Abstract

Facing a rise in great power competition, states are increasingly paying attention to economic statecraft; that is, using economic means to pursue national security and foreign policy goals. Factors such as asymmetric interdependence in the global economy and information networks, the rapid development of dual-use technologies, and the shift of US foreign policy doctrines from liberalism to geopolitics have contributed to the rise of economic statecraft. Regarding China as an opponent in high-tech and geopolitical competition, the US is on the one hand continuously strengthening coercive economic statecraft against China, especially through technological “decoupling.” On the other hand, the US is seeking to unite the so-called like-minded countries to build technological and supply chain coalitions that exclude China. As an ally of the US, Japan is imitating and following the US, while also emphasizing the protection and development of its own “strategically indispensable” industries, striving to maintain a balance between preventing technology leakage and maintaining exports to China. While coercive economic statecraft weakens and contains opponents, it will also harm the US itself as well as its allies. In the future, the US and Japan will further strengthen economic statecraft targeting China, but implementation is likely to be rational and balanced, in an effort to secure “competitive coexistence” with China.

Similar content being viewed by others

1 Introduction

With the intensification of China–US strategic competition, economic friction between the two countries has rapidly spread from trade disputes to broader fields, such as technological competition and supply chain security. Coupled with the fourth industrial revolution and the challenges brought by the COVID-19 pandemic, the impact of economic factors on national security has become increasingly prominent. In terms of its China policy, the US government has strengthened its coercive economic statecraft, including export controls, foreign investment review, entity lists, etc., policies that have largely received continuous bipartisan support. After US President Joe Biden came into office, he continued the Trump administration’s policy of technological “decoupling” with China. Meanwhile, he made every effort to forge technological and supply chain coalitions among the so-called like-minded countries, trying to strengthen “collective resilience.” Japan has quickly responded by starting to strengthen its economic security policy. Japanese Prime Minister Fumio Kishida has created a new ministerial post for economic security. Economic security is becoming a new arena in great power competition.

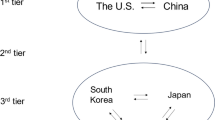

The US, China, and Japan are the three countries with the largest economies in the world, as well as the three countries with the largest R&D investment worldwide. These three nations share deep economic interdependence, and there is also sharp geopolitical confrontation among them, creating intense and complicated relationships. For the US and Japan, China is not only the most important overseas market and a key link in the global supply chain, but also a technological and geopolitical competitor. But China is not economically separated from Western countries, as the Soviet Union was during the Cold War. China is also unlike other countries that have been targeted by the US’s economic statecraft in the past. Those countries were on a smaller scale economically and had few external economic ties. Instead, as an economic great power, China has close economic relations with major economies worldwide, and thus has the ability to offset and counteract the economic statecraft of other countries.

Facing a new target like China, what economic statecraft will the US and Japan adopt? What are the similarities and differences between the two countries’ policies? As allies, will the US and Japan jointly build technological and supply chain coalitions that exclude China? To what extent can Japan follow the US strategy of “decoupling” policy and “collective resilience” toward China? To discuss these questions, this paper will start by exploring the theoretical background and policy implications of economic statecraft, with a focus on analyzing and comparing the US’s and Japan’s economic statecraft against China, and evaluating the progress and limitations of US–Japan cooperation. It is hoped that this paper will deepen the understanding of the economic-security nexus in great power competition, and provide a basis for predicting the direction of China–US–Japan relations.

2 The rise of economic statecraft

Countries’ use of economic statecraft has a long history that extends from the ancient to the modern world. As early as the Spring and Autumn Period (770 BC–476 BC) of China, Guan Zhong helped Duke Huan of Qi to subdue the state of Chu by buying the wild deer of Chu with an excessive amount of money and inducing the people of Chu to leave their land uncultivated. In ancient Greece, Athens imposed an economic blockade on Megara to punish its treacherous behavior. In recent years, with the resurgence of geopolitical competition, the rapid development of dual-use technologies (those with both military and civilian applications), the rise of resistance to globalization and free trade in some countries, and the COVID-19 pandemic’s impact on global supply chains, governments worldwide are increasingly paying attention to economic statecraft issues, including technological competition, industrial policies, supply chain resilience, etc.

As for the concept of “economic statecraft,” political scientist David A. Baldwin defined it in Encyclopedia Britannica as “the use of economic means to pursue foreign policy goals.” He divided economic statecraft into positive and negative measures. Positive measures are actual or promised rewards, including preferential tariffs, subsidies, foreign aid, investment guarantees, and preferential taxation of foreign investment. Negative measures are actual or threatened punishments, including embargoes, boycotts, covert refusals to trade, preclusive buying, expropriation, punitive taxation, aid suspensions and asset freezes (Baldwin 2016).

Unlike the US, which more frequently uses the term “economic statecraft,” Japan more often uses the concept of “economic security policy.” Naoki Nakamura, a researcher in the Upper House of Japan, believes there are three types of economic security policies. First is economic statecraft, which is using the economy as leverage for security policy. Second is the strengthening of economic resilience and industrial competitiveness, which often involves industrial policies that deviate from market rules in response to threats to national economy. Third is the strengthening of the international economic system, which involves maintaining and deepening interdependence and avoiding mutual destruction. He points out that the US, Japan and some other countries are currently coordinating and promoting a new type of economic security policy—uniting the so-called like-minded countries to implement the first type of economic statecraft and the second type of industrial policy. In his view, this is “collective economic security policy,” which conflicts with the third type mentioned above (Nakamura 2020).

It can be said that economic statecraft and economic security policy are two very closely related concepts. But the latter may cover a wider range. In addition to the positive and negative measures imposed on a target country, economic security policies also include one’s own efforts (such as promoting technological innovation, strengthening supply chain resilience, etc.) and international economic cooperation. However, one must also consider that a country’s own efforts constitute the source of power for economic statecraft, and international economic cooperation may also bring security or strategic impacts, and thus they all belong, in a broad sense, under the umbrella of economic statecraft.

Based on the opinions of the above-mentioned scholars, this paper defines economic statecraft in both narrow and broad senses. Economic statecraft in a narrow sense means: To achieve its foreign or security policy goals, a country uses economic means to exert influence on other countries, to prompt the other party to change its position and behavior. The broad definition of economic statecraft is similar to that of economic security policy, including its three types: economic statecraft in the narrow sense, industrial policy, and international economic cooperation. In practice, the same economic method is often applied to multiple target countries and has multiple goals that change over time. Therefore, the classification here is only conceptual. In reality, various means and their goals may overlap, interlace, and change.

The crux of economic statecraft lies in the nexus between economy and security. What connects economy and security is the externality of economic activities. A scholar of Chinese foreign and security policy, William J. Norris pointed out that economic statecraft focuses on the security or strategic externalities of economic activities, including sensitive technology transfer, loss of strategic industries, concentrated supply or demand dependence in trade, investment, and monetary relations, the forging of common interests resulted from currency unions, joint ventures, macroeconomic coordination, simple trade complementarity, etc. In his view, economic statecraft is the intentional manipulation of economic interactions by a state, to capitalize on, reinforce, or reduce the associated strategic externalities (Norris 2016, 12–13).

From this point of view, the implementation of economic statecraft needs to meet two conditions. First is the externality of economic activities as an objective condition, and second is the purpose of a country as a subjective condition. In contemporary international economic activities, the two most concerning strategic externalities are asymmetric interdependence and technological innovation. The purpose of a country depends on whether it tends to pursue economic interests under free and open rules or strengthen national security in the context of geopolitical competition.

2.1 Objective conditions: asymmetric interdependence and technological innovation

Asymmetric interdependence and its policy implications are well-known. When a country has a huge market that is difficult to replace, or a product or technology that is difficult to replace, it owns potential power vis-à-vis other countries. Henry Farrell and Abraham L. Newman, authors of the book, Of Privacy and Power: The Transatlantic Struggle over Freedom and Security, proposed recently that, in addition to asymmetric interdependence at the national level, there is also asymmetric interdependence at the global network level. Specifically, this means that states (mainly developed countries led by the US) that have political authority over the central nodes in the international networked structures of money, goods, and information flow are in a special position to exert influence over others; they can discover and exploit the vulnerabilities of others for coercion or deterrence. The two scholars call this power relationship “weaponized interdependence,” which includes two effects: panopticon and chokepoint (Farrell and Newman 2019). For example, the US can use its special position in the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the internet, the US dollar clearing system and some global supply chains to monitor or choke off other countries. However, if China gains similar dominance in the future through digital infrastructure such as 5G networks, then it can do to the US what the US has already been doing to China (Farrell and Newman 2020).

Another economic activity that may generate security or strategic externalities is technological innovation. This generally occurs through two scenarios: One is that the wealth accumulated by technological innovation can be used to enhance military strength, and the other is that dual-use technologies may be used for military purposes (Kennedy and Lim 2018). At present, many emerging technologies that promote the fourth industrial revolution, such as artificial intelligence, quantum technology, drones, robotics and 5G networks, have both military and civilian uses. Competition around these emerging technologies is becoming a new frontier of great power competition.

It is not difficult to find that the Huawei Technologies’ 5G network construction has both the externality of an asymmetric interdependent structure and the externality of dual-use technologies, and thus has become the primary target of US’s economic statecraft against China. A Brookings Institution report released in March 2021 argued that control over global telecommunications network is political power, and the US must stop Huawei from “weaponizing” its position in telecommunications networks (Doshi and Mcguiness 2021, 1–4 and 20–23). Some American experts believe that the new great power competition would not necessarily take place on battlefields or in boardrooms, but more likely on smartphones, computers and other connected devices and on the digital infrastructure that supports them; China’s export of network and platform technologies to the world would pose a threat to the US, and the US and its allies must unite against China (Rosenberger 2020). Some in the US even regard China’s high-tech civilian infrastructure exports as a “Trojan horse” (Darby and Sewall 2021).

2.2 Subjective conditions: from liberal international order to geopolitical competition

Strategic externalities arising from interdependence and technological innovation are not necessarily all negative. From a liberal point of view, trade, investment and technological cooperation among countries shape reciprocal international relations. But in the view of realists, a country should be more concerned with the relative benefits or distributional outcomes of economic interaction.

Historically, the US has simultaneously pursued the commercial benefits of free trade and guarded against the security risks brought by interdependence. Which aspect is prioritized depends on the international and domestic environment at different times. Over the past few decades, the US has benefited a lot from economic, trade, and scientific and technological cooperation with China. However, the current US is shrouded in the political fog of great power competition. It increasingly regards security costs as more important than economic benefits, and increasingly views China–US economic relations with zero-sum mentality. This is the subjective reason why the US has chosen negative economic statecraft such as technological “decoupling” from China.

Overall, the asymmetric interdependence in the global economy and information networks, the rapid development of dual-use technologies, and the shift in the US foreign policy focus from building a liberal international order to highlighting geopolitical competition—these objective and subjective factors all provide conditions for the rise of economic statecraft. In this context, the border between economy and security is blurred, and technological competition and geopolitics become entangled. The Japan-based PHP Institute calls this new trend “Geo-Technology” (PHP Geo-Technology Strategy Study Group 2020, 1–3). The Atlantic Council also believes that, since 2021, the world has entered the “GeoTech Decade” (Atlantic Council Geotech Center 2021, ES2-4).

3 The US coercive economic statecraft against China

In terms of economic policy toward China, there have long been two competing schools of thought in the US. The “Control Hawks” advocate limiting the outflow of technology as much as possible. While the “Run Faster coalition” believes that export controls will weaken American companies’ competitiveness, and that America’s only hope is to take the lead in technological innovation (Hugo Meijer 2016, 323–329). From the end of the Cold War to the early days of the Obama administration, the “Run Faster coalition” prevailed in the debate. However, since the later stage of the Obama administration, more and more Americans have believed that China could challenge the US leading status in economy, security, global order and other fields, thus demanding to strengthen export controls on China. The US government accordingly took the strategy of “small yard, high fence,” which is to implement strict regulations on limited and specifically sensitive technologies. During the Trump administration, technological competition became the central concern of US policy toward China. In the National Security Strategy issued in December 2017, the National Defense Strategy issued in January 2018, as well as then-vice president Mike Pence’s address in October 2018, the US regarded China’s technological advance as a security threat. As a result, US economic policy toward China has shifted from supporting interdependence and technological cooperation to promoting economic and technological “decoupling” (Foot and King 2019).

After Biden came into office, he generally inherited the Trump administration’s understanding of and policies toward China. In March 2021, the Biden administration released the “Interim National Security Strategic Guidance,” proposing to rebuild American supply chains for critical goods, ensure that supply chains for pharmaceuticals, medical equipment, and other critical materials are not overly reliant on overseas networks; it also proposed that the US and its allies should coordinate the use of economic tools, and join with like-minded democracies to develop and defend trusted critical supply chains and technology infrastructure (The White House 2021a). Following a period of review, Biden continued Trump’s practice of prohibiting American investments in Chinese military-related companies by signing an executive order to prohibit Americans from investing in 59 Chinese companies including Huawei and the Semiconductor Manufacturing International Corporation (SMIC), and listed Hikvision and other Chinese companies involving video surveillance technology in the ban. The Biden administration has also followed the practice of the entity list and listed seven Chinese companies and institutions in the supercomputing field for the first time.

Compared with Trump, Biden is more focused on policies that strengthen America’s own technological competitiveness and supply chain resilience. In February 2021, Biden issued an executive order to conduct a 100-day review of America’s supply chain, requiring the review of four categories of products: semiconductor manufacturing and advanced packaging; large capacity batteries; critical minerals and materials; and pharmaceuticals and active pharmaceutical ingredients. The recommendations proposed in the review have been implemented, including to strengthen US manufacturing capacity for critical goods, to invest in research and development that will reduce supply chain vulnerabilities, and to work with US allies and partners to strengthen collective supply chain resilience (The White House 2021b).

There are two notable trends in US economic statecraft toward China. First, the US has greatly expanded its scope and intensity of using coercive economic statecraft. Second, since the Biden administration, the US has emphasized the strengthening of “collective resilience” in its cooperation with the so-called like-minded countries to build technological and supply chain coalitions that exclude China. The first trend will be analyzed here, and the second trend will be later discussed in the part on US–Japan cooperation.

“Coercive economic statecraft” refers to the aforementioned negative measures in David Baldwin’s category of economic statecraft. The Center for a New American Security (CNAS) defines it as “restrictions—on trade, investment, and financial flows—intended to impose economic costs on a target in pursuit of strategic objectives or to influence a foreign government, group, or individual to offer policy concessions” (Rosenberg et al. 2020, 5). With the exception of the fiercely criticized tariff war, much of the Trump administration’s coercive economic measures against China have received bipartisan support and were inherited by the Biden administration. At present, America’s coercive economic statecraft against China includes mainly the following types:

-

(1)

Export control

In 2018, the US Congress passed the Export Control Reform Act (ECRA), imposing additional export control measures on emerging and basic technologies. The US President then identified 14 emerging and basic technologies through an interdepartmental process, which was administered and regulated by the Bureau of Industry and Security in the US Department of Commerce. Furthermore, the US applied “deemed export” controls to information on controlled technologies obtained by a foreign person through academic research or laboratory work in companies in America.

-

(2)

Entity list

The US Commerce Department has repeatedly added Chinese companies to its “entity list” and imposed sales bans. The list of Chinese companies and institutions covers fields including information and communications, electronic technology, aerospace science and technology, artificial intelligence, quantum technology, surveillance technology, and supercomputers, most of which have been added since 2019 (Hille 2021). In 2020, the US Department of Commerce has also changed the rules of direct products to include foreign-made products from US-origin technology or software, requiring licenses to export or re-export such products to Huawei and other Chinese companies on a presumption of denial. In the same year, the US changed again the rules to completely ban companies using American software or equipment in the world from selling chips to Huawei.

-

(3)

Foreign investment review

In 2018, the US Congress passed the Foreign Investment Risk Review Modernization Act, expanding the role of the Committee on Foreign Investment in the United States (CFIUS). While the review was not solely aimed at China, four of the five foreign investment transactions blocked by the President through CFIUS before 2018 were Chinese. Though the fifth one was from Singapore, it was also deemed to involve Chinese interests. The implementation of this new act is bound to make Chinese investment and acquisition in America more difficult.

-

(4)

Import restriction

The US import restrictions on China mainly include: banning the use of communication devices of Huawei and Zhongxing Telecom Equipment (ZTE); restricting the use of China-made rail vehicles and buses in public transport networks; limiting the use of China-made power management equipment of large capacity; forbidding the use of China-made unmanned aerial vehicles in the US military and government; etc. The Trump administration even sought to restrict the use of TikTok and WeChat in the US.

-

(5)

Restrictions on US investment in China

In 2020, the Trump administration directed the federal pension fund to halt investments in Chinese stocks, and demanded that Chinese companies listed in the US comply fully with American accounting and auditing rules, or they would face being delisted from US stock exchanges. The aforementioned executive order, which bans Americans from investing in Chinese military-related companies, prohibits not only the direct investment in Chinese bonds and stocks, but also in funds that include those securities in their portfolios. China’s three major telecom companies were delisted by the New York Stock Exchange, although Xiaomi reached a settlement with the US Department of Defense to be removed from the list of military-related companies.

-

(6)

Financial sanctions

In recent years, the US Office of Foreign Assets Control (OFAC) has expanded sanctions against Chinese individuals and companies over trade with Iran, North Korea, and Russia, as well as issues related to Hong Kong, Xinjiang, the South China Sea, and fentanyl production.

In addition to the above types of coercive economic statecraft, the US has also strengthened its judicial measures against China such as the US Department of Justice’s “China Initiative” and the prosecution of Huawei in 2018. Besides, while the Biden administration did not impose new tariffs, it has not so far removed the tariffs that were imposed by the previous administration on Chinese products.

It should be pointed out that the coercive economic statecraft is a double-edged sword. While it weakens and restricts the targeted state, it will inevitably hurt oneself and one’s allies mainly in the following aspects. First, export controls may cause domestic companies to lose export markets and to be replaced by their competitors from other countries in the global supply chain, which will not only fail to achieve the original purpose of export controls, but also weaken the economic and technological competitiveness of the state itself. In fact, the US had delayed the establishment of a specific list since the passage of the ECRA in 2018 and decided to impose export controls only on Geospatial AI, instead of all artificial intelligence software, as late as January 2020. Even for some Chinese companies on the entity list, the US Department of Commerce has issued export licenses. According to government documents, from November 2020 to April 2021, 113 export licenses worth about $61 billion were approved for selling products to Huawei, while another 188 licenses valued at around $42 billion were greenlighted for exporting goods to SMIC (Reuters 2021). Second, measures such as import restrictions, tariffs, and the entity list can put domestic companies at risk of being unable to find alternative products in the short term, or being forced to undertake costly supply chain restructuring, and cause consumer detriment as well. Third, coercive economic statecraft can trigger tit-for-tat countermeasures and retaliation. The targeted state will in response speed up its indigenous innovation, reduce external economic and technological dependence, and strengthen the ability to resist economic statecraft. Fourth, restricting the movement of people, technology, and capital, as well as pursuing technological decoupling will, in the long run, bring harm to a country’s technological innovation capabilities. Fifth, export controls and the entity list can harm the interests of companies from allied and friendly countries. In particular, the US secondary sanctions have been criticized by its allies as unilateral actions and exterritoriality. European countries have tried to use “blocking statutes” to prevent companies from complying with the US sanction rules.

4 Japan’s economic security policy: coping with US–China decoupling

Economic statecraft tends to be country-specific and emphasizes an economy being in the service of politics, which is less common in Japan’s policy discourse. Japan prefers the broader concept of “economic security policy,” which targets no specific country. In the 1970s, while it was becoming a world economic power, Japan started to pay attention to economic security as it was affected by the end of US dollar convertibility to gold and the oil crisis (Ozaki 1985). In the early 1980s, Japan advanced the economy-oriented concept of “Comprehensive Security.” Since the beginning of the twenty-first century, Japan has adopted a series of economic policies with geopolitical implications, such as joining the Trans-Pacific Partnership (TPP) negotiation, signing the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Japan-EU Economic Partnership Agreement (EPA) and Regional Comprehensive Economic Partnership (RCEP), and promoting Partnership for Quality Infrastructure and “Data Free Flow with Trust”.

At present, the biggest challenge facing Japan in economic security is how to deal with the “decoupling” policies of the US and US–China technological competition. Since 2019, Japan’s Ministry of Economy, Trade and Industry, Ministry of Foreign Affairs, and Ministry of Defense have all set up new agencies responsible for supply chains, foreign investment, export controls, and technology protection. The 2021 Action Plan of the Growth Strategy approved by the Cabinet contains a special chapter on economic security policies, emphasizing the development of semiconductors, data centers, batteries, rare earth minerals, and pharmaceuticals (Cabinet Secretariat 2021). The Cabinet introduced the Basic Policy on Economic and Fiscal Management and Reform 2021 and set the strategic direction for economic security as follows: to expand and deepen cooperation with like-minded countries under the international order based on fundamental values and rules, to ensure self-determination and acquire advantage, to identify, protect, and develop critical technologies, and to enhance the resilience of essential industries (Cabinet office 2021).

Although the above institutional and policy adjustments are not targeted at any particular country on the surface, they are actually intended to deal with the US-China decoupling, and to guard against and restrict China. Particularly in April 2020, an economic division was added to the National Security Secretariat as the commander of Japan’s economic security policies. Toshihiko Fujii, the head of this economic division, visited senior officials of the National Economic Council in the US before taking office. The main responsibilities of the economic division include: to strengthen the management of sensitive technology through measures such as export controls and review of foreign investment; to impose stricter scrutiny of the admission of international students and researchers; to restrict the use of land around facilities of national security importance; to strengthen cybersecurity; to promote Japan-US economic security cooperation; and to strengthen the supply chains of medical devices in response to COVID-19 (Nihon Keizai Shimbun 2020a).

Confronting with Washington’s policy of decoupling from China, Japan has taken different measures in various areas, including following and cooperating with the US, handling pressure from the US, taking losses, and avoiding risks (see Table 1 for details). In the review of foreign investment, Japan has kept in step with the US. In November 2019, the Japanese Diet approved the amended Foreign Exchange and Foreign Trade Law, which obligates any foreign capital to prior-notify the Japanese government if it obtains more than 1 percent of the equity or voting rights of listed companies in Japan's national security-related industries, decreased from 10% in the past. To support the implementation of this law, in May 2020, Japan’s Ministry of Finance announced the list of companies regarding the prior-notification requirements, the key sectors including 12 “core industries” namely, weapons, aircraft, space, nuclear energy, generic products usable for military purposes, cybersecurity, electric power, gas, telecommunications, water supply, railway, and petroleum, covering 518 companies accounting for 14% of all listed companies (Nihon Keizai Shimbun 2020b).

In terms of export controls, Japan neither followed the US to adopt unilateral approaches, nor did it resort to the entity list. Instead, it temporarily maintained the status quo, i.e. in principle, it participated in multilateral export controls according to four existing international institutions—namely, Wassenaar Arrangement, Nuclear Suppliers Group, Australia Group, and Missile Technology Control Regime. Meanwhile, Japan has established an End User List for the export of goods related to weapons of mass destruction. In the updated list in September 2021, 17 Chinese users were added citing possible missile involvement (Ministry of Economy, Trade and Industry 2021a). Overall, Japan’s export control policies have maintained their original purpose of preventing proliferation, instead of expanding to basic and emerging technologies like what the US has done. Japan’s policy direction is to avoid resorting to unilateral export controls and to form multilateral frameworks in different technological areas to improve common rules for export controls (Subcommittee on Security Export Control Policy, Trade Committee, Industrial Structure Council 2021). In addition, the Japanese government has taken a series of measures to prevent the leakage of sensitive technology. The Ministry of Economy, Trade and Industry has promulgated the Guidance for the Control of Sensitive Technologies for Security Export for Academic and Research Institutions and held seminars nationwide to help small- and medium-sized companies with advanced technologies improve their management skills. The Ministry of Education, Culture, Sports, Science and Technology has also pushed all national universities to set up departments for export control and security management. Japan is also discussing a security clearance system that would restrict some private parties (particularly foreign students and researchers) from participating in projects involving sensitive information.

Tokyo focuses its economic security policies on preventing technological leakage. According to the Ministry of Economy, Industry and Trade, Japan should prevent the leakage of sensitive technologies through foreign investment review and export controls. It should protect critical infrastructure such as information technology networks, protect commercial information, prevent reverse engineering, and require companies and universities to prevent the leakage of sensitive technologies. The government should also increase investment in sensitive technologies, promote domestic production of sensitive technologies that are highly dependent on foreign countries, cooperate with countries with shared values to jointly cultivate technologies, and build a global supply chain with trust (Subcommittee on Security Export Control Policy, Trade Committee, Industrial Structure Council 2019).

The concept of strategic indispensability has garnered much attention in Japan’s policy discussions. Strategic indispensability, as defined in the Recommendations Toward Developing Japan’s “Economic Security Strategy,” published by the Liberal Democratic Party, “refers to ensuring Japan’s long-term, sustainable prosperity and national security by strategically increasing the number of sectors within the entire global industrial structure where Japan is indispensable to the international community.” These sectors include industries in which Japan is positioned at the top of global value chains and industries in which Japan offers overwhelmingly superior technologies, products, and services in the fields of materials and components (Strategic Headquarters on the Creation of a New International Order, Policy Research Council, Liberal Democratic Party of Japan 2020). The Strategy for Semiconductors and the Digital Industry, issued by the Ministry of Economy, Trade and Industry, proposed to further study semiconductor materials and manufacturing equipment technologies that Japan dominates from the perspective of strategic indispensability, while promoting joint development with cutting-edge chip manufacturers overseas (Ministry of Economy, Trade and Industry 2021b). In terms of specific fields, Japanese companies lead the world in the technologies of semiconductor materials and manufacturing equipment (such as silicon wafer manufacturing and cutting), machine tools, and measuring and testing instruments. Japan’s decision to strengthen its export controls on three types of semiconductor materials to South Korea in 2019 is a case of practicing economic statecraft based on strategic indispensability. However, Japan is also concerned that if these strategically indispensable technologies are subject to US export controls as basic technologies, the development of Japanese companies in the Chinese market will be severely limited. Therefore, Yuzo Murayama, a Japanese scholar, suggested establishing a multilateral framework for export controls to reflect Japan’s interests and to avoid complete export controls to China (Murayama 2021).

In addition to government measures, Japanese companies have to study their own solutions as well. In general, Japanese companies are reluctant to make an either-or choice between Chinese and American markets and prefer to maintain business with both countries. One possible way of doing so would be through intra-firm decoupling, which means that employees from Japanese companies cannot hold concurrent positions in both Chinese and US subsidiaries or be sent to these two countries in succession to avoid the suspicion of “deemed export”. Japanese companies could also move from global to regional operations in areas involving the production, research, and development of cutting-edge technologies, i.e. to build supply chains where markets are located (Kokubun 2021). However, both intra-company decoupling and supply chain restructuring are costly. It is still unclear how feasible these measures will be.

It is worth noting that while Japan had to respond quickly to US economic statecraft against China, there are essential differences between its position and that of the US. Tokyo is aware that Washington’s decoupling policies toward China, particularly the unilateral export control and entity list, are detrimental to Japan, and hopes to limit the scope of their influences. Instead of dramatically increasing coercive economic measures like the US, Japan prioritized measures that prevent the leakage of sensitive technologies so as to maintain and strengthen its strategic indispensability, and thereby enhance its bargaining power and deterrent on economic security issues. Japan is reluctant to openly confront China like the US. For example, while Japan excluded in effect products from Huawei and other Chinese companies in the purchase of information and communication equipment, Huawei or China was not singled out by name. Japan is also reluctant to join any bloc aimed at excluding China. For instance, Japan promised to coordinate with the US on 5G business, but it did not participate in the US-proposed Clean Network program, which attempted to exclude Chinese companies in areas such as communication networks, mobile phone applications, cloud services, and submarine cables.

Behind these different policies are different perspectives of China that the US and Japan have. The US views China as a threat to its economy and security, thus shifting from engaging China to decoupling from China even at the cost of sabotaging the international free trade system. In contrast, despite Japan’s security competition with China, Tokyo regards China as an important market and a key link in global supply chains. It does not view relations with China from a zero-sum perspective and has insisted on maintaining a stable and open international economic system. Therefore, Japan is unwilling to provoke or decouple from China, nor does it want to participate in any international framework that excludes China, which may violate WTO rules. Another concern of Japan is that the US, affected by market reactions, is likely to alleviate its coercive economic statecraft against China. If that happens, Japan will be caught up in an awkward position due to its blind following of the US. As a result, when it comes to economic security, although Japan follows suit with the US in some aspects, it also adheres to its own interests and principles.

In short, Japan is trying to strike a balance between the US and China, between national security and economic interests, as well as between protecting sensitive technologies and ensuring export markets.

5 Strengthening collective resilience and excluding China?

As mentioned above, in addition to the use of coercive measures, US economic statecraft toward China has another trend: to unite the so-called like-minded countries to build technological and supply chain coalitions that exclude China and thereby strengthen “collective resilience”. The Biden administration believes that the US cannot solve the problem of supply chain fragility by itself; therefore, it needs to unite allies through the Quadrilateral Dialogue (QUAD), the Group of 7 (G7), and other institutions to reinforce collective supply chain resilience (The White House 2021b). Policy experts in the US have proposed to rally American allies and partners in the Indo-Pacific and Atlantic regions to create a multilateral regime of export controls against China, similar to the Coordinating Committee for Multilateral Export Controls (CoCom) during the Cold War (Brands and Cooper 2020). There is also advocacy of organizing a group of “techno-democracies,” which will be composed of 12 countries including the US, France, Germany, Japan, the UK, Australia, Canada, South Korea, Finland, Sweden, India, and Israel (T-12 for short). The group will focus on key sectors, such as semiconductors and supply chains, that contain made-in-China components or software, as well as countering China’s Digital Silk Road in the construction of 5G networks in developing countries. It also aims to create an international chip fabrication consortium to move semiconductor manufacturing out of China (Cohen and Fontaine 2020).

Japan is not only a key ally of the US in the Indo-Pacific region, but also a major economic and technological power. As such, it has naturally become one of the main partners for the US to implement its “collective resilience” strategy. In September 2021, the US, Japan, Australia, and India held a first in-person summit of leaders of the QUAD countries, declaring that they would reinforce cooperation in ensuring semiconductor supply chain and developing 5G networks (Ministry of Foreign Affairs 2021a). As early as in April 2021, Biden and then Japanese prime minister Yoshihide Suga held a summit and issued a joint statement, agreeing to deepen cooperation in research and development in life sciences and biotechnology, artificial intelligence, quantum sciences, and civil space, as well as to partner on sensitive supply chains, including that of semiconductors. The two countries also launched a new Competitiveness and Resilience (CoRe) Partnership, affirming their commitment to the security and openness of 5G networks. Washington and Tokyo will, respectively, invest $2.5 billion and $2 billion in research, development, testing, and deployment of secure networks, and advanced information and communications technologies, including 5G and next-generation mobile networks (Ministry of Foreign Affairs 2021b).

In fact, the US and Japanese governments have already begun to communicate on the construction of supply chains of critical components such as semiconductors. They set up a working group with the US National Security Council, the US Department of Commerce, the National Security Secretariat of Japan, and Japan’s Ministry of Economy, Trade and Industry, through which the two sides will sort out the risks their supply chains are facing and coordinate on export restrictions to China (Nikkei Asia 2021). In general, the US expects to strengthen “collective resilience” with Japan in three aspects to counter China. The first is restricted access, which includes foreign investment review, export control, and some outright bans. The second is collaborative innovation, which includes bottom-up data sharing, joint research and development, and top-down strategic investment in advanced technologies. The third is third-party engagement, which includes jointly developing and implementing (with partners) a Digital Connectivity Strategy (DCS) for the Indo-Pacific that builds on digital trade and data governance principles found in the TPP and US–Japan digital trade agreement and exploring the changing submarine fiber optic cable market and its multilateral governance (Schoff and Mori 2020).

However, there are doubts about to what extent Japan can respond to the US demands of building technological and supply chain coalitions. The US aims to exclude China from technology research and development, which will cause a chilling effect on high-tech trade. Japan will be caught up between the US pressure of asking it to exert export control against China and the attractiveness of the Chinese market. Take semiconductors as an example. Japan’s semiconductor manufacturing has an advantage in the global market when it comes to semiconductor image sensors, flash memory, silicon wafer and photoresist (materials for manufacturing semiconductors), and semiconductor equipment, such as that used in coating, developing, and cleaning. The US ban on Huawei has had a severe impact on Japanese companies. Kioxia Holdings Corporation, a Japanese multinational computer memory manufacturer, was forced to stop its supply to Huawei, thus postponing its previously announced initial public offering, which would have been Japan’s largest in 2020. Sony also suspended the provision of image CMOS sensors to Huawei, its second-largest customer after Apple. It is true that the governments of the US and Japan will provide preferential policies to domestic and foreign companies investing in their countries that promote technology innovation and supply chain security, and this will help Japanese enterprises reduce production cost. However, if the US expands its sanctions on China, Japan’s semiconductor companies will continue to lose important Chinese customers, which, in the long run, will put their competitiveness in jeopardy.

Moreover, the goal of US semiconductor strategy is to attract foreign enterprises to set up factories in America. This could put Japanese production of semiconductor manufacturing equipment and materials in danger of “hollowing out,” running counter to Japan’s goal of strengthening its own strategically indispensable industry. In fact, after Kioxia postponed its plan to go public, it started merger talks with US company Western Digital, a move that was seen as the first step in Japan–US semiconductor cooperation. However, the negotiations stalled, because the US side wanted the combined company to be headquartered in the US, while Japan was unwilling to accept it and at the same time insisted that factories and high-value-added R&D functions should be retained (Nihon Keizai Shimbun 2021). Therefore, there will be complicated interest-wrangling regarding whether the US and Japan should build a supply chain coalition or protect their own industries, respectively. As such, public statements by the US and Japanese governments are one thing; it is another thing as to whether the statements can be translated into actions by the two countries’ enterprises. After all, enterprises, rather than governments, engage in international economic activities. Surely, companies must abide by laws and regulations of their governments, but commercial activities have their own logic, and may not fully meet the strategic demands of the government.

Even the so-called like-minded countries may not keep pace with the US. For Japan and other allies of the US, economic ties with China are irreplaceable. US allies themselves are also economic and technological competitors to the US. Therefore, the US can only seek cooperation from its allies in a limited range of key technological fields. Washington will find it difficult to ask its allies to change their overall economic ties with China and can hardly establish an economic or technological system that totally excludes China and prioritizes US interests.

6 Looking ahead: balance between different interests

Under the weight of geopolitical confrontation, high-tech competition, and the COVID-19 pandemic, policymakers of states will increasingly consider and adjust foreign economic policies from the perspective of national security. Looking ahead, the US and Japan may further enhance their economic statecraft and increase the use of negative approaches against China.

It should be noted, however, that economic statecraft contains a major paradox; that is, the power source of economic statecraft will be impaired if economic ties with the targeted country are constrained or cut off. Therefore, the US attempt to seek economic and technological decoupling from China may alleviate challenges from China in the short term, but in the long term it will weaken US ability to exert influence on China and undermine its dominant position in the global economy. As far as Japan is concerned, if the US does not coordinate with allies such as Japan over export control and other policies, but resorts instead to a unilateral approach, then Japanese companies will face increasing risks and cost.

In fact, rational voices have emerged within both the US and Japan, which believe that the trend of China growing into a major technological power is unstoppable. Therefore, US–Japan cooperation should not aim to defeat or exclude China, but to maintain their own competitiveness and capability of innovation, shape an open and rules-based global economy, and encourage China to join in as an equal member (Schoff 2020). In terms of specific policies, Washington and Tokyo should consider “competitive coexistence” as the bottom line and be flexible in handling specific cases (PHP Geo-Technology Study Group 2020). If these rational voices can be reflected in decision-making, US and Japan’s economic statecraft against China is likely to become more pragmatic. They will make a case-by-case analysis instead of taking a comprehensive negative stance. It is expected that they will need to maintain balance in the following aspects:

First, striking a balance between containment of and engagement with China. That means the US and Japan must maintain economic ties with China rather than simply cut off technology supplies to China. Even if they continue to take coercive economic measures, they should exercise restraint and strengthen risk management to avoid escalation of disputes (Rosenberg, Harrell and Feng 2020, 49–50).

Second, keeping a balance between the free flow of technology and technology protection. That means Washington and Tokyo would redefine policy goals to focus on maintaining and enhancing their own technological advantages, rather than forcing China to concede through sanctions. Meanwhile, they would adopt a “small yard, high fence” strategy, under which export controls should only be used if no viable alternative technology acquisition pathways exist for China (Rasser 2020).

Third, maintaining a balance between short-term and long-term effect. If China is committed to reducing dependence on the US and Japan in terms of market, finance, technology, etc., the effect of US and Japan’s economic statecraft will be undermined. To avoid that scenario, when the US and Japan strengthen negative measures against China, such as sanctions and controls, they should also consider taking positive measures, such as lifting part of the sanctions and seeking cooperation (Harrell and Rosenberg 2019, 24–25).

In summary, economic statecraft often deviates from the principles of market economy and free trade, and if used excessively, it will turn into protectionism, increase enterprises’ costs and risks, and weaken the foundation of domestic and international economy. Besides, trade and technological wars can trigger diplomatic disputes, stir up nationalist sentiments, and escalate tensions that could spiral out of control. Therefore, the damage economic statecraft will cause is not necessarily smaller than that caused by military conflicts. States must be prudent, self-restrained, and balanced when planning, implementing, and reviewing economic statecraft. The technological and geopolitical competition among great powers will continue for the foreseeable future, but that can hardly change economic interdependence among them. Only through dialogues, consultations, and crisis management can these states avoid a lose-lose situation, establish new norms and rules in the arena, and gradually find a way to coexist that reconciles national security and economic interest.

References

Atlantic Council Geotech Center. 2021. Report of the commission on the geopolitical impacts of new technologies and data. The Atlantic Council. https://www.atlanticcouncil.org/content-series/geotech-commission/exec-summary/. Accessed 27 Jan 2022.

Baldwin, David A. 2016. Economic statecraft. Encyclopedia Britannica. https://www.britannica.com/topic/economic-statecraft. Accessed 27 Jan 2022.

Brands, Hal, and Zack Cooper. 2020. The great game with China is 3D chess. https://foreignpolicy.com/2020/12/30/china-united-states-great-game-cold-war/. Accessed 27 Jan 2022.

Cabinet office. 2021. Basic policy on economic and fiscal management and reform 2021 [財政運営と改革の基本方針2021]. https://www5.cao.go.jp/keizai-shimon/kaigi/cabinet/2021/2021_basicpolicies_ja.pdf. Accessed 27 Jan 2022.

Cabinet Secretariat. 2021. Action plan of the growth strategy [成長戦略実行計画]. https://www.cas.go.jp/jp/seisaku/seicho/pdf/ap2021.pdf. Accessed 27 Jan 2022.

Cohen, Jared, and Richard Fontaine. 2020. Uniting the techno-democracies. Foreign Affairs 99 (6): 112–122.

Darby, Christopher, and Sarah Sewall. 2021. The innovation wars: America’s eroding technological advantage. Foreign Affairs 100 (2): 148.

Doshi, Rush, and Kevin Mcguiness. 2021. Huawei meets history: great powers and telecommunications risk, 1840–2021. The Brookings Institution. https://www.brookings.edu/wp-content/uploads/2021/03/Huawei-meets-history-v4.pdf. Accessed 27 Jan 2022.

Farrell, Henry, and Abraham L. Newman. 2019. Weaponized interdependence: How global economic networks shape state coercion. International Security 44 (1): 45–74.

Farrell, Henry, and Abraham L. Newman. 2020. Chained to globalization: Why it’s too late to decouple. Foreign Affairs 99 (1): 70–73.

Foot, Rosemary, and Amy King. 2019. Assessing the deterioration in China-U.S. relations: U.S. governmental perspectives on the economic‑security nexus. China International Strategy Review 1(1): 42–48.

Gui, Yongtao [归泳涛]. 2021. Economic statecraft, economic security and the new trends in U.S. and Japan’s policies toward China [经济方略、经济安全政策与美日对华战略新动向]. Japanese Studies [日本学刊] 6: 27-49.

Harrell, Peter E., and Elizabeth Rosenberg. 2019. Economic dominance, financial technology, and the future of U.S. economic coercion. Center for a New American Security. https://www.cnas.org/publications/reports/economic-dominance-financial-technology-and-the-future-of-u-s-economic-coercion. Accessed 27 Jan 2022.

Hille, Kathrin. 2021. Huawei woes hide ‘toothless’ US export controls against Chinese tech. Financial Times. https://www.ft.com/content/2f5fc6c9-ca2b-496c-9783-b47bf060769d. Accessed 27 Jan 2022.

Kennedy, Andrew B., and Darren J. Lim. 2018. The innovation imperative: Technology and US-China rivalry in the twenty-first century. International Affairs 94 (3): 554–572.

Kokubun, Toshifumi [國分俊史]. 2021. Personnel system of Japanese companies: “great transformation” is necessary due to intensifying US-China confrontation [日本企業の人事制度 米中対立激化で"大転換"が必須に ]. Wedge 381:28-30.

Meijer, Hugo. 2016. Trading with the enemy: The making of US export control policy toward the People’s Republic of China. New York: Oxford University Press.

Ministry of Economy, Trade and Industry. 2021a. Review of the end user list. September 17, 2021. https://www.meti.go.jp/english/press/2021a/0917_001.html. Accessed 27 Jan 2022.

Ministry of Economy, Trade and Industry. 2021b. The strategy for semiconductors and the digital industry [半導体・デジタル産業戦略]. https://www.meti.go.jp/press/2021b/06/2021b0604008/2021b0603008-1.pdf. Accessed 27 Jan 2022.

Ministry of Foreign Affairs. 2021a. Joint statement from QUAD leaders. https://www.mofa.go.jp/mofaj/files/100238179.pdf. Accessed 27 Jan 2022.

Ministry of Foreign Affairs. 2021b. U.S.-Japan joint leaders’ statement: “U.S.-Japan global partnership for a new era.” https://www.mofa.go.jp/mofaj/files/100177718.pdf. Accessed 27 Jan 2022.

Murayama, Yuzo [村山裕三]. 2021. Making use of Japan’s ‘strategic indispensability’ [日本の「戦略的不可欠性」を活かせ]. Voice 518: 44-51.

Nakamura, Naoki [中村直貴]. 2020. Economic security: Toward the redefinition of the concept and the development of a coherent policy system[経済安全保障-概念の再定義と一貫した政策体系の構築に向けて―]. Legislature and Investigation [立法と調査] 428: 118-130

Nihon Keizai Shimbun [日本経済新聞]. 2020a. Following economic security policy: Cross-ministry ‘economic division’ is the commander. [経済安保政策を追う 省庁横断『経済班』が司令塔]. June 3, 2020: 5.

Nihon Keizai Shimbun [日本経済新聞]. 2020b. Foreign investment regulation: prioritizing the review of 518 companies [外資規制 重点審査518社]. May 9, 2020: 5.

Nihon Keizai Shimbun [日本経済新聞]. 2021. Semiconductor revival: the Japan-US tug of war [半導体再興 日米綱引き]. August 29, 2021: 1.

Nikkei Asia. 2021. Japan and US aim for chip supply chain deal in April summit. https://asia.nikkei.com/Business/Tech/Semiconductors/Japan-and-US-aim-for-chip-supply-chain-deal-in-April-summit. Accessed 27 Jan 2022.

Norris, William J. 2016. Chinese economic statecraft: Commercial actors, grand strategy, and state control. Ithaca and London: Cornell University Press.

Ozaki, Robert S. 1985. Introduction: The political economy of Japan’s foreign relations. In Japan’s foreign relations: A global search for economic security, ed. Robert S. Ozaki and Walter Arnold, 10–11. Boulder and London: Westview Press.

PHP Geo-Technology Study Group. 2020. Japan’s direction in the era of competition for hi-tech hegemony [ハイテク覇権競争時代の日本の針路]. PHP Institute. https://thinktank.php.co.jp/wp-content/uploads/2020/03/20200402.pdf. Accessed 27 Jan 2022.

Rasser, Martijn. 2020. Rethinking export controls: Unintended consequences and the new technological landscape. https://www.cnas.org/publications/reports/rethinking-export-controls-unintended-consequences-and-the-new-technological-landscape. Accessed 27 Jan 2022.

Reuters. 2021. EXCLUSIVE-Huawei, SMIC received billions worth of U.S. tech over six months. https://www.reuters.com/article/usa-china-huawei-tech-idCNL1N2RH239. Accessed 27 Jan 2022.

Rosenberg, Elizabeth, Peter E. Harrell, and Ashley Feng. 2020. A new arsenal for competition: Coercive economic measures in the U.S.-China relationship. Center for a New American Security. https://www.cnas.org/publications/reports/a-new-arsenal-for-competition. Accessed 27 Jan 2022.

Rosenberger, Laura. 2020. Making cyberspace safe for democracy. Foreign Affairs 99 (3): 146–159.

Schoff, James L. 2020. U.S.-Japan technology policy coordination: Balancing techno-nationalism with a globalized world. https://carnegieendowment.org/2020/06/29/u.s.-japan-technology-policy-coordination-balancing-technonationalism-with-globalized-world-pub-82176. Accessed 27 Jan 2022.

Schoff, James L., and Satoru Mori. 2020. The U.S.-Japan alliance in an age of resurgent techno-nationalism. Sasakawa Peace Foundation. Asia Strategy Initiative Policy Memorandum 4: 6–7.

Strategic headquarters on the creation of a new international order, Policy Research Council, Liberal Democratic Party of Japan. 2020. Recommendations toward developing Japan’s “economic security strategy”. https://jimin.jp-east-2.storage.api.nifcloud.com/pdf/news/policy/201021_5.pdf. Accessed 27 Jan 2022.

Subcommittee on Security Export Control Policy, Trade Committee, Industrial Structure Council [産業構造審議会通商・貿易分科会安全保障貿易管理小委員会]. 2019. Interim report [中間報告]. October 8, 2019. https://www.meti.go.jp/shingikai/sankoshin/tsusho_boeki/anzen_hosho/pdf/20191008001_01.pdf. Accessed 27 Jan 2022.

Subcommittee on Security Export Control Policy, Trade Committee, Industrial Structure Council [産業構造審議会通商・貿易分科会安全保障貿易管理小委員会]. 2021. Interim report [中間報告]. June 10, 2021. https://www.meti.go.jp/shingikai/sankoshin/tsusho_boeki/anzen_hosho/pdf/20210610_1.pdf. Accessed 27 Jan 2022.

The White House. 2021a. Renewing America’s advantages: Interim national security strategic guidance. https://www.whitehouse.gov/wp-content/uploads/2021a/03/NSC-1v2.pdf. Accessed 27 Jan 2022.

The White House. 2021b. Rebuilding resilient supply chains, revitalizing American manufacturing, and fostering broad-based growth. https://www.whitehouse.gov/wp-content/uploads/2021b/06/100-day-supply-chain-review-report.pdf. Accessed 27 Jan 2022.

Funding

This work was funded by National Office for Philosophy and Social Sciences (Grant no. 20VGQ004).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author is one of the managing editors of China International Strategy Review and declares that there is no competing interest regarding the publication of this article.

Additional information

This essay is adapted and updated from a longer article published in Chinese in the Japanese Studies. See Gui (2021).

Rights and permissions

About this article

Cite this article

Gui, Y. Moving toward decoupling and collective resilience? Assessing US and Japan’s economic statecraft against China. China Int Strategy Rev. 4, 55–73 (2022). https://doi.org/10.1007/s42533-022-00097-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42533-022-00097-z