Abstract

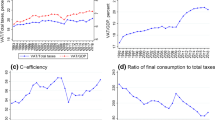

Annual growth rates of real GDP in New Zealand have varied widely, from 18% to −8%, since World War II. During this period the tax burden (the ratio of tax revenue to GDP) has trended upward from 23% to 35%. The tax mix (the ratio of indirect taxes to direct taxes) has varied between 0.31 and 0.75, having increased recently with the introduction of the goods and services tax. In this paper we estimate a combination of the tax burden and the tax mix which would maximise the rate of growth of real GDP. We find that such a tax structure would have a time-varying tax burden with a mean of 22.5%, and a time-varying tax mix with a mean of 0.54, which implies a mean share of direct taxes in total tax revenue of 65%. We also find that a move to such a tax structure would generate nearly a 17% increase in real GDP, and while this increase would yield a 6% reduction in tax revenue to the Treasury, it would deliver a 27% increase in purchasing power to the remainder of the economy.

Similar content being viewed by others

References

Brash, D. T. (1996). “New Zealand's Remarkable Reforms.” Fifth Annual Hayek Memorial Lecture, Institute of Economic Affairs. London.

Caragata, P. J. (1997). The Economic and Compliance Costs of Taxation: A Report on the Health of the Tax System in New Zealand. Wellington, NZ: Inland Revenue.

Caragata, P. J. and D. E. A. Giles. (1996). “Simulating the Relationship Between the Hidden Economy and the Tax Mix in New Zealand.” Working Paper No. 22, Working Papers on Monitoring the Health of the Tax System. Wellington, NZ: Inland Revenue.

Caragata, P. J. and J. P. Small. (1996). “The Tax Burden, The Tax Mix and Output Growth in New Zealand: A Tax Mix Model.” Working Paper No. 25, Working Papers on Monitoring the Health of the Tax System. Wellington, NZ: Inland Revenue.

Charnes, A., W. W. Cooper, A. Y. Lewin and L. M. Seiford. (1994). Data Envelopment Analysis: Theory, Methodology and Applications. Boston: Kluwer Academic Publishers.

Engen, E. M. and J. Skinner. (1996). “Taxation and Economic Growth.” Working Paper 5826. Cambridge, MA: National Bureau of Economic Research.

Evans, L., A. Grimes, B. Wilkinson and D. Teece. (1996). “Economic Reform in New Zealand 1984–1995: The Pursuit of Efficiency.” Journal of Economic Literature December, 34(4), 1856–1902.

Feldstein, M. (1996). “HowBig Should Government Be?” Working Paper 5868. Cambridge, MA: National Bureau of Economic Research.

Lovell, C. A. K. and J. T. Pastor. (1995). “Units Invariant and Translation Invariant DEA Models.” Operations Research Letters 18(3), 147–151.

Scully, G. W. (1996). “Taxation and Economic Growth in New Zealand.” Working Paper No. 14 (revised), Working Papers on Monitoring the Health of the Tax System. Wellington, NZ: Inland Revenue.

Solow, R. M. (1956). “A Contribution to the Theory of Economic Growth.” Quarterly Journal of Economics, February, 65–94.

Tanzi, V. and H. H. Zee. (1997). “Fiscal Policy and Long-Run Growth.” International Monetary Fund Staff Papers June, 44(2), 179–209.

“The Supply-Siders Ride Again,” The Economist, August 24, 1996, p. 64.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Branson, J., Lovell, C.A.K. A Growth Maximising Tax Structure for New Zealand. International Tax and Public Finance 8, 129–146 (2001). https://doi.org/10.1023/A:1011216618163

Issue Date:

DOI: https://doi.org/10.1023/A:1011216618163