Abstract

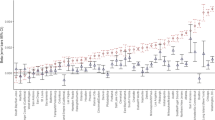

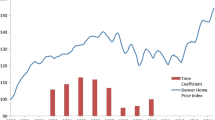

This paper is motivated by automated valuation systems, which would benefit from an ability to estimate spatial variation in location value. It develops theory for the local regression model (LRM), a semiparametric approach to estimating a location value surface. There are two parts to the LRM: (1) an ordinary least square (OLS) model to hold constant for interior square footage, land area, bathrooms, and other structural characteristics; and (2) a non-parametric smoother (local polynomial regression, LPR) which calculates location value as a function of latitude and longitude. Several methods are used to consistently estimate both parts of the model. The LRM was fit to geocoded hedonic sales data for six towns in the suburbs of Boston, MA. The estimates yield substantial, significant and plausible spatial patterns in location values. Using the LRM as an exploratory tool, local peaks and valleys in location value identified by the model are close to points identified by the tax assessor, and they are shown to add to the explanatory power of an OLS model. Out-of-sample MSE shows that the LRM with a first-degree polynomial (local linear smoothing) is somewhat better than polynomials of degree zero or degree two. Future applications might use degree zero (the well-known NW estimator) because this is available in popular commercial software. The optimized LRM reduces MSE from the OLS model by between 5 percent and 11 percent while adding information on statistically significant variations in location value.

Similar content being viewed by others

References

Brockmann, M., T. Gasser, and E. Herrmann. (1993). “Locally Adaptive Bandwidth Choice for Kernel Regression Estimators,” Journal of the American Statistical Association 88(424), 1302-1309.

Clapp, J. M. (2000). “A New Method for Estimating Land Value Surfaces over Time.” Draft paper, University of Connecticut Center for Real Estate.

Clapp, J. M., H. Kim, and A. E. Gelfand. (2001). “Spatial Prediction of House Prices Using LPR and Bayesian Smoothing.” Draft paper, University of Connecticut Center for Real Estate.

Clapp, J. M., M. Rodriguez, and R. K. Pace. (2001). “Residential Land Values and the Decentralization of Jobs,” Journal of Real Estate Finance and Economics 22(1), 43-61.

Hardle, W., and O. Linton. (1994). “Applied Nonparametric Methods.” In R. F. Engle and D. L. McFadden (eds), Handbook of Econometrics, vol. 4, (pp. 2296-2339). New York: Elsevier.

Hardle, W., S. Klinke, and M. Muller. (2000). XploRe Learning Guide. Springer.

Hastie, T. J., and R. J. Tibshirani. (1990). Generalized Additive Models. Chapman & Hall/CRC.

Hu, D. (1999). “A Semiparametric Investigation of Lower-Income Home Mortgage Purchases in the Secondary Mortgage Market.” Draft paper, Zell/Lurie Real Estate Center, The Wharton School, University of Pennsylvania.

Jackson, J. R. (1979). “Intraurban Variation in the Price of Housing,” Journal of Urban Economics 6, 464-479.

Linton, O., and Nielsen, Jens Perch. (1995). “A Kernel Method of Estimating Structured Nonparametric Regression Based on Marginal Integration,” Biometrika 82(1), 93-100.

McMillen, D. P. (1994). “Vintage Growth and Population Density: An Empirical Investigation,” Journal of Urban Economics 36, 333-352.

McMillen, D. P., and P. Thorsnes. (2000). “The Reaction of Housing Prices to Information on Superfund Sites: A Semiparametric Analysis of the Tacoma, Washington Market,” Advances in Econometrics 14, 201-228.

Meese, R., and N. Wallace. (1991). “Nonparametric Estimation of Dynamic Hedonic Price Models and the Construction of Residential Housing Price Indices,” AREUEA Journal 19(3), 308-331.

Pagan, A., and A. Ullah. (1999). Nonparametric Econometrics. Cambridge, UK: Cambridge University Press.

Pavlov, A. D. (2000). “Space-Varying Regression Coefficients: A Semi-parametric Approach Applied to Real Estate Markets,” Real Estate Economics 28(2), 249-283.

Robinson, P. M. (1988). “Root-N-Consistent Semiparametric Regression,” Econometrica 56(4), 931-954.

Rosen, S. (1974). “Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition,” Journal of Political Economy 82(2), 34-55.

Ruppert, D., M. P. Wand, U. Holst, and O. Hossjer. (1997). “Local Polynomial Variance Function Estimation,” Technometrics 39(3), 262-273.

Stock, J. H. (1989). “Nonparametric Policy Analysis,” Journal of the American Statistical Association 84(406), 567-575.

Thorsnes, P., and McMillen, D. P. (1998). “Land Value and Parcel Size: A Semiparametric Analysis,” Journal of Real Estate Finance and Economics 17(3), 233-244.

Yatchew, A. (1998). “Nonparametric Regression Techniques in Economics,” Journal of Economic Literature XXXVI, 669-721.

Yatchew, A. (1999). “Differencing Methods in Nonparametric Regression: Simple Techniques for the Applied Econometrician,” Draft paper, Department of Economics, University of Toronto.

Wand, M. P., and M. C. Jones. (1995). Kernel Smoothing. Chapman and Hall.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Clapp, J.M. A Semiparametric Method for Valuing Residential Locations: Application to Automated Valuation. The Journal of Real Estate Finance and Economics 27, 303–320 (2003). https://doi.org/10.1023/A:1025838007297

Issue Date:

DOI: https://doi.org/10.1023/A:1025838007297