Abstract

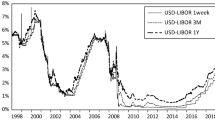

The paper employs daily interest rates from the short-end of the Eurocurrency market in order to test the validity of the Expectations Hypothesis (EH). In particular, exploiting the stochastic trends embedded in the time series the EH implications are tested in a multivariate cointegration framework. The empirical findings indicate that once daily rates are used the estimated coefficients are very close to their theoretical values as predicted by the EH. Furthermore, we cannot reject the hypothesis that the EH is an adequate description of the US yield curve. Similarly, for the German and UK yield curves the number of common stochastic trends present in their yield curves is consistent with the EH. However, the restrictions imposed by the theory on parameters of the cointegration space are rejected.

Similar content being viewed by others

REFERENCES

Bernanke, B. and A. Blinder (1992), 'The Federal Funds Rate and the Channels of Monetary Transmission,' American Economic Review, 82(4), pp. 901-921.

Boudoukh, J., M. Richardson, T. Smith, and R. Whitelaw (1999), 'Ex Ante Bond Returns and the Liquidity Preference Hypothesis,' Journal of Finance, LIV(3), pp. 1153-1167.

Britton, E. and J. Whitley (1997), 'Comparing the Monetary Transmission Mechanism in France, Germany and the United Kingdom: Some Issues and Results,' Bank of England Quarterly Bulletin, 37(2), pp. 152-162.

Campbell, J. and R. Shiller (1987), 'Cointegration and Tests of Present-Value Models,' Journal ofPolitical Economy, 95, pp. 1063-1088.

Campbell, J. and R. Shiller (1988), 'Interpreting Cointegrated Models,' Journal of Economic Dynamics and Control, 12, pp. 505-522.

Cox, J., J. Ingersoll, and S. Ross (1985), 'A Theory of the Term Structure of Interest Rates,' Econometrica, 53(2), pp. 385-407.

Cuthberston, K., S. Hayes, and D. Nitzsche (1998), 'Interest Rates in Germany and the UK: Cointegration and Error Correction Models,' Manchester School, 66(1), pp. 27-43.

Drakos, K. (2001), 'Fixed Income Excess Returns and Time to Maturity,' International Review of Financial Analysis, 10(4).

Engsted, T. and C. Tanggaard (1994), 'Cointegration and the US Term Structure,' Journal of Banking and Finance, 18, pp. 167-181.

Fase, M.M.G. (1999), On Interest Rates and Asset Prices in Europe, Edward Elgar, Cheltenham, UK and Northampton, MA, USA.

Fase, M.M.G. and G.J. de Bondt (2000), 'Institutional Environment and Monetary Transmission in the Euro-Area: a Cross-Country View,' Revue de la Banque/Bank-en Verzekeringswezen, 64, pp. 149-155.

Gerlach, S. and F. Smets (1997), 'The Term Structure of Euro-rates: Some Evidence in Support of the Expectations Hypothesis,' Journal of International Money and Finance, 16(2), pp. 305-321.

Hall, A., H. Anderson, and C. Granger (1992), 'A Cointegration Analysis of Treasury Bill Yields,' Review of Economics and Statistics, 74, pp. 116-126.

Hardouvelis, G. (1994), 'The Term Structure Spread and Future Changes in Long and Short Rates in the G7 Countries,' Journal of Monetary Economics, 33, pp. 255-283.

Hicks, J. (1946), Value and Capital, Oxford University Press, London.

Johansen, S. (1988), 'Statistical Analysis of Cointegration Vectors,' Journal of Economic Dynamics and Control, 12(2), pp. 231-254.

Johansen, S. (1991), 'Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models,' Econometrica, 59, pp. 1551-1580.

Jondeau, E. and R. Ricart (1999), 'The Expectations Hypothesis of the Term Structure: Tests on US, German, French and UK Euro-rates,' Journal of International Money and Finance, 18, pp. 725-750.

Kieler, M. and T. Saarenheimo (1998), 'Differences in Monetary Policy Transmission? A Case not Closed,' EC Economic Papers, 132, November.

Lutz, F. (1940), 'The Structure of Interest Rates,' Quarterly Journal of Economics, 55, pp. 36-83.

MacDonald, R. and A. Speight (1991), 'The Term Structure of Interest Rates under Rational Expectations: Some International Evidence,' Applied Financial Economics, 1, pp. 211-221.

McCulloch, H. (1987), 'The Monotonicity of the Term Premium: A Closer Look,' Journal of Financial Economics, 18, pp. 185-192.

Mishkin, F. (1988), 'The Information in the Term Structure: Some Further Results,' Journal of Applied Econometrics, 3, pp. 307-314.

Osterwald-Lenum, M. (1992), 'A Note with Quantiles of the Asymptotic Distribution of the Maximum Likelihood Cointegration Rank Test Statistics,' Oxford Bulletin of Economics and Statistics, 54, pp. 461-472.

Richardson, M., P. Richardson, and T. Smith (1992)? 'The Monotonicity of the Term Premium: Another Look,' Journal of Financial Economics, 31, pp. 97-106.

Shea, G. (1992), 'Benchmarking the Expectations Hypothesis of the Interest Rate Term Structure: An Analysis of Cointegration Vectors,' Journal of Business and Economic Statistics, 10(3), pp. 347-366.

Shiller, R. (1990), 'The Term Structure of Interest Rates,' in: B. Friedman and F. Hahn, (eds), Handbook of Monetary Economics, 1, North-Holland, Amsterdam, pp. 629-722.

Stock, J. and M. Watson (1988), 'Testing for Common Trends,' Journal of the American Statistical Association, 83, pp. 1097-1107.

Tzavalis, E. and M. Wickens (1998), 'A Re-Examination of the Rational Expectations Hypothesis of the Term Structure: Reconciling the Evidence from Long-Run and Short-Run Tests,' International Journal of Finance and Economics, 3, pp. 229-239.

White, H. (1980), 'A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity,' Econometrica, 48(4), pp. 817-838.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Drakos, K. A Daily View of the Term Structure Dynamics: Some International Evidence. De Economist 150, 41–52 (2002). https://doi.org/10.1023/A:1014851101861

Issue Date:

DOI: https://doi.org/10.1023/A:1014851101861