Abstract

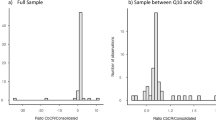

This paper examines the 1989–1993 publicly available financial reports of 46 U.S.-based multinationals to estimate the revenue implications of implementing a U.S. federal formula apportionment system. Ignoring behavioral responses, we estimate shifting to an equal-weighted, three-factor formula would have increased their U.S. tax liabilities by 38 percent, with an 81 percent increase for oil and gas firms. We find the firms report a lower percentage of their worldwide profits as American profits than their American share of assets, sales, or payroll. The results may be attributed to more profitable foreign operations, tax-motivated income shifting, or measurement error.

Similar content being viewed by others

References

Bird, Richard M., and Donald J. S. Brean. (1986). “The Interjurisdictional Allocation of Income and the Unitary Taxation Debate.” Canadian Tax Journal 34(6), November−December, 1377–1416.

Bucks, Dan R., and Michael Mazerov. (1993). “The State Solution to the Federal Government's International Transfer Pricing Problem.” National Tax Journal 46(3), September, 385–392.

Frisch, Daniel. (1983). “Issues in the Taxation of Foreign Source Income.” In M. Feldstein (ed.), Behavioral Simulation Methods in Tax Policy Analysis. Chicago: University of Chicago Press, pp. 289–330.

Gordon, Roger, and John Wilson. (1986). “An Examination of Multijurisdictional Corporate Income Taxes Under Formula Apportionment.” Econometrica 54(6), November, 1357–1373.

Harris, David, Randall Morck, Joel Slemrod, and Bernard Yeung. (1993). “Income Shifting in the U.S. Multinational Corporations.” In A. Giovanni, R. G. Hubbard, and J. Slemrod (eds.), Studies in International Taxation. Chicago: University of Chicago Press, pp. 277–302.

Hines, James R., Jr., and Eric Rice. (1994). “Fiscal Paradise: Foreign Tax Havens and American Business.” Quarterly Journal of Economics 109(1), 149–182.

McLure, Charles E., Jr. (1989). “Economic Integration and European Taxation of Corporate Income at Source: Some Lessons from the U.S. Experience.” In M. Crammie and B. Robinson (eds.), Beyond 1992: A European Tax System. London: Institute for Fiscal Studies, pp. 39–51.

McLure, Charles E., Jr., Jorge Martinez−Vasquez and Sally Wallace. (1995). “Subnational Fiscal Decentralization in Ukraine.” In R. M. Bird, R. Ebel, and C. Wallich (eds.), Decentralization of the Socialist State: Intergovernmental Finance in Transition Economies. Washington: The World Bank, pp. 281–319.

Musgrave, Peggy B. (1973). “International Tax Base Division and the Multinational Corporation.” Public Finance 27(4), 394–411.

Schadewald, Michael S. (1996). “Global Apportionment: How Would it Affect the Largest U.S. Corporations?” Tax Notes International July 8, 131–139. Also see correction in “Correction to Tax Policy Forum on Global Apportionment.” Tax Notes International July 15, 193.

Sheffrin, Steven M., and Jack Fulcher. (1983). “Alternate Divisions of the Tax Base: How Much Is at Stake?” In C. E. McLure, Jr. (ed.), The State Corporate Income Tax: Issues in Worldwide Unitary Combination. Stanford: Hoover Institution Press, pp. 192–209.

Sheffrin, Steven M., and Jack Fulcher. (1984). “The Container Case: Can We Identify the Winners and Losers.” Proceedings of the Annual Conference of the National Tax Association−Tax Institute of America.

Weber, Richard P., and James E. Wheeler. (1992). “Using Income Tax Disclosures to Explore Significant Economic Transactions.” Accounting Horizons, 14–29.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Shackelford, D., Slemrod, J. The Revenue Consequences of Using Formula Apportionment to Calculate U.S. and Foreign-Source Income: A Firm-Level Analysis. International Tax and Public Finance 5, 41–59 (1998). https://doi.org/10.1023/A:1008664408465

Issue Date:

DOI: https://doi.org/10.1023/A:1008664408465