Abstract

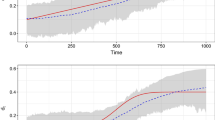

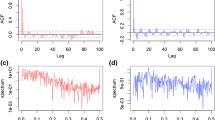

The paper deals with the power and robustness of the R/S type tests under “contiguous” alternatives. We briefly review some long memory models in levels and volatility, and describe the R/S-type tests used to test for the presence of long memory. The empirical power of the tests is investigated when replacing the fractional difference operator (1−L)d by the operator (1−rL)d, with r<1 close to 1, in the FARIMA, LARCH and ARCH time series models. We also investigate the Gegenbauer process with a pole of the spectral density at frequency close to zero.

Similar content being viewed by others

References

Andel, J.: Long memory time series models, Kybernetica 22(1986), 105–123.

Baillie, R. T., Bollerslev, T. and Mikkelsen, H. O.: Fractionally integrated generalized autoregressive conditional heteroskedasticity, J. Econometrics 74(1996), 3–30.

Beran, J.: Statistics for Long-Memory Processes, Chapman and Hall, London, 1994.

Davidson, R. and MacKinnon, J. G.: Graphical methods for investigating the size and power of hypothesis tests, The Manchester School 66(1998), 1–26.

Den Haan, W. J. and Levin, A.: A practitioner's guide to robust covariance matrix estimation, In:G.S. Maddala and C.R. Rao (eds),Handbook of Statistics, Vol. 15, 1997, pp. 291–341.

Ding, Z. and Granger, C. W. J.: Modeling volatility persistence of speculative returns: a new approach, J. Econometrics 73(1996), 185–215.

Giraitis, L., Hidalgo, J. and Robinson, P. M.: Gaussian estimation of parametric spectral density with unknown pole, Ann. Statist. 29(2001), 987–1023.

Giraitis, L., Kokoszka, P. S. and Leipus, R.: Stationary ARCH models: Dependence structure and central limit theorem, Econometric Theory 16(2000), 3–22.

Giraitis, L., Kokoszka, P. S., Leipus, R. and Teyssiére, G.: Rescaled variance and related tests for long memory in volatility and levels, J. Econometrics 112(2003), 265–294.

Giraitis, L., Robinson, P. M. and Surgailis, D.: A model for long memory conditional heteroskedasticity, Ann. Appl. Probab. 10(2000), 1002–1024.

Giraitis, L. and Surgailis, D.: ARCH-type bilinear models with double long memory, Stochast. Processes Appl. 100(2002), 275–300.

Granger, C. W. J. and Joyeux, R.: An introduction to long-memory time series models and fractional differencing, J. Time Ser. Anal. 1(1980), 15–29.

Gray, H. L., Zhang, N. F. and Woodward, W. A.: On generalized fractional processes, J. Time Ser. Anal. 10(1989), 233–257.

Hosking, J. R. M.: Fractional differencing, Biometrika 68(1981), 165–176.

Hurst, H. E.: Long-term storage capacity of reservoirs, Trans. Amer. Soc. Civil Eng. 116(1951), 770–799.

Kazakevičius, V. and Leipus, R.: A new theorem on existence of invariant distributions with applications to ARCH processes, J. Appl. Probab. 40(2003), 147–162.

Kwiatkowski, D., Phillips, P. C. B., Schmidt, P. and Shin, Y.: Testing the null hypothesis of stationarity against the alternative of a unit root: how sure are we that economic series have a unit root? J. Econometrics 54(1992), 159–178.

Lee, D. and Schmidt, P.: On the power of the KPSS test of stationarity against fractionally-integrated alternatives, J. Econometrics 73(1996), 285–302.

Lo, A. W.: Long-term memory in stock market prices, Econometrica 59(1991), 1279–1313.

Newey, W. K. and West, K. D.: A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix, Econometrica 55(1987), 703–708.

Robinson, P. M.: Testing for strong serial correlation and dynamic conditional heteroskedastic-ity in multiple regression, J. Econometrics 47(1991), 67–84.

Robinson, P. M.: Time series with strong dependence, In: C. A. Sims (ed.), Advances in Econometrics, Sixth World Congress, Cambridge Univ. Press, 1994, pp. 47–95.

Teyssiére, G.: Nonlinear and semi-parametric long-memory ARCH, Preprint.

Vogelsang, T. J.: Sources of nonmonotonic power when testing for a shift in mean of a dynamic time series, J. Econometrics 88(1999), 283–299.

Rights and permissions

About this article

Cite this article

Giraitis, L., Kokoszka, P., Leipus, R. et al. On the Power of R/S-Type Tests under Contiguous and Semi-Long Memory Alternatives. Acta Applicandae Mathematicae 78, 285–299 (2003). https://doi.org/10.1023/A:1025702003631

Issue Date:

DOI: https://doi.org/10.1023/A:1025702003631