Abstract

“Blessed is he who expects nothing, for he shall never be disappointed”

—Benjamin Franklin

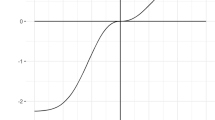

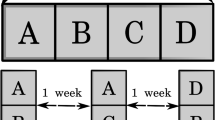

Based on our risk-value framework, this paper presents extensions for the disappointment models that were originally proposed by Bell (1985) and Loomes and Sugden (1986). We provide explicit functional forms for modeling the effect of disappointment on risky choice behavior that generalizes Bell's work and lends tractability to the efforts of Loomes and Sugden. Our generalized disappointment models can explain a number of decision paradoxes, and offer additional insights into nonexpected utility preferences based on the intuitive notions of disappointment and risk-value tradeoffs.

Similar content being viewed by others

References

Allais, Maurice. (1953). “Le Comportement de L'homme Rationnel Devant le Risque, Critique des Postulats et Axiomes de L'ecole Americaine,” Econometrica 21, 503–546.

Allais, Maurice. (1979). “The Foundations of a Positive Theory of Choice Involving Risk and a Criticism of the Postulates and Axioms of the American School.” In Maurice Allais and Ole Hagen (eds.), Expected Utility Hypotheses and the Allais Paradox. Holland: Dordrecht, pp. 27–145.

Bell, David E. (1982). “Regret in Decision Making Under Uncertainty,” Operations Research 30, 961–981.

Bell, David, E. (1985). “Disappointment in Decision Making Under Uncertainty,” Operations Research 33, 1–27.

Camerer, Colin F. (1995). “Individual Decision Making.” In John H. Kagel and Alvin E. Roth (eds.), Handbook of Experimental Economics. Princeton, NJ: Princeton University Press.

Chew, Soo Hong. (1983). “A Generalization of the Quasilinear Mean with Applications to the Measurement of Income Inequality and Decision Theory Resolving the Allais Paradox,” Econometrica 51, 1065–1092.

Chew, Soo Hong and Kenneth R. MacCrimmon. (1979). “Alpha-nu Choice Theory: A Generalization of Expected Utility Theory,” working paper 669. Vancouver: Faculty of Commerce and Business Administration, University of British Columbia.

Conlisk, John. (1989). “Three Variants on the Allais Example,” American Economic Review 79, 392–407.

Dyer, James S. and Jianmin Jia. (1997). “Relative Risk-value Models,” European Journal of Operational Research 103, 170–185.

Fishburn, Peter C. (1983). “Transitive Measurable Utility,” Journal of Economic Theory 31, 293–317.

Fishburn, Peter C. and Gary A. Kochenberger. (1979). “Two-piece von Neumann-Morgenstern Utility Functions,” Decision Sciences 10, 503–518.

Gul, Faruk. (1991). “A Theory of Disappointment Aversion,” Econometrica 59, 667–686.

Hogarth, Robin M. and Hillel J. Einhorn. (1990). “Venture Theory: A Model of Decision Weights,” Management Science 36, 780–803.

Inman, Jeffrey J., James S. Dyer, and Jianmin Jia. (1997). “A Generalized Utility Model of Disappointment and Regret Effects on Post-choice Valuation,” Marketing Science 16, 97–111.

Jia, Jianmin. (1995). “Measures of Risk and Risk-value Theory,” unpublished Ph.D. Dissertation. Texas: University of Texas at Austin.

Jia, Jianmin and James S. Dyer. (1995). “Risk-value Theory,” working paper. Texas: Graduate School of Business, University of Texas at Austin.

Jia, Jianmin and James S. Dyer. (1996). “A Standard Measure of Risk and Risk-value Models,” Management Science 42, 1961–1705.

Jia, Jianmin, James S. Dyer, and John C. Butler. (1999). “Measures of Perceived Risk,” Management Science 45, 519–532.

Kahneman, Daniel H. and Amos Tversky. (1979). “Prospect Theory: An Analysis of Decision Under Risk,” Econometrica 47, 263–290.

Karmarkar, Uday S. (1978). “Subjectively Weighted Utility: A Descriptive Extension of the Expected Utility Model,” Organizational Behavior and Human Decision Process 21, 61–72.

Loomes, Grahm and Robert Sugden. (1986). “Disappointment and Dynamic Consistency in Choice Under Uncertainty,” Review of Economic Studies LIII, 271–282.

Luce, R. Duncan and Elke U. Weber. (1986). “An Axiomatic Theory of Conjoint, Expected Risk,” Journal of Mathematical Psychology 30, 188–205.

Machina, Mark J. (1982). “Expected Utility Analysis Without the Independence Axiom,” Econometrica 50, 277–323.

Neilson, William S. (1992). “A Mixed Fan Hypothesis and its Implications for Behavior Toward Risk,” Journal of Economic Beha¨ior and Organization 19, 197–211.

Prelec, Drazen. (1990). “A ‘Pseudo-endowment’ Effect, and its Implications for Some Recent Nonexpected Utility Models,” Journal of Risk and Uncertainty 3, 247–259.

Prelec, Drazen. (1998). “The Probability Weighting Function,” Econometrica 66, 497–527.

Tversky, Amos and Daniel H. Kahneman. (1986). “Rational Choice and the Framing of Decisions,” Journal of Business 59, pt. 2, 251–278.

Tversky, Amos and Daniel H. Kahneman. (1992). “Advances in Prospect Theory: Cumulative Representation of Uncertainty,” Journal of Risk and Uncertainty 5, 297–323.

von Neumann, John and Oskar Morgenstern. (1947). Theory of Games and Economic Behavior. Princeton, NJ: Princeton University Press.

Wu, George and Richard Gonzalez. (1996). “Curvature of the Probability Weighting Function,” Management Science 42, 1676–1690.

Yaari, Menachim, E. (1987). “The Dual Theory of Choice under Risk,” Econometrica 55, 95–115.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Jia, J., Dyer, J.S. & Butler, J.C. Generalized Disappointment Models. Journal of Risk and Uncertainty 22, 59–78 (2001). https://doi.org/10.1023/A:1011153523672

Issue Date:

DOI: https://doi.org/10.1023/A:1011153523672