Abstract

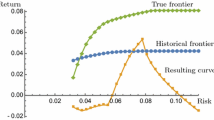

The purpose of this article is to demonstrate the effect of investment time horizon on the choice of risky assets in a portfolio when the investor in question is optimizing a Safety-First (downside risk-aversion) utility function. It is shown, under standard assumptions, that although shortfall risk decreases exponentially with investment time horizon, the portfolio asset allocation proportions remain invariant. In fact, in some instances, the optimal allocation will not even depend on the drift of the underlying assets. Thus, we extend the classical results of Samuelson and Merton, derived under conventional utility assumptions, to an individual optimizing an A.D. Roy Safety-First objective; a discontinuous utility function that has been extolled as conforming to observed investor behaviour. A numerical example is provided.

Similar content being viewed by others

References

Butler, K.C. and D.L. Domian, “Risk, Diversification and the Investment Horizon.” Journal of Portfolio Management 17, 41–48, (1991).

Butler, K.C. and D.L. Domian, “Long-run returns on Stock and Bond Portfolios: Implications for Retirement Planning.” Financial Services Review 2(1), 41–49, (1993).

Gunthorpe, D. and H. Levy, “Portfolio Composition and the Investment Horizon.” Financial Analysts Journal51–56, (1994).

Kritzman, M., “What Practitioners Need To Know About Time Diversification.” Financial Analysts Journal 14–18, (1994).

Hull, J.C. Options, Futures and other Derivative Securities 2nd Edition, Prentice Hall, New Jersey, (1993).

Marshall, J.F., “The Role of the Investment Horizon in Optimal Portfolio Sequencing.” The Financial Review 29(4), 557–576, (1994).

McEnally, R.W., “Time Diversification: Surest Way to Lower Risk?” Journal of Portfolio Management 11, 24–26, (1985).

Merton, Robert C., “Optimum Consumption and Portfolio Rules in a Continuous Time Model” Journal of Economic Theory 3, 373–413, (1971).

Milevsky, M.A., K. Ho and C. Robinson, “Asset Allocation via the Conditional First Exit Time or How To Avoid Outliving Your Money.” Review of Quantitative Finance and Accounting 9(1), (1997).

Roy, A.D., “Safety-First and the Holding of Assets.” Econometrica 20(3), 431–449, (1952).

Samuelson, Paul C., “Lifetime Portfolio Selection by Dynamic Stochastic Programming.” Review of Economic and Statistics 51, 239–246, (1969).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Milevsky, M.A. Time Diversification, Safety-First and Risk. Review of Quantitative Finance and Accounting 12, 271–282 (1999). https://doi.org/10.1023/A:1008326915984

Issue Date:

DOI: https://doi.org/10.1023/A:1008326915984