Abstract

The aim of this study is to investigate the causal relationship between electricity consumption and real output at the macro level and the sectoral levels in three main economic sectors, namely the agricultural, industrial, and services sectors in Egypt during the period 1971–2013. I use Johansen cointegration approach, vector error correction model, and Toda and Yamamoto (J Econom 66:225–250, 1995) approach. Empirical findings reveal the existence of a cointegration relationship between the variables at the macro level and the sectoral levels. At the macro level, there is bidirectional causality between real output and electricity consumption. Whereas at the sectoral levels, there exists bidirectional causality between electricity consumption and real output in the services sector and unidirectional causality running from real output in the industrial sector to electricity consumption. However, there is no causal relationship between electricity consumption and real output in the agricultural sector. These results can help policymakers in setting the appropriate electricity conservation policies that enhance economic growth at the macro level and the sectoral levels to prevent any possible adverse effect that may harm economic and social development. Additionally, ensuring a higher level of electricity generation needed for achieving high and sustainable economic growth is vital, where higher electricity generation can be provided through investing in clean technologies and renewable energy resources, such as wind and solar energy.

Similar content being viewed by others

Introduction

During the last decade, the importance of electricity has increased, as it has been undoubtedly an essential pillar for economic and social development, especially for developing countries. Thus, researchers are concerned with analyzing the importance of electricity through investigating the causal relationship between electricity consumption and economic growth to help policymakers in setting their policies concerning plans for energy conservation policies and for achieving development and economic growth.

Moreover, investigating the causal relationship between electricity consumption and sectoral outputs is vital nowadays to help in setting the appropriate policies at the sectoral levels not only the aggregate one, especially that different economic sectors (agriculture, industry, and services) differ in their dependence on electricity consumption and the polluted emissions released from them.

Egypt nowadays is seeking to achieve a high and sustainable economic growth rate at the aggregate level and the sectoral levels, however, policymakers, when setting the policies targeting high and sustainable economic growth, have to take into consideration several challenges, such as the increasing demand for energy and electricity needed for economic growth, without adversely affecting the environment, besides the high rate of population growth and the poor planning urbanization system [30, 31].

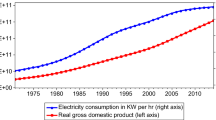

The real GDP per capita and electricity consumption per capita in Egypt have increased on average during most of the period (1971–2014, Fig. 1). It can be noticed that electricity consumption per capita has increased from 201.2 kWh in 1971 to 375.15 kWh in 1980; then after two decades, it became 961.9 kWh; then it reached 1657.76 kWh after a decade in 2014 with an average annual growth rate of 3.96% from 2000 to 2014.

Source: compiled by the author based on The World Bank [70]

Real GDP per capita (US dollars) and electricity consumption per capita (kWh) in Egypt.

Moreover, real GDP per capita has increased from 800 dollars in 1971 to 1192.5 dollars in 1980; then it was 1950 dollars in 2000 and 2608 dollars in 2014, with an average annual growth rate of 2.1% from 2000 to 2014. Also, by comparing the real economic growth rate in Egypt with the real economic growth rate in emerging-market and developing economies and advanced economies, it is found that the real economic growth rate in Egypt has exceeded that of emerging-market and developing economies and advanced economies during the period 1980 to 1987, with some fluctuations after 1987; but during the period 1997–2014, the real economic growth rate in Egypt (around 4.2%) was below the real economic growth rate in emerging market (around 5.6%) [34, 60].

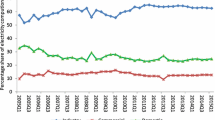

Also, per-capita income in Egypt during the last 10 years has increased at a lower rate with comparison with per-capita income in the emerging-market and developing economies; whereas it has increased by about 50% on average in Egypt, it has increased by about 75% in the emerging-market and developing economies [60]. Additionally, Fig. 2 shows the increasing trend of electricity consumption per unit of GDP during (1990–2014) and this may be an indication for depending more on electricity consumption in achieving more economic growth.

Electricity consumption per unit of real GDP (kWh per PPP constant international dollars) in Egypt. Source: compiled by the author based on The World Bank [70]

Not only real GDP per capita shows continuous increase but also the share of the value added of the two economic sectors (industry and services) to GDP, and as Table 1 reveals the contribution of the three sectors to GDP in Egypt, it is shown that the contribution of the agricultural sector to GDP in Egypt has decreased during the period (1990–2014) from 19.36% in 1990 to 11% in 2014. On the contrary, the share of value added of the industrial sector has witnessed a continuous increase during the period 1990–2014 and the contribution of the services sector to GDP has been the greatest one since 1990, as it has been on average around 50%.

The growth of these economic sectors depends on electricity consumption. Table 2 shows the share of electricity consumption by the three sectors (agriculture, industry, and services) in Egypt as a percentage of total electricity consumption. It can be noticed that although electricity consumption has been considered the highest in the industrial sector, it has shown a decreasing trend, contrary to the services sector and agricultural sector with an increasing trend. Moreover, electricity consumption per unit of value added of the three sectors represented in Fig. 3 shows that electricity consumption per unit of real value added of industrial sector has the highest value during the period as compared to electricity consumption per unit of real value added of the services sector and agricultural sector.

Overall, it can be concluded from the share of electricity consumption by three sectors together with electricity consumption per unit of real GDP and electricity consumption per unit of real value added of the three sectors, the importance of electricity consumption and sectoral outputs for the Egyptian economy and the importance of electricity consumption to economic growth at the macro level and the sectoral levels.

However, the importance of electricity consumption raises a very important issue that needs to be addressed by policymakers in setting their electricity conservation policies and this is related to the effect of electricity generation and consumption on environmental conditions, which mainly depends on primary energy sources that fuel electricity generation in Egypt.

As shown in Fig. 4 that 79% of electricity generation is fueled by natural gas, 12% is fueled by oil sources, and the remainder of electricity generation depends upon renewable energy resources and hydropower. This dependence on natural gas and oil sources in electricity generation has resulted in carbon dioxide emissions, and this is shown in Fig. 5, which presents carbon dioxide emissions from electricity and heat production as a percentage of total fuel combustion during the period 1971 to 2014. Carbon dioxide emissions have increased from 22.7% in 1980 to 32.57% in 1990, to 35.3% in 2000 and then to 50.33% in 2014 to be responsible for releasing half of the carbon dioxide emissions in Egypt.

Source: compiled by the author based on The World Bank [70]

Electricity generation by primary energy sources (2014) in Egypt.

Source: compiled by the author based on The World Bank [70]

Carbon dioxide emissions from electricity and heat production (% of total fuel combustion) in Egypt

This continuous increase in carbon dioxide emissions makes it necessary for the Egyptian government to set efficient electricity-conservation policies aiming at reducing the polluting emissions without adversely affecting the economic growth either at the aggregate level or the sectoral levels.

Thus, the purpose of the study is to investigate the causal relationship between electricity consumption and real output at the macro level and the sectoral levels and the study focuses on three main economic sectors, namely the agricultural, industrial, and services sectors.

The study contributes to the existing literature in two parts; firstly, as to the best of my knowledge, this is the first study to examine the causal relationship between electricity consumption and sectoral outputs in Egypt, and the results can be important in helping policymakers in setting the conservation electricity policies taking into consideration the possible effects of these policies on economic growth at the macro level and the sectoral levels and aiming at reducing the possible polluted emissions resulted from higher electricity generation. Secondly, the present study comprises long-term period data.

The paper employs Johansen cointegration approach and Granger causality based on vector error correction model (VECM) and Toda and Yamamoto [71] approach to explore the causal relationship between electricity consumption and real output at the macro level and the sectoral levels over the period 1971–2013, which is chosen based upon data availability.

The rest of the paper is structured as follows: Sect. 2 provides a brief review of the literature, Sect. 3 provides an overview for electricity sector in Egypt, Sect. 4 describes data and methodology, Sect. 5 discusses empirical results, and Sect. 6 concludes and recommends some policy implications.

Literature review

Different studies have explored the causal relationship between electricity consumption and economic growth either in a single county or multiple countries and others have investigated this relationship using panel data approach and they concluded the existence of four hypotheses: (1) conservation hypothesis; (2) growth hypothesis; (3) feedback hypothesis, and (4) neutrality hypothesis, and a summary of these studies is shown in Table 3.

Conservation hypothesis

The conservation hypothesis states that there exists a unidirectional causal relationship from economic growth to electricity consumption and this means that electricity conservation policies may have minimum effects on economic growth, and several studies confirm this hypothesis as Ghosh [24], Halicioglu [27], Narayan and Smyth [47], Mozumder and Marathe [44], Lean and Smyth [40], and Belaid and Youssef [13].

Growth hypothesis

The growth hypothesis suggests that unidirectional causality from electricity consumption to economic growth exists and this leads to the possible negative effects of the implementation of electricity conservation policies on economic growth, and several studies confirm this hypothesis. Among them can be highlighted several studies such as Aqeel and Butt [8], Shiu and Lam [65], Altinay and Karagol [7], Yuan et al. [78], Narayan and Singh [46], Abosedra et al. [1], Akinlo [5], Chandran et al. [18], Ciarreta and Zarraga [19], Kouakou [39], Bildirici and Kayikci [14], Tang and Shahbaz [68], Mawejje and Mawejje [42], and Sharif et al. [64].

Feedback hypothesis

The feedback hypothesis proposes that there exists bidirectional causality between electricity consumption and economic growth, and there is interdependence between the two variables. Several studies can be highlighted confirming this hypothesis, such as Yoo [74], Zachariadis and Pashouortidou [79], Yoo [75], Tang [67], Odhiambo [50], Ouedraogo [52], Lorde et al. [41], Ahamad and Islam [3], Shahbaz et al. [62], Gurgul and Lach [25], Polemis and Dagoumas [58], Belaid and abderrahmani [12], Karanfil and Li [37], Ibrahiem [29], Osman et al. [51], Ahmad et al. [4], and Sarwar et al. [61].

Neutrality hypothesis

The neutrality hypothesis suggests that there is no causal relationship between electricity consumption and economic growth, and so implementation of conservation electricity policies may have no effect on economic growth. Several studies confirm this hypothesis, including Wolde–Rufael [73] for Algeria, Congo Republic, Kenya, South Africa, and Sudan; Chen et al. [17] for China, Taiwan and Thailand; Narayan and Prasad [45]; Yoo and Kwak [76] for Peru; Karanfil and Li [37] for North America, Sub-Saharan Africa, Upper–Middle income countries; and Bah and Azam [9].

Others investigate this relationship through examining multiple countries and the results are mixed and differ across countries [17, 45, 66, 73, 75].

Moreover, several studies examine the electricity consumption-economic growth nexus in the MENA region, and also results are mixed [15, 23, 48, 53].

Although mainly all the previous studies are concerned with the relationship between electricity consumption and economic growth, other researchers focus on the relationship between electricity consumption and specific sectoral outputs to examine the causal relationship between them and to recommend the appropriate policy in each sector. A summary of these studies is shown in Table 4.

Nathan and Liew [49] examine the causal relationship between electricity consumption and several economic sectoral outputs in Cambodia using autoregressive distributed lag (ARDL) model and Granger causality test. They conclude the existence of unidirectional causality running from electricity consumption to agricultural, industrial, and transportation sectors, and unidirectional causality from services sector to electricity consumption.

Mawejje and Mawejje [42] explore the causal relationship between electricity consumption and sectoral output, namely agriculture, industry, and services in Uganda using Granger causality test and found a short-run unidirectional causal relationship running from the services sector to electricity consumption and a long-run causal relationship running from electricity consumption to industrial sector and no causal relationship between electricity consumption and agricultural sector was detected. Pei et al. [54] investigate the causal relationship between electricity consumption and sectoral output of agriculture, manufacturing, and services in Malaysia using Granger causality. The results confirm the existence of a causal relationship running from electricity consumption to agricultural sector and non-existence of causal relationship between electricity consumption and the other two sectors (manufacturing and services).

As shown from the previous literature review that the results of a causal relationship between electricity consumption and real output at the macro level or sectoral levels are inconclusive, and as pointed out by Zhang et al. [80] that although there is evidence for the existence of a causal relationship between electricity consumption and economic growth, the direction of causality is still debatable among research and this may be attributed to several factors; some are related to the selection of variables, sources of data, methodologies applied, and different energy policies adopted by different countries.

Overview of electricity sector in Egypt

In Egypt, private companies owned electricity as it was first launched in 1893. Then, in 1962, the electricity was owned by the government, and all the private companies were nationalized. Thus, the electricity industry is a government-owned monopoly (Yousri, [77]).

Electricity production and consumption have witnessed a continuous increase during the period 1985–2014, as shown in Fig. 6. Electricity generation has increased from 31.7 TWh in 1985 to 53.4 TWh in 1995, 104 TWh in 2005 and 170.2 TWh in 2014. Also, electricity consumption has increased from 24.48 TWh in 1985 to 46.46 TWh in 1995, 95.3 TWh in 2005 and 152.2 TWh in 2014. It can be noticed also that electricity generation has been in excess over electricity consumption during this period, making Egypt a net exporter of electricity over the period 1985–2014.

In fiscal year 2015/2016, Egypt’s total installed capacity of electricity was 38.8 GW and 186.3 GWh was generated [72]. Moreover, in recent years, Egypt has had challenges in facing electricity demand among all sectors (agriculture, industry, services, and residential), which is manifested in several power blackouts [26], and this can be attributed to shortages in natural gas production, especially that about 79% of electricity production in Egypt is fueled by natural gas, increasing energy demand, insufficient production and transmission capacity, and aging infrastructure [72].

For decades, electricity prices have been subsidized, where prices were lower than real marginal costs, indicating rigidity in domestic electricity prices and this has had bad consequences represented mainly in increasing energy demand and misusing of electricity, and made a burden on the government, especially that fueling electricity depends on non-renewable resources (natural gas) with high marginal costs unlike renewable resources (wind and solar) with high fixed costs but nearly zero marginal costs [11, 77]. Also, electricity subsidies comprise direct and indirect ones. As for direct, they are related to the provision of electricity to consumers, and for indirect ones they are related to the subsidies for oil and natural gas production used in the production of electricity [6].

The government in 1986 made an attempt to raise energy prices gradually, but for social reasons this attempt was stopped [11]. In 2011, total energy subsidies in Egypt exceeded seven times health expenditures and three times education spending [33].

In 2012/2013, however, the government began an efficient pricing scheme by making a gradual increase in the energy prices and subsidy reform and the increase has reached about 18% in some segments and prices for oil and natural gas used for electricity production have increased by about 33% [6, 77]. The government also issued the decree 1257 for the year 2014 to set electricity prices gradual adjustment plan aimed to increase electricity tariffs gradually during the period (2014/2015–2018/2019), where tariffs are expected to increase by 114% and 47% for high-consumption households and low consumption households, respectively during the 5 years [6, 43].

Moreover, in 2014, the government removed about 22% of energy subsidies [28] and still this gradual increase in energy and electricity prices continues especially that one of the conditional policies for the loan given to the Egyptian government by IMF in 2016 is to remove energy subsidies.

In addition, the Supreme Council of Energy has implemented a plan aiming at shifting to renewable energy resources by 2020 to cover 20% of Egypt’s total generated electricity, where 12% would be provided by wind energy and the rest of renewable energy resources would be from biomass, solar, and hydro sources [26].

Data description and econometric modeling

Annual data that cover the period 1971–2013 in this study are obtained from World Bank indicators [70]. GDP or real output per capita (y) and sectors value added namely agriculture (agr), industry (ind), services (ser) are expressed in constant local currency while electric power consumption per capita (ec) is expressed in kilowatt-hours (kWh). I have converted sectors value added into per-capita terms by dividing them by total population. All variables in this study are transformed to their natural logarithmic form. Table 5 provides a summary of descriptive statistics.

Johansen and Juselius [36] maximum likelihood estimation method is conducted to explore the relationship between electricity consumption and real output at the macro level and the sectoral levels to investigate the presence of multiple cointegrating vectors. According to Johansen [35] test for multivariate cointegration, there are two likelihood ratio tests: maximum eigenvalue test and trace test.

Before conducting Johansen and Juselius [36] maximum likelihood estimation method, however, stationary will be tested, as in time series analysis and based upon Engle and Granger [22], most variables may be non-stationary variables due to the presence of trends and thus testing for stationary must be conducted as a first step. Two unit root tests are conducted; augmented Dickey–Fuller (ADF) [20] and the Phillips–Perron (PP) [57], however, as stated by Perron [55], failure in detecting structural break(s) may result in misleading hypothesis testing, so Perron test based on Dickey–Fuller test adds dummy variables in the ADF test regression to account for the presence of structural break(s), then the structural break test is modified with an innovative outlier and additive one [59]. Thus, for avoiding misleading results, I conduct two approaches of the Perron and Vogelsang [56] unit root test besides ADF and PP tests before proceeding in conducting Johansen–Juselius cointegration approach. The first one is the additive outlier (AO) model permitting immediate change in the time series and the second one is the innovative outlier (IO) model permitting gradual shift and adjustment in the mean of the time series and (AO) model is employed through two steps; the first one concerned with estimation of

while the second one estimates

As for (IO) break, however, it can be tested by estimating

where Δ is the first difference operator, dummy variables are represented by DUt which is equal to 1, and DTt is equal to t − TB if t is greater than TB and zero otherwise, also D(TB)t is equal to one if t = TB + 1 and zero otherwise. ϵt and εt are the residuals [68].

And if it is concluded that time series are non-stationary at level, then cointegration and vector error correction model can be employed in the next step.

Moreover, before conducting cointegration analysis, optimal lag length has to be determined using different criteria as Akaike information criteria (AIC) and Schwartz criteria (SC), and then after choosing optimal lag length, Johansen and Juselius [36] maximum likelihood estimation method will be employed to examine the existence of multiple cointegrating vectors, and then, VECM can be employed to identify the short-run and long-run relationships between them.

This can be represented by Eqs. (4) and (5) for model 1 to explore the causal relationship between electricity consumption and real output at the macro level and Eqs. (6), (7), (8), and (9) for model 2 to explore the causal relationship between electricity consumption and real output at the sectoral levels. In each equation, it can be noticed that the dependent variable is explained by itself, the others explanatory variables and the error correction term.

where Δ is the difference operator, ect is the error correction term, and μt and εt are the error terms. γ and β are coefficients of explanatory variables in model 1 and model 2, respectively, which are concerned with the short-run effect, while α and ϑ the coefficients of error correction term in model 1 and model 2, respectively, are concerned with the speed that the variables in the model could come back to long-run equilibrium when there is a deviation from it.

For robustness check, Toda and Yamamoto [71] approach is conducted. This can be done through several steps. The first step is to detect the order of integration in all-time series for the purpose of specifying the maximum order of integration (dmax) for all groups of variables. The second step involves specifying VAR model as follows:

where dmax denotes maximum order of integration of all group variables and k is the optimal lag length. The third step involves determining optimal lag length in the VAR model. The final step is estimating Granger test based on Eqs. (10) and (11) for model 1 and Eqs. (11) (12), (13), (14), and (15) for model 2 [9].

Empirical results and discussions

This study examines the causal relationship between electricity consumption and real output at the macro level and the sectoral levels, namely agricultural, industrial, and services sectors in Egypt during the period 1971–2013. Several steps would be done to explore the causal relationship between the variables. Augmented Dickey–Fuller (ADF), Phillips–Perron (PP), and Perron and Vogelsang [56] unit root tests would be employed for the purpose of examining the order of integration for every variable. After testing for stationary, Johansen’s maximum likelihood multiple cointegration approach will be conducted for exploring the existence of the long-run relationship among the variables. Then, if the variables are cointegrated vector error correction model (VECM) will be conducted to investigate the causal relationship between the variables. Moreover, Toda and Yamamota approach is conducted as a robustness check for causality relationship between the variables.

I begin with augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) tests to examine the stationary of all the variables under consideration, where the null hypothesis is that the series is non-stationary and it is checked on the time series in levels and first differences. The results are reported in Table 6.

The results indicated that all the variables (electricity consumption, real output, agriculture value added, industry value added, and services value added) are integrated of order 1 and that they are non-stationary at levels using Phillips– Perron test and ADF test except for agriculture value added in case of using ADF test.

For the reason of the possibility of the presence of structural breaks, and aiming at avoiding misleading results concerning the decision related to the null hypothesis of unit root test, Perron–Vogelsang test is conducted for robustness and the results are reported in Table 7.

The results indicate that all the variables (electricity consumption, real output, agriculture value added, industry value added, and services value added) are integrated of order 1 and that they are non-stationary at levels and stationary at first differences with different structural breaks as reported in Table 7.

Table 7 shows that electricity consumption, economic growth, and sectoral outputs have structural breaks in the 1980s and the 1990s, and these results may be attributed to several causes; the existence of period of oil boom in the Arab Gulf states late 1970s and early 1980s where Egypt benefited from it and also the 1986 oil price collapse [10, 21].

In addition, structural breaks can coincide with a sharp rise in oil prices in 1990 associated with the Gulf War and Iraq's invasion of Kuwait, and UN embargo of crude oil exports from Iraq and Kuwait, and as a result, oil prices increased from the second quarter of 1990 to the fourth quarter of 1990 from 16.1 dollars per barrel to 30 dollars per barrel, an almost 86.3% increase [69]. Moreover, the Egyptian government signed an agreement with both the World Bank and the International Monetary Fund (IMF), known as the Economic Reform and Structural Adjustment Program (ERSAP), in 1991 and according to it, the Egyptian government increased electricity prices to about 74% of long-run marginal costs in 1994 and oil prices to 100% of international prices [2, 38, 63]. Moreover, economic growth has risen from 2.1% in 1991 to reach 4.5% in 1995, then 7.5% in 1998 [34].

Since all the variables seem to be integrated of order one, then investigating the long-run relationship between the variables using Johansen cointegration approach is possible.

Before proceeding with the second step, however, which focuses on employing Johansen maximum likelihood cointegration test, vector auto regression (VAR) model on the basis of Schwarz criterion (SC) and Akaike information (AIC) criterion has to be conducted to determine optimal lag length. The results are presented in Table 8 where the optimal lag length is 1 for model 1 model 2 based on Schwarz criterion (SC).

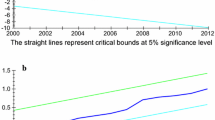

Then, for the purpose of detecting cointegrating vectors of equations’ number, Johansen’s maximum likelihood multiple cointegration test is employed. The results for both model 1 and model 2 are presented in Table 9. As for model 1, and based upon trace statistics and maximum eigenvalue, one cointegrated equation at 5% significant level can be detected, thus, it can be concluded that electricity consumption and real output are co-integrated in model 1. Similarly, for model 2, it can be observed that based upon maximum eigenvalue and trace statistics, electricity consumption, and real value added for the three sectors (agriculture, industry, and services) are co-integrated.

Based upon the results of Johansen cointegration test and the existence of long-run relationship between the variables in model 1 and model 2, VECM is conducted for Eqs. 4, 5, 6, 7, 8, and 9. The direction of causality using standard Granger causality test and the results are reported in Tables 10 and 11 for model 1 and model 2, respectively. The long-run causal relationship is detected through the significance of the coefficient of error correction term by using t test, whereas Wald statistic determines the short-run causal relationship.

In model 1, the coefficient of the error term in Eqs. (4) and (5) is negative and statistically significant where the dependent variables are electricity consumption per capita and real output (real GDP per capita), respectively. This is an indication for the existence of long-run bidirectional causal relationship between electricity consumption and real output. Also, it is shown that the error correction term is − 0.07 in case of electricity consumption being the dependent variable, so it can be concluded that about 7% of the disequilibrium of electricity consumption per capita of the shock of previous year can adjust back in the current year to the long-run equilibrium. Additionally, the error correction term is − 0.017 in case of real output being the dependent variable, so it can be concluded that about 1% of the disequilibrium of real output of the shock of previous year can adjust back in the current year to the long-run equilibrium.

The results of Wald statistics also show the existence of a bidirectional causal relationship between electricity consumption and real output in the short run. These results are consistent with Wolde–Rufael [73] that also concluded a bidirectional causal relationship between electricity consumption and economic growth in Egypt but inconsistent with Sharaf [63] that concluded unidirectional causal relationship from economic growth to electricity consumption and Ozturk and Acaravci [53] that found a unidirectional causal relationship from electricity consumption to economic growth. As for the existence of a bidirectional causal relationship between electricity consumption and real output, it is consistent with the Egyptian case, as mentioned above that both real GDP per capita and electricity consumption per capita are increasing, and Egypt as a developing country faces challenges in achieving a high and sustainable economic growth rate so it depends on energy sources as a stimulus for accomplishing its development and thus electricity consumption is needed for achieving high economic growth. Moreover, the dependence of economic growth on electricity consumption may be manifested by a decreasing trend of GDP per unit of electricity consumption where it has decreased from 8.916 PPP dollar per KWh in 1990 to 7.6 PPP dollar per KWh in 2000 to reach 5.95 PPP dollar per KWh in 2014 [70], which may be an indication for the importance and the vital needs of more electricity consumption in achieving more economic growth.

Similarly, economic growth causes greater electricity consumption where some of the resources generated from economic growth are devoted towards investment in advanced technologies aiming at increasing sources of electricity generation.

As for model 2, the coefficient of the error term in Eq. (9) is negative and statistically significant at 1% level where the dependent variable is the real value added of services sector. This result indicates the existence of unidirectional long-run causality running from electricity consumption to real value added in the services sector, and it is shown that the error correction term is − 0.04, so it can be concluded that about 4% of the disequilibrium of value added of services sector of the shock of previous year can adjust back in the current year to the long-run equilibrium.

Moreover, unidirectional causality running from value added in industrial sector to electricity consumption is detected using Wald statistics, besides the existence of bidirectional causality between electricity consumption and services sector in the short run. This may be consistent with the continuous increase of share of electricity consumption by the services sector as compared to industrial sector, as represented above in Table 2; but no causal relationship between electricity consumption and real value added in the agricultural sector is detected.

Finally, diagnostic tests are presented at the bottom of Tables 10 and 11 to ensure the robustness of the obtained results.

Toda and Yamamoto augmented Granger causality is conducted for robustness check. The first step involves determining the order of integration for all variables and from Tables 6 and 7 and based on Phillips–Perron test and Perron–Vogelsang test, all the variables are integrated of order one. Thus, it can be detected that the maximum order of integration (dmax) is one. Additionally, the optimal lag length is 1, according to Schwarz criterion (SC) for both model 1 and model 2 based on results from Table 8. Thus, VAR order is (1 + 1) and the Eqs. (10), (11), (12), (13), (14) and (15) are estimated and then Granger causality is estimated and the results are presented in Table 12.

The results of the Toda–Yamamota causal relationship are presented in Table 12. For model 1, there exists bidirectional causality between electricity consumption and real output, which is consistent with the results from VECM.

As for model 2, there exists bidirectional causality between real value added in the services sector and electricity consumption, unidirectional causality from real value added in the industrial sector to electricity consumption, and no causal relationship between real value added in the agricultural sector and electricity consumption and these results are consistent also with that of VECM in the short run. Therefore, it can be concluded that the results of Toda and Yamamoto augmented Granger causality confirm that of VECM and based upon these results, several recommendations can be suggested to policymakers.

Conclusions and policy implications

This study explores the causal relationship between electricity consumption and real output at the macro level and the sectoral levels in three main economic sectors, namely the agricultural, industrial, and services sectors in Egypt during the period 1971–2013. Johansen cointegration approach, vector error correction model, and Toda and Yamamoto Augmented Granger causality are employed to achieve the aim of the study.

Johansen multivariate cointegration approach confirms the existence of a long-run relationship between the variables at the macro level and the sectoral levels. In addition, results from conducting Ganger causality test through applying VECM and Toda and Yamamoto Augmented Granger causality show the existence of a feedback hypothesis at the macro level. At the sectoral levels, the neutrality hypothesis exists in case of the agricultural sector, whereas the feedback hypothesis and conservation hypothesis exist for the services sector and industrial sector, respectively.

Depending upon these results, several policy implications can be suggested for policymakers. The existence of bidirectional causality between electricity consumption and real output at the macro level and between electricity consumption and real value added in services sector makes it necessary for the government to design a sustainable plan aiming at providing efficient electricity supply, as it is vital for achieving economic growth. Moreover, electricity conservation policies and electricity efficient policies can be adopted aiming at reducing pollutants and avoiding environmental degradation, but any possible adverse effect on economic growth must be taken into consideration while accomplishing these policies.

Also, the existence of unidirectional causality from industrial output to electricity consumption and non-existence of causal relationship between agricultural output and electricity consumption could help policymakers in designing their conservation electricity policies without much fear of deteriorating real output in the industrial sector or agricultural one, and some efforts for energy conservation activities have been adopted by several Egyptian institutions as those applied in the industrial sector and led to about 25% of energy saving besides removing, gradually, the historical energy subsidies [11]. Although several energy conservation policies have been adopted in Egypt, still more efforts are needed. These can be accomplished through enhancing domestic and international competition to help in improving the quality of the products and decreasing the operating expenses, besides effective enforcement of the Environmental Law number 4 for the year 1994 to control polluted emissions and improve water and air quality [11]. Moreover, incentives for encouraging usage of electricity-efficient tools and efficient utilization of natural gas and full utilization of hydropower in an attempt to minimize the dependence on oil sources can be adopted [11]. The government also must encourage private-sector companies to invest into clean technologies and renewable energy resources, as Egypt has enormous renewable energy resources such as wind and solar energy but investing in them needs huge funds.

References

Abosedra, S., Dah, A., Ghosh, S.: Electricity consumption and economic growth, the case of Lebanon. Appl. Energy 86(4), 429–432 (2009). https://doi.org/10.1016/j.apenergy.2008.06.011

African Development Bank Group: Economic reform and structural adjustment programme, project performance evaluation report (2000)

Ahamad, M.G., Islam, N.: Electricity consumption and economic growth nexus in Bangladesh: revisited evidence. Energy Policy 39, 6145–6150 (2011). https://doi.org/10.1016/j.enpol.2011.07.014

Ahmad, A., Zhao, Y., Shahbaz, M., Bano, S., Zhang, Z., Wang, S., Liu, Y.: Carbon emissions and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96, 131–143 (2016). https://doi.org/10.1016/j.enpol.2016.05.032

Akinlo, A.E.: Electricity consumption and economic growth in Nigeria: evidence from cointegration and co-feature analysis. J. Policy Model. 31, 681–693 (2009). https://doi.org/10.1016/j.jpolmod.2009.03.004

Al-Ayouty, I., El-Raouf, N.A.: Energy security in Egypt, economic literature review, vol. 1. The Egyptian Center for Economic studies, Cairo (2015)

Altinay, G., Karagol, E.: Electricity consumption and economic growth: evidence from Turkey. Energy Econ. 27(6), 849–856 (2005). https://doi.org/10.1016/j.eneco.2005.07.002

Aqeel, A., Butt, M.S.: The relationship between energy consumption and economic growth in Pakistan. Asia Pac. Dev. J. 8(2), 101–110 (2001)

Bah, M.M., Azam, M.: Investigating the relationship between electricity consumption and economic growth: evidence from South Africa. Renew. Sust. Energy Rev. 80, 531–537 (2017). https://doi.org/10.1016/j.rser.2017.05.251

Banafea, W.A.: Structural breaks and causality relationship between economic growth and energy consumption in Saudi Arabia. Int. J. Energy Econ. Policy 4(4), 726–734 (2014)

Bedrous, M.A.: CO2 abatement linked to increased energy efficiency in the Egyptian power sector. World Energy Council, London (2007)

Belaid, F., Abderrahmani, F.: Electricity consumption and economic growth in Algeria: a multivariate causality analysis in the presence of structural change. Energy Policy 55, 286–295 (2013). https://doi.org/10.1016/j.enpol.2012.12.004

Belaid, F., Youssef, M.: Environmental degradation, renewable and non-renewable electricity consumption and economic growth: assessing the evidence from Algeria. Energy Policy 102, 277–287 (2017). https://doi.org/10.1016/j.enpol.2016.12.012

Bildirici, M.E., Kayikci, F.: Economic growth and electricity consumption in former Soviet Republics. Energy Econ. 34, 743–753 (2012). https://doi.org/10.1016/j.eneco.2012.02.010

Bouoiyour, J., Selmi, R.: The nexus between electricity consumption and economic growth in MENA countries. Energy Stud. Rev. 20(2), 25–44 (2014)

Bp statistical review of world energy. https://www.bp.com/statisticalreview (2017)

Chen, T., Kuo, H., Chen, C.: The relationship between GDP and electricity consumption in 10 Asian countries. Energy Policy 35(4), 2611–2621 (2007). https://doi.org/10.1016/j.enpol.2006.10.001

Chandran, V.G.R., Sharma, S., Madhavan, K.: Electricity consumption-growth nexus: the case of Malaysia. Energy Policy 38(1), 606–612 (2010). https://doi.org/10.1016/j.enpol.2009.10.013

Ciarreta, A., Zarraga, A.: Economic growth-electricity consumption causality in 12 European countries: a dynamic Panel data approach. Energy Policy 38, 3790–3796 (2010). https://doi.org/10.1016/j.enpol.2010.02.058

Dickey, D.A., Fuller, W.A.: Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 74(366), 427–431 (1979). https://doi.org/10.2307/2286348

El-Beblawi, H.: Economic growth in Egypt: impediments and constraints (1974–2004). The International Bank for Reconstruction and Development/World Bank—on behalf of the Commission on Growth and Development. WorkingPaper No 14 (2008)

Engle, R., Granger, C.: Cointegration and error correction: representation, estimation and testing. Econometrica 55(2), 251–276 (1987)

Farhani, S., Shahbaz, M.: What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2 emissions in MENA region? Renew. Sustain. Energy Rev. 40, 80–90 (2014). https://doi.org/10.1016/j.rser.2014.07.170

Ghosh, S.: Electricity consumption and economic growth in India. Energy Policy 30, 125–129 (2002)

Gurgul, H., Lach, L.: The electricity consumption versus economic growth of the Polish economy. Energy Econ. 34, 500–510 (2012). https://doi.org/10.1016/j.eneco.2011.10.017

Hafner, M., Tagliapietra, S., El Andaloussi, E.: Outlook for electricity and renewable energy in Southern and Eastern Mediterranean countries. MEDPRO Technical Report No. 16, European Commission European Research area, Seventh Framework Programme (2012)

Halicioglu, F.: Residential electricity demand dynamics in Turkey. Energy Econ. 29(2), 199–210 (2007). https://doi.org/10.1016/j.eneco.2006.11.007

Hegazy, K.: Egypt’s energy sector: regional cooperation outlook and prospects of furthering engagement with the energy charter, Energy Charter Secretariat Knowledge Center (2015)

Ibrahiem, D.M.: Renewable electricity consumption, foreign direct investment and economic growth in Egypt: an ARDL approach. Proc. Econ. Financ. 30, 313–323 (2015). https://doi.org/10.1016/S2212-5671(15)01299-X

Ibrahiem, D.M.: Environmental Kuznets curve: an empirical analysis for carbon dioxide emissions in Egypt. Int. J. Green Econ. 10(2), 136–150 (2016). https://doi.org/10.1504/IJGE.2016.10001598

Ibrahiem, D.M.: Road energy consumption, economic growth, population and urbanization in Egypt: cointegration and causality analysis. Environ. Dev. Sustain. 20(3), 1053–1066 (2018). https://doi.org/10.1007/s10668-017-9922-z

International Energy Agency (IEA): Egypt: electricity and heat. https://www.iea.org/countries/non-membercountries/egypt (2017)

International Monetary Fund: Energy subsidies in the Middle East and North Africa: lessons from the reform. https://www.imf.org/external/np/fad/subsidies/pdf/menanote.pdf (2014)

International Monetary Fund (IMF): World economic outlook database. https://www.imf.org/external/pubs/ft/weo/2018/weo/2018/01/weodata/weoselgr.aspx (2018)

Johansen, S.: Statistical analysis of cointegrating vectors. J. Econ. Dyn. Control 12(2–3), 231–254 (1988)

Johansen, S., Juselius, K.: Maximum likelihood estimation and inference on cointegration with applications, the demand for money. Oxf. Bull. Econ. Stat. 52(2), 169–210 (1990)

Karanfil, F., Li, Y.: Electricity consumption and economic growth: exploring panel specific differences. Energy Policy 82, 264–277 (2015). https://doi.org/10.1016/j.enpol.2014.12.001

Korayem K.: Egypt’s economic reform and structural adjustment ERSAP, the Egyptian Center for Economic Studies, Working paper No 19. (1997)

Kouakou, A.K.: Economic growth and electricity consumption in Cote d′Ivoire: evidence from time series analysis. Energy Policy 39, 3638–3644 (2011)

Lean, H.H., Smyth, R.: Multivariate granger causality between electricity generation, exports prices and GDP in Malaysia. Energy 35(9), 3640–3648 (2010). https://doi.org/10.1016/j.energy.2010.05.008

Lorde, T., Waithe, K., Francis, B.: The importance of electrical energy for economic growth in Barbados. Energy Econ. 32, 1411–1420 (2010). https://doi.org/10.1016/j.eneco.2010.05.011

Mawejje, J., Mawejje, D.N.: Electricity consumption and sectoral output in Uganda: an empirical investigation. J. Econ. Struct. 5(21), 1–16 (2016). https://doi.org/10.1186/s40008-016-0053-8

Ministry of Electricity and Renewable Energy: Egyptian electricity holding company, Annual report, 2014/2015. www.moee.gov.eg/english_new/EEHC_Rep/2014-2015en.pdf (2015)

Mozumder, P., Marathe, A.: Causality relationship between electricity consumption and GDP in Bangladesh. Energy Policy 35(1), 395–402 (2007). https://doi.org/10.1016/j.enpol.2005.11.033

Narayan, P.K., Prasad, A.: Electricity consumption-real GDP causality nexus: evidence from a bootstrapped causality test for 30 OECD countries. Energy Policy 36(2), 910–918 (2008). https://doi.org/10.1016/j.enpol.2007.10.017

Narayan, P.K., Singh, B.: The electricity consumption and GDP nexus for the Fiji Islands. Energy Econ. 29(6), 1141–1150 (2007). https://doi.org/10.1016/j.eneco.2006.05.018

Narayan, P.K., Smyth, R.: Electricity consumption, employment and real income in Australia evidence from multivariate Granger causality tests. Energy Policy 33(9), 1109–1116 (2005). https://doi.org/10.1016/j.enpol.2003.11.010

Narayan, P.K., Smyth, R.: Multivariate Granger causality between electricity consumption, exports and GDP: evidence from a panel of Middle Eastern countries. Energy Policy 37(1), 229–236 (2009). https://doi.org/10.1016/j.enpol.2008.08.020

Nathan, T.M., Liew, V.K.: Does electricity consumption have significant impact towards the sectoral growth of Cambodia? Evidence from Wald test causality relationship. J. Empir. Econ. 1(2), 59–66 (2013)

Odhiambo, N.M.: Electricity and economic growth in South Africa: a trivariate causality test. Energy Econ. 31(5), 635–640 (2009). https://doi.org/10.1016/j.eneco.2009.01.005

Osman, M., Gachino, G., Hoque, A.: Electricity consumption and economic growth in the GCC countries: panel data analysis. Energy Policy 98, 318–327 (2016). https://doi.org/10.1016/j.enpol.2016.07.050

Ouedraogo, I.M.: Electricity consumption and economic growth in Burkina Faso: a co-integration analysis. Energy Econ. 32(3), 524–531 (2010). https://doi.org/10.1016/j.eneco.2009.08.011

Ozturk, I., Acaravci, A.: Electricity consumption and real GDP causality nexus: evidence from ARDL bounds testing approach for 11 MENA countries. Appl. Energy 88, 2885–2892 (2011). https://doi.org/10.1016/j.apenergy.2011.01.065

Pei, T.L., Shaari, M.S., Ahmad, T.S.T.: The effects of electricity consumption on agriculture, service and manufacturing sectors in Malaysia. Int. J. Energy Econ. Policy 6(3), 401–407 (2016)

Perron, P.: The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57, 1361–1401 (1989)

Perron, P., Vogelsang, T.J.: Nonstationarity and level shifts with an application to purchasing power parity. J. Bus. Econ. Stat 10(3), 301–320 (1992). https://doi.org/10.1080/07350015.1992.10509907

Phillips, P.C., Perron, P.: Testing for a unit root in time series regression. Biometrika 75(2), 335–346 (1988)

Polemis, M.L., Dagoumas, A.S.: The electricity consumption and economic growth nexus: evidence from Greece. Energy Policy 62, 798–808 (2013). https://doi.org/10.1016/j.enpol.2013.06.086

Popp, S.: New innovational outlier unit root test with a break at unknown time. J. Stat. Comput. Simul. 78(12), 1145–1161 (2008). https://doi.org/10.1080/00949650701411429

Salsecci, G., Frigoli, G., Eskander, E.: Egypt’s economic reform agenda: a new path for growth. Med Gulf Initiative Bull. 5 (2015)

Sarwar, S., Chen, W., Waheed, R.: Electricity consumption, oil price and economic growth: global perspective. Renew. Sustain. Energy Rev. 76, 9–18 (2017). https://doi.org/10.1016/j.rser.2017.03.063

Shahbaz, M., Tang, C.F., Shabbir, M.S.: Electricity consumption and economic growth nexus in Portugal using co-integration and causality approaches. Energy Policy 39(6), 3529–3536 (2011). https://doi.org/10.1016/j.enpol.2011.03.052

Sharaf, M.F.: Energy consumption and economic growth in Egypt, a disaggregated causality analysis with structural breaks. Top. Middle East. Afr. Econ. 18(2), 61–86 (2016)

Sharif, A., Jammazi, R., Raza, S.A., Shahzad, S.J.H.: Electricity and growth nexus dynamics in Singapore: fresh insights based on wavelet approach. Energy Policy 110, 686–692 (2017). https://doi.org/10.1016/j.enpol.2017.07.029

Shiu, A., Lam, P.L.: Electricity consumption and economic growth in China. Energy Policy 32, 47–54 (2004)

Squalli, J.: Electricity consumption and economic growth: bounds and causality analyses for OPEC members. Energy Econ. 29(6), 1192–1205 (2007). https://doi.org/10.1016/j.eneco.2006.10.001

Tang, C.F.: A re-examination of the relationship between electricity consumption and economic growth in Malaysia. Energy Policy 36(8), 3077–3085 (2008). https://doi.org/10.1016/j.enpol.2008.04.026

Tang, C.F., Shahbaz, M.: Sectoral analysis of the causal relationship between electricity consumption and real output in Pakistan. Energy Policy 60, 885–891 (2013). https://doi.org/10.1016/j.enpol.2013.05.077

Tatom, John A.: The 1990 Oil Price Hike in Perspective, Federal Reserve Bank of St. Louis Review 73, 3–18 (1991)

The World Bank: World development indicators (WDI). The World Bank, Washington, DC (2017). https://data.worldbank.org/data.catalog/world-development-indicators

Toda, H., Yamamoto, Y.T.: Statistical inference in sector autoregressions with possibly integrated processes. J. Econom. 66, 225–250 (1995)

US Energy Information Administration (EIA): Egypt country analysis briefs. https://www.eia.gov/beta/international/analysis.php?iso=EGY (2018)

Wolde-Rufael, Y.: Electricity consumption and economic growth: a time series experience for 17 African countries. Energy Policy 34(10), 1106–1114 (2006). https://doi.org/10.1016/j.enpol.2004.10.008

Yoo, S.H.: Electricity consumption and economic growth: evidence from Korea. Energy Policy 33, 1627–1632 (2005). https://doi.org/10.1016/j.enpol.2004.02.002

Yoo, S.H.: The causal relationship between electricity consumption and economic growth in the ASEAN countries. Energy Policy 34(18), 3573–3582 (2006). https://doi.org/10.1016/j.enpol.2005.07.011

Yoo, S.H., Kwak, S.Y.: Electricity consumption and economic growth in seven South American countries. Energy Policy 38, 181–188 (2010). https://doi.org/10.1016/j.enpol.2009.09.003

Yousri DM: The Egyptian electricity market, designing a prudent peak load pricing system, Faculty of Management Technology, German Universities in Cairo, Working Paper Series, 29 (2011)

Yuan, J., Zhao, C., Yu, S., Hu, Z.: Electricity consumption and economic growth in China: co-integration and co-feature analysis. Energy Econ. 29(6), 1179–1191 (2007). https://doi.org/10.1016/j.eneco.2006.09.005

Zachariadis, T., Pashouortidou, N.: An empirical analysis of electricity consumption in Cyprus. Energy Econ 29(2), 183–198 (2007). https://doi.org/10.1016/j.eneco.2006.05.002

Zhang, C., Zhou, K., Yang, S., Shao, Z.: On electricity consumption and economic growth in China. Renew. Sust. Energy Rev. 76, 353–368 (2017). https://doi.org/10.1016/j.rser.2017.03.071

Acknowledgements

I would like to express my sincerest gratitude to the editor and the two anonymous reviewers. I am very grateful for the constructive and critical comments made by two anonymous reviewers that undoubtedly improved the depth of the manuscript.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Ibrahiem, D.M. Investigating the causal relationship between electricity consumption and sectoral outputs: evidence from Egypt. Energy Transit 2, 31–48 (2018). https://doi.org/10.1007/s41825-018-0009-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41825-018-0009-8

Keywords

- Electricity consumption

- Economic growth

- Sectoral output

- Cointegration

- Granger causality

- VECM

- Toda and Yamamoto

- Egypt