Abstract

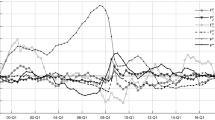

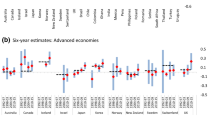

We analyze exchange rate pass-through in seven CIS countries using monthly data from 1999 to 2010. In the short run, VAR models estimates show that exchange rate movements in the US dollar affect consumer prices to a relatively high degree (about 50%), while the Euro exchange rate is less important. Moreover, short-run exchange rate pass-through is very heterogeneous across countries. In particular, countries with high-energy imports from Russia generally have higher exchange rate pass-through. In the long run, panel cointegration results show pass-through rates of 60% and above for both the US dollar and Euro exchange rates.

Similar content being viewed by others

Notes

Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, and Uzbekistan are members of the CIS. Turkmenistan and Ukraine are no official members but they participate in activities of the CIS. We also include Georgia, who was a CIS member between 1993 and 2009.

Results are available upon request from the authors.

Results are available upon request from the authors.

Purchasing power parity theory predicts that real exchange rates should be stationary, which implies complete exchange rate pass-through. Therefore, the weak results of panel cointegration tests for some specifications may arise because exchange rate pass-through is incomplete. Despite the ambiguity of panel cointegration tests, the estimated coefficients still provide consistent estimates of the exchange rate pass-through because panel models avoid the problem of spurious regression by using pooled data (Phillips and Moon, 1999; Kao, 1999).

References

Andrews, DWK and Zivot, E . 1992: Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business and Economic Statistics 10 (3): 251–270.

Banerjee, A . 1999: Panel data unit roots and cointegration: An overview. Oxford Bulletin of Economics and Statistics 61 (S1): 607–629.

Beck, R and Barnard, G . 2009: Towards a flexible exchange rate policy in Russia. OECD Economics Department Working Paper no. 744, OECD Publishing. http://dx.doi.org/10.1787/218428024413.

Carranza, L, Galdon-Sanchez, JE and Gomez-Biscarri, J . 2009: Exchange rate and inflation dynamics in dollarized economies. Journal of Development Economics 89 (1): 98–108.

Darvas, Z . 2001: Exchange rate pass-through and real exchange rate in EU candidate countries. Discussion Paper 10/01, Economic Research Centre of the Deutsche Undesb Bank. Frankfurt a. M., Germany.

de Bandt, O, Banerjee, A and Kozluk, T . 2008: Measuring long-run exchange rate pass-through. Economics – The Open-Access, Open-Assessment E-Journal 2 (6): 1–36.

Dobrynskaya, V and Levando, D . 2005: A study of exchange rate pass-through effect in Russia. Working Paper WP9/2005/02, Moscow State University, Higher School of Economics: Moscow, Russia.

Dreger, C and Fidrmuc, J . 2011: Drivers of exchange rate dynamics in selected CIS countries: Evidence from a FAVAR analysis. Emerging Markets Finance and Trade 47 (4): 5–15.

EBRD. 2012: Transition region in the shadows of the eurozone crisis. Chapter 2. Transition Report, EBRD: London.

Égert, B and MacDonald, R . 2009: Monetary transmission mechanism in Central and Eastern Europe: Surveying the surveyable. Journal of Economic Surveys 23 (2): 277–327.

Elliott, G, Rothenberg, TJ and Stock, JH . 1996: Efficient tests for an autoregressive unit root. Econometrica 64 (4): 813–836.

Goldberg, PK and Knetter, MM . 1997: Goods prices and exchange rates: What have we learned? Journal of Economic Literature 35 (3): 1243–1272.

Hadri, K . 2000: Testing for stationarity in heterogenous panel data. Econometrics Journal 3 (2): 148–161.

Im, KS, Pesaran, MH and Shin, Y . 2003: Testing for unit root in heterogenous panels. Journal of Econometrics 115 (1): 53–74.

Kao, C . 1999: Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics 90 (1): 1–44.

Kataranova, M . 2010: Sviaz’ mezhdu obmennym kursom i infliatsiei v Rossii (In Russian: The link between the exchange rate and inflation in Russia). Zhurnal Voprosy Ekonomiki 1 (1): 1–29.

Korhonen, I and Wachtel, P . 2006: A note on exchange rate pass-through in CIS countries. Research in International Finance and Business 20 (2): 215–226.

Kwiatkowski, D, Phillips, PCB, Schmidt, P and Shin, Y . 1992: Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? Journal of Econometrics 54 (1–3): 159–178.

Larue, B, Gervais, J-P and Rancourt, Y . 2010: Exchange rate pass-through, menu costs and threshold cointegration. Empirical Economics 38 (1): 171–192.

Levin, A, Lin, C-F and Chu, C-SJ . 2002: Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108 (1): 1–24.

Maddala, GS and Wu, S . 1999: A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and Statistics 61 (S1): 631–652.

Menon, J . 1995: Exchange rate pass-through. Journal of Economic Surveys 9 (2): 197–231.

Mishkin, F . 2008: Exchange rate pass-through and monetary policy. NBER Working Paper no. 13889. National Bureau of Economic Research: Cambridge, MA.

Ng, S . and Perron, P . 2001: Lag length selection and the construction of unit root tests with good size and power. Econometrica 69 (6): 1519–1554.

Pedroni, P . 1996: Fully modified OLS for heterogenous cointegrated panels and the case of purchasing power parity. Working Paper no. 96–020, Indiana University, Indianapolis.

Pedroni, P . 2001: Purchasing power parity tests in cointegrated panels. Review of Economics and Statistics 83 (4): 727–731.

Phillips, PCB and Moon, HR . 1999: Linear regression limit theory for nonstationary panel data. Econometrica 67 (5): 1057–1112.

Pomfret, R . 2003: Economic performance in Central Asia since 1991: Macro and micro evidence. Comparative Economic Studies 45 (4): 442–465.

Pomfret, R . 2011: Exploiting energy and mineral resources in Central Asia, Azerbaijan and Mongolia. Comparative Economic Studies 53 (1): 5–33.

Raballand, G . 2003: Determinants of the negative impact of being landlocked on trade: An empirical investigation through the Central Asian case. Comparative Economic Studies 45 (4): 520–536.

Samkharadze, B . 2008: Monetary transmission mechanism in Georgia: analyzing pass-through of different channels. National Bank of Georgia Working Paper no. 02/2008. National Bank of Georgia: Tbilisi, Georgia.

Acknowledgements

The authors would like to thank the participants of the conference on Fiscal Stabilization and Monetary Union, Mendel University Brno, November 2011, as well as Aleksandra Riedl and Campbell Leith for valuable comments and suggestions. The views are the authors’ and do not necessarily reflect those of the Oesterreichische Nationalbank or the Eurosystem.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Beckmann, E., Fidrmuc, J. Exchange Rate Pass-Through in CIS Countries. Comp Econ Stud 55, 705–720 (2013). https://doi.org/10.1057/ces.2013.8

Published:

Issue Date:

DOI: https://doi.org/10.1057/ces.2013.8