Abstract

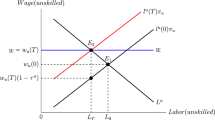

We consider changes in income tax progressivity in an economy where workers' productivities differ and workers and firms bargain individually over wages. With given employment a pure increase in tax progressivity reduces wages by reducing workers' relative bargaining power. When average taxes also increase, after-tax wages are unambiguously reduced, while the effects on gross wages and firm profitability are ambiguous. We next endogenize employment and firm entry under a uniform worker productivity distribution and the government's only policy instrument is a linear income tax. While a first-best solution then is ruled out, a second-best solution can be implemented using a family of linear tax functions, where a more progressive tax implies a higher tax revenue to the government. We show that the government can increase its tax revenue, and reduce after-tax income differences, without any additional disturbance to allocation.

Similar content being viewed by others

References

Agell, J. (1999). “On the Benefits from Rigid Labour Markets: Norms, Market Failures, and Social Insurance.” Economic Journal 109, F143–F164.

Albrecht, J.W. and S. B. Vroman. (1998). “Nash EquilibriumWage Distributions.” International Economic Review 39, 183- 203.

Albrecht, J.W. and S. B. Vroman. (1999). “Unemployment Compensation Finance and EfficiencyWages.” Journal of Labor Economics 17, 141–167.

Anderberg, D. and A. Balestrino. (1999). “Household Production and the Design of the Tax Structure.” Working Paper, University of Warwick/University of Pisa.

Andersen, T. M. and B. S. Rasmussen. (1999). “Effort, Taxation and Unemployment.” Economics Letters 62, 97–103.

Atkinson, A. B. and J. E. Stiglitz. (1980). Lectures on Public Economics. New York: McGraw-Hill.

Blundell, R. (1997). The Impact of Taxation on Labour Force Participation and Labour Supply. The OECD Jobs Study. Oxford University Press.

Ellingsen, T. and Å. Rosén. (1997). “Fixed or Flexible? Wage Determination in Search Equilibrium.” Working Paper, Stockholm School of Economics.

Hausman, J. (1985). “Taxes and Labor Supply.” In A. Auerbach and M. Feldstein (eds.), Handbook of Public Economics, vol 1. Amsterdam: North-Holland, 213–263.

Hersoug, T. (1984). “Union Wage Responses to Tax Changes.” Oxford Economic Papers 37, 37–51.

Hoel, M. O. (1990). “Efficiency Wages and Income Taxes.” Journal of Economics 51, 89–99.

Inderst, R. (1999). “Efficiency Wages under Adverse Selection and the Role of Rigid Wages.” Working Paper, University of Mannheim.

Jacobsson, U. (1976). “On the Measurement of the Degree of Progression.” Journal of Public Economics 5, 161–168.

Juhn, C., K. M. Murphy and R. Topel. (1991). “Why has the Natural Rate of Unemployment Increased Over Time?” Brookings Papers on Economics Activity 2, 75–126.

Kleven, H. J., W. R. Richter and P. B. Sø rensen. (1999). “Optimal Taxation with Household Production.” Oxford Economic Papers, forthcoming.

Koskela, E. and J. Vilmunen. (1996). “Tax Progression is Good for Employment in Popular Models of Trade Union Behaviour.” Labour Economics 3, 65–80.

Kreuger, D. and F. Perri. (1999). “Risk Sharing: Private Insurance Markets of Redistributive Taxes?” Staff Report 262, Federal Reserve Bank of Minneapolis.

Lucas, R. E. and N. Stokey. (1983). “Optimal Fiscal and Monetary Policy in an Economy without Capital.” Journal of Monetary Economics 12, 55–94.

Mirrlees, J. (1971). “An Exploration in the Theory of Optimum Income Taxation.” Review of Economic Studies 38, 175–208.

Mirrlees, J. (1974). “Notes onWelfare Economics, Information and Uncertainty.” In M. Balch, D. McFadden and S. Wu (eds.), Essays on Economic Behavior under Uncertainty. Amsterdam: North-Holland.

Mirrlees, J. (1976). “Optimal Tax Theory: A Synthesis.” Journal of Public Economics 6, 327–358.

Musgrave, R. A. and T. Thin. (1948). “Income Tax Progression, 1929- 1948.” Journal of Political Economy 56, 498–514.

OECD. (1995). The OECD Jobs Study. Taxation Employment and Unemployment. Paris: OECD.

Pissarides, C. A. (1990). “Equilibrium Unemployment Theory.” Oxford: Basil Blackwell.

Rø ed, K. and S. Strø m. (1999). “Progressive Taxes and the Labour Market—is the Trade-Off between Equality and Efficiency Inevitable?” Memorandum 19/99, Department of Economics, University of Oslo.

Sandmo, A. (1981). “Income Tax Evasion, Labour Supply and the Equity-Efficiency Tradeoff.” Journal of Public Economics 16, 265–288.

Shapiro, C. and J. E. Stiglitz. (1984). “Equilibrium Unemployment as a Worker Discipline Device.” American Economic Review 74, 433–444.

Strand, J. (1987). “Unemployment as a Discipline Device with Heterogeneous Labor.” American Economic Review 77, 489–493.

Strand, J. (1999). “Labor Unions versus Individualized Bargaining with Heterogeneous Labor.” Memorandum 29/99, Department of Economics, University of Oslo.

Strand, J. (2000). “Wage Bargaining and Turnover Costs with Heterogeneous Labor and Asymmetric Information.” Labour Economics 7, 95–116.

Sø rensen, P. B. (1997). “Public Finance Solutions to the European Unemployment Problem?” Economic Policy 221–264.

Sø rensen, P. B. (1998). “Tax Policy, the Good Jobs and the Bad Jobs.”Working Paper, Economic Policy Research Unit, University of Copenhagen.

Varian, H. (1980). “Redistributive Taxation as Social Insurance.” Journal of Public Economics 14, 49–68.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Strand, J. Effects of Progressive Taxes under Decentralized Bargaining and Heterogeneous Labor. International Tax and Public Finance 9, 195–210 (2002). https://doi.org/10.1023/A:1014603621311

Issue Date:

DOI: https://doi.org/10.1023/A:1014603621311