Abstract

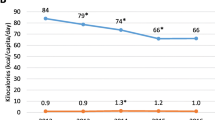

Junk food consumption is associated with rising obesity rates in the United States. While a “junk food” specific tax is a potential public health intervention, a majority of states already impose sales taxes on certain junk food and soft drinks. This study reviews the state sales tax variance for soft drinks and selected snack products sold through grocery stores and vending machines as of January 2007. Sales taxes vary by state, intended retail location (grocery store vs. vending machine), and product. Vended snacks and soft drinks are taxed at a higher rate than grocery items and other food products, generally, indicative of a “disfavored” tax status attributed to vended items. Soft drinks, candy, and gum are taxed at higher rates than are other items examined. Similar tax schemes in other countries and the potential implications of these findings relative to the relationship between price and consumption are discussed.

Similar content being viewed by others

References

Blanck HM, Dietz WH, Galuska DA, Gillespie C, Hamre R, Kettel Khan L, et al. State-specific prevalence of obesity among adults – United States, 2005. MMWR Morb Mortal Wkly Rep. 2006;36 (55):985–988.

Malik VS, Schulze MB, Hu FB . Intake of sugar-sweetened beverages and weight gain: a systematic review. Am J Clin Nutr. 2006;84 (2):274–288.

Center for Science in the Public Interest. Dispensing Junk: How School Vending Undermines Efforts to Feed Children Well. Washington, DC: CSPI; 2004.

James J, Thomas P, Cavan D, Kerr D . Preventing childhood obesity by reducing consumption of carbonated drinks: cluster randomised controlled trial. BMJ. 2004;328 (7450):1237.

Zenk SN, Powell LM . US secondary schools and food outlets. Health Place. 2008;14 (2):336–346.

Vending Times Inc. Census of the Industry: 2007 Edition. New York, NY: Vending Times, Inc.; 2007.

U.S. Department of Health and Human Services. The Surgeon General's Call to Action to Prevent and Decrease Overweight and Obesity. Rockville, MD: US Department of Health and Human Services, Public Health Service, Office of the Surgeon General; 2001.

Institute of Medicine. Preventing Childhood Obesity: Health in the Balance. Washington, DC: National Academies Press; 2005.

Institute of Medicine. Progress in Preventing Childhood Obesity. Washington, DC: National Academies Press; 2007.

Alliance for a Healthier Generation. Memorandum of Understanding Regarding New School Beverage Policy. New York, NY: Alliance for a Healthier Generation; 2006.

Alliance for a Healthier Generation. Memorandum of Understanding Regarding Guidelines for Competitive Foods Sold in Schools to Students. New York, NY: Alliance for a Healthier Generation; 2006.

Finkelstein EA, Fiebelkorn IC, Wang G . National medical spending attributable to overweight and obesity: how much, and who's paying? Health Aff (Millwood). 2003, Suppl Web Exclusives: W3–W26.

Mello MM, Studdert DM, Brennan TA . Obesity – the new frontier of public health law. N Engl J Med. 2006;354 (24):2601–2610.

Davey RC . The obesity epidemic: too much food for thought? Br J Sports Med. 2004;38 (3):360–363.

Miljkovic D, Nganje W, de Chastenet H . Economic factors affecting the increase in obesity in the United States: differential response to price. Food Policy. 2008;33 (1):48–60.

Kim D, Kawachi I . Food taxation and pricing strategies to “thin out” the obesity epidemic. Am J Prev Med. 2006;30 (5):430–437.

Jacobson MF, Brownell KD . Small taxes on soft drinks and snack foods to promote health. Am J Public Health. 2000;90 (6):854–857.

Netscan's Health Policy Tracking Service. State Actions to Promote Nutrition, Increase Physical Activity, and Prevent Obesity: A 2006 First Quarter Legislative Overview. Falls Church, VA: Thomson West; 2006.

General Excise vs. Sales Tax. State of Hawaii, Department of Taxation 2000 July; Tax Facts, 96-1. Available at http://hawaii.gov/tax/taxfacts/tf96-01.pdf, accessed 14 February 2008.

Mersky RM, Dunn DJ . Fundamentals of Legal Research. 8th Edition. New York, NY: Foundation Press; 2002.

Federation of Tax Administrators. State Sales Tax Rates: 1 January 2007. Available at http://www.taxadmin.org/fta/rate/sales.html, accessed 27 March 2007.

Caraher M, Cowburn G . Taxing food: implications for public health nutrition. Public Health Nutr. 2005;8 (8):1242–1249.

Leicester A, Windmeijer F . The ‘Fat Tax’: Economic Incentives to Reduce Obesity, Briefing Note 4. London: Institute for Fiscal Studies; 2004.

Skinner T, Miller H, Bryant C . The literature on the economic causes of and policy responses to obesity. Food Economics – Acta Agriculturae Scandinavica, Section C. 2005;2 (3):128–137.

European Commission Directorate-General Taxation and Customs Union Tax Policy. VAT Rates Applied in the Member States of the European Community. Available at http://ec/europa.eu/taxation_customs/resources/documents/taxation/vat/how_vat_works/rates/vat_rates_2005_en.pdf, accessed 8 September 2007.

Chicago Soft Drink Tax. Illinois Department of Revenue 2005 June; Publication 116. Available at http://www.revenue.state.il.us/Publications/Pubs/Pub-116.pdf, accessed 14 February 2008.

Kuchler F, Tegene A, Harris JM . Taxing snack foods: manipulating diet quality or financing information programs? Rev Agric Econ. 2005;27 (1):4–20.

Tefft N . The effects of a “snack tax” on household soft drink expenditure. Available at (link currently inactive) http://www.ssc.wisc.edu/~ntefft/research/snack_tax_draft_1.pdf, accessed 8 September 2007.

French SA, Story M, Jeffery RW, Snyder P, Eisenberg M, Sidebottom A, et al. Pricing strategy to promote fruit and vegetable purchase in high school cafeterias. J Am Diet Assoc. 1997;97 (9):1008–1010.

French SA, Jeffery RW, Story M, Breitlow KK, Baxter JS, Hannan P, et al. Pricing and promotion effects on low-fat vending snack purchases: the CHIPS Study. Am J Public Health. 2001;91 (1):112–117.

French SA . Pricing effects on food choices. J Nutr. 2003;133 (3):841S–843S.

Chaloupka FJ, Warner KE . The economics of smoking. In: Cuyler AJ, Newhouse JP, editors. The Handbook of Health Economics. New York: North-Holland, Elsevier Science B.V.; 2000, p. 1539–1627.

Chaloupka FJ . The effects of price on alcohol use, abuse, and their consequences. In: Bonnie RJ, O'Connell ME, editors. Reducing Underage Drinking: A Collective Responsibility. Washington, DC: National Research Council, Institute of Medicine, The National Academies Press; 2004, p. 541–564.

West R . What lessons can be learned from tobacco control for combating the growing prevalence of obesity? Obes Rev. 2007;8 (s1):145–150.

McKinlay JB, Marceau LD . Upstream healthy public policy: lessons from the battle of tobacco. Int J Health Serv. 2000;30 (1):49–69.

Stone GR, Seidman LM, Sunstein CR, Tushnet MV, Karlan PS . Constitutional Law, 4th Edition. New York: Aspen; 2001.

Gostin LO . Law as a tool to facilitate healthier lifestyles and prevent obesity. JAMA. 2007;297 (1):87–90.

Byrd S . Civil rights and the “Twinkie” tax: the 900-pound gorilla in the war on obesity. Louisiana Law Rev. 2004;65:303–385.

Powell LM, Slater S, Mirtcheva D, Bao Y, Chaloupka FJ . Food store availability and neighborhood characteristics in the United States. Prev Med. 2007;44 (3):189–195.

Food Stamp Act of 1977. 7, 2011-et seq. 2007. U.S.C.

Nielsen SJ, Siega-Riz AM, Popkin BM . Trends in energy intake in U.S. between 1977 and 1996: similar shifts seen across age groups. Obesity Res. 2002;10 (5):370–378.

Guthrie JE, Lin B, Frazao E . Role of food prepared away from home in the American diet, 1977–78 vs. 1994–96: changes and consequences. J Nutr Educ Behav. 2002;34:140–150.

Economic Research Service, USDA. Food Marketing System in the U.S. 22 August 2007. Available at www.ers.usda.gov/Briefing/FoodMarketingSystem/foodservice.htm, accessed 14 February 2008.

Acknowledgements

This study was prepared under the Robert Wood Johnson Foundation-supported ImpacTeen project through a grant to the University of Illinois at Chicago and a subcontract to The MayaTech Corporation. The views presented in this paper are those of the authors and do not represent the views of the Robert Wood Johnson Foundation or its Board of Directors or the authors' employers.

Author information

Authors and Affiliations

Corresponding author

Additional information

Because of observations from the tobacco wars, the authors look at how taxes on junk food might help combat obesity.

Rights and permissions

About this article

Cite this article

Chriqui, J., Eidson, S., Bates, H. et al. State Sales Tax Rates for Soft Drinks and Snacks Sold through Grocery Stores and Vending Machines, 2007. J Public Health Pol 29, 226–249 (2008). https://doi.org/10.1057/jphp.2008.9

Published:

Issue Date:

DOI: https://doi.org/10.1057/jphp.2008.9