Abstract

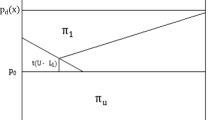

Should the supplier of a bottleneck input be prevented from vertically integrating downstream unless the (perhaps regulated) price of the input is set equal to costs? This issue has arisen with respect to the entry of incumbent local exchange carriers into the provision of long distance services. While competitors (and likely society) would prefer the bottleneck facility to be priced at marginal cost, this paper shows that entry by the bottleneck supplier when its price exceeds marginal cost will typically be welfare improving. The intuition is that the integrated firm behaves as if its marginal cost of the bottleneck input is lower than the price of the input, which results in lower prices, and increased welfare. This effect outweighs the potential distortions in the market caused by the artificial cost difference between the integrated firm and its competitors, and under plausible conditions can outweigh the effects of a competing firm exiting the market as a result of the integration.

Similar content being viewed by others

References

Armstrong, M., C. Doyle, and J. Vickers. 1996. “The Access Pricing Problem: A Synthesis.” Journal of Industrial Economics 44(June): 131-150.

Bulow, J., J. Geanakopolis, and P. Klemperer. 1985. “Multimarket Oligopoly Strategic Substitutes and Complements.” Journal of Political Economy 93(3): 488-511.

Biglaiser, G., and P. DeGraba. 2001. “Downstream Integration by a Bottleneck Input Supplier Whose Regulated Wholesale Prices are Above Cost.” RAND Journal of Economics 32(2): 302-315.

DeGraba, P. 1995. “Characterizing Solutions of Supermodular Games; Intuitive Comparative Statics, and Unique Equilibria.” Economic Theory 5: 181-188.

Krattenmaker, T., and S. Salop. 1986. “Anticompetitive Exclusion: Raising Rival's Costs to Achieve Power Over Price.” Yale Law Journal 96(December): 209-293.

Laffont, J-J., and J. Tirole. 2000. Competition in Telecommunications. Cambridge, MA: MIT Press.

Mandy, D. M. 2000. “Killing the Goose That May Have Laid the Golden Egg: Only the Data Know Whether Sabotage Pays.” Journal of Regulatory Economics 17(2): 157-172.

Mandy, D. M. 2002. “TELRIC Pricing with Vintage Capital.” Forthcoming, Journal of Regulatory Economics.

Riordan, M., and S. Salop. 1995. “Evaluating Vertical Mergers: A Post-Chicago approach.” Antitrust Law Journal 63(Winter): 513-568.

Shapiro, C. 1996. “Merger with Differentiated Products,” Antitrust 10(Spring): 23-30.

Willig, R. 1979. “The Theory of Network Access Pricing.” In Issues in Public Utility Regulation, edited by H.M. Trebing. East Lansing, MI: Michigan State University Public Utilities Papers.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Degraba, P. A Bottleneck Input Supplier's Opportunity Cost of Competing Downstream. Journal of Regulatory Economics 23, 287–297 (2003). https://doi.org/10.1023/A:1023364210896

Issue Date:

DOI: https://doi.org/10.1023/A:1023364210896