Abstract

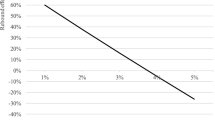

The purpose of this paper is to analyze the role of anenergy tax on technical improvements and on prices ofconsumer durables induced by strategic competition inenergy efficiency. If the gasoline tax is raised thisdoes in principle not affect the producers of carsbecause the motorist pays for it in terms of a highercost of using the car. This, however, affects the unitsales of car producers because of substitution towardsother modes of transportation. A second element ofreaction to energy price variation is an indirect oneand relates to the effect of energy prices ontechnology. Competition forces car producers todevelop more energy efficient cars in order to reducethe cost of using a car. This indirect effect canpartly offset the direct effect of higher energyprices on demand if it is profitable for theautomobile industry to engineer more energy efficientequipment. We will analyze the impact of an energy taxon energy efficiency and on the price of a durablegood. This will be done within the framework of aduopoly competing in prices and in the energyefficiency of its products. The government chooses awelfare maximizing energy tax as an incentive toinnovate. Then we will analyze a strategic two-stagedecision process in which the duopolists first decideabout energy efficiency and then compete in prices.

Similar content being viewed by others

References

Bickel, P. and R. Friedrich (1995), Was kostet uns die Mobilität — Externe Kosten des Verkehrs. Berlin: Springer.

Buchanan, J. M. (1969), ‘External Diseconomies and Corrective Taxes and Market Structure’, American Economic Review 59, 174-177.

Calthrop, E. and S. Proost (1998), ‘Road Transport Externalities’, Environmental and Resource Economics 11(3–4), 335-348.

Conrad, K. (1983), ‘Cost Prices and Partially Fixed Factor Proportions in Energy Substitution’, European Economic Review 21, 299-312.

Conrad, K. and M. Schröder (1991), ‘Demand for Durable and Non-Durable Goods, Environmental Policy and Consumer Welfare’, Journal of Applied Econometrics 6, 271-286.

Conrad, K. and J. Wang (1993), ‘The Effect of Emission Taxes and Abatement Subsidies on Market Structure’, International Journal of Industrial Organization 11, 499-518.

Downing, P. B. and L. J. White (1986), ‘Innovation in Pollution Control’, Journal of Environmental Economics and Management 13, 18-29.

Ecchia, G. and M. Mariotti (1994), A Survey on Environmental Policy: Technological Innovation and Strategic Issues. Disc. Paper Nota Di Lavoro 44.94, Fondazione Eni Enrico Mattei.

Gately, D. (1992), ‘Imperfect Price-Reversibility of U.S. Gasoline Demand: Asymmetric Responses to Price Increases and Declines’, The Energy Journal 13(4), 179-207.

Greene, D. L. (1192), ‘Vehicle User and Fuel Economy: How Big Is the “Rebound” Effect?’, The Energy Journal 13(1), 117-143.

INFRAS A.G. and IWW (1994), External Effects of Transport. Zürich and Karlsruhe.

Krouse, C. G. (1990), Theory of Industrial Economics. Cambridge, MA: Basil Blackwell.

Lee, D. R. (1975), ‘Efficiency of Pollution Taxation and Market Structure’, Journal of Environmental Economics and Management 2, 69-72.

Magat, W. A. (1978), ‘Pollution Control and Technological Advance: A Dynamic Model of the Firm’, Journal of Environmental Economics and Management 5, 1-25.

Milliman, S. R. and R. Prince (1989), ‘Firm Incentives to Promote Technological Change in Pollution Control’, Journal of Environmental Economics and Management 17, 247-265.

Newbery, D. M. (1991), ‘Pricing and Congestion: Economic Principles Relevant to Pricing Roads’, Oxford Review of Economic Policy 4(2), 22-38.

Tirole, J. (1989), The Theory of Industrial Organization. Cambridge, MA: MIT Press.

Walker, J. O. and F. Wirl (1993), ‘Irreversible Price — Induced Efficiency Improvements: Theory and Empirical Application to Road Transportation’, The Energy Journal 14(4), 183-205.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Conrad, K. Energy Tax and Competition in Energy Efficiency: The Case of Consumer Durables. Environmental and Resource Economics 15, 159–177 (2000). https://doi.org/10.1023/A:1008362416293

Issue Date:

DOI: https://doi.org/10.1023/A:1008362416293