Abstract

The work discusses the Perception-Based Analysis (PBA) and its adequacy for evaluating brands positioning from the point of view of the consumers. PBA is a relatively new post hoc segmentation method, based on a topology representing neural network, able to identify homogeneous segments of perceptions in an indiscriminate mass of data. The ‘Neural Gas’ algorithm was used to find clusters in a sample of 376 students who evaluated the Nike brand across 42 items of Brand Personality Scale. Discriminant Analysis was performed to check the ability of PBA to form homogeneous segments, and an Exploratory/Confirmatory Factor Analysis (E/CFA) was carried out to confirm the validation. Five prototypes of perception were identified and described according to the importance respondents put on brand attributes. Four (among five) prototypes demonstrate a significant relationship (positive or inverse) with two or more dimensions of brand perception. Homogeny of the segments was attested, both, by Discriminant and by the E/CFA. Results suggest that PBA was both valid and reliable for capturing output brand positioning, once it succeeded in performing two important segmentation tasks: (a) identifying clusters relatively homogeneous in terms of brand perception, and (b) portraying the general opinion prevailing in every group of consumers about the brand assessed.

Similar content being viewed by others

INTRODUCTION

Economists have come to accept consumers’ perceptions of choice alternatives as necessary ingredients of their standard model. According to McFadden1 ‘economists investigating consumer behavior can learn a great deal from careful study of market research findings and marketing practice’, and ‘cognitive illusions in purchase behavior seem to coexist comfortably with the use of discrete response models’ (p. 368). Brands, on the other hand, act as shorthand in the consumers’ minds, of the set of functional and emotional associations and of trust, so that they do not have to think much about their purchase decision.2

Brands are powerful entities because they blend functional, performance-based values with emotional values.3 Therefore, while the Jaguar may compete with other brands of cars on rationally evaluated performance value, it may be bought because of the emotional value of prestige. A brand can be defined from a dyadic perspective, the manufacturers’ (input) perspective or the consumers’ imaginary (output) perspective. From the input perspective the notion of a brand is encapsulated in ideas portraying a brand as a legal instrument, as a logo, a company and as an identity system; from the output perspective a brand can be an image in consumers’ minds, a personality, a relationship, an adding value or an evolving entity. However, ‘the number of authors adhering to the concept of brands as associations in consumers’ minds attests the growing support for consumer-centered perspective on the meaning of brands’ (p. 91).2

This work analyzes the brand from the output, more specifically from the consumers’ imaginary description, using Perception-Based Analysis (PBA)4 to evaluate consumers’ perceptions about a well-known brand. The work is exploratory in nature and a Topology Representing Network (TRN) algorithm is employed both to identify groups of consumers with relatively homogeneous perceptions and to typify their perceptions. Results suggested that PBA succeeded in correctly typifying the post hoc segments5, 6 with acceptable fit measures and minimum overlaps, thus constituting an attractive alternative for brand perception evaluation.

BRAND PERSONALITY

According to the American Marketing Association, a ‘brand’ is as ‘a name, term, sign, symbol, or design, or combination of them, intended to identify the goods or services of one seller or group of sellers and to differentiate them from those of competitors’. This definition has been criticized for stressing the importance of visual features as the basis for differentiation and for being too mechanical and excessively concerned with the physical product.2

Research has shown that brands are a multifaceted concept, and to talk about ‘a brand’ sometimes overlooks the richness of this concept. A useful tool for understanding the nature of brands is the ‘brand iceberg’. An iceberg is drawn with 15 per cent visible above the water and 85 per cent invisible beneath the water; the visible parts are logo and name and the invisible are values, intellect and culture.3 ‘Brands are complex offerings that are conceived in brand plans, but ultimately they reside in consumers’ minds’ (p. 27). Brands exist mainly by virtue of a continuous process whereby organizational activities are interpreted and internalized by customers as a cluster of values.

Brand personality is a metaphoric way of portraying a brand that facilitates the attribution of emotional values to brands, especially when advertising involves celebrity endorsement. Consumers show no difficulty in assigning personal qualities to inanimate brand objects,7 in thinking about brands as if they were human characters8 or to animate products of their own.

The vitality of a brand can be realized by different forms of animism. A brand can be perceived as an animated entity by the assumption that it somehow possesses the spirit of an endorser (for example a celebrity), or of a person whose image can be associated with it (for example a grandmother and a chocolate brand she used to gift us). The association between a brand and a person can be so strong that the person's spirit is evoked in one's mind when using the brand.9 Another form of animism involves the complete anthropomorphization of the brand itself with the transcendence of human qualities, like emotion, thought and volition. ‘A brand's emotional values are also inferred from its design and packing, along with other marketer-controlled clues such as pricing and type of outlet selling the brand’ (p. 40).3

An interesting way to comprehend the essence of brand personality is exploring the brand pyramid concept (Figure 1). The logic behind the brand pyramid is that when managers devise a new brand, they are initially concerned with unexploited gaps in markets and try to conceive a brand able to deliver unique attributes. However, consumers are less concerned with attributes (for example a multifunction remote controller) and are more attentive to the benefits gained from these attributes (for example ease of recording TV shows). With experience, consumers begin to understand the brand for its benefits and emotional rewards.

The brand pyramid (Adapted from Chenatony)3.

At the top of the pyramid is a personality representing the personality traits associated with the values of the brand. By using a personality who exhibits the traits of the brand (for example a film star, pop star, athlete and so on) to promote the brand consumers draw inferences that the brand has some of the values of the promoting personality. Ultimately, the laddering in the pyramid is used to enable the brand to make a unique and welcomed promise.

Brand personality also acts as a symbolic or self-expressive function. People do not buy a Mercedes just because of the brand's performance, but rather because of the meanings of status and lifestyle represented by the brand. Brands acquire symbolic meanings in society and, through people interacting with each other, the meanings represented by a brand become better understood by people. When choosing between competing brands, customers assess the fit between the personalities of competing brands and the personality they wish to project.3

PERCEPTION-BASED ANALYSIS

Perception-Based Analysis (PBA)4, 10 and Perception-Based Market Segmentation (PBMS)11 are alternatives to more traditional Response-Based Market Segmentation (RBMS). RBMS derives the market segments directly from class-specific parameter estimates for the variables that are assumed to determine brand choice. PBA and PBMS can be classified as post hoc methods of segmentation,5, 6 as the number and type of segments are determined directly from data analysis, without any reference a priori. To employ PBMS it is suggested that one thinks about analysis as decomposed into an exploratory and an inferential step. During the exploratory step brand identity is ignored and the profiles/vectors in the stacked matrix are examined to determine the number of generic patterns in the data. These generic product profiles serve as the raw material for extracting a number of distinguished perceptual positions. These positions (or patterns) represent a typical combination of attributes (prototypes) consumers have on their minds. Deriving a limited number of patterns can be done using a cluster analysis procedure like K-means or vector quantization (VQ) method.12 The TRN was the alternative of choice in this work as being superior to simple K-means in reproducing intricate cluster structures.13

In the PBA inferential step the brand names are then incorporated and used for cross-tabulating the joint distribution of perceptual positions of any pair of brands the analyst is interested in. This procedure required some adaptation to be employed in this work: instead of identifying a general perception about each brand, as Mazanec and Strasser10 did, we were interested in getting different perceptions about the same brand. As a consequence, instead of portraying consumers’ views about brands A, B, C,…, N we were interested in capturing the patterns A, B, C,…, N, representing different positions of a brand in the consumers’ minds.

Another reason for choosing TRN was its ability to evaluate the best number of segments existing in data. As5 ‘a general problem of the nonhierarchical methods is the determination of the number of cluster present in the data’ (p. 19), the percentage of uncertainty reduction index (per cent UR) incorporated in TRN conveys an intuitively appealing piece of information to decide on the best number of clusters to identify.14 The per cent UR is based on pairs of data points misplaced across replicated VQ runs; the few data misplacements over replications, the higher per cent UR.

BRAND PERCEPTION

The identification of different brand perceptions was based on PBA,4, 10, 11 which, in a technical sense, corresponds to identifying latent segments in an indiscriminate mass of data. According to that model the term perception corresponds to the attributes that respondents valuate the most in a set of choice alternatives. Our data were interval-type resultant from ‘NIKE’ evaluation using the 42 items of the Brand Personality Scale (BPS),7 reduced to five factors during the work to improve interpretability. A previous logarithmic transformation had been performed to reduce the skewness and kurtosis.15

According to the PBA, during the exploratory step perceptions are analyzed at the generic level and compressed into typical profiles. These profiles represent typical combinations of attributes (prototypes) consumers have on their minds. If, for example, consumers have four typical images of a brand, then respondents’ reactions can be recoded into a single feature variable like A, B, C and D or simply P1 (Perception 1), P2, P3 and P4.

PROTOTYPING

Before prototyping data an earlier step was carried out to assess the best number of clusters to be formed. This was based on the improvement of the uncertainty reduction index (per cent UR)14 for solutions ranging from two to ten clusters. The per cent UR suggested five clusters as the best solution. The clustering process was handled with TRN software, which implements the Neural Gas Algorithm. The model introduced under the name of ‘Topology Representing Network’,13 employs the competitive learning principle in which the prototypes rival one against each other in attempting to approximate the frequency distribution of empirical data. However, unlike other networks4 ‘the training rule adjusts not only the winning prototype but all prototypes according to the rank of distances between data point and the first winner, second winner, etc.’ (p. 49).

Two measures were saved during the classification process: parameter estimation and cluster labels. Parameter estimation is a TRN output resulting from the network training and represents the importance of each variable for cluster identification: the higher a variable load in a cluster, the more important it is for the respondents in that cluster.16 Cluster labels is another output of the same algorithm and correspond to a vector representing each cluster as a category (say clusters no. 1, 2, 3…, n).

Interpretation of prototypes characteristics can be done visually but is not an easy task. According to Dolnicar et al14 ‘the interpretation of these prototypes is left to the researcher and thus to a great extent is subjective (making this procedure more objective is obviously an important future research task)’ (p. 29). For them, the meaning of every perceptual position can be inferred from the loads of marker variables in every prototype. In this work some variables have been considered marker for loading distinctively (highly or poorly) in one or another cluster. Attributes such as ‘successful’ and ‘leader’, for example, distinguished for loading heavily in Cluster 5; and others, such as ‘real’ marked for loading weakly in Clusters 2 and 3.

To improve prototype interpretability, the cluster identification was done in two rounds: a first round including all the 42 variables of the original scale, and a second with a more distinctive set of variables. The reduced set of five dimensions (Cronbach αs > 0.77) was identified throughout an Exploratory Factor Analysis from the original 26 variables, explaining 57.7 per cent of variance. Results of both rounds did not differ significantly (Wilcoxon signed ranks test z=−1.324, Sig. 0.185; sign test z=−0.651, Sig. 0.515), and therefore the reduced set of variables was adopted to facilitate the prototypes’ description. Clusters’ size and prototypes’ loads are reported in Table 1. The terms ‘clusters’ and ‘prototypes’ are assumed as equivalents in this work, as they represent the same groups of respondents: the former refers to the people in the groups and the latter describes the characteristics of the groups.

INTERPRETATION OF PROTOTYPES

After evaluating the latent positions existing in complex data and prototyping them labels have been added to every case according to the group they fit better. Five distinct groups have been identified. At a first glimpse on the parameter estimation it was possible to recognize a minor group (7 per cent) expressing severe criticism about the brand. In general terms, it was possible to see that for members of Cluster 4 ‘almost nothing fits’ Nike. Even the more pronounced attributes, such as down to earth, cheerful, trendy and successful, load around 0.55 in a 0–1 range, as shown in Figures 2 and 3.

Contrasting with the ‘almost nothing fits’ group, people in Cluster 1 (16 per cent) manifested a relatively favorable view about Nike, as 18 of 26 items in this group loaded over 0.9 in a 0–1 range. As we can see in Figure 3, while Cluster 1 concentrates most of the personality traits’ loads at the top of scale (between 0.8 and 1.0), Cluster 4 concentrates the loads around 0.5. But even showing the most favorable view about Nike, Cluster 1 cannot be characterized as an ‘everything fits’ group, because some attributes suggesting sincerity (sincere, real and wholesome) or sophistication (feminine and smooth) loaded around 0.6, which can be interpreted as a sign of relative criticism.

Clusters 2, 3 and 5 share the space between the extreme perceptions of Clusters 1 and 4. In general terms, it is possible to say that people in Clusters 2, 3 and 5 are less generous about Nike than those in Cluster 1, but not too critical as those in Cluster 4. Some differences between these three clusters are quite subtle and not easily perceived. To make the differences more evident loads pertaining to the Clusters 2–5 were standardized in a 0–1 interval using the normal distribution, and plotted on a two-axis graph (Figure 4).

Among the three ‘intermediary’ clusters, perceptions regarding Nike reliability, glamour, energy and competence can be interpreted by the loads of some variables in every cluster. Nike reliability (expressed by variables like real, sincere and wholesome), for example, is better perceived in Cluster 5 than in Clusters 2 and 3. Or say, Nike is fairly reliable for people in Clusters 2 and 3 but is quite trustworthy for Cluster 5s.

Results can be interpreted both by the clusters’ lines proximity (a sign of importance) and by the clusters’ lines distance (a sign of avoidance). Analyzing Figure 4, it is possible to see that some variables expressing sophistication (charming, glamorous, good looking) are more important for people in Clusters 2 and 3 than for those in Clusters 4 and 5.

Some variables expressing competence (successful, leader, technical) are more important for consumers in Clusters 3 and 5 than for those in Clusters 2 and 4; some variables suggesting energy (exciting, western, tough) are clearly in opposition to the Cluster 4 direction but not too distant from Cluster 2; and some variables suggesting sincerity (sincere, real, wholesome) are in the opposite way of Cluster 2 but not too distant from Cluster 4. A condensed interpretation of the five clusters is shown in Table 2.

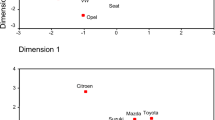

METHOD VALIDATION

To evaluate the neural algorithm ability to form clusters of homogeneous perceptions a Discriminant Analysis and an E/CFA were carried out using cluster numbers as a dependent category variable. The sole objective of the Discriminant Analysis, in this work, was to produce a spatial map to visualize the main dimensions; not a statistical inference. The resulting Figure 5 shows that the algorithm succeeded in producing homogenous groups of respondents according to their perceptions with minimum overlapping. It also confirmed that Cluster 4 is not only a minor group but that perceptions of its members are fairly dispersed and are difficult to typify.

An E/CFA was used for being a useful precursor to CFA, which allows the researcher to explore measurement structures more fully before moving into a confirmatory framework.17 It represents an intermediary step between EFA and CFA, which provides substantial information, important in the development of realistic confirmatory solutions. The E/CFA purpose in this work was twofold: (a) to verify data ability to reproduce BPS original dimensions in a Brazilian context, and (b) to estimate the parameters and dimensions to be compared with perceptions produced from PBA clusters loads.

Since an EFA had been carried out during the prototyping procedure, the exploratory step was considered superfluous. The dimensions identified on that previous procedure, explaining 57.7 per cent of variance, were assumed as the underlying structure existing in data and variables with highest factor loads taken as factors’ anchors. The confirmatory step assumed that each variable had non-zero loading on the factor it was assigned to measure, and zero loading on all other factors.

Three of the five factors (sincerity, competence and sophistication) were assumed as equivalent to the original dimensions, as most of the variables coincided. Excitement and ruggedness factors mixed variables from different dimensions and had to be re-specified. Excitement received some variables from the sincerity dimension and therefore was re-specified as conventional modernity, for expressing actuality and affectivity at the same time, or say: a factor suggesting up-to-dateness but not young wildness. Ruggedness mixed some of its own original variables with excitement’ and was re-specified as vanguardism, for mixing fashion tendency (trendy) and adventure. As we can see in Table 3, all the variables used in the measurement model were very significant (Estimate/Standard Error > 2) to explain the dimensions they had been assigned to, and except for ‘smooth’ and ‘feminine’ – two attributes of sophistication – all variables counted more than 30 per cent of their variance for the latent corresponding factor (R2). Brand dimensions were allowed to correlate, according to the original work.7 Factors’ correlations are shown in Table 4.

Except for brand sincerity, which seems to be less associated, all the latent factors show correlations over 0.5. The two factors resulting from re-specification (Challenge and Cheerfulness) showed high correlation (0.89), which can be interpreted as a sign of proximity in terms of meaning. This was somewhat expected as both the re-specified factor received variables from excitement (E) original dimension. The high correlation (0.92) involving challenge and sophistication was not expected, as the first one comprises variables from the ruggedness original factor, an idea almost opposite to sophistication. Even conceding that both dimensions suggest some energy the high correlation was considered surprising here.

The structural model was specified with all the five prototypes of perception as dependent on brand dimensions. As the prototypes were binary-type, the Robust Weighted Least Square (WLSMV) estimator was chosen for being the most appropriate estimator for categorical indicators.17, 18 Fit measures (TLI=0.915; RMSEA=0.076) were considered acceptable for that purpose.17

Some segments, but not all, showed a significant relationship with brand dimensions probit regression coefficients, confirming that every prototype has a different view about Nike. Prototype 1, for example, sees positively sincerity and challenge, but the latter is more than double the former, confirming that sincerity is not a good facet of Nike. Prototype 2 has a positive view in relation to cheerfulness and sophistication but a negative view in relation to challenge. Prototype 3 shows a negative view about Nike cheerfulness and sincerity. Prototype 4 did not show significant dependency from any dimension. And Prototype 5 sees Nike as challenging and relatively sincere but not as a sophisticated brand. The R2 included in last row of Table 5, just below the standardized coefficients, confirms that all the prototypes, except number four, accounts more than 50 per cent of its variance for model adjustment.

Most of those findings are in accordance with PBA evaluation. For example, comparing the challenge and sincerity standardized coefficients for Prototype 1, it is possible to see that the former is more than twice the value of the last. Taking into consideration that both are highly significant, this confirms that even among the most generous group of consumers, honesty is not a strong facet of Nike. The highest positive coefficient for variables suggesting sophistication in Prototype 2 confirms that group as the one that best perceives charm in Nike. The positive coefficient for cheerfulness is also in accordance with PBA, but the criticism about challenge (−3.467) was not elicited by that procedure.

The negative coefficients for cheerfulness and sincerity in Prototype 3 confirm that this group does not see distinctive attributes on Nike and is seriously critical about its reliability. Criticism about brand reliability can be inferred in two ways: (a) straightforwardly derived from the negative value of sincerity and (b) indirectly from the sincerity variables that were assigned to the cheerfulness dimension in this work. The criticism about brand glamour captured by PBA could not be confirmed by E/CFA.

The lack of a significant relationship between Prototype 4 and brand dimensions seems reasonable, as people in this group did not valuate any distinctive trait of Nike. In consequence, no significant relationship could be expected between their perception and brand dimensions. Coefficients of Prototype 5 confirmed that this perception remembers in some way the positive evaluations of Prototypes 1 and 2, but sharply differ in terms of glamour, which is severely criticized by people in this group.

CONCLUSION

To conclude, the result of E/CFA suggests that PBA succeeded in performing two important tasks related to post hoc segmentation: (a) identified groups of consumers with relatively homogeneous perceptions, and (b) offered appropriate information for prototype’ description. The accuracy with which consumers were assigned to the clusters was attested by the fit measures. The convergence of results produced by different methods can be interpreted as a sign of validity; moreover, in this situation, when the E/CFA could reproduce most of the non-parametric PBA results. This way it seems reasonable to conclude that the Neural Gas Algorithm constitutes an appealing alternative to finding a latent segment in an indiscriminate mass of data, or when the bases for a priori segmentation are not trustworthy, as occurred in the present study.

Most of the prototype perceptions based on PBA were validated by E/CFA. Even requiring some re-specifications the original dimensions could be used to estimate parameters for prototypes. Most of the significant relationships found coincided with the PBA-based description. The release of some variables that could not be used for not fitting the model was not considered problematic once the data were collected in a country other than USA. According to Aaker,7 the scale might not be appropriate for measuring brand personality in different cultural contexts and ‘with the use of the Brand Personality Scale, the variables can be manipulated systematically and their impact on brand's personality measured’ (p. 354).

Four of five prototypes demonstrate a significant relationship (positive or inverse) with two or more dimensions of brand perception. According to E/CFA it was possible to confirm that: (a) people in Cluster 1 see Nike as a challenger and a quite sincere brand; (b) people in Cluster 2 see Nike as sophisticated and cheerful but not as an adventurer brand; (c) people in Cluster 3 see Nike as low profile and non-reliable brand; (d) people in Cluster 4 do not see any significant quality in Nike; and (e) people in Cluster 5 see Nike as a challenger, and a quite sincere and unsophisticated brand.

Even being considered adequate for brand assessment this approach requires some care. PBA was considered appropriate for post hoc segmentation and therefore for capturing brand positioning. But the ability of BPS7 to measure brand personality has some restrictions. Azoulay and Kapferer,19 for example, argue from the personality literature that Aaker's scale7 of brand personality merges a number of dimensions of brand identity that cannot be interpreted as personality. Others claim that it cannot generalize to all brands and that some traits, like ‘western’ and ‘small town’ are difficult to be interpreted.3

Despite any semantic discussion regarding which real facet of the brand BPS is able to measure, it does not seem to be decisive for brand managers. It does not matter whether the scale describes real traits of personality or just reflects some facets of brand identity. It was most important for the purpose of this work to confirm PBA as an adequate tool to interpret the brands’ output positioning.

References

McFadden, D. (2001) Economic choices. The American Economic Review 91 (3): 351–378.

Chernatony, L. de and Riley, F.D. (1997) The chasm between managers’ and consumers’ views of brands. Journal of Strategic Marketing 5: 89–104.

Chernatony, L. de (2006) From Brand Vision to Brand Evaluation, 2nd edn. Burlington, MA: Elevier.

Mazanec, J.A. and Strasser, H. (2001) A Nonparametric Approach to Perception-Based Market Segmentation Foundation, Vol. I. Berlin: Springer-Verlang.

Wedel, M. and Kamakura, W.A. (2000) Market Segmentation: Conceptual and Methodological Foundations, 2nd edn. New York: Springer.

Lilen, G.L. and Rangaswamy, A. (2004) Marketing Engineering, 2nd edn. Canada: Trafford.

Aaker, J.L. (1997) Dimensions of brand personality. Journal of Marketing Research 34 (3): 347–356.

Plummer, J.T. (2000) How personality makes a difference. Journal of Advertising Research, 40 (6): 79–84.

Fournier, S. (1998) Consumers and their brands: Developing relationship theory in consumer research. The Journal of Consumer Research 24 (4): 343–373.

Mazanec, J.A. and Strasser, H. (2007) Perception-based analysis of tourism products and service providers. Journal of Travel Research 45 (4): 387–401.

Mazanec, J.A. (2006) Evaluating perceptions-based marketing strategies: An agent-based model and simulation experiment. Journal of Modeling Management 1 (1): 52–74.

Mazanec, J.A. (2005) New methodology for analyzing competitive positions: A demonstration study of travelers’ attitude toward their modes of transport. Tourism Analysis 9 (4): 231–240.

Martinetz, T. and Schulten, K. (1994) Topology representing networks. Neural Networks 7 (3): 507–522.

Dolnicar, S., Grabler, K. and Mazanec, J.A. (1999) A tale of three cities: Perceptual charting for analyzing destination images. In: A.G. Woodside, G.I. Crouch, J.A. Mazanec, M. Oppermann and M.Y. Sakai (eds.) Consumer Psychology of Tourism, Hospitality and Leisure. Wallingford, CT: CABI.

Hair Jr, J.F., Anderson, R.E., Tatham, R.L. and Black, R.L. (1998) Multivariate Data Analysis. Upper Saddle River, NJ: Prentice-Hall.

Mazanec, J.A. (2001) Neural market structure analysis: Novel topology-sensitive methodology. European Journal of Marketing 35 (7/8): 894–914.

Brown, T.A. (2006) Confirmatory Factor Analysis for Applied Research. New York: The Guilford Press.

Muthén, L.K. and Muthén, B.O. (2004) MPlus: Statistical Analysis with Latent Variables – User's Guide. Los Angeles, CA: Muthén & Muthén.

Azoulay, A. and Kapferer, J.N. (2003) Do brand personality scales really measure brand personality? Brand Management 11 (2): 143–155.

Acknowledgements

The authors thank the Vienna University of Economics and Business Administration (Wirtschaftsuniversität Wien) for providing the software, and Professor Josef Mazanec for his comments and suggestions about this study.

Author information

Authors and Affiliations

Corresponding author

Additional information

1got his Master's degree in Business Administration (Finance) from the Universidade Federal do Rio Grande do Sul (Brazil) and his PhD from the same university. Now he is Professor at Universidade Federal de Pelotas (Brazil).

2got his Master's degree in Business Administration from the University of Chile and his PhD in Sciences de Gestion from Pierre Mendès University (Grenoble – France). Now he is Professor at Ecole Supérieure de Commerce of Troyes (France) and Professor at Universidade Federal do Rio Grande do Sul (Brazil).

Rights and permissions

About this article

Cite this article

Anana, E., Nique, W. Perception-Based Analysis: An innovative approach for brand positioning assessment. J Database Mark Cust Strategy Manag 17, 6–18 (2010). https://doi.org/10.1057/dbm.2009.32

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/dbm.2009.32