Abstract

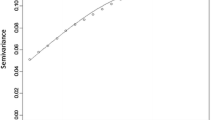

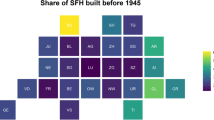

This article examines anisotropic spatial autocorrelation in single-family house prices and in hedonic house-price equation residuals using a spherical semivariogram and transactions data for one county in the Philadelphia, Pennsylvania, MSA. Isotropic semivariograms model spatial relationships as a function of the distance separating properties in space. Anisotropic semivariograms model spatial relationships as a function of both the distance and the direction separating observations in space. The goals of this article are (1) to determine whether there is spatial autocorrelation in hedonic house-price equation residuals and (2) to empirically examine the validity of the isotropy assumption. We estimate the parameters of spherical semivariograms for house prices and for hedonic house-price equation residuals for 21 housing submarkets within Montgomery County, Pennsylvania. These housing submarkets are constructed by dividing the county into 21 groupings of economically similar adjacent census tracts. Census tracts are grouped according to 1990 census tract median house prices and according to characteristics of the housing stock. We fit the residuals of each submarket hedonic house price equation to both isotropic and anisotropic spherical semivariograms. We find evidence of spatial autocorrelation in the hedonic residuals in spite of a very elaborate hedonic specification. Additionally, we have determined that, in some submarkets, the spatial autocorrelation in the hedonic residuals is anisotropic rather than isotropic. The empirical results suggest that the spatial autocorrelation in Montgomery County single-family house-price equation residuals is anisotropic in submarkets where residents typically commute to a regional or local central business district.

Similar content being viewed by others

References

Anselin, L. (1978). Spatial Econometrics: Methods and Models. Dordrecht: Kluwer Academic.

Bailey, M., R. Muth, and H. Nourse. (1963). “A Regression Method for Real Estate Price Index Construction,” Journal of the American Statistical Association 58(304), 933–942.

Bailey, T. C., and A. C. Gatrell. (1995). Interactive Spatial Data Analysis. Essex, England: Addison Wesley Longman.

Basu, S., and T. Thibodeau. (1998). “Analysis of Spatial Autocorrelation in House Prices,” Journal of Real Estate Finance and Economics 17(1), 61–85.

Can, A. (1992). “Specification and Estimation of Hedonic Housing Price Models,” Regional Science and Urban Economics 22, 453–477.

Case, B., and J. Quigley. (1991). “The Dynamics of Real Estate Prices,” Review of Economics and Statistics 83, 50–58.

Case, K., and R. Shiller. (1987). “Prices of Single-Family Homes Since 1970: New Indexes for Four Cities.” National Bureau of Economic Research Working Paper No. 2393. Cambridge, MA.

Case, K., and R. Shiller. (1989). “The Efficiency of the Market for Single-Family Homes,” American Economic Review 79(1), 125–137.

Clapp, J., and C. Giaccotto. (1992). “Estimating Price Trends for Residential Property: A Comparison of Repeat Sales and Assessed Value Methods,” Journal of the American Statistical Association 87, 300–306.

Cliff, Andrew D., and J. K. Ord. (1973). Spatial Autocorrelation. London: Pion.

Cressie, N. A. (1993). Statistics for Spatial Data. New York: Wiley.

Dubin, R. A. (1988). “Estimation of Regression Coefficients in the Presence of Spatially Autocorrelated Error Terms,” Review of Economics and Statistics 70, 466–474.

Dubin, R. A., R. Kelley Pace, and T. G. Thibodeau. (1998). “Spatial Autoregression Techniques for Real Estate Data,” Journal of Real Estate Literature 79–95.

Gillingham, R. (1975). “Place to Place Rent Comparisons,” Annals of Economic and Social Measurement 4(1), 153–174.

Goodman, A. C. (1978). “Hedonic Prices, Price Indices, and Housing Markets,” Journal of Urban Economics 5(4), 471–484.

Hill, R. C., J. R. Knight, and C. F. Sirmans. (1997). “Estimating Capital Asset Price Indexes,” Review of Economics and Statistics 79(2), 226–233.

Isaaks, E. H., and R. M. Srivastava. (1989). An Introduction to Applied Geostatistics. New York: Oxford University Press.

Journel, A. G., and C. J. Huijbregts. (1978). Mining Geostatistics. London: Academic Press.

Maddala, G.S. (1977). Econometrics. New York: McGraw-Hill.

Mardia, K. V., and R. J. Marshall, (1984). “Maximum Likelihood Estimation of Models for Residual Covariance in Spatial Regression,” Biometrika 71, 135–146.

Matheron, G. (1963). “Principles of Geostatistics,” Economic Geology 58, 1246–1266.

Oden, N. L., and R. R. Sokal. (1986). “Directional Autocorrelation: An Extension of Spatial Correlograms in Two Dimensions,” Systematic Zoology 35, 608–617.

Pace, R. Kelley, and O. W. Gilley. (1997). “Using the Spatial Configuration of the Data to Improve Estimation,” Journal of the Real Estate Finance and Economics 14(3), 333–340.

Quigley, J. (1995). “A Simple Hybrid Model for Estimating Real Estate Indexes,” Journal of Housing Economics 4(1), 1–12.

Ripley, B. (1981). Spatial Statistics. New York: Wiley.

Simon, G. (1997). “An Angular Version of Spatial Correlations, with Exact Significance Tests,” Geographical Analysis 29(3), 267–278.

Thibodeau, Thomas G. (1989). “Housing Price Indexes from the 1974–83 SMSA Annual Housing Surveys,” Journal of the American Real Estate and Urban Association 17, 100–117.

Thibodeau, Thomas G. (1990). “Estimating the Effect of High Rise Office Buildings on Residential Property Values,” Land Economics 66(4), 402–408.

Thibodeau, Thomas G. (1992). Residential Real Estate Prices from the 1974–1983 Standard Metropolitan Statistical Area American Housing Survey. Mount Pleasant, MI: Blackstone Books, Studies in Urban and Resource Economics.

Thibodeau, Thomas G. (1996). “House Price Indices from the 1984–1992 MSA American Housing Surveys,” Journal of Housing Research 6(3), 439–481.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gillen, K., Thibodeau, T. & Wachter, S. Anisotropic Autocorrelation in House Prices. The Journal of Real Estate Finance and Economics 23, 5–30 (2001). https://doi.org/10.1023/A:1011140022948

Issue Date:

DOI: https://doi.org/10.1023/A:1011140022948