Abstract

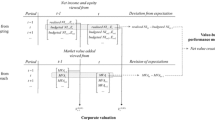

This paper extends the residual income literature to provide a framework for the use of residual income in performance measurement, applicable in value-based management. It shows that, under a simple initializing assumption, an accounting-free measure of ‘excess value created’ over a multi-period interval can be written entirely in terms of (i) within-interval realized residual incomes and (ii) end-of-interval expected future residual incomes, both appropriately adjusted for the time value of money. It also shows that, when the simple initializing assumption is relaxed, excess value created can be expressed in terms of ‘excess residual incomes,’ measured by comparison with expectations as at the beginning of the multiperiod interval.

Similar content being viewed by others

References

Amey, L. (1969). The Efficiency of Business Enterprises. George Allen and Unwin.

Anthony, R. (1983). Tell It Like It Was. Irwin.

Bromwich, M. (1973). “Measurement of Divisional Performance: A Comment and Extension.” Accounting and Business Research 3, 123-132.

Dechow, P., A. Hutton and R. Sloan. (1999). “An Empirical Assessment of the Residual Income Valuation Model.” Journal of Accounting and Economics 26, 1-34.

Dutta, S. and S. Reichelstein. (2001). “Controlling Investment Decisions: Depreciation and Capital Charges.” Review of Accounting Studies 7, 253-281.

Edey, H. (1962). “Business Valuation, Goodwill and the Super-Profit Method.” In W. Baxter and S. Davidson (eds.), Studies in Accounting Theory. Sweet and Maxwell.

Ehrbar, A. (1998). EVA: The Real Key to Creating Wealth. Wiley.

Feltham, G. and J. Ohlson. (1995). “Valuation and Clean Surplus Accounting for Operating and Financial Activities.” Contemporary Accounting Research 11, 689-731.

Feltham, G. and J. Ohlson. (1996). “Uncertainty Resolution and the Theory of Depreciation Measurement.” Journal of Accounting Research 34, 209-234.

Feltham, G. and J. Ohlson. (1999). “Residual Earnings Valuation with Risk and Stochastic Interest Rates.” The Accounting Review 74, 165-183.

Flower, J. (1971). “Measurement of Divisional Performance.” Accounting and Business Research 1, 205-214.

Francis, J., P. Olsson and D. Oswald. (2000). “Comparing the Accuracy and Explainability of Dividend, Free Cash Flow and Abnormal Earnings Equity Value Estimates.” Journal of Accounting Research 38, 71-102.

Myers, J. (1999). “Implementing Residual Income Valuation with Linear Information Dynamics.” The Accounting Review 74, 1-28.

O'Hanlon, J. and K. Peasnell. (1998). “Wall Street's Contribution to Management Accounting: The Stern Stewart EVA Financial Management System.” Management Accounting Research 9, 421-444.

Ohlson, J. (1989). “Accounting Earnings, Book Value and Dividends: The Theory of the Clean Surplus Equation (Part I).” In R. Brief and K. Peasnell (eds.), Clean Surplus: A Link Between Accounting and Finance. Garland, 1996, 167-227.

Ohlson, J. (1995). “Earnings, Book Values, and Dividends in Equity Valuation.” Contemporary Accounting Research 11, 661-687.

Penman, S. (2001). Financial Statement Analysis and Security Valuation. McGraw-Hill.

Penman, S. and T. Sougiannis. (1997). “The Dividend Displacement Property and the Substitution of Anticipated Earnings for Dividends in Equity Valuation.” The Accounting Review 72, 1-21.

Reichelstein, S. (2000). “Providing Managerial Incentives: Cash Flows versus Accrual Accounting.” Journal of Accounting Research 38, 243-269.

Rogerson, W. (1997). “Intertemporal Cost Allocation and Managerial Investment Incentives: A Theory Explaining the Use of Economic Value Added as a Performance Measure.” Journal of Political Economy 105, 770-795.

Solomons, D. (1965). Divisional Performance: Measurement and Control. Irwin.

Stewart, G. (1991). The Quest for Value. Harper Business.

Young, S. and S. O'Byrne. (2001). EVA® and Value-Based Management: A Practical Guide to Implementation. McGraw-Hill.

Rights and permissions

About this article

Cite this article

O'Hanlon, J., Peasnell, K. Residual Income and Value-Creation: The Missing Link. Review of Accounting Studies 7, 229–245 (2002). https://doi.org/10.1023/A:1020230203952

Issue Date:

DOI: https://doi.org/10.1023/A:1020230203952