Abstract

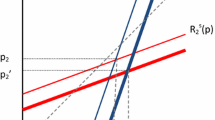

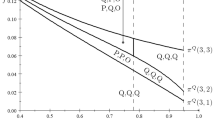

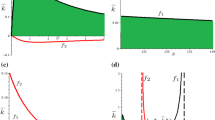

The dynamic price competition in a horizontally differentiated duopoly when consumers value previous market shares is analyzed. The conditions for the existence of stable Markov-Perfect Equilibrium (MPE) in linear strategies are established. When they exist, the optimal pricing policies suggest that a firm with a higher previous market share charges a higher price, all else equal. It is possible to observe pricing below cost for some periods. In the steady state, the MPE leads to a more competitive outcome (lower prices) than the case where there are no consumption externalities. The model can produce outcomes where the steady state is reached very slowly which provides an alternative explanation for slow emergence of competition when entrants face an established incumbent: It may be due to persistence in consumer tastes.

Similar content being viewed by others

References

S. Athey and A. Schmutzler, Investment and market dominance, RAND J. Economics 32 (2001) 1–26.

A.V. Banerjee, A simple model of Herd behavior, Quart. J. Economics 107 (1992) 797–817.

T. Basar and G. Oldser, Dynamic Noncooperative Game Theory (Academic Press, New York, 1982).

G.S. Becker, A note on restaurant pricing and other examples of social influences on price, J. Political Economy 99 (1991) 1109–1116.

A. Beggs and P.D. Klemperer, Multiperiod competition with switching costs, Econometrica 60 (1992) 651–666.

D. Bergemann and J. Valimäki, Market diffusion with two-sided learning, RAND J. Economics 28 (1997) 773–795.

S. Bikhchandani, D. Hirshleifer and I. Welch, A theory of fads, fashion, custom and cultural change as informational cascades, J. Political Economy 100 (1992) 992–1026.

E. Brynjolfsson and C.F. Kemerer, Network externalities in microcomputer software: An econometric analysis of the spreadsheet market, Managm. Sci. 42 (1996) 1627–1647.

C. Budd, C. Harris and J. Vickers, A model of the evolution of duopoly: Does the asymmetry between firms tend to increase or decrease?, Rev. Economic Studies 60 (1993) 543–574.

L.M.B. Cabral and M.H. Riordan, The learning curve, market dominance and predatory pricing, Econometrica 62 (1994) 1115–1141.

R. Caminal and X. Vives, Why market shares matter? An information-based theory, RAND J. Economics 27 (1996) 221–239.

Y. Chen and R.W. Rosenthal, Dynamic duopoly with slowly changing customer loyalties, Internat. J. Industrial Organization 14 (1996) 269–297.

J. Farrell and G. Saloner, Installed base and compatibility: Innovation, product prean nouncement and predation, Amer. Econom. Rev. 76 (1986) 940–955.

B. Jun and X. Vives, Strategic incentives in dynamic duopoly (1999) mimeo.

M. Katz and C. Shapiro, Network externalities, competition and compatibility, Amer. Econom. Rev. 75 (1985) 424–440.

M. Katz and C. Shapiro, Product introduction with network externalities, J. Industrial Economics 40 (1992) 55–84.

E. Maskin and J. Tirole, A theory of dynamic oligopoly, III: Cournot competition, European Econom. Rev. 31 (1987) 947–968.

A.J. Padilla, Dynamic duopoly with consumer switching costs, J. Econom. Theory 67 (1995) 520–530.

N. Vettas, Investment dynamics in markets with endogenous demand, J. Industrial Economics 48 (2000) 189–194.

C.C. von Weizsäcker, Notes on endogenous change of tastes, J. Econom. Theory 3 (1971) 345–372.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Doganoglu, T. Dynamic Price Competition with Consumption Externalities. NETNOMICS: Economic Research and Electronic Networking 5, 43–69 (2003). https://doi.org/10.1023/A:1024994117734

Issue Date:

DOI: https://doi.org/10.1023/A:1024994117734