Abstract

This paper measures the extent to which small businesses in the United States in the late 1980s were able to access the external credit finance they desired. We argue that a comprehensive definition of credit rationing must account for both (a) creditworthy firms that apply for and are denied financing, and (b) creditworthy firms that decide not to apply for desired external financing, given expectations about how long it may take to obtain financing and the evolution of investment opportunities.

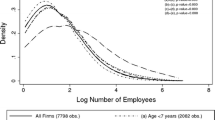

Data from a national survey of small businesses shows that only 2.14 percent of firms did not obtain the funding for which they applied in 1987–88. Another 2.17 percent may have faced some short-run constraints on investment: they were initially denied by lenders but received the credit for which they applied by the end of the sample period. Finally, an additional 4.22 percent of firms are estimated to have been discouraged from applying because of expected denial.

Constrained firms are smaller, younger, and more likely to be owned by their founders than those firms that successfully applied for external finance. The total number of credit constrained firms seems quite small, particularly because we cannot distinguish empirically between creditworthy and noncreditworthy firms. Thus the extent of true credit rationing appears quite limited.

Similar content being viewed by others

References

Berger, Allen N. and Gregory F. Udell, 1992, ‘Some Evidence on the Empirical Significance of Credit Rationing’, Journal of Political Economy 100(5), 1047–1077.

Berger, Allen N. and Gregory F. Udell, 1994, ‘Did Risk-based Capital Allocate Bank Credit and Cause a "Credit Crunch" in the United States?’, Journal of Money, Credit and Banking 26(3), Part 2, 585–628.

Berger, Allen N. and Gregory F. Udell, 1995, ‘Relationship Lending and Lines of Credit in Small Firm Finance’, Journal of Business 68(3), 351–381.

Cressy, Robert, 1996, ‘Are Business Startups Debt-Rationed?’, Economic Journal 106 (September), 1253–1270.

Davis, Steven J., John C. Haltiwanger and Scott Schuh, 1996, Job Creation and Destruction (Cambridge, Massachusetts: MIT Press).

Economic Report of the President, 1996, Washington, D.C.: United States Government Printing Office.

Federal Reserve System, 1992, National Survey of Small Business Finances, 1988-89: Technical Manual and Codebook, Washington, D.C.: National Technical Information Service, U.S. Department of Commerce.

Freimer, Marshall and Myron J. Gordon, 1965, ‘Why Bankers Ration Credit’, Quarterly Journal of Economics 79(3), 397–416.

Goldfeld, Stephen M., 1966, Commercial Bank Behavior and Economic Activity: A Structural Study of Monetary Policy in the Postwar United States, Amsterdam: North Holland Publishing Co.

Hodgman, Donald R., 1959, ‘In Defense of the Availability Doctrine: A Comment’, Review of Economics and Statistics 59, 70–73.

Hodgman, Donald R., 1960, ‘Credit Risk and Credit Rationing’, Quarterly Journal of Economics 74(2), 258–278.

Jaffee, Dwight M., 1971, Credit Rationing and the Commercial Loan Market, New York: John Wiley and Sons.

Jaffee, Dwight M. and Thomas Russell, 1976, ‘Imperfect Information, Uncertainty, and Credit Rationing’, Quarterly Journal of Economics 90(4), 651–666.

Jappelli, Tullio, 1990, ‘Who Is Credit Constrained in the U.S.Economy?’, Quarterly Journal of Economics 105(1), 219–234.

Jovanovic, Boyan, 1982, ‘Selection and the Evolution of Industry’, Econometrica 50(3), 649–670.

McCallum, John, 1991, ‘Credit Rationing and the Monetary Transmission Mechanism’, American Economic Review 81(4), 946–951.

Peek, Joe and Eric S. Rosengren, 1995, ‘Banks and the Availability of Small Business Loans’, Federal Reserve Bank of Boston Working Paper Number 95-1, January.

Petersen, Mitchell A. and Raghuram G. Rajan, 1994, ‘The Benefits of Lending Relationships: Evidence from Small Business Data’, Journal of Finance 49(1), 3–37.

Rhyne, Elisabeth Holmes, 1988, Small Business, Banks, and SBA Loan Guarantees: Subsidizing the Weak or Bridging a Credit Gap?, New York: Quorum Books.

Sealy, C. W., Jr., 1979, ‘Credit Rationing in the Commercial Loan Market: Estimates of a Structural Model Under Conditions of Disequilibrium’, Journal of Finance 34(3), 689–702.

Slovin, Myron B. and Marie Elizabeth Sushka, 1983, ‘A Model of the Commercial Loan Rate’, The Journal of Finance 38(5), 1583–1596.

Stiglitz, Joseph and Andrew Weiss, 1981, ‘Credit Rationing in Markets with Imperfect Information’, American Economic Review 71(3), 393–410.

The State of Small Business: A Report of the President, 1997, Washington, D.C.: United States Government Printing Office (http://www.sba.gov/advo/stats/ec_state.html).

U.S. Small Business Administration, Office of Advocacy, 1988, Capital Formation in the States, January.

U.S. Small Business Administration, Office of Advocacy, 1994, The White House Conference on Small Business: Foundation for a New Century, April.

Waller, Christopher J. and Stephen Lewarne, 1994, ‘An Expository model of Credit Rationing’, Journal of Macroeconomics 16(3), 539–545.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Levenson, A.R., Willard, K.L. Do Firms Get the Financing They Want? Measuring Credit Rationing Experienced by Small Businesses in the U.S.. Small Business Economics 14, 83–94 (2000). https://doi.org/10.1023/A:1008196002780

Issue Date:

DOI: https://doi.org/10.1023/A:1008196002780