Abstract

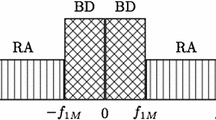

This paper has integrated space into the effect of a direct pollution control on the pollution damage of heavily populated areas like CBD. This integration gives us some new insights into the effectiveness of a pollution tax as a pollution control device when the plant location of the firm is endogenized. It is shown that when the plant location is endogenous, as pollution taxes become higher, the firm moves its plant towards the CBD, causing higher pollution damage to the CBD residents, if the production function exhibits decreasing returns to scale.

Similar content being viewed by others

References

Eswaran, M., Y. Kanemoto and D. Ryan (1981), 'A Dual Approach to the Locational Decision of the Firm', Journal of Regional Science 21, 469–490.

Forsund, F. R. (1972), 'Allocation in Space and Environment Pollution', Swedish Journal of Economics 74, 19–34.

Gokturk, S. S. (1979), 'A Theory of Pollution Control, Location Choice, and Abatement Decisions', Journal of Regional Science 19, 461–467.

Harford, J. and S. Ogura (1983), 'Pollution Taxes and Standards: A Continuum of Quasi-Optimal Solutions', Journal of Environmental Economics and Management 10, 1–17.

Hazilla, M. and R. J. Kopp (1990), 'The Social Cost of Environmental Quality Regulations: A General Equilibrium Analysis', Journal of Political Economy 98, 853–873.

Hoel, M. (1997), 'Environmental Policy with Endogenous Plant Locations', Scandinavian Journal of Economics 99(2), 241–259.

Jeppesen, T., J. A. List and H. Folmer (2002), 'Environmental Regulations and New Plant Location Decisions: Evidence from a Meta-Analysis', Journal of Regional Science 42, 19–49.

Khalili, A., V. K. Mathur and D. Bodenhorn (1974), 'Location and Theory of Production: A Generalization', Journal of Economic Theory 9, 467–475.

Lee, D. R. and W. S. Misiolek (1986), 'Substituting Pollution Taxation for General Taxation: Some Implications for Efficiency in Pollution"s Taxation', Journal of Environmental Economics and Management 19, 338–347.

Markusen, J. R., E. R. Morey and N. D. Olewiler (1995), 'Competition in Regional Environmental Policies When Plant Locations are Endogenous', Journal of Public Economics 56, 55–77.

Mathur, V. K. (1976), 'Spatial Economic Theory of Pollution Control', Journal of Environmental Economics and Management 3, 16–28.

Miller, S. M. and D.M. Jensen (1978), 'Location and the Theory of Production: A Review, Summary and Critique of Recent Contributionss'. Regional Science and Urban Economics 8, 117–128.

Oates, W. E. and R. M. Schwab (1988), 'Economic Competition among Jurisdictions: Efficiency Enhancing or Distortion Inducing?', Journal of Public Economics 35, 333–354.

Portnoy, P. R., ed. (1978), Current Issues in U.S. Environmental Policy. Baltimore: Johns Hopkins University Press.

Romstad, E. and H. Folmer (2000), 'Green Taxation', in H. Folmer and edH. L. Gabeld, eds., Principles of Environmental and Resource Economics (pp. 529–563), 2nd Edition and Revised Edition. Cheltenham, UK: Edward Elgar.

Shephard, R.W. (1970), Cost and Profit Function. Princeton, New Jersey: Princeton University Press.

Srinivasan, J. N. (1973), 'Taxation Evasion: A Model', Journal of Political Economy 2, 339–346.

Tietenberg, T. H. (1973), 'Specific Taxes and the Control of Pollution: A General Equilibrium Analysis', Quarterly Journal of Economics 87, 503–522.

Ulph, A. (2000), 'Environmental and Trade', in Folmer H. L. Gabeld, ed., Principles of Environmental and Resource Economics (pp. 479–528), 2nd Edition and Revised Edition. Cheltenham, UK: Edward Elgar.

U.S. Congress, Clean Air Amendments of 1970 (PL 91-604). Washington, DC: USGPO.

U.S. Congress, The Federal Water Pollution Control Act Amendments of 1972 (PL 92-500). Washington, DC: USGPO.

White, M. J. and D. Wittman (1982), 'Pollution Taxes and Optimal Spatial Location', Economica 49 ,297–311.

Xing, Y. and C. D. Kolstad (2002), 'Do Lax Environmental Regulations Attract Foreign Investments?', Environmental and Resource Economics 21(1), 1–22.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hwang, H., Mai, CC. The Effects of Pollution Taxes on Urban Areas with an Endogenous Plant Location. Environmental and Resource Economics 29, 57–65 (2004). https://doi.org/10.1023/B:EARE.0000035440.20693.f6

Issue Date:

DOI: https://doi.org/10.1023/B:EARE.0000035440.20693.f6