Abstract

This paper investigates the implications of similarities and differences in demographics between Japan and the United States. For this purpose, we construct an overlapping generations model wherein people decide their number of children and levels of consumption for differentiated goods. We assume that immigration takes place according to the utility difference between inside and outside a country. We uncover possible effects of an improvement in longevity on the market size and welfare. We then calibrate our model to match the Japanese and US data from 1955 to 2015 and pin down the dominant effect. Moreover, our counterfactual analyses show that accepting immigration in Japan can be useful in overcoming population and market shrinkage caused by an aging population.

Similar content being viewed by others

Notes

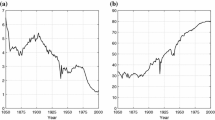

The average annual population growth rate from 1955 to 1989 was 0.93% in Japan and 1.12% in the United States, while the figures from 1990 to 2009 were 0.18% in Japan and 1.01% in the United States, and more recently, the figures from 2010 to 2015 were − 0.15% in Japan and 0.8 in the United States.

Here, the expected per-capita lifetime consumption is defined as the sum of each individual’s young period consumption and her old period consumption multiplied by the survival probability.

In a multi-country setting involving trade of differentiated goods, this might cause the home market effect, under which a country with a larger market size hosts a more than proportionate share of firms and production activities. Recent studies on the home market effect include Behrens et al. (2009) and Zeng and Uchikawa (2014). For a survey on this issue, see Zeng (2014) for example.

We ignore the population distribution within a country, which can potentially affect the degree of backward linkage through responses of households’ location choices. If we fully incorporate the multiple regions and location choices of firms and households, our model would explode and become intractable.

As we see later, under the iceberg transport cost, \(\tau\), a profit maximizing firm sets its export price as the domestic price multiplied by \(\tau\).

Here, we consider the time costs in terms of labor supply. To see this point, suppose that the young period budget constraint becomes \(w_{t}(1-b_{l}n_{t})=[\)expenditure on consumption\(]+b_{p} n_{t}+\) \(s_{t}\), where \(b_{p}\) is the pecuniary costs and \(b_{l}\) represents time required for rearing each child. [expenditure on consumption] represents the first three terms of the right hand side of (4). This budget constraint is rewritten as \(w_{t}=[\)expenditure on consumption\(]+(b_{p}+b_{l})n_{t}+s_{t}\). Note here that \(w_{t}=1\). Thus, it is essentially the same as the original budget constraint (4).

\(X_{yt}(i)\) and \(X_{ot+1}(i)\) are obtained by replacing \(p_{t}(i)\) and \(p_{t+1}(i)\) with \(\tau q\) in (6), respectively.

Hence, in our model, the homogeneous good trade offsets the trade deficit or surplus of differentiated goods so that the trade balance clears.

This implies that the number of surviving old individuals in period t becomes as \(\phi L_{t-1}\), and the number of children in period t is given by \(n_{t}L_{t}\), which is the number of young individuals in period \(t+1\).

Note here that the foreign wage rate is not necessarily equal to one. Labor productivity can differ between countries.

We assume that the pool of potential immigrants is sufficiently large so that \(V_{w}\) is exogenous.

We assume this for analytical tractability. Issues related to the timing of migration are beyond the scope of this paper. We also assume that immigrants earn wages in the host country and bring no financial asset from the source country, and that immigrants and native individuals are homogeneous as workers for analytical tractability.

This assumption can be written in parameters as \(\Psi (\phi )-\theta \left( 1+\phi \beta \right) \ln p_{w}\left( \delta m_{w}\right) ^{1/(1-\sigma )}<V_{w}<\) \(\Psi (\phi )\).

Note that \({\widehat{L}}\) is time-invariant.

The period length is constrained by the data availability. Especially, reliable Data on Japanese GDP is available only after 1955 due to the World War Two and the consecutive occupation by the United Nations, and the US Life table data is available only up to 2015.

The matlab codes for calibration are available upon request.

The gap partially captures labor market effects including human capital accumulation by longevity.

The Life table calculates life expectancy using the death certificate data. In every year, the Japanese authority estimates the average life years of a person by ages and sexes weighting the cause of death, population by ages, sexes, and so on. Life expectancy in the National Vital Statistics System in the US is also estimated in the same way. See Arias (2012) for more details.

Because there are 35 years in each period, \(\beta =2/3\) implies that the annual discount rate is approximately 0.0117. This value is close to recent annual interest rates in Japan.

This parameter is calculated by utilizing the data of expenditures on children provided by Lino et al. (2017). In the paper, expenditures on a child from birth through age 17 in 1960 and 2015 are estimated as $ 202,020 and $ 233,610 respectively. We calculate the average growth rate of the cost as 0.2645\(\%\) per year. By multiplying the base cost and the growth rate, we obtain the value 0.000291.

AMR first divides the admissible intervals of relevant parameters to create meshes, and picks one point from each mesh. Then it calculates the MSE for each point to find the point that minimizes the MSE. Next, it divides the neighborhood of the point with the minimum MSE to create finer meshes, and again picks one point from each mesh. It repeats this process until the chosen points converge. See Berger and Oliger (1984).

We assume that the agents are aware of these changes.

Instead, we can borrow a few parameter values from existing empirical studies and specify the remaining parameter values in ad hoc ways. Even if we follow this approach, we can obtain very similar results obtained in the main text as long as we choose moderate values for the remaining parameter values. Thus, we face a trade-off in the sense that if we stick to specify parameter values in convincing ways, we have to resort to a linear approximation, and if we avoid a linear approximation, we need to give up obtaining convincing parameter values. Nevertheless, these two options yield very similar results. Given the similarity in results, we present the first option in this paper.

The numbers are 0.000939 (1950) and − 0.006601(1955) in Japan and 0.24919 (1950) and 0.23779 (1955) in the United States.

Because Japanese data on population size by age are not available from 1951 to 1954, we use data for 1950 and 1955.

From calibration, the values are \(k_{1}=-\,1.9552\) and \(k_{2}=0.0357\) in Japan and \(k_{1} =-\,38.6626\) and \(k_{2}=0.2202\) in the United States. These calibrated values suggest the existence of home market effect, which implies the necessity of the Dixit–Stiglitz structure.

The gap between the actual data and the calibrated data may partially stem from ignoring the labor market effect including human capital accumulation.

For parameters other than \(\phi\), we use the same values as those specified in the previous section.

Note here that Proposition 2 deals with the steady-state whereas our numerical analyses do not because the total population grows over time.

In Fig. 8, we replace both \(\varepsilon\) and \(\mu\) between the two countries. If we replace only \(\varepsilon\) or only \(\mu\), we obtain very similar results to those shown in Fig. 8. By comparing the case wherein we replace only \(\varepsilon\) to that wherein we replace \(\mu\), we can see that the effects on the number of birth and the cohort population distribution are larger in the former than in the latter. These results are available upon request.

Note here that the burden of working population to support non-working population includes child care. Even if we consider the child dependency ratio as well as the elderly dependency ratio, we obtain the similar results. See Appendix A for further details.

References

Abel, A. B. (1985). Precautionary saving and accidental bequest. American Economic Review, 75(4), 777–791.

Acemoglu, D., & Johnson, S. (2007). Disease and development: The effect of life expectancy on economic growth. Journal of Political Economy, 115(6), 925–985.

Arias, E. (2012). United States Life Tables, 2008. National Vital Statistics Reports, 61(3)

Baldwin, R., Forsloid, R., Martin, P., Ottaviano, G. I. P., & Robert-Nicoud, F. (2003). Economic geography and public policy. Princeton: Princeton University Press.

Bar, M., & Leukhina, O. (2010). Demographic transition and industrial revolution: A macroeconomic investigation. Review of Economic Dynamics, 13(2), 424–251.

Behrens, K., Lamorgese, A. R., Ottaviano, G. I. P., & Tabuchi, T. (2009). Beyond the home market effect: Market size and specialization in a multi-country world. Journal of International Economics, 79(2), 259–265.

Berger, M. J., & Oliger, J. (1984). Adaptive mesh refinement for hyperbolic partial differential equations. Journal of Computational Physics, 53(3), 484–512.

Blanchard, O. J. (1985). Debt, deficits and finite horizons. Journal of Political Economy, 93(2), 223–247.

Borjas, G. J. (2003). The labor demand curve is downward sloping: Reexamining the impact of immigration on the labor market. Quarterly Journal of Economics, 118(4), 1335–1374.

Card, D. (2001). Immigrant inflows, native outflows, and the local labor market impacts of higher immigration. Journal of Labor Economics, 19(1), 22–64.

Card, D. (2009). Immigration and inequality. American Economic Review, 99(2), 1–21.

Cervellati, M., & Sunde, U. (2005). Human capital, life expectancy, and the process of development. American Economic Review, 95(5), 1653–1672.

Cervellati, M., & Sunde, U. (2011). Life expectancy and economic growth: the role of the demographic transition. Journal of Economic Growth, 16(2), 99–133.

Combes, P. P., Mayer, T., & Thisse, J.-F. (2008). Economic geography: The integration of regions and nations. Princeton: Princeton University Press.

Dixit, A. K., & Stiglitz, J. E. (1977). Monopolistic competition and optimum product variety. American Economic Review, 67(3), 297–308.

Eckstein, Z., Mira, P. S., & Wolpin, K. (1999). A quantitative analysis of Swedish fertility dynamics: 1751–1990. Review of Economic Dynamics, 2(1), 137–165.

Eckstein, Z., & Wolpin, K. I. (1985). Endogenous fertility and optimal population size. Journal of Public Economics, 27(1), 93–106.

Ehrlich, I., & Lui, F. T. (1991). Intergenerational trade, longevity, and economic growth. Journal of Political Economy, 99(5), 1029–1059.

Fujita, M., Krugman, P., & Venables, A. J. (1999). The spatial economy. Cambridge, MA: MIT Press.

Kalemli-Ozcan, S. (2002). Dose mortality decline promote economic growth? Journal of Economic Growth, 7(4), 411–439.

Kalemli-Ozcan, S. (2003). A stochastic model of mortality, fertility, and human capital investment. Journal of Development Economics, 70(1), 103–118.

Kalemli-Ozcan, S., Ryder, H. E., & Weil, D. N. (2000). Mortality decline, human capital investment, and economic growth. Journal of Development Economics, 62(1), 1–23.

Krugman, P., & Elizondo, R. (1995). Trade policy and the third world metropolis. Journal of Development Economics, 49(1), 137–150.

Lino, M., Kuczynski, K., Rodriguez, N., & Schap, T. (2017). Expenditures on children by families, 2015, Miscellaneous Publication No. 1528-2015. U.S. Department of Agriculture, Center for Nutrition Policy and Promotion.

Lorentzen, P., McMillan, J., & Wacziarg, R. (2008). Death and development. Journal of Economic Growth, 13(2), 81–124.

Miyazawa, K. (2006). Growth and inequality: A demographic explanation. Journal of Population Economics, 19(3), 559–578.

Ottaviano, G. I. P., & Peri, G. (2012). Rethinking the effect of immigration on wages. Journal of the European Economic Association, 10(1), 152–197.

Ottaviano, G. I. P., Peri, G., & Wright, G. C. (2013). Immigration, offshoring, and American Job. American Economic Review, 103(5), 1925–1959.

Prettner, K., Bloom, D., & Strulik, H. (2013). Declining fertility and economic well-being: Do education and health ride to the rescue? Labor Economics, 22, 70–79.

Prettner, K., & Strulik, H. (2016). Technology, trade, and growth: The role of education. Macroeconomic Dynamics, 20(5), 1381–1394.

Soares, R. (2005). Mortality reductions, educational attainment, and fertility choice. American Economic Review, 95(3), 580–601.

Strulik, H., Prettner, K., & Prskawetz, A. (2013). The past and future of knowledge-based growth. Journal of Economic Growth, 18(4), 411–437.

Yaari, M. (1965). Uncertain lifetimes, life insurance, and the theory of the consumer. Review of Economic Studies, 32(2), 137–150.

Yakita, A. (2001). Uncertain lifetime, fertility and social security. Journal of Population Economics, 14(4), 635–640.

Zeng, D.-Z. (2014). The role of country size in spatial economics: A survey of the home market effects. Proceedings of Rijeka Faculty of Economics: Journal of Economics and Bussines, 32(2), 379–403.

Zeng, D.-Z., & Uchikawa, T. (2014). Ubiquitous inequality: The home market effect in a multicountry space. Journal of Mathematical Economics, 50, 225–233.

Zhang, J., & Zhang, J. (2001a). Longevity and economic growth in a dynastic family model with an annuity market. Economics Letters, 72(2), 269–277.

Zhang, J., & Zhang, J. (2001b). Bequest motives, social security, and economic growth. Economic Inquiry, 39(3), 453–466.

Acknowledgements

This study was conducted as a part of the Project “Spatial Economic Analysis on Trade and Labor Market Interactions in the System of Cities” undertaken at the Research Institute of Economy, Trade and Industry (RIETI). This work was also supported by JSPS KAKENHI Grant Number 15H03344, 16H03615, 17H02519, 17J06452, and 18H00842. We thank Tomoyuki Nakajima (the editor), two anonymous referees, Keita Shiba, Ken Tabata, Masaaki Toma, and participants at 56th Annual Meeting of Western Regional Science Association, 12th Meeting of the Urban Economics Association, and 2017 SMU Conference on Urban and Regional Economics for their helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

We here provide in detail the effects of immigration on the dependency ratio. The dependency ratio, \(DR_{t}\), in this paper is defined as follows:

The dependency ratio implies the average number of children and elderly people who are taken care by a young and working person. Thus, the ratio is decomposed into two parts, the elderly dependency ratio (\(EDR_{t+1}\)) and the child dependency ratio (\(CDR_{t}\)), as follows:

The elderly dependency ratio shows the average number of elderly people per young person, and the child dependency ratio shows the average births of a young person per year. Figure 10 provides the actual, calibrated ,and counterfactual values of the dependency ratio.

We know from the figures on the actual dependency ratio that Japan has faced continuous increases in it. However, in the US, it decreased until 1990 and have increased after 1990. Until 1990, the effects of longevity improvements were overwhelmed by increases in the young cohort population, which reflect the effect of the baby-boom. The baby-boom effect was also seen in Japan, however, it was overwhelmed by the improvement of longevity, resulting in increases in the dependency ratio. Moreover, from the figures on the decomposition of the dependency ratio, we know that the movements of the elderly dependency ratio mostly explains the movements of the dependency ratio in both countries.

Figure 10 provides the results of the counterfactual analysis regarding openness towards immigration. Immigration openness does not affect the child dependency ratio significantly in both countries. However, it significantly affects the elderly dependency ratio, and hence, the dependency ratio. In fact, Japan would have had a lower dependency ratio if it had accepted immigration as the US, and the US would have had a higher dependency ratio if it had been closed towards immigration as Japan.

Rights and permissions

About this article

Cite this article

Fukumura, K., Nagamachi, K., Sato, Y. et al. Demographics, immigration, and market size. JER 71, 597–639 (2020). https://doi.org/10.1007/s42973-019-00023-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42973-019-00023-w