Abstract

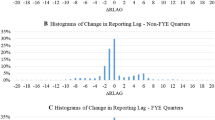

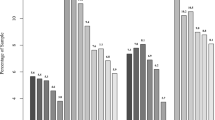

Using a sample of announcements drawn from the 1980s and early 1990s, we reassess the relation between earnings news and earnings announcement timing. Using analyst forecast errors to proxy for news, we find that early announcements are associated with good news relative to late announcements. The relation between news and timing, however, does not appear to be strictly monotonic. Furthermore, we find that unexpected earnings explain 4% or less of the variation in timing. Finally, we assess whether abnormal returns behave in a manner that is consistent with a good news early, bad news late relation.

Similar content being viewed by others

References

Ball, Ray, and S. P. Kothari. (1991). “Security Returns Around Earnings Announcements.” The Accounting Review 66, 718-738.

Bowen, Robert, Marilyn Johnson, Terry Shevlin, and D. Shores. (1992). “Determinants of the Timing of Quarterly Earnings Announcements.” Journal of Accounting, Auditing, and Finance 7, 395-422.

Brown, Lawrence, Dosoung Choi, and Kwon-Jung Kim. (1994). “The Impact of Announcement Timing on the Informativeness of Earnings and Dividends.” Journal of Accounting, Auditing, and Finance 9, 653-674.

Chambers, Anne, and Stephen Penman. (1984). “Timeliness of Reporting and the Stock Price Reaction to Earnings Announcements.” Journal of Accounting Research 22, 21-47.

Collins, Stephen. (1985). “Professional Liability: the Situation Worsens.” Journal of Accountancy 160, 57-66.

Dutta, Sunil, and Jacob Nelson. (1998). “Shareholder Litigation and Market Information: Effects of the Endorsement of the Fraud-on-the-Market Doctrine on Market Information.” Working paper, University of California, Berkeley.

Dye, Ronald. (1991). “Informationally Motivated Auditor Replacement.” Journal of Accounting and Economics 14, 347-374.

Easton, Peter, and Mark Zmijewski. (1993). “SEC Form 10K/10Q Reports and Annual Reports to Shareholders: Reporting Lags and Squared Market Model Prediction Errors.” Journal of Accounting Research 31, 113-129.

Francis, Jennifer, Donna Philbrick, and Katherine Schipper. (1994). “Shareholder Litigation and Corporate Disclosures.” Journal of Accounting Research 32, 137-164.

Givoly, Dan, and Dan Palmon. (1982). “Timeliness of Annual Earnings Announcements: Some Empirical Evidence.” The Accounting Review 57, 486-508.

Kross, William. (1981). “Earnings and Announcement Time Lags.” Journal of Business Research 9, 267-280.

Kross, William and Douglas Schroeder. (1984). “An Empirical Investigation of the Effect of Quarterly Earnings Announcement Timing on Stock Returns.” Journal of Accounting Research 22, 153-176.

Penman, Stephen. (1984). “Abnormal Returns to Investment Strategies Based on the Timing of Earnings Reports.” Journal of Accounting and Economics 6, 165-183.

Sivakumar, Kumar and Gregory Waymire. (1993). “The Information Content of Earnings in a Discretionary Reporting Environment: Evidence from NYSE Industrials, 1905–1910.” Journal of Accounting Research 31, 62-91.

Skinner, Douglas. (1993). “Why Firms Voluntarily Disclose Bad News.” Journal of Accounting Research 32, 38-60.

Sloan, Richard. (1996). “Do Stock Prices Fully Impound Information in Accruals and Cash Flows About Future Earnings?” The Accounting Review 71, 289-316.

Stickel, Scott. (1992). “Reputation and Performance Among Security Analysts.” Journal of Finance 47, 1811-1836.

Trueman, Brett. (1990). “Theories of Earnings-Announcement Timing.” Journal of Accounting and Economics 12, 285-301.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Begley, J., Fischer, P.E. Is there Information in an Earnings Announcement Delay?. Review of Accounting Studies 3, 347–363 (1998). https://doi.org/10.1023/A:1009635117801

Issue Date:

DOI: https://doi.org/10.1023/A:1009635117801