Abstract

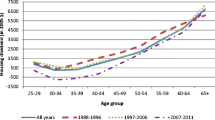

This paper investigates the impact of housing demand on the composition of the optimal portfolios of homeowners in France, following the methodology developed by Flavin and Yamashita (NBER Working Paper 6389, 2002). We use historical data on housing prices and financial assets returns to estimate the mean return and covariance matrix of a set of assets including housing. We then calculate mean-variance efficient frontiers associated to various levels of the housing-to-net wealth ratio, corresponding to the average ratios observed for different age groups in the 1998 French Wealth Survey sample. Our numerical results fit the average portfolios in different age brackets quite well. Also, returns of housing and its covariance with the other assets indicate there is room in France for housing price derivatives.

Similar content being viewed by others

References

Blake, D. (1996). \ldEfficiency, Risk Aversion and Portfolio Insurance: an Analysis of Financial Asset Portfolios Held by Investors in the United Kingdom,\rd The Economic Journal 106(September).

Brueckner, J.K. (1997). \ldConsumption and Investment Motives and the Portfolio Choices of Homeowners,\rd The Journal of Real Estate Finance and Economics 15(2), 159–180.

Englund, P., M. Hwang, and J. M. Quigley. (2002). \ldHedging Housing Risk,\rd The Journal of Real Estate Finance and Economics 24(1), 163–197.

Englund, P., J. M. Quigley, and C. Redfearn. (1998). \ldImproved Price Indexes for Real Estate: Measuring the Course of Swedish Housing Prices,\rd Journal of Urban Economics 44(2), 171–196.

Flavin, M., and T. Yamashita. (1998). \ldOwner-occupied Housing and the Composition of the Household Portfolio over the Life Cycle,\rd NBER Working Paper 6389.

Flavin, M., and T. Yamashita. (2002). \ldOwner-occupied Housing and the Composition of the Household Portfolio,\rd The American Economic Review 1, 345–362.

Friggit, J. (1999). \ldProduits d\'eriv\'es \`a sous-jacent immobilier: utilisation des indices notariaux comme sous-jacents de produits d\'eriv\'es en immobilier d'habitation,\rd mimeo.

Goetzman, W. N. (1993). \ldThe Single Family Home in the Investment Portfolio,\rd The Journal of Real Estate Finance and Economics 6(3), 201–222.

Gouri\'eroux, C., A. Laferr\`ere, and F. Dubujet. (2002). \ldLes indices de prix du logement en France, donn\'ees et m\'ethodologie,\rd INSEE M\'ethodes 98, INSEE.

Grossman, S. J., and G. Laroque. (1990). \ldAsset Pricing and Optimal Portfolio Choice in the presence of Illiquid Durable Consumption Goods,\rd Econometrica 58(1), 25–51.

Hardman, A. M., and Y. Ioannides. (1995). \ldMoving behavior and the housing market,\rd Regional Science and Urban Economics 25(1), 21–39.

Henderson, V., and Y. Ioannides. (1983). \ldA Model of Housing Tenure Choice,\rd The American Economic Review 73, 98–113.

Henderson, V., and Y. Ioannides. (1987). \ldOwner Occupancy: Investment vs Consumption Demand,\rd Journal of Urban Economics 21, 228–241.

Iacoviello, M., and F. Ortalo-Magn\'e. (2003). \ldHedging Housing Risk in London,\rd The Journal of Real Estate Finance and Economics 27(2), 191–203.

Ingersoll, J. F. (1987). Theory of Financial Decision Making. Studies in Financial Economics, Rowman and Littlefield publishers.

INSEE. (1999). \ldRevenus et patrimoine des m\'enages \'Edition 1999,\rd Synth\`eses 28, INSEE.

Le Blanc, A., and C. Lagarenne. (2000). \ldPropri\'et\'e occupante et composition du portefeuille au cours du cycle de vie,\rd INSEE Working Paper F2006, INSEE.

Ross, S. A. (1978). \ldThe Current Status of the Capital Asset Pricing Model,\rd Journal of Finance 33, 885–901.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

le Blanc, D., Lagarenne, C. Owner-Occupied Housing and the Composition of the Household Portfolio: The Case of France. The Journal of Real Estate Finance and Economics 29, 259–275 (2004). https://doi.org/10.1023/B:REAL.0000036673.64928.7f

Issue Date:

DOI: https://doi.org/10.1023/B:REAL.0000036673.64928.7f