Abstract

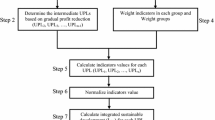

The underground mining evolution for block cave mines in Chile and worldwide has made important strides in the last decades. Nonetheless, reserves determination in the initial stages of these types of projects—mainly for long-term planning—is not studied in as much detail as it should be, especially regarding the impact on the final value of the enterprise. Today, the first estimation of the size of a block cave mine, typically expressed in tons, tends to determine very large footprints and ore bodies. The resulting large-scale mine is obtained by applying the marginal cut-off grade (COG) to determine reserves. Yet, in many cases, it is possible to obtain an equal or higher benefit, extracting fewer reserves in less time, with a smaller active area, which significantly reduces the project’s uncertainty. To explore scenarios obtained by applying a higher marginal COG in the initial phases of the project, the Hill of Value methodology is used to estimate the net present value (NPV) in relation to the production rate and the COG. However, the application of this methodology considers certain simplifications that generate results which are not completely satisfactory in specific cases. This paper suggests an improvement of this method to obtain more reliable results regarding determination of a COG profile that will optimize the NPV of a block-cave project. The methodology was developed and applied in a massive polymetallic deposit with zinc, lead, and silver mineralization, corresponding to a real block caving project. The methodology provides NPV results that differ by approximately 15% in comparison to the real mine plan, while also being considerably simpler and faster to calculate. In summary, the proposed methodology provides a reasonable and fast procedure to estimate higher than marginal COG that increases the NPV of block cave mine projects.

Similar content being viewed by others

References

Lane KF (1964) Choosing the optimum cut-off grade. Colo Sch Min Q 59(4):811–829

Lane KF (1988) The economic definition of ore, cutoff grade in theory and practice. Mining Journal books, London

De la Huerta F (1994) Aplicación del criterio de costo de oportunidad en la planificación de producción de minas subterráneas. Master Thesis, Universidad de Chile

Hall B (2003) How mining companies improve share price by destroying shareholder value. In: Proceedings CIM Mining Conference and Exhibition, pp 1–17

Rendu JM (2014). An introduction to cut-off grade estimation. Society for Mining, Metallurgy, and Exploration

Vargas E (2014) Cálculo de envolvente económica para minas de caving bajo incertidumbre geológica. Master Thesis. Universidad de Chile

Ovalle A, Vera M (2014) Optimizing Hill of value for block caving. In: Castro R (ed) 3er international symposium on block and sublevel, Chile, pp 442–449

Vasquez J (2017) Optimization of mining planning in block / panel caving mines including development activities. APCOM, Golden

Rodríguez M (2018) Optimización del plan de producción conjunto cielo abierto – subterránea. Master Thesis. Universidad de Chile

Taylor HK (1986) Rates of working of mines-a simple rule of thumb. Institution of Mining and Metallurgy Transactions Section A Mining Industry, 95

Castro RL, Gonzalez F, Arancibia E (2009) Development of a gravity flow numerical model for the evaluation of drawpoint spacing for block/panel caving. J South Afr Inst Min Metall 109(7):393–400

Acknowledgments

The authors gratefully acknowledge the support of CONICYT project FB0809, the Block Caving Laboratory, and the Advanced Mining Technology Center of the University of Chile.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Vera, M., Ovalle, A. & Castro, R. A New Methodology Based on Hill of Value for Ore Reserve Selection in Long-Term Planning for Block Caving. Mining, Metallurgy & Exploration 37, 187–196 (2020). https://doi.org/10.1007/s42461-019-00152-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42461-019-00152-1