Abstract

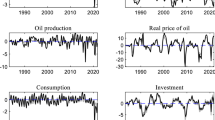

This analysis explores the effects of oil price shocks on U.S. economic growth. We begin with a well-known model developed by James Hamilton, consider refinements to his definition of an oil price “shock,” and then explore alternatives to his basic reduced-form model. We find that a structurally inspired error-correction model for non-farm business output, which allows for oil price changes to have both long-run and short-run effects, performs better than the basic reduced-form model and also shows significantly smaller adverse effects of rising oil prices. Our preferred model suggests that oil prices reduced GDP growth by about 0.4 percentage point on average through the first three quarters of 2008, before contributing 1.7 percentage points in the fourth quarter as prices plummeted.

Similar content being viewed by others

References

Barsky, Robert B., and Kilian, Lutz . 2004. “Oil and the Macroeconomy since the 1970s.” Journal of Economic Perspectives, 18 (4): 115–134.

Bernanke, Ben S., Gertler, Mark, and Watson, Mark . 1997. “Systematic Monetary Policy and the Effects of Oil Price Shocks.” Brookings Papers on Economic Activity, 1: 91–142.

Hamilton, James D . 1985. “Historical Causes of Postwar Oil Shocks and Recessions.” The Energy Journal, 6 (January): 97–116.

Hamilton, James D . 2003. “What Is an Oil Shock? Journal of Econometrics, 113 (April): 363–398.

Hamilton, James D., and Herrera, Ana Maria . 2004. “Oil Shocks and Aggregate Macroeconomic Behavior: The Role of Monetary Policy.” Journal of Money, Credit, and Banking, 36 (2): 265–286.

Hooker, Mark A . 1996. “What Happened to the Oil Price-Macroeconomy Relationship? Journal of Monetary Economics, 38: 195–213.

Kilian, Lutz . 2008. “The Economic Effects of Energy Price Shocks.” Journal of Economic Literature, 46 (4): 871–909.

Kilian, Lutz . 2009. “Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market.” American Economic Review, 99 (3): 1053–1069.

Kliesen, Kevin L . 2008. “Oil and the U.S. Macroeconomy: An Update and a Simple Forecasting Exercise,” Federal Reserve Bank of St. Louis Working Paper Series.

Wen, Yi, and Aguiar-Conraria, Luis . 2005. “Understanding the Large Negative Impact of Oil Shocks,” Federal Reserve Bank of St. Louis Working Paper Series.

Additional information

1Neal Ghosh is an economic analyst at Macroeconomic Advisers where he works across a range of research tasks including model estimation and simulation support, data collection and analysis in support of special projects, and current macroeconomic analysis. He received a B.A in Economics in December 2007 and an M.S. in Finance in May 2009, both from Washington University.

2Chris Varvares is the president of Macroeconomic Advisers, LLC, a company he co-founded in 1982. Mr. Varvares is also the current president (October 2008 – September 2009) of the National Association for Business Economics (NABE). Prior to founding Macroeconomic advisers, he was a member of the staff of the President's Council of Economic Advisers. Mr. Varvares is a former director of NABE, past president of the St. Louis chapter, and is a member of the American Economic Association. He is a member of the New York State Economic and Revenue Advisory Board, serves on the Bureau of the Census Advisory Committee, and has been a panelist for the World Economic Forum. Mr. Varvares holds a B.A. in Economics from the George Washington University and an M.A. in Economics from Washington University in St. Louis.

*James Morley is an associate professor of Economics at Washington University in St. Louis, where he teaches macroeconomics, finance, and econometrics. His research focuses on the development of time series models and techniques to examine the nature and sources of business cycle fluctuations. His other professional activities include being a visiting researcher at the Bank of Canada and a research fellow at the Federal Reserve Bank of St. Louis. He has also been a “time series” consultant for Macroeconomic Advisers, LLC since 2005.