Abstract

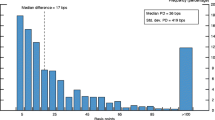

There is strong evidence that the interest rates charged by banks on the flow of newly extended Commercial & Industrial (C&I) loans predict future loan performance and CAMEL rating downgrades by bank supervisors. While internal risk ratings have little explanatory power for future loan performance, they do help predict future CAMEL downgrades. These findings suggest that supervisors might consider using interest rates in the off-site surveillance of banks. At the same time, we propose that reformers consider basing capital requirements and deposit insurance premia on loan interest rates instead of (or in addition to) internal risk ratings and models.

Similar content being viewed by others

References

Altman, Edward I., and Heather J. Suggitt. “Default Rates in the Syndicated Bank Loan Market: A Mortality Analysis.” Journal of Banking and Finance 24,no. 1–2 (2001), 229–253.

Berger, Allen N., and Gregory Udell. “Collateral, Loan Quality, and Bank Risk.” Journal of Monetary Economics 25 (1990), 43–47.

Carey M., and Treacy, W. “Internal Credit Rating Systems at Large U.S. Banks.” Federal Reserve Bulletin (November), 1998.

English, W. B., and Nelson, W. R. “Bank Risk Rating of Business Loans.” Finance and Economics Discussion Series, Board of Governors of the Federal Reserve, Issue 98–51 (December, 1998).

Gilbert, Alton R., Andrew Meyer, and Mark D. Vaughn. “The Role of a Camel Downgrade in Bank Surveillance.” In: George Kaufman ed., Bank Fragility and Regulation: Evidence from Different Countries, Research in Financial Services: Private and Public Policy 12 (2000), 265–285.

Hannan, Timothy. “Bank Commercial Loan Markets and the Role of Market Structure: Evidence From Surveys of Commercial Lending.” Journal of Banking and Finance 15 (1992), 122–149.

Kane, Edward. “Appearance and Reality in Deposit Insurance—the Case for Reform.” Journal of Banking and Finance June, 175–188.

Robert, Avery B., and Michael Gordy. “Estimation of a Markov Model of Loan Seasoning with Aggregated Performance Data.” Memo, Federal Reserve Board, 1995.

Strahan, Phillip. “Borrower Risk and the Price and Non-Price Terms of Bank Loans.” Working Paper Number 90, Department of Economics, Boston College, 1999.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Morgan, D.P., Ashcraft, A.B. Using Loan Rates to Measure and Regulate Bank Risk: Findings and an Immodest Proposal. Journal of Financial Services Research 24, 181–200 (2003). https://doi.org/10.1023/B:FINA.0000003322.43105.33

Issue Date:

DOI: https://doi.org/10.1023/B:FINA.0000003322.43105.33