Abstract

Despite an abundance of cross-sectional, panel, and event studies, there is strikingly little convincing documentation of direct positive impacts of financial opening on the economic welfare levels or growth rates of developing countries. The econometric difficulties are similar to those that bedevil the literature on trade openness and growth though, if anything, they are more severe in the context of international finance. There is also little systematic evidence that financial opening raises welfare indirectly by promoting collateral reforms of economic institutions or policies. At the same time, opening the financial account does appear to raise the frequency and severity of economic crises. Nonetheless, developing countries continue to move in the direction of further financial openness. A plausible explanation is that financial development is a concomitant of successful economic growth, and a growing financial sector in an economy open to trade cannot long be insulated from cross-border financial flows. This survey discusses the policy framework in which financial globalization is most likely to prove beneficial for developing countries. The reforms developing countries need to carry out to make their economies safe for international asset trade are the same reforms they need to carry out to curtail the power of entrenched economic interests and liberate the economy's productive potential.

Similar content being viewed by others

Notes

See World Bank (2008, p. 2). The capital inflow figure that I cite refers to “net external financing,” or the net resources foreign investors provide in order to finance a country's current account deficit, its net international reserve accumulation, and its residents’ own net purchases of assets located abroad. The measure includes errors and omissions.

Stulz (2005) discusses some of the measures described below, as well as others.

Edwards (2007) constructs his index by augmenting earlier work of Quinn (2003) and Mody and Murshid (2005) with information from national sources.

“Net external financing” is defined in footnote 1.

If errors and omissions are neglected, developing country private residents’ net acquisition of claims on industrial countries equals net external financing less reserve accumulation plus the current account surplus. Thus, on average over 2003–08, private residents of developing countries added a net sum of about $600 billion every year to their assets held abroad.

Earlier this point was emphasized by Díaz Alejandro (1985), whose account of the early 1980s Chilean crisis put at center stage the folly of believing “that financial markets, domestic and international, were no different from the markets for apples or meat” (p. 9). One is tempted to observe, however, that in many countries food production processes are heavily regulated by government due to the possibility of disease transmission through the supply chain. In the United States, Upton Sinclair's indictment of laissez-faire in the meat-processing industry, The Jungle (1906), led to a partial “sudden stop” in U.S. meat exports—as has happened more recently to several countries in response to outbreaks of mad cow disease. Quickly the United States passed the legislation setting up the Food and Drug Administration. Issuers of subprime-related financial products in the United States during the mid-2000s certainly were not subject to oversight comparably stringent to that applied to American meat products.

Even the hypothesis that openness to trade promotes growth is supported by quite limited statistical evidence. Harrison and Rodríguez-Clare (2007) survey the econometric literature on trade and growth and conclude, contrary to the positive reading of Fischer (2003, p. 14), that “the empirical work on this question is surprisingly mixed.” The interpretive obstacles that Harrison and Rodríguez-Clare identify are exactly the same as those that bedevil studies of the effects of financial openness on growth. Although the obstacles are qualitatively the same, however, their resolution often seems even more problematic in the financial sphere. One problem, already mentioned, is the absence of reliable measures of the height of barriers to financial trade. In the sphere of merchandise trade one can turn to data on statutory tariff rates and quotas and even shipping costs, but financial barriers are likely to be more exotic and difficult to quantify. To the extent that capital-flow barriers involve unobservable informational asymmetries that are less severe in nonfinancial markets, for example, they will be much harder to measure than are trade barriers. I discuss other problems of empirical interpretation below.

Of course, this rather mild indictment of capital-account fundamentalism is not inconsistent with Rogoff's (2007) more recent comment that “Too many policymakers still believe that externally imposed opening to international capital flows was the main culprit behind the financial crises of the 1990s—a view that unfortunately is lent some intellectual respectability by a small number of left-leaning academics…. Pushing for greater capital market liberalization after the debacle of the 1990's will be controversial. But the core of the idea was right then, and it is right now.” An interesting discussion of the IMF staff's shifting attitudes toward capital account restrictions in the context of actual country advice is in Independent Evaluation Office (2005).

Fiscal cost estimates for past banking crises are tabulated by Ergungor and Thomson (2005). Fiscal costs are naturally far below total economic costs, including repercussions on the broader economy.

For a recent general survey of financial stability issues, see Schinasi (2006).

Some studies suggest that in many cases it is domestic financial liberalization that has been the main driver of lending booms and subsequent crises, with capital inflows playing a secondary supporting role. This perspective suggests a primary policy focus on the oversight and stress-testing of domestic financial intermediation. See, for example, Gourinchas, Valdés, and Landerretche (2001).

Former IMF Managing Director Michel Camdessus characterized the 1994 Mexican crisis as “the first financial crisis of the twenty-first century.” Boughton (2001) has suggested that the 1956 Suez crisis may really have been the first 21st century crisis. On different grounds one might well identify the 1890 Baring Crisis as the first 21st century crisis.

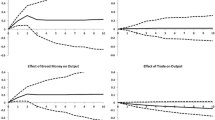

Joyce and Nabar (2008) argue on empirical grounds that sudden stops affect investment only when they coincide with banking-system crises, and that openness to capital flows accentuates the negative investment effect of banking crises. Edwards (2007) finds no evidence that countries with higher capital mobility face an increased risk or incidence of crisis, but concludes that crises tend to reduce economic growth more in countries that are more open financially.

Consistent with these concerns is the finding of Kose, Prasad, and Terrones (2007) that emerging markets have not benefited much from enhanced opportunities to share consumption risks. Also consistent is the cross-sectional finding of Klein and Olivei (2008) that any positive effect of financial openness on financial depth and growth applies mainly to longstanding OECD countries.

In evaluating cross-country differences in returns to capital, more work at the micro level, such as Minhas’ (1963) study, would be illuminating.

For a discussion of similar issues in cross-sectional tests of the trade-growth link, and a proposed alternative approach, see Estevadeordal and Taylor (2008). The interpretation of pure cross-sectional tests becomes even murkier if the underlying growth regression specification includes the investment rate as a regressor, as often is the case, although Henry's basic point still holds true. By controlling for the investment rate, the econometrician forecloses an estimated effect of financial opening on growth through the capital-deepening channel.

Harrison and Rodríguez-Clare (2007) call for further micro studies to resolve questions about the effects of trade openness on growth.

Klein's (2008) results, which show a positive impact of liberalization on growth only after a critical initial income threshold has been passed (but not for high-income capital-rich countries), could be interpreted as pointing in this direction. See also Arteta, Eichengreen, and Wyplosz (2003) and Klein and Olivei (2008).

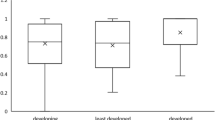

A finding in the theoretical literature is that open economies might be most susceptible to financial instability at intermediate levels of financial development. See, for example, Aghion, Bacchetta, and Banerjee (2004).

See also the case studies included in Ishii and others (2002), as well as Mishkin (2008).

“Thailand Scraps Capital Controls after Stocks Plummet,” International Herald Tribune, December 9, 2006.

An interesting discussion of the Australian experience is in McCauley (2006).

Some of the following material draws on Obstfeld (2007).

The emphases on both the balance sheet effects of currency movements and the differing marginal consumption propensities of different economic groups are salient in the classic literature on contractionary devaluations. For lucid discussions, see Díaz Alejandro (1963 and 1965, p. 31).

References

Aghion, Philippe, Philippe Bacchetta, and Abhijit Banerjee, 2004, “Financial Development and the Instability of Open Economies,” Journal of Monetary Economics, Vol. 51 (September), pp. 1077–1106.

Aghion, Philippe, Romain Rancière, and Kenneth Rogoff, 2006, “Exchange Rate Volatility and Productivity Growth: The Role of Financial Development,” NBER Working Paper No. 12117 (Cambridge, Massachusetts, National Bureau of Economic Research).

Aizenman, Joshua, Brian Pinto, and Artur Radziwill, 2007, “Sources for Financing Domestic Capital—Is Foreign Saving a Viable Option for Developing Countries?” Journal of International Money and Finance, Vol. 26 (September), pp. 682–702.

Alfaro, Laura, Areendam Chanda, Sebnem Kalemli-Ozcan, and Selin Sayek, 2004, “FDI and Economic Growth: The Role of Local Financial Markets,” Journal of International Economics, Vol. 64 (October), pp. 89–112.

Arteta, Carlos, Barry Eichengreen, and Charles Wyplosz, 2003, “When Does Capital Account Liberalization Help More than It Hurts?” in Economic Policy in the International Economy: Essays in Honor of Assaf Razin, ed. by Elhanan Helpman and Efraim Sadka (Cambridge, United Kingdom, Cambridge University Press).

Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad, 2005, “Does Financial Liberalization Spur Growth?” Journal of Financial Economics, Vol. 77 (July), pp. 3–55.

Bekaert, Campbell R. Harvey, and Christian Lundblad, 2006, “Growth Volatility and Financial Liberalization,” Journal of International Money and Finance, Vol. 25 (April), pp. 370–403.

Bhagwati, Jagdish, 1998, “The Capital Myth: The Difference between Trade in Widgets and Dollars,” Foreign Affairs, Vol. 77 (May/June), pp. 7–12.

Bhalla, Surjit S., 2006, “Dissent Note on the Report on Fuller Capital Account Convertibility,” in Report of the Committee on Fuller Capital Account Convertibility, ed. by Savak S. Tarapore and others (Mumbai, Reserve Bank of India).

Bolaky, Bineswaree, and Caroline L. Freund, 2004, “Trade, Regulations, and Growth,” World Bank Policy Research Working Paper 3255 (Washington, World Bank).

Borensztein, Eduardo, José De Gregorio, and Jong-Wha Lee, 1998, “How Does Foreign Direct Investment Affect Economic Growth?” Journal of International Economics, Vol. 45 (June), pp. 115–135.

Bosworth, Barry P., 2005, “Managing Capital Flows: What We Have Learned,” (unpublished; Washington, Brookings Institution).

Bosworth, Barry P., and Susan M. Collins, 1999, “Capital Flows to Developing Economies: Implications for Saving and Investment,” Brookings Papers on Economic Activity: 1 (Washington, Brookings Institution), pp. 143–180.

Boughton, James R., 2001, “Was Suez in 1956 the First Financial Crisis of the Twenty-First Century?” Finance & Development, Vol 38 (September) (Washington, International Monetary Fund). Available via the Internet: www.imf.org/external/pubs/ft/fandd/2001/09/boughton.htm.

Burger, John D., and Francis E. Warnock, 2006, “Local Currency Bond Markets,” IMF Staff Papers, Vol. 53 (Special Issue), pp. 133–46.

Burger, John D., and Francis E. Warnock, 2007, “Foreign Participation in Local Currency Bond Markets,” Review of Financial Economics, Vol. 16, No. 3, pp. 291–304.

Calvo, Guillermo A., 1998, “Capital Flows and Capital-Market Crises: The Simple Economics of Sudden Stops,” Journal of Applied Economics, Vol. 1 (November), pp. 35–54.

Calvo, Guillermo A., Leonardo Leiderman, and Carmen M. Reinhart, 1996, “Inflows of Capital to Developing Countries in the 1990s,” Journal of Economic Perspectives, Vol. 10 (Spring), pp. 123–139.

Calvo, Guillermo A ., and Carmen M. Reinhart, 2002, “Fear of Floating,” Quarterly Journal of Economics, Vol. 117 (May), pp. 379–408.

Caselli, Francesco, and James Feyrer, 2007, “The Marginal Product of Capital,” Quarterly Journal of Economics, Vol. 122 (May), pp. 535–568.

Chari, Anusha, and Peter Blair Henry, 2004, “Risk Sharing and Asset Prices: Evidence from a Natural Experiment,” Journal of Finance, Vol. 59 (June), pp. 1295–1324.

Chinn, Menzie D., and Hiro Ito, 2005, “What Matters for Financial Development? Capital Controls, Institutions, and Interactions,” NBER Working Paper No. 11370 (Cambridge, Massachusetts, National Bureau of Economic Research).

Claessens, Stijn, Daniela Klingebiel, and Sergio Schmukler, 2003, “Government Bonds in Domestic and Foreign Currency,” Policy Research Working Paper 2986 (Washington, World Bank Development Research Group).

Collins, Susan M., 2004, “International Financial Integration and Growth in Developing Countries: Issues and Implications for Africa,” Journal of African Economies, Vol. 13, No. 2, pp. ii55–ii94.

Cooper, Richard N., 1999, “Should Capital Controls Be Banished?” Brookings Papers on Economic Activity: 1 (Washington, Brookings Institution), pp. 89–141.

Cowan, Kevin, and José De Gregorio, 2007, “International Borrowing, Capital Controls and the Exchange Rate: Lessons from Chile,” in Capital Controls and Capital Flows in Emerging Economies: Policies, Practice, and Consequences, ed. by Sebastian Edwards (Chicago, University of Chicago Press).

de la Torre, Augusto, and Sergio L. Schmukler, 2007, Emerging Markets and Globalization: The Latin American Experience (Palo Alto, California, and Washington, Stanford University Press and World Bank).

Demirgüç-Kunt, Asli, and Ross Levine, eds., 2001, Financial Structure and Economic Growth (Cambridge, Massachusetts, MIT Press).

Díaz Alejandro, Carlos. F., 1963, “A Note on the Impact of Devaluation and the Redistributive Effect,” Journal of Political Economy, Vol. 71 (December), pp. 577–580.

Díaz Alejandro, Carlos. F., 1965, Exchange Rate Devaluation in a Semi-Industrialized Country: The Experience of Argentina, 1955–1961 (Cambridge, Massachusetts, MIT Press).

Díaz Alejandro, Carlos. F., 1985, “Good-Bye Financial Repression, Hello Financial Crash,” Journal of Development Economics, Vol. 19 (September–October), pp. 1–24.

Dobson, Wendy, and Gary Clyde Hufbauer, 2001, World Capital Markets: Challenge to the G-10 (Washington, Institute for International Economics).

Dominguez, Kathryn M.E., and Linda L. Tesar, 2007, “International Borrowing and Macroeconomic Performance in Argentina,” in Capital Controls and Capital Flows in Emerging Economies: Policies, Practice, and Consequences, ed. by Sebastian Edwards (Chicago, University of Chicago Press).

Dornbusch, Rudi, 2002, “A Primer on Emerging Market Crises,” in Preventing Currency Crises in Emerging Markets, ed. by Sebastian Edwards and Jeffrey A. Frankel (Chicago, University of Chicago Press).

Edison, Hali, Ross Levine, Luca Ricci, and Torsten Sløk, 2002, “International Financial Integration and Economic Growth,” Journal of International Money and Finance, Vol. 21 (November), pp. 749–776.

Edwards, Sebastian, 2007, “Capital Controls, Sudden Stops, and Current Account Reversals,” in Capital Controls and Capital Flows in Emerging Economies: Policies, Practice, and Consequences, ed. by Sebastian Edwards (Chicago, University of Chicago Press).

Eichengreen, Barry, 2001, “Capital Account Liberalization: What Do Cross-Country Studies Tell Us?” World Bank Economic Review, Vol. 15 (March), pp. 341–365.

Eichengreen, Barry, and Ricardo Hausmann, 1999, “Exchange Rates and Financial Fragility,” in New Challenges for Monetary Policy (Kansas City, Missouri, Federal Reserve Bank of Kansas City).

Eichengreen, Barry, and Ricardo Hausmann, and Pipat Luengnaruemitchai, 2004, “Why Doesn’t Asia Have Bigger Bond Markets?” NBER Working Paper No. 10576 (Cambridge, Massachusetts, National Bureau of Economic Research).

Eichengreen, Barry, and Ricardo Hausmann, and Pipat Luengnaruemitchai, 2008, “Bond Markets as Conduits for Capital Flows: How Does Asia Compare?” in International Financial Issues in the Pacific Rim, ed. by Takatoshi Ito and Andrew K. Rose (Chicago, University of Chicago Press).

Ergungor, O. Emre, and James B. Thomson, 2005, “Systemic Banking Crises,” Policy Discussion Paper 9 (February), Federal Reserve Bank of Cleveland.

Estevadeordal, Antoni, and Alan M. Taylor, 2008, “Is the Washington Consensus Dead? Growth, Openness, and the Great Liberalization, 1970s–2000s” (unpublished; Washington and Davis, California, Inter-American Development Bank and University of California, Davis), August.

Feldstein, Martin, 1999, “A Self-Help Guide for Emerging Markets,” Foreign Affairs, Vol. 78 (March/April), pp. 93–109.

Fischer, Stanley, 1998, “Capital Account Liberalization and the Role of the IMF,” in Should the IMF Pursue Capital Account Convertibility? Princeton Essays in International Finance, Vol. 207 (Princeton, New Jersey, Princeton University).

Fischer, Stanley, 2003, “Globalization and Its Challenges,” American Economic Review, Vol. 93 (May), pp. 1–30.

Frankel, Jeffrey A., and Eduardo A. Cavallo, 2004, “Does Openness to Trade Make Countries More Vulnerable to Sudden Stops, or Less? Using Gravity to Establish Causality,” NBER Working Paper No. 10957 (Cambridge, Massachusetts, National Bureau of Economic Research).

Goldstein, Morris, 2002, Managed Floating Plus (Washington, Institute for International Economics).

Goldstein, Morris, and Philip Turner, 2004, Controlling Currency Mismatches in Emerging Markets (Washington, Institute for International Economics).

Gourinchas, Pierre-Olivier, and Olivier Jeanne, 2006, “The Elusive Gains from International Financial Integration,” Review of Economic Studies, Vol. 73, No. 3, pp. 715–741.

Gourinchas, Pierre-Olivier, and Olivier Jeanne, 2007, “Capital Flows to Developing Countries: The Allocation Puzzle,” NBER Working Paper No. 13602 (Cambridge, Massachusetts, National Bureau of Economic Research).

Gourinchas, Pierre-Olivier, Rodrigo Valdés, and Oscar Landerretche, 2001, “Lending Booms: Latin America and the World,” Economía, Vol. 1 (Spring), pp. 47–99.

Gozzi, Juan Carlos, Ross Levine, and Sergio L. Schmukler, 2008, “Internationalization and the Evolution of Corporate Valuation,” Journal of Financial Economics, Vol. 88 (June), pp. 607–632.

Hall, Robert E., and Charles I. Jones, 1999, “Why Do Some Countries Produce So Much More Output per Worker than Others? Quarterly Journal of Economics, Vol. 114 (February), pp. 83–116.

Harrison, Ann, and Andrés Rodríguez-Clare, 2007, “Trade, Foreign Investment, and Industrial Policy,” (unpublished; Berkeley, California and University Park, Pennsylvania) University of California, Berkeley, and Pennsylvania State University), September.

Henry, Peter Blair, 2000a, “Stock Market Liberalization, Economic Reform, and Emerging Market Equity Prices,” Journal of Finance, Vol. 55 (April), pp. 529–564.

Henry, Peter Blair, 2000b, “Do Stock Market Liberalizations Cause Investment Booms?” Journal of Financial Economics, Vol. 58, No. (1–2), pp. 301–334.

Henry, Peter Blair, 2003, “Capital Account Liberalization, the Cost of Capital, and Economic Growth,” American Economic Review, Vol. 93 (May), pp. 91–96.

Henry, Peter Blair, 2007, “Capital Account Liberalization: Theory, Evidence, and Speculation,” Journal of Economic Literature, Vol. 45 (December), pp. 887–935.

Husain, Aasim, Ashoka Mody, and Kenneth Rogoff, 2004, “Exchange Rate Regime Durability and Performance in Developing versus Advanced Economies,” Journal of Monetary Economics, Vol. 52 (January), pp. 35–64.

Hutchison, Michael M., and Ilan Noy, 2005, “How Bad Are the Twins? Output Costs of Currency and Banking Crises,” Journal of Money, Credit and Banking, Vol. 37 (August), pp. 725–752.

Independent Evaluation Office, 2005, The IMF's Approach to Capital Account Liberalization (Washington, International Monetary Fund).

Ishii, Shogo, and others 2002, “Capital Account Liberalization and Financial Sector Stability,” IMF Occasional Paper No. 211 (Washington, International Monetary Fund).

Jeanne, Olivier, 2005, “Why Do Emerging Economies Borrow in Foreign Currency?” in Other People's Money, ed. by Barry Eichengreen and Ricardo Hausmann (Chicago, University of Chicago Press).

Jeanne, Olivier, 2007, “International Reserves in Emerging Market Countries: Too Much of a Good Thing?” Brookings Papers on Economic Activity: 1 (Washington, Brookings Institution), pp. 1–79.

Joyce, Joseph P., and Malhar Nabar, 2008, “Sudden Stops, Banking Crises and Investment Collapses in Emerging Markets” (unpublished; Wellesley, Massachusetts, Wellesley College).

Kaminsky, Graciela L., and Carmen M. Reinhart, 1999, “The Twin Crises: The Causes of Banking and Balance of Payments Problems,” American Economic Review, Vol. 89 (June), pp. 473–500.

Klein, Michael W., 2008, “Capital Account Liberalization and the Varieties of Growth Experience” (unpublished; Medford, Massachusetts, Tufts University), April.

Klein, Michael W., and Giovanni P. Olivei, 2008, “Capital Account Liberalization, Financial Depth, and Economic Growth,” Journal of International Money and Finance, Vol. 27 (October), pp. 861–875.

Kose, M. Ayhan, Eswar Prasad, Kenneth Rogoff, and Shang-Jin Wei, 2006, “Financial Globalization: A Reappraisal,” NBER Working Paper No. 12484 (Cambridge, Massachusetts, National Bureau of Economic Research).

Kose, M. Ayhan, Eswar Prasad, and Marco E. Terrones, 2007, “How Does Financial Globalization Affect Risk Sharing? Patterns and Channels” (unpublished; International Monetary Fund and Cornell University), June.

Kose, M. Ayhan, Eswar Prasad, and Marco E. Terrones, 2008, “Does Openness to International Financial Flows Contribute to Productivity Growth?” (unpublished, Washington and Ithaca, New York: International Monetary Fund and Cornell University).

Krugman, Paul R., 1979, “A Model of Balance-of-Payments Crises,” Journal of Money, Credit and Banking, Vol. 11 (August), pp. 311–325.

Lancaster, Kelvin, and Richard G. Lipsey, 1956, “The General Theory of Second Best,” Review of Economic Studies, Vol. 24 (December), pp. 11–32.

Lane, Philip R., and Gian Maria Milesi-Ferretti, 2007, “The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970–2004,” Journal of International Economics, Vol. 73 (November), pp. 223–250.

Levine, Ross, 2005, “Finance and Growth: Theory and Evidence,” in Handbook of Economic Growth, ed. by Philippe Aghion and Steven N. Durlauf (Amsterdam, Elsevier).

Liviatan, Nissan, 1980, “Ant-Inflationary Monetary Policy and the Capital Import Tax,” Warwick Economic Research Paper Series 171.

Lucas Jr., Robert E., 1990, “Why Doesn’t Capital Flow from Rich to Poor Countries?” American Economic Review, Vol. 80 (May), pp. 92–96.

Martin, Philippe, and Hélène Rey, 2006, “Globalization and Emerging Markets: With or without Crash?” American Economic Review, Vol. 96 (December), pp. 1631–1651.

McCauley, Robert, 2006, “Internationalising a Currency: The Case of the Australian Dollar,” BIS Quarterly Review (December), pp. 41–54.

Minhas, Bagicha Singh, 1963, An International Comparison of Factor Costs and Factor Use (Amsterdam, North-Holland).

Mishkin, Frederic S, 2006, The Next Great Globalization (Princeton, New Jersey, Princeton University Press).

Mishkin, Frederic S, 2008, “Why We Shouldn’t Turn Our Backs on Financial Globalization” (unpublished; Washington, Board of Governors of the Federal Reserve System).

Mitton, Todd, 2006, “Stock Market Liberalization and Operating Performance at the Firm Level,” Journal of Financial Economics, Vol. 81 (September), pp. 625–647.

Mody, Ashoka, and Antu Panini Murshid, 2005, “Growing Up with Capital Flows,” Journal of International Economics, Vol. 65 (January), pp. 249–266.

Noland, Marcus, 2007, “South Korea's Experience with International Capital Flows,” in Capital Controls and Capital Flows in Emerging Economies: Policies, Practice, and Consequences, ed. by Sebastian Edwards (Chicago, University of Chicago Press).

Obstfeld, Maurice, 1999, “Foreign Resource Inflows, Saving, and Growth,” in The Economics of Saving and Growth: Theory, Evidence, and Implications for Policy, ed. by Klaus Schmidt-Hebbel and Luis Servén (Cambridge, United Kingdom, Cambridge University Press).

Obstfeld, Maurice, 2004, “Globalization, Macroeconomic Performance, and the Exchange Rates of Emerging Economies,” Monetary and Economic Studies, Vol. 22, No. S-1, pp. 29–55.

Obstfeld, Maurice, 2007, “The Renminbi's Dollar Peg at the Crossroads,” Monetary and Economic Studies, Vol. 25, No. S-1, pp. 29–55.

Obstfeld, Maurice, and Kenneth Rogoff, 1995, “The Mirage of Fixed Exchange Rates,” Journal of Economic Perspectives, Vol. 9 (Fall), pp. 73–96.

Obstfeld, Maurice, and Alan M. Taylor, 2004, Global Capital Markets: Integration, Crisis, and Growth (Cambridge, United Kingdom, Cambridge University Press).

Obstfeld, Maurice, Jay C. Shambaugh, and Alan M. Taylor, 2008, “Financial Stability, the Trilemma, and International Reserves,” NBER Working Paper 14217 (Cambridge, Massachusetts, National Bureau of Economic Research).

Ocampo, José Antonio, and Maria Luisa Chiappe, 2003, Counter-Cyclical Prudential and Capital Account Regulations in Developing Countries (Stockholm, Almqvist & Wiksell International).

Prasad, Eswar, and Raghuram G. Rajan, 2008, “A Pragmatic Approach to Capital Account Liberalization” Journal of Economic Perspectives, Vol. 22 (Summer), pp. 149–72.

Prasad, Eswar, Raghuram G. Rajan, and Arvind Subramanian, 2006, “Patterns of International Capital Flows and Their Implications for Economic Development,” in The New Economic Geography: Effects and Policy Implications (Kansas City, Missouri, Federal Reserve Bank of Kansas City).

Prasad, Eswar, Raghuram G. Rajan, and Arvind Subramanian, 2007, “Foreign Capital and Economic Growth,” Brookings Papers on Economic Activity: 1 (Washington, Brookings Institution), pp. 153–230.

Prasad, Eswar, Kenneth Rogoff, Shang-Jin Wei, and M. Ayhan Kose, 2003, “Effects of Financial Globalization on Developing Countries: Some Empirical Evidence,” IMF Occasional Paper No. 220 (Washington, International Monetary Fund).

Quinn, Dennis P., 2003, “Capital Account Liberalization and Financial Globalization, 1890–1999: A Synoptic View,” International Journal of Finance and Economics, Vol. 8 (July), pp. 189–204.

Rajan, Raghuram G., and Luigi Zingales, 2003, “The Great Reversals: The Politics of Financial Development in the 20th Century,” Journal of Financial Economics, Vol. 69 (July), pp. 5–50.

Rodrik, Dani, 1998, “Who Needs Capital-Account Convertibility?” in Should the IMF Pursue Capital Account Convertibility? Princeton Essays in International Finance, Vol. 207 (Princeton, New Jersey, Princeton University).

Rodrik, Dani, and Arvind Subramanian, 2008, “Why Did Financial Globalization Disappoint?” (unpublished; Boston and Washington, Harvard University and Peterson Institute for International Economics).

Rogoff, Kenneth, 2002, “Rethinking Capital Controls: When Should We Keep an Open Mind?” Finance & Development, Vol. 39 (December). Available via the Internet: www.imf.org/external/pubs/ft/fandd/2002/12/rogoff.htm.

Rogoff, Kenneth, 2007, “The Way Forward for Global Financial Policy,” Project Syndicate (April 13). Available via the Internet: www.brookings.edu/views/op-ed/rogoff20070413.htm.

Schinasi, Garry J., 2006, Safeguarding Financial Stability: Theory and Practice (Washington, International Monetary Fund).

Sinclair, Upton, 1906, The Jungle (New York, Doubleday, Page and Company).

Singh, Anoop, and others 2005, “Stabilization and Reform in Latin America: A Macroeconomic Perspective on the Experience Since the Early 1990s,” IMF Occasional Paper No. 238 (Washington, International Monetary Fund).

Stiglitz, Joseph E., 2003, Globalization and Its Discontents (New York, Norton).

Stulz, René M., 2005, “The Limits of Financial Globalization,” Journal of Finance, Vol. 60 (August), pp. 1595–1638.

Tarapore, Savak S., 1998, “An Indian Approach to Capital-Account Convertibility,” in Should the IMF Pursue Capital Account Convertibility? Princeton Essays in International Finance, Vol. 207 (Princeton, New Jersey, Princeton University).

Tarapore, Savak S., and others, 2006, Report of the Committee on Fuller Capital Account Convertibility (Mumbai, Reserve Bank of India, July 31).

Tirole, Jean, 2002, International Crises, Liquidity, and the International Monetary System (Princeton, New Jersey, Princeton University Press).

Tornell, Aaron, and Frank Westermann, 2005, Boom-Bust Cycles and Financial Liberalization (Cambridge, Massachusetts, MIT Press).

Tovar, Camilo E., 2005, “International Government Debt Denominated in Local Currency: Recent Developments in Latin America,” BIS Quarterly Review (December), pp. 109–118.

Tytell, Irina, and Shang-Jin Wei, 2004, “Does Financial Globalization Induce Better Macroeconomic Policies?” IMF Working Paper 04/84 (Washington, International Monetary Fund).

Williamson, John, 2001, “The Case for a Basket, Band and Crawl (BBC) Regime for East Asia,” in Future Directions for Monetary Policies in East Asia, ed. by David Gruen and John Simon (Sydney, Reserve Bank of Australia).

World Bank, 2006, Global Development Finance: The Development Potential of Surging Capital Flows (Washington, World Bank).

World Bank, 2008, Global Development Finance: The Role of International Banking (Washington, World Bank).

Additional information

*Maurice Obstfeld is the Class of 1958 Professor of Economics, University of California, Berkeley. This article was prepared as a background paper for the Commission on Growth and Development and originally published as “International Finance and Growth in Developing Countries: What Have We Learned?” World Bank Growth Commission Working Paper Series Number 34. The author is grateful for assistance from Gabriel Chodorow-Reich, José Antonio Rodríguez-Lopez, Lorenz Küng, and Mary Yang. The current draft has benefited from discussions with Sara Guerschanik Calvo, Julian di Giovanni, Barry Eichengreen, Gian Maria Milesi-Ferretti, Peter Blair Henry, Ayhan Kose, Alan M. Taylor, Roberto Zagha, and an anonymous referee, as well as from comments at the April 9, 2007 conference in New York organized by the Commission. Thanks go as well to Sebastian Edwards for supplying the updated Edwards (2007) data on capital controls.