Abstract

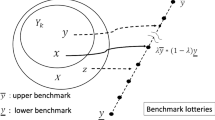

Ellsberg's (1961) famous paradox shows that decision-makers give events with ‘known’ probabilities a higher weight in their outcome evaluation. In the same article, Ellsberg suggests a preference representation which has intuitive appeal but lacks an axiomatic foundation. Schmeidler (1989) and Gilboa (1987) provide an axiomatisation for expected utility with non-additive probabilities. This paper introduces E-capacities as a representation of beliefs which incorporates objective information about the probability of events. It can be shown that the Choquet integral of an E-capacity is the Ellsberg representation. The paper further explores properties of this representation of beliefs and provides an axiomatisation for them.

Similar content being viewed by others

REFERENCES

Anscombe, F. and Aumann, R.J. (1963), A definition of subjective probability, Annals of Mathematical Statistics34: 199–205.

Camerer, C. and Weber, M. (1992), Recent developments in modeling preferences: uncertainty and ambiguity, Journal of Risk and Uncertainty5: 325–370.

Choquet, G. (1953), Theory of capacities, Annales Institut Fourier5: 131–295.

Denneberg, D. (1995), Extensions of measurable space and linear representation of the Choquet integral, Mathematik-ArbeitspapiereNo. 45, Universität Bremen.

Dow, J. and Werlang, S.R.d.C. (1992), Uncertainty aversion, risk aversion, and the optimal choice of portfolio, Econometrica60: 197–204.

Dow, J. and Werlang, S.R.d.C. (1994), Nash equilibrium under Knightian uncertainty: breaking down backward induction, Journal of Economic Theory64: 305–324.

Eichberger, J. and Kelsey, D. (1996a), Uncertainty aversion and dynamic consistency, International Economic Review37: 625–640.

Eichberger, J. and Kelsey, D. (1996b), Uncertainty aversion and preference for randomisation, Journal of Economic Theory71: 31–43.

Eichberger, J. and Kelsey, D. (1997a), Non-additive beliefs and game theory, Mimeo, Universität des Saarlandes.

Eichberger, J. and Kelsey, D. (1997b), Signaling games with uncertainty,Mimeo, Department of Economics, University of Birmingham.

Eichberger, J. and Kelsey, D. (1997c), Free riders do not like uncertainty,Mimeo, Department of Economics, University of Birmingham.

Eichberger, J. and Kelsey, D. (1997d), Education signaling and uncertainty, Mimeo, Universität des Saarlandes.

Ellsberg, D. (1961), Risk, ambiguity and the savage axioms, Quarterly Journal of Economics75: 643–669.

Epstein, L.G. and LeBreton, M. (1993), Dynamically consistent beliefs must be Bayesian, Journal of Economic Theory61: 1–22.

Fishburn, P.C. (1970), Utility Theory for Decision Making. New York: Wiley.

Ghirardato, P. (1994), Coping with ignorance: unforeseen contingencies and nonadditive uncertainty,Mimeo, University of California at Berkeley.

Gilboa, I. (1987), Expected utility theory with purely subjective non-additive probabilities, Journal of Mathematical Economics16: 65–88.

Gilboa, I. and Schmeidler, D. (1993), Updating ambiguous beliefs, Journal of Economic Theory59: 33–49.

Gilboa, I. and Schmeidler, D. (1994), Additive representations of non-additive measures and the Choquet integral, Annals of Operations Research52: 43–65.

Haller, H. (1996), Non-additive beliefs in solvable games, Mimeo, Virginia Polytechnic Institute WP E-95-14.

Jaffray, J.-Y. (1989), Linear utility theory for belief functions, Operations Research Letters8: 107–112.

Jaffray, J.-Y. (1992), Bayesian updating and belief functions, IEEE Transactions on Systems, Man, and Cybernetics22: 1144–1152.

Klibanoff, P. (1994), Uncertainty, decision and normal form games, Mimeo, Northwestern University.

Lo, K.C. (1996), Equilibrium in beliefs under uncertainty, Journal of Economic Theory71: 443–484.

Machina, M.J. and Schmeidler, D. (1992), A more robust definition of subjective probability, Econometrica60: 745–780.

Marinacci, M. (1996), Ambiguous games, Mimeo, Northwestern University.

Mukerji, S. (1997a), Understanding the non-additive probability decision model, Economic Theory9: 23–46.

Mukerji, S. (1997b),Ambiguity aversion and uncompleteness of contractual form, American Economic Review, forthcoming.

Saarin, R. and Wakker, P. (1992), A simple axiomatisation of non-additive expected utility, Econometrica60: 1255–1272.

Savage, L. (1954), Foundations of Statistics, New York: Wiley.

Schmeidler, D. (1989), Subjective probability and expected utility without additivity, Econometrica57: 571–587.

Shafer, G. (1976), A Mathematical Theory of Evidence, Princeton NJ: Princeton University Press.

Shafer, G. (1990), Perspectives on the theory and practice of belief functions, International Journal of Approximate Reasoning4: 323–362.

Von Neumann, J. and Morgenstern, O. (1947), Theory of Games and Economic Behavior, 2nd edition, Princeton, NJ: Princeton University Press.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Eichberger, J., Kelsey, D. E-Capacities and the Ellsberg Paradox. Theory and Decision 46, 107–138 (1999). https://doi.org/10.1023/A:1004994630014

Issue Date:

DOI: https://doi.org/10.1023/A:1004994630014