Abstract

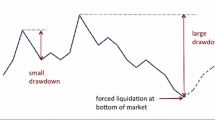

Equity duration offers an interesting new approach to measuring stock risk. The cross-sectional relation between duration and returns is puzzling and invites further investigation.

Similar content being viewed by others

References

Bansal, R., R. Dittmar and C. Lundblad. (2002). “Consumption, Dividends, and the Cross-Section of Equity Returns.” Working paper, Duke University.

Brennan, M. and Y. Xia. (2003). “Risk and Valuation under an Intertemporal Asset Pricing Model.” Journal of Business, article will appear in January 2006 issue, vol. 79,no. 1.

Campbell, J. and T. Vuolteenaho. (2003). “Bad Beta, Good Beta.” Working paper, Harvard University.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Santa-clara, P. Discussion of “Implied Equity Duration: A New Measure of Equity Risk”. Review of Accounting Studies 9, 229–231 (2004). https://doi.org/10.1023/B:RAST.0000028187.59987.8f

Issue Date:

DOI: https://doi.org/10.1023/B:RAST.0000028187.59987.8f