Abstract

The rational expectations revolution made clear that a complete macro model requires a specification of the government's economic policy. We argue that monetary policy should be conducted in such a way that the market can predict policy actions. An implication of market success in predicting policy actions is that interest rates move ahead of the policy actions, and such a timing relationship may appear to some as the central bank following the market instead of leading it. Another implication of the market predicting policy actions is that nominal interest rate changes provide no useful information to the central bank about the strength of aggregate demand or inflationary expectations. Finally, failure of the market to predict policy actions reflects a problem that needs to be addressed.

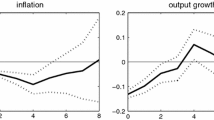

We explore the theoretical implications of a monetary policy that is completely specified and perfectly understood by the market. We construct a bare-bones model to illustrate the key concepts. Finally, we conduct an empirical investigation of these issues, especially in the context of monetary policy since 1988, when the establishment of the federal funds future market made available well-defined market information on expectations about Fed policy actions. We find that when the intended funds rate is changed, interest rates over the maturity spectrum respond to “news” measured by changes in the one-month-ahead funds futures yield but do not respond to the anticipated component of the change in the intended funds rate.

Similar content being viewed by others

References

Bomfim, A.N., and V.R. Reinhart. “Making News: Financial Market Effects of Federal Reserve Disclosure Practices.” Board of Governors of the Federal Reserve System, Division of Monetary Affairs and Division of International Finance March 14, 2000.

Clarida, R., J. Gali, and M. Gertler. “The Science of Monetary Policy.” Journal of Economic Literature 37 (1999), 1661-1707.

Judd, J.P., and G.D. Rudebusch. “Taylor's Rule and the Fed: 1970-1997.” Federal Reserve Bank of San Francisco Economic Review 98(1997:3), 3-16.

Kuttner, K.N. “Monetary Policy Surprises and Interest Rates: Evidence from the Fed Funds Futures Market.” Federal Reserve Bank of New York, November 26, 1999.

McCallum, B.T. “Issues in the Design of Monetary Policy Rules.” In: J.B. Taylor and M. Woodford, eds., Handbook of Macroeconomics. Amsterdam: North Holland, 1999.

Orphanides, A. “Monetary Policy Rules based on Real Time Data.” Board of Governors of the Federal Reserve System, Finance and Economics Discussion Series Paper 1998-03.

Poole, W. “Synching, Not Sinking, the Markets.” Speech before a meeting of the Philadelphia Council for Business Economics, Federal Reserve Bank of Philadelphia, Philadelphia, Pennsylvania-August 6, 1999. <www.stls.frb.org/general/speeches/990806.html>.

Roley, V.V., and G.H. Sellon, “The Information Content of Monetary Policy Nonannouncements.” Mimeo, Federal Reserve Bank of Kansas City, August 1999.

Robertson, J.C., and D. L. Thornton. “Using Federal Funds Futures Rates to Predict Federal Reserve Actions.” Federal Reserve Bank of St. Louis Review (November/December 1997), 45-53.

Taylor, J.D. “Discretion versus Policy Rules in Practice.” Carnegie-Rochester Conference Series on Public Policy 39 (1993), 195-214.

Taylor, J.D. Monetary Policy Rules. Chicago: University of Chicago Press, 1999.

Thornton, D.L. “The Fed's Influence on the Federal Funds Rate: Is it Open Market or Open Mouth Operations?” Federal Reserve Bank of St. Louis Research Division Working Paper 99-022A, November 1999.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Poole, W., Rasche, R.H. Perfecting the Market's Knowledge of Monetary Policy. Journal of Financial Services Research 18, 255–298 (2000). https://doi.org/10.1023/A:1026555225089

Issue Date:

DOI: https://doi.org/10.1023/A:1026555225089