Abstract

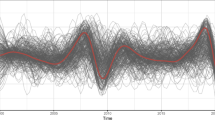

This paper considers the usefulness of diffusion indexes in identifying and predicting business cycle turning points in real time using a large data set from March 2005 to September 2014. We construct a monthly diffusion index, compare several smoothing and signal extraction methods, and evaluate predictions based on our index. We document the performance of diffusion-index-based forecasts and compare it against the performance of dynamic-factor-model-based forecasts. Our findings suggest that diffusion indexes remain relevant and effective in identifying turning points. In addition, we show that a diffusion index could outperform a dynamic factor model in identifying the onset of the 2008 recession in real time.

Similar content being viewed by others

Notes

Historical diffusion indexes come from series that are called rising or falling relative to each series’ specific cyclical turns. Thus, a series is considered to be rising during every month between its trough and subsequent peak. Not all series reach their peaks simultaneously.

It is the Institute of Supply Management’s New Order Index, which “reflects the number of participants reporting increased orders during the previous month compared to the number reporting decreased orders”. For more information on the Conference Board’s index, see https://www.conference-board.org/data/bci/index.cfm?id=2160.

For a complete list of series contained in the data set, as well as their publication schedule, see Giannone et al. (2008). The appendix of their paper also provides a detailed list of data transformation methods used to treat each indicator.

We also conducted all our exercises using quarterly diffusion indexes. Apart from the quarterly indexes being smoother than the monthly ones, the results are qualitatively the same and are thus omitted from the paper.

Zhao (2020) showed that estimating even a set of five weights using a short time series in real-time may produce combined forecasts that are inferior to a simple average. This is especially true when the target variables or forecasts are subject to structural breaks.

Stock and Watson (2014) considered both unequal weights and a lag adjustment. Since we are not particularly interested in the exact date of a turning point (apart from that one is about to come), a lag adjustment is not necessary. Also, a lag adjustment unavoidably results in loss of information given the data publication lag. This defeats the purpose of a real-time index. Giannone et al. (2008) sorted their variables into several blocks. We experimented with creating block-level diffusion indexes and weighting the blocks differently before aggregating them into a single index. Our in-sample analysis showed no significant improvement. Therefore, we do not consider weighting and lag adjustment in this paper.

If one prefers to revise previous index values each time new data become available, the revisions ought to be made before smoothing, not during or after. In other words, the need for revising the index should not arise merely from using a particular smoothing method. An index value may only be revised when the underlying data are revised.

In a recent survey, Alexandrov et al. (2012) reviewed additional approaches, including a model based approach, nonparametric linear filtering, singular spectrum analysis, and wavelets. We also evaluated several other smoothing methods, such as the asymmetric band pass filter of Christiano and Fitzgerald (2003). We find that more sophisticated smoothing devices do not generally perform better. Results obtained from these other methods are, therefore, omitted.

Whether this result holds in reality obviously depends on the set of indicators used to build the diffusion index. If a diffusion index is constructed based on leading indicators only, then a turn in the diffusion index should lead that of the business cycle. Our data set contains a large mixture of indicators. So we cannot be definitive regarding the neutral value of our specific index. Only the theoretical neutral point is discussed here.

Data were obtained from http://www.macroadvisers.com/monthly-gdp/.

Naïve no change forecasts or lags of actual values or forecasts based on real GDP declines never provide any forecasting lead by definition. As a result, these forecasts tend to have much better classification accuracy but absolutely no ability to forecast.

As we have argued in the previous section, diffusion-index-based binary forecasts are not directly comparable with these naïve forecasts. We provide this statistic here as a reference. It is not reported in Table 1.

In addition to NBER announcements, one could potentially use BEA’s first releases of real GDP and take a decline as a signal for a turning point. For the three recessions in our sample, the NBER announcements came with 9, 8, and 11 months lags, respectively. Using BEA’s first releases, the signals came with 6, 7, and 9 months lags, respectively. Using our index with the “below 100” rule, we would have obtained signals with only 4, 0, and 3 months lags, respectively. Though not in a rigorous way, our results compare well with that from a recent attempt by Giusto and Piger (2017). They use a machine-learning algorithm known as the LVQ classifier to identify cyclical peaks in real time based on four coincident macroeconomic indicators. Their signal came with 3, 7, and 5 months lags, respectively for the most recent three recessions (see their Table 1).

For example, Fossati (2016) uses, with some success, factor analysis to identifying turning points, where the underlying data set contains only four series.

References

Alexander, S. S. (1958). Rate of change approaches to forecasting-diffusion indexes and first differences. The Economic Journal, 68(270), 288–301.

Alexander, S. S., & Stekler, H. O. (1959). Forecasting industrial production-leading series versus autoregression. Journal of Political Economy, 67(4), 402–409.

Alexandrov, T., Bianconcini, S., Dagum, E. B., Maass, P., & McElroy, T. S. (2012). A review of some modern approaches to the problem of trend extraction. Econometric Reviews, 31(6), 593–624.

Berge, T. J., & Jordá, Ó. (2011). Evaluating the classification of economic activity into recessions and expansions. American Economic Journal: Macroeconomics, 3(2), 246–277.

Boivin, J., & Ng, S. (2006). Are more data always better for factor analysis? Journal of Econometrics, 132, 169–194.

Brier, G. W. (1950). Verification of forecasts expressed in terms of probability. Monthly Weather Review, 75, 1–3.

Christiano, L. J., & Fitzgerald, T. J. (2003). The band pass filter*. International Economic Review, 44(2), 435–465.

DeLong, E. R., DeLong, D. M., & Clarke-Pearson, D. L. (1988). Comparing the areas under two or more correlated receiver operating characteristic curves. Biometrics, 44(3), 837.

Fernandez, A., & Swanson, N. (2017). Further evidence on the usefulness of real-time datasets for economic forecasting. Quantitative Finance and Economics, 1(1), 2–25.

Fossati, S. (2016). Dating US business cycles with macro factors. Studies in Nonlinear Dynamics & Econometrics, 20(5), 529–547.

Giannone, D., Reichlin, L., & Small, D. (2008). Nowcasting: The real-time information content of macroeconomic data. Journal of Monetary Economics, 55, 665–676.

Giusto, A., & Piger, J. (2017). Identifying business cycle turning points in real time with vector quantization. International Journal of Forecasting, 33(1), 174–184.

Hanley, J. A., & McNeil, B. J. (1982). The meaning and use of the area under a receiver operating characteristic (ROC) curve. Radiology, 143(1), 29–36.

Harvey, D., Leybourne, S., & Newbold, P. (1997). Testing the equality of prediction mean squared errors. International Journal of Forecasting, 13(2), 281–291.

Lahiri, K., Monokroussos, G., & Zhao, Y. (2016). Forecasting consumption. Journal of Applied Econometrics, 31(7), 1254–1275.

Lahiri, K., Peng, H., & Zhao, Y. (2015). Testing the value of probability forecasts for calibrated combining. International Journal of Forecasting, 31(1), 113–129.

Lundquist, K., & Stekler, H. O. (2012). Interpreting the performance of business economists during the great recession. Business Economics, 47(2), 148–154.

Merton, R. C. (1981). On market timing and investment performance. I. An equilibrium theory of value for market forecasts. The Journal of Business, 54(3), 363–406.

Monokroussos, G., & Zhao, Y. (2020). Nowcasting in real time using popularity priors. International Journal of Forecasting. https://doi.org/10.1016/j.ijforecast.2020.03.004.

Moore, G. H. (1950). Statistical indicators of cyclical revivals and recessions. Cambridge: NBER.

Rünstler, G. (2016). On the design of data sets for forecasting with dynamic factor models. In European central bank working paper series (1893).

Stekler, H. O., & Talwar, R. M. (2013). Forecasting the downturn of the great recession. Business Economics, 48(2), 113–120.

Stekler, H.O., & Ye, T. (2017). Evaluating a leading indicator: An application—The term spread. Empirical Economics, 53(1), 183–194.

Stock, J. H., & Watson, M. W. (2002). Macroeconomic forecasting using diffusion indexes. Journal of Business & Economic Statistics, 20(2), 147–162.

Stock, J. H., & Watson, M. W. (2014). Estimating turning points using large data sets. Journal of Econometrics, 178(Part 2), 368–381.

Vaccara, B.N., & Zarnowitz, V. (1977). How good are the leading indicators? In Proceedings of the American Statistical Association, Business and Economic Statistics Section. Washington, D.C.: American Statistical Association.

Zhao, Y. (2020). Robustness of forecast combination in unstable environment. Empirical Economics. https://doi.org/10.1016/j.ijforecast.2020.03.004.

Author information

Authors and Affiliations

Corresponding author

Additional information

This work is dedicated to Herman Stekler, a great scholar and mentor and a giant in the field of forecasting. Herman made a very significant contribution to this paper, whose earlier versions circulated as joint work. Per his wish, this version was submitted for publication as a single-author paper. The author thanks the editor, the anonymous referees, Kajal Lahiri, Tara Sinclair, and conference participants at the 22nd Federal Forecasters Conference in Washington, D.C. for helpful comments and suggestions. Errors and omissions, if any, are the author’s responsibility. The author also thanks David Small for kindly providing the data set used in this study. The Towson Academy of Scholars generously provided financial support.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhao, Y. Predicting U.S. Business Cycle Turning Points Using Real-Time Diffusion Indexes Based on a Large Data Set. J Bus Cycle Res 16, 77–97 (2020). https://doi.org/10.1007/s41549-020-00046-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-020-00046-y