Abstract

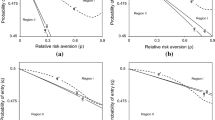

We use numerical methods to compute Nash equilibrium (NE) bid functions for four agents bidding in a first-price auction. Each bidder i is randomly assigned: ri ɛ [0, rmax], where 1 − ri is the Arrow-Pratt measure of constant relative risk aversion. Each ri is independently drawn from the cumulative distribution function Φ(ċ), a beta distribution on [0, rmax]. For various values of the maximum propensity to seek risk, rmax, the expected value of any bidder's risk characteristic, E(ri), and the probability that any bidder is risk seeking, P(ri > 1), we determine the nonlinear characteristics of the (NE) bid functions.

Similar content being viewed by others

References

Cox, J.C. and Oaxaca, R. (1994a). “Inducing Risk Neutral Preferences: Further Analysis of the Data.” Department of Economics, University of Arizona, Journal of Risk and Uncertainty, to appear.

Cox, J.C. and Oaxaca, R. (1994b). “Is Bidding Behavior Consistent with Bidding Theory for Private Value Auctions.” Department of Economics, University of Arizona, In R.M. Isaac (ed.), Research in Experimental Economics, vol. 6, to appear.

Cox, J.C., Roberson, B., and Smith, V.L. (1982a). “Theory and Behavior of Single Object Auctions.” In Vernon L. Smith (ed.), Research in Experimental Economics, vol. 2. Greenwich, CT: JAI Press.

Cox, J.C., Smith, V.L., and Walker, J.M. (1982b). “Auction Market Theory of Heterogeneous Bidders.” Economic Letters.9, 319-325.

Cox, J.C., Smith, V.L., and Walker, J.M. (1988). “Theory and Individual Behavior in First-Price Auctions.” Journal of Risk and Uncertainty.1, 61-69.

Cox, J.C., Smith, V.L., and Walker, J.M. (1992). “Theory and Misbehavior of First-Price Auctions: Comment.” American Economic Review.82, 1392-1412.

Law, A.M. and Kelton, W.D. (1991). Simulation Modeling and Analysis, 2nd ed. New York: McGraw-Hill.

Pearson, K. (ed.). (1934). Tables of the Incomplete Beta-Function.Cambridge: Cambridge University Press.

Press, W.H., Flannery, B.P., Teukolsky, S.A., and Vetterling, W.T. (1986). Numerical Recipes, Cambridge: Cambridge University Press.

Smith, V.L. and Walker, J.M. (1992). “Rewards, Experience and Decision Costs in First Price Auctions.” Economic Inquiry, to appear.

Yakowitz, S. and Szidarovszky, F. (1989). An Introduction to Numerical Computations.New York: MacMillan Publishing Co.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Van Boening, M.V., Rassenti, S.J. & Smith, V.L. Numerical Computation of Equilibrium Bid Functions in a First-Price Auction with Heterogeneous Risk Attitudes. Experimental Economics 1, 147–159 (1998). https://doi.org/10.1023/A:1009992209358

Issue Date:

DOI: https://doi.org/10.1023/A:1009992209358