Abstract

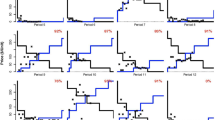

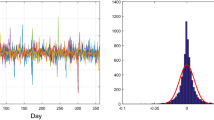

This paper reports a preliminary experimental test of international quota trading on a market characterized by several dominant traders. Uncertain quota demand and supply imply true market-clearing prices that in general differ from an expected competitive quota price. However, in the experiment the expected price level emerges as a focal point on which the bulk of quota trade contracts are keyed. Thus, incomplete price discovery occurs.

Similar content being viewed by others

References

Barrett, Scott (1994), ‘Self-Enforcing International Environmental Agreements’, Oxford Economic Papers 46(5), October 1994, 878-894.

Barrett, Scott (1998), ‘On the Theory and Diplomacy of Environmental Treaty-Making’, Environmental and Resource Economics 11(3–4), 317-333.

Bohm, Peter (1997), ‘Joint Implementation as Emission Quota Trade: An Experiment Among Four Nordic Countries’, Nord 1997: 4, Nordisk Ministerråd, København.

Bohm, Peter (1997), ‘Are Tradable Emission Quotas Internationally Acceptable? An Inquiry with Diplomats as Country Representatives’, Nord 1997: 8, Nordisk Ministerråd, København.

Bohm, Peter (1998), ‘Compensation for Uncertainty — Efficient Approaches to Making International Emissions Trading Attractive to Non-Rich Countries’, Manuscript, Department of Economics, Stockholm University.

Bohm, Peter and Björn Carlén (1999), ‘Laboratory Tests of Joint Implementation Among Four Countries Taken to be Committed to Stringent Carbon Emission Targets’, Resource and Energy Economics 21, 43-66.

Carlén Björn (1998), ‘Effects of Dominant Countries on a Tradable Quota Market for Carbon Emission: A Laboratory Test’, Manuscript, Department of Economics, Stockholm University.

Carraro, Carlo and Domenico Siniscalco (1992), ‘The International Dimension of Environmental Policy’, European Economic Review 36, 379-387.

Conover, W.J. (1980), Practical Nonparametric Statistics. New York: John Wiley & Sons.

Davis, Douglas D. and Charles A. Holt (1993), Experimental Economics. Princeton: Princeton University Press.

Friedman, Daniel (1993), ‘The Double Auction Market Institution: A Survey’, in Friedman and Rust, eds., The Double Auction Market. Reading: Addison-Wesley.

Hagem, Cathrine and Bjart Holtsmark (1998), ‘Emission Trading under the Kyoto Protocol’, Report 1998: 1, CICERO, University of Oslo.

Hoel, Michael (1993), ‘Cost-effective and Efficient International Environmental Agreements’, International Challenges 13(2).

Intergovernmental Panel on Climate Change (IPCC) (1996), Climate Change 1995. Economic and Social Dimensions of Climate Change, Cambridge University Press.

Mullins, Fiona and Richard Baron (1997), International Greenhouse Gas Emission Trading, Working Paper 9, Annex I Expert Group of the UN FCCC.

Plott, Charles R. and Peter Gray (1990), ‘The Multiple Unit Double Auction’, Journal of Economic Behavior and Organization 13, 245-258.

Plott, Charles R. and Julian C. Jamison (1997), ‘Costly Offers and the Equilibration Properties of the Multiple Unit Double Auction Under Conditions of Unpredictable Shifts of Demand and Supply’, Journal of Economic Behavior and Organization 32, 591-612.

Rose, Adam and Thomas Tietenberg (1993), ‘An International System of Tradeable CO2Entitlements: Implications for Economic Development’, Journal of Environment and Development 2, 1-36.

Sandor, Richard L., Joseph B. Cole and M. Eileen Kelly (1994), ‘Model Rules and Regulations For a Global CO2Emissions Credit Market’, in Combating Global Warming, Possible Rules, Regulations and Administrative Arrangements for a Global Market in CO2 Emission Entitlements. New York: UNCTAD.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Søberg, M. Price Expectations and International Quota Trading: An Experimental Evaluation. Environmental and Resource Economics 17, 259–277 (2000). https://doi.org/10.1023/A:1026457110029

Issue Date:

DOI: https://doi.org/10.1023/A:1026457110029