Abstract

In a differential game between two symmetric firms, provided with a clean and a dirtyproduction activity, it is analyzed how investment and emissions are affected by environmentalregulation. If both firms face the same environmental policy, a stricter policy reduceslong‐run investment in the dirty technology, while the effect on the clean one is ambiguous.Long‐run emissions of each firm, and consequently total emissions, decrease. This resultneed not necessarily hold if both firms face different policy instruments: Each firm's investmentlevels, and consequently also its emissions, increase when its competitor faces a stricterenvironmental policy.

Similar content being viewed by others

References

W.A. Brock and A.G. Malliaris, Differential Equations, Stability and Chaos in Dynamic Economics, North-Holland, Amsterdam, 1989.

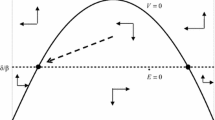

E.J. Dockner and H. Takahashi, On the saddle-point stability for a class of dynamic games, Journal of Optimization Theory and Applications 67(1990)247-258.

T.L. Feenstra, P.M. Kort, P.A. Verheyen and A.J. de Zeeuw, Standards versus taxes in a dynamic duopoly model of trade, in: Economic Policy for the Environment and Natural Resources: Techniques for the Management and Control of Pollution, ed. A.P. Xepapadeas, Elgar, Cheltenham, 1996, pp. 197-216.

D. Fudenberg and J. Tirole, Game Theory, 3rd ed., MIT Press, Cambridge, MA, 1993.

J.P. Gould, Adjustment costs in the theory of investment of the firm, Review of Economic Studies 35(1968)47-56.

M. Hanig, Differential gaming models of oligopoly, Ph.D. Thesis, Massachusetts Institute of Technology, University of Chicago, Chicago, 1986.

O. Van Hilten, P.M. Kort and P.J.J.M. van Loon, Dynamic Policies of the Firm, Springer, Berlin, 1993.

M. Hoel, Global environmental problems: The effects of unilateral actions taken by one country, Journal of Environmental Economics and Management 20(1991)55-70.

C. Holt et al., Planning Production, Inventories, and Work Force, Prentice-Hall, Englewood Cliffs, 1960.

P.M. Kort, Pollution control and the dynamics of the firm: The effects of market-based instruments on optimal firm investments, Optimal Control Applications and Methods 17(1996)267-279.

P. Michaelis, Ökonomische Instrumente in der Umweltpolitik: Eine empirische Bestandsaufnahme, Die Weltwirtschaft 1(1995)72-98.

M. Rauscher, Foreign trade and the environment, in: Environmental Scarcity: The International Dimension, ed. H. Siebert, Mohr, Tübingen, 1991, pp. 17-31.

S.S. Reynolds, Capacity, preemption and commitment in an infinite horizon model, International Economic Review 28(1987)69-88.

A. Seierstad and K. Sydsaeter, Optimal Control Theory with Economic Applications, 2nd ed., North-Holland, Amsterdam, 1993.

A.W. Starr and Y.C. Ho, Nonzero-sum differential games, Journal of Optimization Theory and Applications 3(1969)184-206.

M. Stimming, Kapitalakkumulationsspiele im Angebotsduopol unter Berücksichtigung umweltpolitischer Maßnahmen — Ein Vergleich von Emissionssteuern und handelbaren Emissionsrechten, Preprint No. 20/1996, Department of Economics, University of Magdeburg, 1996.

J. Weimann, Umweltökonomik, 2nd ed., Springer, Berlin, 1991.

A.P. Xepapadeas, Environmental policy, adjustment costs and behavior of the firm, Journal of Environmental Economics and Management 23(1992)258-275.

Rights and permissions

About this article

Cite this article

Stimming, M. Capital accumulation subject to pollution control:Open‐loop versus feedback investment strategies. Annals of Operations Research 88, 309–336 (1999). https://doi.org/10.1023/A:1018994716675

Issue Date:

DOI: https://doi.org/10.1023/A:1018994716675