Abstract

Discontinued operations, special items, or extraordinary items typically are nonrecurring items in firms' income statements. As such, prior research has theorized that these items are of minimal relevance to market valuation of the firm, since they are transitory in nature. Moreover, anecdotal evidence in the financial press is supportive of this notion. We examine firms that report either single or multiple occurrences of such items over a rolling six-year period between 1977 and 1996 and find in both cases that such items are value-relevant. When multiple occurrences are not partitioned by type (discontinued operations, special items, or extraordinary items), the more recent such event in the series has a negative effect upon market value of equity, whether it has had a positive or negative effect upon net income.

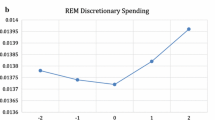

This is consistent with at least two possible explanations, multiple occurrences of such items indicate firms in financial difficulty, or multiple occurrences indicate firms whose managers have engaged in repeated attempts at earnings management, and that the most recent attempt is being devalued by the market. We find patterns of discretionary accruals consistent with managers engaging in upward earnings management prior to multiple write-downs using special items. We also find that firms with multiple write-downs are more likely to go into liquidation or bankruptcy within the next five years. We find that single occurrences also are value-relevant and are positively correlated with market values. Tests on the sample when partitioned by type lead to similar results, though signs of the effects upon net income change in some instances.

Similar content being viewed by others

References

Ball, R. and P. Brown, “An Empirical Evaluation of Accounting Income Numbers.” Journal of Accounting Research Autumn, 159–178, (1968).

Bailey, J., “Trash-hauler WMX Gets Carried Away with Expansion. ‘Non-Recurring’ Charges have been Recurring Headache For Company.” Wall Street Journal January 30, B4, (1997).

Barth, M.E.,W.H. Beaver, and W.R. Landsman, “Relative Valuation Roles of Equity Book Value and Net Income as a Function Of Financial Health.” Journal of Accounting and Economics February, 1–34, (1998).

Barth, M.E., W.H. Beaver, and W.R. Landsman, “Fundamental Issues Related to Using Fair Value Accounting For Financial Reporting.” Accounting Horizons 9, 87–107, (1995).

Bernard, V. “Accounting-based Valuation Methods, Determinants of Market-to-Book Ratios, and Implications for Financial Statement Analysis.” Working paper, University of Michigan, (1994).

Bleakley, F. “New Write-Offs Mostly Please Investors.” Wall Street Journal December 21, C1, (1995).

Bricker, R., G. Previts, T. Robinson, and S. Young, “Financial Analyst Assessment of Company Earnings Quality.” Journal of Accounting, Auditing, and Finance Summer, 541–554, (1995)

Burgstahler, D.C. and I.D. Dichev. “Earnings, Adaptation, and Equity Value.” The Accounting Review 72, 187–215, (1997).

Castagna, A. and Z. Matolcsy, “The Marginal Information Content of Selected Items in Financial Statements.” Journal of Business Finance and Accounting Summer, 317-333, (1995).

Cheng, C.S.A., “Empirical Validity of All-Inclusive Income an Investigation of Volatility of Aggregated and Disaggregated Income Line Items and their Explanatory Power for Returns University of Houston.” Working paper, (1998).

Clayman, M. “One-Time Charges Never Having to Say You're Sorry?” Financial Analysts Journal September- October, 57–60, (1995).

Collins, D.W., E.L. Maydew, and I.S. Weiss, “Changes in the Value-Relevance of Earnings and Book Values Over The Last 40 Years.” Journal of Accounting and Economics 24, 39–68, (1997).

Condon, B. “Pick a Number, Any Number.” Forbes March 23, 124, (1998).

Dechow, P., R. Sloan, and A. Sweeney, “Detecting Earnings Management.” The Accounting Review April, 193–225, (1995).

Defond, M.L. and J. Jiambaivo, “Debt Covenant Violation and Manipulation of Accruals.” Journal of Accounting and Economics 17, 145–176, (1994).

Defond, M.L., J. Jiambaivo, and C.W. Park, “Smoothing Income in Anticipation of Future Earnings.” Journal of Accounting and Economics 23, 115–139, (1997).

Elliott, J.A. and J.D. Hanna, “Repeated Accounting Write-Offs and the Information Content of Earnings.” Journal of Accounting Research Supplement 135–156, (1996).

Francis, J. and K. Schipper, “Have financial statements lost their relevance?” Working paper, University of Chicago, (1996).

Gaver, J.J., K.M. Gaver, and J.R. Austin, “Additional Evidence on Bonus Plans and Income Management.” Journal of Accounting and Economics 19, 3–28, (1995).

Healy, P.M., “The Effect of Bonus Schemes on Accounting Decisions.” Journal of Accounting and Economics 7, 85–107, (1985).

Hoskin, R., J. Hughes, and W. Ricks, “Evidence on the Incremental Information Content of Additional Firm Disclosures Made Concurrently with Earnings.” Journal of Accounting Research Supplement 1–32, (1986).

Jones, J. “Earnings Management During Import Relief Investigations.” Journal of Accounting Research 29, 193–228, (1991).

Lalli, F., “The Real Dow.” Money March 76–79, (1997).

Lev, B. and P. Zarowin, “The Boundaries of Financial Reporting and How to Extend Them.” Working paper, New York University, New York, N.Y., (1998).

Levitt, A. “The Numbers Game Remarks at New York University.” September 28, 1998.

Myers, S.C., “Determinants of Corporate Borrowing.” Journal of Financial Economics 5, 147–175, (1997).

Ohlson, J., “Earnings, Book Values and Dividends in Security Valuation.” Contemporary Accounting Research 11, 661–687, (1995).

Schipper, K., “Commentary on Earnings Management.” Accounting Horizons 3, 91–102, (1991).

Smith, R. and S. Lipin, “Are Companies Using Restructuring Costs to Fudge the Figures? A Repeated Strategic Move Makes Future Earnings Seem Unrealistically Rosy.” Wall Street Journal January 30, A1, (1996).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Black, E.L., Carnes, T.A. & Richardson, V.J. The Value Relevance of Multiple Occurrences of Nonrecurring Items. Review of Quantitative Finance and Accounting 15, 391–411 (2000). https://doi.org/10.1023/A:1012054609524

Issue Date:

DOI: https://doi.org/10.1023/A:1012054609524