Abstract

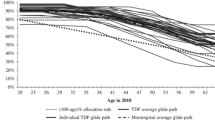

The glide path of typical target date funds is based on the relatively simple assumption of risk. If an explicit term structure of risk is present or risk is time-varying, the conventional glide path may not be adequate to fulfil the purpose of target date funds. We introduce a new approach to define the glide path of target date funds. Our starting point is to determine the level of risk budget for each target date. According to the pre-defined risk budget, we derive the asset allocation of target date funds by explicitly incorporating the current term structure of risk. As risk does change through different market phases, we implement a dynamic asset allocation strategy for target date funds that considers simultaneously both the pre-defined risk budget and the prevailing market risks. The main difference is that at any given time our risk-controlled dynamically rebalanced target date funds would not exceed the pre-defined risk budget regardless of market movements.

Similar content being viewed by others

Notes

Institutional Investor, March 2009, reports that the asset of target date funds has reached $ 185 billion.

VIX is the volatility index, which is the key measure of market expectations of near-term volatility conveyed by S&P500 index option prices traded in CBOE. The index is a leading barometer of investor sentiment and market volatility. ML MOVE index is compiled by Merrill Lynch based on the weighted average of implied volatilities of 1-month Treasury options on the 2-year, 5-year, 10-year and 30-year US Treasury securities expressed in basis points (with a total weight of 40 per cent on the 10-year Treasury and total weights of 20 per cent each on the other maturities).

References

Andersen, T., Bollerslev, T., Christoffersen, P. and Diebold, F. (2006) Practical volatility and correlation modeling for financial market risk management. In: M. Carey and R. Stultz (eds.) The Risks of Financial Institutions. Chicago, IL: University of Chicago Press for NBER, pp. 513–548.

Basu, A., Byrne, A. and Drew, M. (2008) Dynamic lifecycle strategies for target date retirement funds. Nathan, Australia: Griffith Business School, Griffith University (mimeo).

Bodie, Z., Merton, R. and Samuelson, W. (1991) Labor supply flexibility and portfolio choice in life cycle model. Journal of Economic Dynamics and Control 16: 427–449.

Campbell, J. and Viceira, L. (2002) Strategic Asset Allocation: Portfolio Choice for Long-Term Investors. New York: Oxford University Press.

Campbell, J. and Viceira, L. (2005) The term structure of the risk-return trade-off. Financial Analysts Journal 61 (1): 34–44.

Dimson, E., Marsh, P. and Staunton, M. (2006) The worldwide equity premium: A smaller puzzle. Paper presented at the European Finance Association; 23–26 August, Zurich, Switzerland.

Harvey, C. (1989) Time-varying conditional covariances in tests of asset pricing models. Journal of Financial Economics 24: 289–317.

McCalla, D. (1994) Enhancing asset allocation performance with a volatility-based rebalancing process. In: J. Ledermann and R. Klein (eds.) Global Asset Allocation: Techniques for Optimizing Portfolio Management. New York: John Wiley & Sons, pp. 55–74.

Merton, R. (1969) Lifetime portfolio selection under uncertainty: The continuous time case. Review of Economics and Statistics 51: 247–257.

Poterba, J., Rauh, J., Venti, S. and Wise, D. (2009) Lifecycle asset allocation strategies and the distribution of 401(k) retirement wealth. In: D. Wise (ed.) Developments in the Economics of Aging. Chicago, IL: University of Chicago Press, pp. 15–50.

Samuelson, P. (1969) Lifetime portfolio selection by dynamic stochastic programming. Review of Economics and Statistics 51: 239–246.

Shiller, R. (2006) The life-cycle personal accounts proposal for social security: An evaluation of President Bush's proposal. Journal of Policy Modeling 28: 427–444.

Surz, R. and Israelsen, C. (2008) Evaluating target date lifecycle funds. Journal of Performance Measurement 12 (2): 62–70.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yoon, Y. Glide path and dynamic asset allocation of target date funds. J Asset Manag 11, 346–360 (2010). https://doi.org/10.1057/jam.2010.20

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jam.2010.20