Abstract

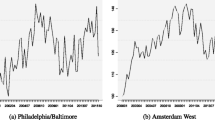

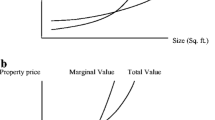

This article studies the relative volatility of commercial and residential property prices. Empirical evidence of commercial property prices being more volatile than the prices of residential property is presented. Models are built following that of Lucas. Theoretical statements are derived to show the exact conditions under which the observations arise. The cases of fixed supply and flexible supply are considered separately.

Similar content being viewed by others

References

Anderson, G. J. (1991). “Expenditure Allocation Across Nondurables, Services, Durables and Savings: AnEmpirical Study of Separability in the Long Run.” Journal of Applied Econometrics 6(2), 153-68.

Burnside, C. (1995). Notes on the Linearization and GMM Estimation of Real Business Cycle Models. Working Paper, World Bank.

Burnside, C., M. Eichenbaum, and S. Rebelo. (1995). “Capital Utilization and Returns to Scale,” NBER Macroeconomics Annual 67-100.

Case, B., and J. Quigley. (1991). “The Dynamics of Real Estate Prices,” Review of Economics and Statistics 73(1), 50-58.

Greenwood, J., and Z. Hercowitz. (1991). “The Allocation of Capital and Time over the Business Cycle,” Journal of Political Economy 99, 1188-1214.

Hamilton, J. (1994). Time Series Analysis. Princeton: Princeton University Press.

Hanushek, E., and J. Quigley. (1979). “The Dynamics of Housing Market: a Stock Adjustment Model of Housing Consumption,” Journal of Urban Economics 6(1), 90-111.

Hanushek, E., and J. Quigley. (1980). “What Is the Price Elasticity of Housing Demand,” Review of Economics and Statistics 62(3), 449-454.

Hanushek, E., and J. Quigley. (1990). “Commercial Land Use Regulation and Local Government Finance,” American Economic Review 80(2), 176-180.

Wootton, J. L. (1998). Private Communications.

Kamhon, K., S. Kwong, and C. K. Y. Leung. (1998). The Dynamics of Commerical and Residential Hosuing Prices: A General Equilibrium Model. Working Paper. Chinese University of Hong Kong.

Leung, C. K. Y. (1997). Economic Growth and Increasing Housing Prices.Working Paper. Chinese University of Hong Kong.

Leung, C. K. Y. (1999). “Income Tax, Property Tax, and Tariff in a Small Open Economy,” Review of International Economics 7(3), 541-554.

Lucas, R. (1978). “Asset Prices in an Exchange Economy,” Econometrica 46(6), 1426+1445.

Rebelo, S. (1991). “Long-Run Policy Analysis and Long-Run Growth,” Journal of Political Economy 99, 500-521.

Quan, D., and J. Quigley. (1991). “Price Formation and the Appraisal Function in Real Estate Markets,” Journal of Real Estate Finance and Economics 4(2), 127-146.

Sargent, T. (1987). Dynamic Macroeconomic Theory. Cambridge: Harvard University Press. 36

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Kwong, S.K.S., Leung, C.K.Y. Price Volatility of Commercial and Residential Property. The Journal of Real Estate Finance and Economics 20, 25–36 (2000). https://doi.org/10.1023/A:1007875704572

Issue Date:

DOI: https://doi.org/10.1023/A:1007875704572