Abstract

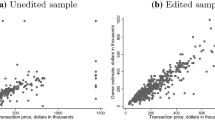

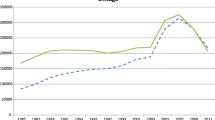

Analysis of variations in house values among localities requires reliable house value indices. Gatzlaff and Haurin (1994) indicate that traditional hedonic house value index estimates, using only information from a sample of sold homes to estimate value movements for the entire housing stock, may be subject to substantial bias. This article extends previous work by adapting the censored sample procedure to the repeat-sales index estimation model. Using data from Dade County, Florida, a house value index constructed from a sample of homes selling more than once, rather than all houses in a locality, is found to be biased. The bias is shown to be highly correlated with changes in economic conditions.

Similar content being viewed by others

References

Bailey, M. J., R. F. Muth, and H. O. Nourse. “A Regression Method for Real Estate Price Index Construction.” Journal of the American Statistical Association 58(304) (1963), 933–942.

Case, B., and J. Quigley. “The Dynamics of Real Estate Prices,” Review of Economics and Statistics 73(3) (1991), 50–58.

Case, B., H. P ollakowski, and S. Wachter. “On Choosing Among House Price Index Methodologies,” AREUEA Journal 19(3) (Fall 1991), 286–307.

Case, K., and R. Shiller. “The Efficiency of the Market for Single-Family Homes,” American Economic Review 79(1) (March 1989), 125–37.

Dhrymes, P. J. “Limited Dependent Variables.” In Z. Griliches and M. Intrilligator (eds.), Handbook of Econometrics. Amsterdam: Elsevier Science Publishers, 1986.

Eller, T. J. Household Wealth and Asset Ownership: 1991. U. S. Bureau of the Census, Current Population Reports. Washington: U.S. Government Printing Office, P70–34, 1994.

Fishe, R. P., R. P. Trost, and P. Lurie. “Labor Force Earnings and College Choice of Young Women: An Examination of Selectivity Bias and Comparative Advantage,” Economics of Education Review 1 (1981), 169–191.

Gatzlaff, D., and D. Haurin. “Sample Selection and Biases in Local House Value Indices.” Working paper, The Ohio State University, 1994.

Gatzlaff, D., and D. Ling. “Measuring Changes in Local House Prices: An Empirical Investigation of Alternative Methodologies,” Journal of Urban Economics 35(2) (1994), 221–244.

Goodman, A., and T. Thibodeau. “Heteroskedasticity in Repeat-Sale House Price Equations.” Working paper, Wayne State University, 1995.

Greene, W. “Sample Selection Bias as a Specification Error: Comment,” Econometrica 49(3) (May 1981), 795–798.

Hartzell, D., R. Pittman, and D. Downs. “An Updated Look at the Size of the U.S. Real Estate Market Portfolio,” Journal of Real Estate Research 9(2) (Spring 1994), 197–212.

Haurin, D., and P. Hendershott. “House Price Indexes: Issues and Results,” AREUEA Journal 19(3) (Fall 1991), 259–269.

Heckman, J. “Shadow Prices, Market Wages, and Labor Supply,” Econometrica 42 (1974), 679–694.

Heckman, J. “Sample Selection Bias as a Specification Error,” Econometrica 47 (1979), 153–161.

Hendershott, P., and T. Thibodeau. “The Relationship between Median and Constant Quality House Prices: Implications for Setting FHA Loan Limits,” AREUEA Journal 18(3) (Fall 1990), 323–334.

Hosios, A. J., and J. E. Pesando. “Measuring Prices in Resale Housing Markets in Canada: Evidence and Implications,” Journal of Housing Economics 1(1) (1991), 1–15.

Ihlanfeldt, K. R., and J. Martinez-Vazquez. “Alternative Value Estimates of Owner-Occupied Housing: Evidence on Sample Selection Bias and Systematic Errors,” Journal Of Urban Economics 20(3) (November 1986), 357–369.

Lancaster, T., and A. Chesher. “Stock and Flow Sampling,” Economics Letters 8 (1981), 63–65.

Lee, Lung-Fei, and G. S. Maddala. “Sequential Selection Rules and Selectivity in Discrete Choice Econometric Models,” Econometric Methods and Applications II. 1985, pp. 311–329.

Maddala, G.S. Limited Dependent and Qualitative Variables in Econometrics. Cambridge: Cambridge University Press, 1985.

Mankiw, G., and D. Weil. “The Baby Boom, the Baby Bust, and the Housing Market,” Regional Science and Urban Economics 19(2) (May 1989), 235–258.

Poirier, D. J. “Partial Observability in Bivariate Probit Models,” Journal of Econometrics 12 (1980), 209–219.

Rosen, S. “Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition,” Journal of Political Economy 82(1) (1974), 34–55.

Tallis, G. M. “The Moment Generating Function of the Truncated Multi-Normal Distribution,” Journal of the Royal Statistical Society. (Series B) 23 (1961), 223–229.

Tunali, I. “A Common Structure for Models of Double Selection.” Working paper, University of Wisconsin-Madison, 1983.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Gatzlaff, D.H., Haurin, D.R. Sample Selection Bias and Repeat-Sales Index Estimates. The Journal of Real Estate Finance and Economics 14, 33–50 (1997). https://doi.org/10.1023/A:1007763816289

Issue Date:

DOI: https://doi.org/10.1023/A:1007763816289