term loyalty programmes.

References

Berger, P.D. and Nasr, N.I. (1998) Customer lifetime value: Marketing models and applications. Journal of Interactive Marketing 12 (1): 16–30.

Bayer, J. (2006) Customer segmentation in the telecommunications industry. Journal of Database Marketing & Customer Strategy Management 17 (3): 247–256.

Reichheld, F.F. (1996) The loyalty effect. Boston, MA: Harvard Business School Press.

Jain, D. and Singh, S.S. (2002) Customer lifetime value research in marketing: A review and future directions. Journal of Interactive Marketing 16 (2): 34–46.

Hogan, J., Lemon, K.N. and Libai, B. (2003) What is the true value of a lost customer? Journal of Service Research 5 (3): 196–208.

Reinartz, W.J. and Kumar, V. (2002) The mismanagement of customer loyalty. Harvard Business Review 80 (7): 4–12.

Barnett, V. and Lewis, T. (1994) Outliers in Statistical Data, 3rd edn. Chichester: John Wiley & Sons.

Shadrokh, A. and Pazira, H. (2010) A new statistic for detecting outliers in exponential case. Australian Journal of Basic and Applied Sciences 4 (11): 5614–5620.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Aroudaki, H. On the monthly usage dynamic of prepaid subscribers – Hidden insights. J Database Mark Cust Strategy Manag 19, 262–274 (2012). https://doi.org/10.1057/dbm.2012.24

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/dbm.2012.24