Abstract

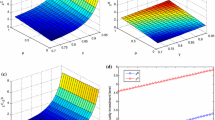

In this paper, we analyze the problem of an individual firm that has to deal with lossesfrom criminal activities. It is assumed that the firm can protect itself by investing in securityequipment. Two different models are considered. In the first model, the firm has the possibilityto spend money on production and on security investment. More production increasesrevenue but also criminal losses, while the latter can be decreased by investing in security.It turns out that the optimal production level increases with security equipment and is determinedsuch that marginal revenue, net from criminal losses, equals marginal cost. For theoptimal level of security investment it holds that, in the case of the existence of a long‐runsteady‐state equilibrium, the properly discounted future reductions in criminal losses, whichare due to an additional unit of security investment, exactly balances the initial outlaynecessary to acquire an extra unit of security investment. In the second model, we extendthis analysis by considering the effect that the firm's reputation has in the criminal world. Ifthe firm has produced a lot in the past without having invested in security equipment, thisfirm is known to be a fruitful target for criminals. Therefore, more criminals will try to robthis firm, and this will increase future criminal losses.

Similar content being viewed by others

References

G.S. Becker, Crime and punishment: An economic approach, Journal of Political Economy 76(1976)169.

G. Feichtinger and R.F. Hartl, Optimale Kontrolle ökonomischer Prozesse, de Gruyter, 1986.

R.F. Hartl, A dynamic activity analysis for a monopolistic firm, Optimal Control Applications and Methods 9(1988)253.

A. Lensink, Angst levert winst op (Fear leads to profits), Intermediair 32(1996)47.

Rights and permissions

About this article

Cite this article

Kort, P., Haunschmied, J. & Feichtinger, G. Optimal firm investment in security. Annals of Operations Research 88, 81–98 (1999). https://doi.org/10.1023/A:1018907119401

Issue Date:

DOI: https://doi.org/10.1023/A:1018907119401