Abstract

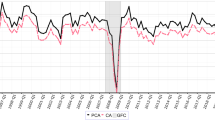

The present study tests for the J-curve for five North European countries—Belgium, Denmark, The Netherlands, Norway, and Sweden—using generalized impulse response functions. The results provide empirical support for the J-curve. Each country has an impulse response function generated from a vector error-correction model that suggests that after a depreciation, there will be a dip in the export-import ratio within the first half-year after the depreciation. The long-run export-import ratio appears to be higher than the low point of this early dip in almost all cases. Also, in most cases, the export-import ratio appears in many periods after the depreciation to be converging from below to a higher long-run equilibrium.

Similar content being viewed by others

References

Backus, David, Patrick Kehoe, and Finn Kydland (1994) “Dynamics of the Trade Balance and the Terms of Trade: The J-Curve.” American Economic Review 84:84–103.

Bahmani-Oskooee, Mohsen and Janardhanan Alse (1994) “Short-Run Versus Long-Run Effects of Devaluation: Error-Correction Modeling and Cointegration.” Eastern Economic Journal 20:453–464.

Caves, Richard, Jeffrey Frankel, and Ronald Jones (1999) World Trade and Payments: An Introduction, 8th ed. New York; Addison-Wesley.

Gupta-Kapoor, Anju and Uma Ramakrishnan (1999) “Is There a J-Curve? A New Estimation for Japan.” International Economic Journal 13:71–79.

Hannan, Edward and Barry Quinn (1979) “The Determination of the Order of an Autoregression.” Journal of the Royal Statistical Society, Series B 41:190–195.

Hatemi-J, Abdulnasser (2001) “Time-Series Econometrics Applied to Macroeconomic Issues.” JIBS Dissertation Series, 007.

Hsing, Han-Min and Andreas Savvides (1996) “Does a J-Curve Exist for Korea and Taiwan?” Open Economies Review 7:126–145.

Johansen, Søren (1988) “Statistical Analysis of Cointegration Vectors.” Journal of Economic Dynamics and Control 12:231–254.

Johansen, Søren (1991) “Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models.” Econometrica 59:1551–1580.

Johansen, Søren (1992) “Cointegration in Partial Systems and the Efficiency of Single-Equation Analysis.” Journal of Econometrics 52:389–402.

Johansen, Søren (1996) “Likelihood Based Inference in Cointegrated Vector Autoregressive Models.” Advanced Texts in Econometrics. Oxford University Press.

Johansen, Søren and Katarina Juselius (1990) “Maximum Likelihood Estimation and Inferences on Cointegration-With Applications to the Demand for Money.” Oxford Bulletin of Economics and Statistics 52:169–210.

Junz, Helen and Rudolf Rhomberg (1973) “Price Competitiveness in Export Trade Among Industrial Countries.” American Economic Review 63:412–418.

Krugman, Paul and Maurice Obstfeld (2001) International Economics: Theory and Policy, 5th ed. New York; Addison-Wesley.

Lal, Anil and Thomas Lowinger (2001) “J-Curve: Evidence from East Asia.” Manuscript Presented at the 40th Annual Meeting of theWestern Regional Science Association, February 2001 in Palms Springs, CA.

Pesaran M. Hashem and Yongcheol Shin (1998) “Generalized Impulse Response Analysis in Linear Multivariate Models.” Economics Letters 58:17–29.

Rose, Andrew (1990) “Exchange Rates and the Trade Balance: Some Evidence from Developing Countries.” Economic Letters 34:271–275.

Rose, Andrew and Janet Yellen (1989) “Is There a J-Curve?” Journal of Monetary Economics 24:53–68.

Schwarz, Gideon (1978) “Estimating the Dimension of a Model.” Annals of Statistics 6:461–464.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hacker, R.S., Hatemi-J, A. Is the J-Curve Effect Observable for Small North European Economies?. Open Economies Review 14, 119–134 (2003). https://doi.org/10.1023/A:1022357828945

Issue Date:

DOI: https://doi.org/10.1023/A:1022357828945