Abstract

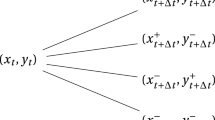

In a highly publicized example, a marketing and refining subsidiary of Metallgesellschaft controlled short term derivative positions reportedly equivalent to 160 million barrels of oil, 80 times the daily output of Kuwait. Presumably, the short term positions were taken to hedge oil contracts to customers over an extended period. This paper develops the analytics underlying the hedging of long term flow commitments with short term futures contracts. Its contributions includes the determination of minimum variance hedging paths for multiperiod flow portfolios and the evaluation of both period-by-period and end-of-horizon volatilities under various hedging schemes. The analysis allows for basis risk, non-zero cost-of-carry, and spot diffusion processes that have a non-zero market price of risk. The results are developed in the context of an efficient market and standard equilibrium pricing models.

Similar content being viewed by others

References

Baesel, Jerome and Dwight Grant, “Optimal Sequential Futures Trading.” Journal of Financial and Quantitative Analysis 17(5), 683–695, (December 1982).

Bessembinder, Hendrik, Jay Coughenour, Paul Seguin, and Margaret Smoller, “Mean Reversion in Asset Prices: Evidence from the Futures Term Structure.” The Journal of Finance 50(1), 361–375, 1995.

Cox, John C., J.E. Ingersoll, and Stephen Ross, “An Intertemporal General Model of Asset Prices.” Econometrica 53(2), 363–384, 1985.

Wall Street Journal, January 27, 1995.

Culp, Christopher L. and Merton Miller, “Hedging a Flow of Commodities with Futures: Lessons from Metallgesellschaft.” Derivatives Quarterly 7–15, (Fall 1994).

Culp, Christopher L. and Merton Miller, “Metallgesellschaft and the Economics of Synthetic Storage.” Journal of Applied Corporate Finance 7(4), (Winter, 1995).

“Germany's Corporate Whodunnit.” The Economist 71, (February 4, 1995).

Edwards, Franklin and Michael Canter, “The Collapse of Metallgesellschaft: Unhedgeable Risks, Poor Hedging, or Just Bad Luck.” Journal of Futures Markets 15(3), 211–264, 1995.

Gibson, R. and E. Schwartz, “Valuation of Long Term Oil-Linked Assets.” Anderson Graduate School of Management, UCLA, Working Paper # 6–89, 1989.

Gibson, R. and E. Schwartz, “Stochastic Convenience Yield and the Pricing of Oil Contingent Claims.” Journal of Finance 45(3), 959–976, (July, 1990).

Grant, Dwight, “Rolling The Hedge Forward: An Extension.” Financial Management 13(4), 26–28, (Winter, 1984).

Mello, Antonio S. and John E. Parsons, “Maturity structure of a Hedge Matters: Lessons Learned from the Metallgesellschaft Debacle.” Journal of Applied Corporate Finance, (Spring 1995).

McCabe, George, M. and Charles T. Frankle, “The Effectiveness of Rolling the Hedge Forward in the Treasury Bill Futures Market.” Financial Management, 12(2), 21–29, (Summer, 1983).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hilliard, J.E. Analytics Underlying the Metallgesellschaft Hedge: Short Term Futures in a Multi-Period Environment. Review of Quantitative Finance and Accounting 12, 195–220 (1999). https://doi.org/10.1023/A:1008383017921

Issue Date:

DOI: https://doi.org/10.1023/A:1008383017921