Abstract

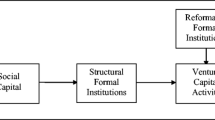

European attempts at imitation of U.S. venture capital have been less successful in stimulating ‘high’ tech start-ups. Our analysis of the differences between Dutch and U.S. developments points at institutional and organizational differences as explanatory factors. Disappointing longer term performances of Dutch IPOs have caused the closure of the Dutch Parallelmarket. Indeterminate length of life of Dutch vc funds contributed to a loss of trust in early stage IPOs. The U.S. – in contrast – benefitted from contractually fixed length of life of venture capital funds. The U.S. share of early stage investment displayed a wave-like pattern, which is positively related to the number of IPOs and of vc firms. Interconnectedness and follow-on funds depress early stage investment.

Similar content being viewed by others

References

Bygrave, William D. and Jeffry A. Timmons, 1992, Venture Capital at the Crossroads, Harvard Business School Press, pp. 21-22.

Corhay, A. and A. Tourani Rad, 1992, ‘De Kwaliteit van de Parallelmarkt’, Economisch Statistische Berichten, pp. 645-647.

Eigenhuizen, Financieel Dagblad, 1994

Financial Times, ‘Venture and Development Capital; A Financial Times Survey’, September 22 1992, September 24, 1993, September 23, 1994, September 25, 1995.

Fortune, October 31 1994.

Gleba, D. T, March 1995, Upside 7(3), 82-84.

HCA (Holland Colours), annual report 1994/95.

Megginson, William L. and Kathleen A. Weiss, 1991, ‘Venture Capitalist Certification in Initial Public Offerings’, Journal of Finance (July), 879-903.

Ministry of Finance, 1990, Evaluatienota Garantieregeling Particuliere Participatiemaatschappijen 1981.

Munsters, J. A. and A. Tourani Rad, 1994, Beursintroductie en Venture Capital Ondersteuning, Amsterdam: NIBE

Myers, Stewart, 1992, ‘The Search for Optimal Capital Structure’, in Stern Joel and Chew Jr. Donald (eds.), The Revolution in Corporate Finance, 2nd edition, Basil Blackwell, pp. 135-144.

Myers, Stewart, 1992. ‘The Capital Structure Puzzle’, in Stern Joel and Chew Jr. Donald (eds.), The Revolution in Corporate Finance, 2nd edition: Basil Blackwell, pp. 144-156.

NVCA (National Venture Capital Association), Annual Review, Arlington.

Renes, J., 1995, ‘Fiscale Aspecten van Kapitaalverschaffing door Venture Capitalists’, in Venture Capital Gids 1995, pp. 50-56.

Ritter, Jay R., 1991, ‘The Long Run Performance of Initial Public Offerings’, in Journal of Finance, pp. 3-27.

Sahlman, William A., 1990, ‘The Structure and Governance of Venture Capital Organizations’, Journal of Financial Economics, pp. 473-521.

Soja, T. A. and J. E. Reyes, 1990, Investment Benchmarks: Venture Capital.

Venture Capital Gidsen, NVP (Dutch Association of Venture Capital Companies), The Hague: Delwel.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Brouwer, M., Hendrix, B. Two Worlds of Venture Capital: What Happened to U.S. and Dutch Early Stage Investment?. Small Business Economics 10, 333–348 (1998). https://doi.org/10.1023/A:1007932615195

Issue Date:

DOI: https://doi.org/10.1023/A:1007932615195