Abstract

We consider optimal monetary policy in a model that integrates credit frictions in the standard New Keynesian model with sticky prices and wages as well as adjustment costs of capital. Different from traditional models with credit frictions, such as those by Carlstrom and Fuerst (Econ Theory 12:583–597, 1998), our model is able to generate an anti-cyclical external finance premium as observed empirically in the U.S. economy. Monetary policy is characterized by a Taylor rule according to which the nominal interest rate is set as a function of the deviation of the inflation rate from its target rate, the output gap, and Tobin’s q. The latter is measured by the relative price of newly installed capital. We show that monetary policy should optimally decrease interest rates with higher capital prices. However, the consideration of Tobin’s q implies only small welfare effects. These results are robust with respect to a more general Epstein and Zin (Econometrica 57:937–969, 1989) welfare specification and to exogenous shifts to both the atemporal marginal rate of substitution between consumption and leisure as well as the households’ discounting behavior.

Similar content being viewed by others

Notes

This mechanism is missing in the model of Cúrdia and Woodford (2016) who abstract from capital and focus on credit spreads in a model of heterogenous households.

The last part of the equation follows from the independence of \(\omega _{ft}\) and \(N_{ft}\), so that \(\int _0^1 \omega _f N_f df = \int _0^1 N_f df \int _0^1 \omega _f df\), and from a law of large numbers, i.e., \(\int _0^1\omega _{f}df = \mathbb {E}(\omega _f)\equiv \Omega \).

In addition, he lends intra-periodically to firms in the primary sector. Since – as noted above – he receives his loan back at the end of the period, we ignore the loan in the budget constraint.

See, e.g., Bullard and Mitra (2002).

See Appendix 3 for more details.

Schmitt-Grohé and Uribe (2004a) do not compensate for consumption at time \(t-1\). Their definition yields a smaller welfare measure since the household’s utility is a decreasing function of the habit. However, because the ranking of different monetary policy rules is independent of the scale of the welfare measure, we use the analytically more convenient definition.

See Schmitt-Grohé and Uribe (2004b) for this representation.

The latter two effects are not present in the model of Faia and Monacelli (2007), because they assume convex costs of price adjustment so that, in the symmetric equilibrium of the product market, all firms will choose the same price. In addition, they do not model wage stickiness.

Since the search for the optimal policy is relatively time-consuming in this model, we have not computed the welfare for policies that neglect the price of capital. The low speed of computation is caused by the repeated numerical evaluation of the Hessian matrix of the dynamic system of equations, some of which require numeric integration.

See, e.g., Hall (1997).

See, e.g., Chari et al. (2009), p. 244.

Note, however, that the deviation from the reciprocity of EIS and RA within our basic framework of additively separable expected utility comes with the implicit assumption of non-indifference with respect to the timing of uncertainty resolution which is tricky to calibrate, cf. Epstein et al. (2014).

Cf. Swanson (2012).

Carlstrom and Fuerst (1997) assume that \(\Delta _t^P\) equals the wage income of entrepreneurs \(\alpha _e {\tilde{Y}}_t\) with \(\alpha _e\) close to zero and ignore this term in their 1998 paper.

The respective rule is \({\text {vec}}\,(ABC)=(C'\otimes A){\text {vec}}\,B\), where \(\otimes \) denotes the Kronecker product of the matrices \(C'\) and A. Since the eigenvalues of \(C'\otimes A\) are equal to the product of the eigenvalues of \(C'\) and A, the eigenvalues of \(L^x\otimes L^x\) are within the unit circle and \(I-L^x \otimes L^x\) is invertible. See Lütkepohl (2005), p. 661-662 for these results.

References

Basu, S., & Bundick, B. (2012). Uncertainty shocks in a model of effective demand. In NBER working paper. No. 18420.

Bernanke, B. S., & Gertler, M. (1999). Monetary policy and asset price volatility. Economic Review, Federal Reserve Bank of Kansas City, Quarter IV, 17–51.

Bernanke, B. S., & Gertler, M. (2001). Should central banks respond to movements in asset prices? American Economic Review, 91(2), 253–257.

Bernanke, B. S., Gertler, M., & Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. In J.B. Taylor & M. Woodford (eds.), Handbook of macroeconomics, Volume 1C. pp. 1341–1393. North-Holland: Amsterdam.

Bullard, J., & Mitra, K. (2002). Learning about monetary policy rules. Journal of Monetary Economics, 49(6), 1105–1129.

Calvo, G. A. (1983). Staggered prices in a utility-maximizing framework. Journal of Monetary Economics, 12, 383–98.

Carlstrom, C. T., & Fuerst, T. S. (1997). Agency costs, net worth, and business fluctuations: A computable general equilibrium analysis. American Economic Review, 87, 893–910.

Carlstrom, C. T., & Fuerst, T. S. (1998). Agency costs and business cycles. Economic Theory, 12, 583–597.

Carlstrom, C. T., & Fuerst, T. S. (2007). Asset prices, nominal rigidities, and monetary policy. Review of Economic Dynamics, 10, 256–275.

Chari, V. V., Kehoe, P. J., & McGrattan, E. R. (2009). New Keynesian models: Not yet useful for policy analysis. American Economic Journal: Macroeconomics, 1(1), 242–266.

Christiano, L. J., Eichenbaum, M., & Evans, C. L. (2005). Nominal rigidities and the dynamic effects of a shock to monetary policy. Journal of Political Economy, 113, 1–45.

Christiano, L. J., Eichenbaum, M. S., & Trabandt, M. (2015). Understanding the great recession. American Economic Journal: Macroeconomics, 7, 110–167.

Christiano, L., Ilut, C., Motto, R., & Rostagno, M. (2010). Monetary policy shocks and stock market booms. In Proceedings—Economic policy symposium. Federal Reserve Bank of Kansas City: Jackson Hole. pp. 85–145.

Cúrdia, V., & Woodford, M. (2016). Credit friction and optimal monetary policy. Journal of Monetary Economics, 84, 30–65.

Chugh, S. K. (2013). Costly external finance and labor market dynamics. Journal of Economic Dynamics and Control, 37, 2882–2912.

Epstein, L. G., Farhi, E., & Strzalecki, T. (2014). How much would you pay to resolve long run risk? American Economic Review, 104(9), 2680–2697.

Epstein, L. G., & Zin, S. (1989). Substitution, risk aversion and the temporal behavior of consumption and asset returns: A theoretical framework. Econometrica, 57, 937–969.

Erceg, C. J., Henderson, D. W., & Levin, A. D. (2000). Optimal monetary policy with staggered wage and price contracts. Journal of Monetary Economics, 46, 281–313.

Faia, E., & Monacelli, T. (2007). Optimal interest rate rules, asset prices, and credit frictions. Journal of Economic Dynamics and Control, 31, 3228–3254.

Gale, D., & Hellwig, M. (1985). Incentive-compatible debt contracts: The one-period problem. Review of Economic Studies, 52, 647–664.

Gilchrist, S., & Saito, M. (2008). Expectations, asset prices, and monetary policy: The role of learning. In J. Y. Campbell (Ed.), Asset prices and monetary policy (pp. 45–102). Chicago: University of Chicago Press.

Gourio, F. (2012). Disaster risk and business cycles. American Economic Review, 102(6), 2734–2766.

Hall, R. E. (1997). Macroeconomic fluctuations and the allocation of time. Journal of Labor Economics, 15(1), S223–S250.

Jermann, U. J. (1998). Asset pricing in production economies. Journal of Monetary Economics, 41, 257–275.

Lütkepohl, H. (2005). New introduction to multiple time series analysis. Berlin: Springer.

Machado, V. D. G. (2012). Monetary policy and asset price volatility. In Working Paper Series, Banco Central do Brasil. No. 274.

Mimir, Y. (2016). Financial intermediaries, credit shocks and business cycles. Oxford Bulletin of Economics and Statistics, 78(1), 42–74.

Nakajima, T. (2005). A business cycle model with variable capacity utilization and demand disturbances. European Economic Review, 49, 1331–1360.

Schmitt-Grohé, S., & Uribe, M. (2004a). Solving dynamic general equilibrium models using a second-order approximation to the policy function. Journal of Economic Dynamics and Control, 28, 755–775.

Schmitt-Grohé, S., & Uribe, M. (2004b). Optimal operational monetary policy in the Christiano-Eichenbaum-Evans model of the US business cycle. In Centre for Economic Policy Research (CEPR) discussion paper No. 4554.

Schmitt-Grohé, S., & Uribe, M. (2005). Optimal fiscal and monetary policy in a medium-scale macroeconomic model: Expanded version. In National Bureau of Economic Research (NBER) Working Paper, No. W11417.

Schmitt-Grohé, S., & Uribe, M. (2007). Optimal simple and implementable monetary and fiscal rules. Journal of Monetary Economics, 54, 1702–1725.

Swanson, E. T. (2012). Risk aversion and the labor margin in dynamic equilibrium models. American Economic Review, 102(4), 1663–1691.

Taylor, J. B. (1993). Discretion versus policy rules in practice. Carnegie-Rochester Conference Series on Public Policy, 30, 195–214.

Townsend, R. M. (1979). Optimal contracts and competitive markets with costly state verification. Journal of Economic Theory, 21, 265–293.

Williamson, S. D. (1987). Costly monitoring, optimal contracts, and equilibrium credit rationing. Quarterly Journal of Economics, 102, 135–145.

Acknowledgements

This work is supported by the German Research Foundation (Deutsche Forschungsgemeinschaft) under grant MA 1110/3-1 within its priority program ”Financial Market Imperfections and Macroeconomic Performance”. We gratefully acknowledge this support.

Author information

Authors and Affiliations

Corresponding author

Appendices

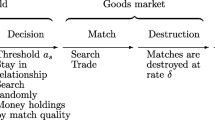

Appendix 1: Analysis of the Model

1.1 Price Setting

Consider the relative price \(P_{jt+s}/P_{t+s}\) of an intermediary goods producer j receiving the signal to choose its optimal relative price \(p_{At}=P_{At}/P_t\) in period t and that has not been able to reset its price up to period \(t+s\):

Accordingly, the firm will choose \(p_{At}\) in period t to maximize

The first-order condition for this problem is:

and can be written as

The price index (2.3) implies

The second equality follows from the updating rule (2.7) and the fact that the non-optimizers are a random sample of optimizers and non-optimizers. Dividing by \(P_t\) on both sides delivers:

Market clearing requires

so that

Using the same reasoning for \({\tilde{P}}_t\) as for the price index \(P_t\) yields:

1.2 Wage Setting

Consider the real wage \(W_{ht}/P_t\) of a household member who has set his wage optimally in period t to \({\tilde{w}}_t=W_{At}/P_t\) and who has not been able to do so again until period \(s=1, 2, \dots \). This is given by

and the demand for his type of labor service equals

where \(w_{t+s}\) denotes the real wage prevailing in period \(t+s\). Accordingly, the Lagrangian for the optimal real wage reads:

The first-order condition with respect to \({\tilde{w}}_t\) is

Using \(\Lambda _{ht+s}=\Lambda _{t+s}\) this can be arranged to read

where

The wage index (2.25) implies

so that the real wage equals

Finally consider the index

in the family’s current-period utility function. Using (2.24), this can be written

Let

and

Using the same line of argument employed to derive (7.1f) yields the dynamic equation for the measure of wage dispersion \(s^n_t\):

so that

Note that we must track the variable \({\tilde{N}}_t\) in order to compute our welfare measure.

1.3 Dynamics

The full model consists of Eqs. (7.1), (7.2), (2.5), (2.13), (2.19a), (2.20), (2.22), (2.29), (2.35), (2.36), (2.37), the resource constraint (2.38), the capital accumulation equation (2.34), the Taylor rule (2.32), and the dynamics of the shocks, (2.10) and (2.31), respectively. In order to compute our welfare measure we have to add the recursive definitions of \(V^C_t\) and \(V^N_t\) implied by (2.39). These are

For convenience, we summarize the entire system below:

1.4 Stationary Solution and Calibration

The model is solved via a second-order approximation of the decision rules at the stationary solution of the deterministic version of the model. This solution follows from the model’s equations if we set the shocks equal to \(Z_t=1\), and \(G_t=G\) and cancel the time indices.

In the first step we determine v and \(\bar{\omega }\). We proceed as Carlstrom and Fuerst (1997, 1998) and employ a log-normal distribution for \(\phi \) with parameters \(\mu _\omega \) and \(\sigma _\omega \). We determine these parameters and the stationary bankruptcy threshold \(\bar{\omega }\) from three conditions:

-

i.

We assume a mean of one: \(\mathbb {E}(\omega ) = \Omega =1\),

-

ii.

a bankruptcy rate of \(\Phi (\bar{\omega })=0.00974\) (taken from Carlstrom and Fuerst (1998), p. 590).

-

iii.

and an external finance premium of \(\frac{\bar{\omega }}{h(\bar{\omega })}-1=r_L=1.0187^{0.25}-1\) (also taken from Carlstrom and Fuerst (1998), p. 590)

Given \(\bar{\omega }\) we can solve (7.4.7) for v.

In the second step we determine the additional discount parameter \(\gamma \). The stationary versions of (7.4.22) and (7.4.24) imply

In the third step we solve the stationary wage and price equations. It is immediate from Eq. (7.4.11) that \(p_A=1\) so that Eq. (7.4.12) implies \(s^y=1\) and Eq. (7.4.13) \(Y={\tilde{Y}}\). Equations (7.4.10), (7.4.25), and (7.4.26) deliver

Equation (7.4.15) implies \({\tilde{w}} = w\) so that \({\tilde{s}}^n=1\) via (7.4.16) and \(N={\tilde{N}}\) from (7.4.17). The stationary values of the auxiliary variables follow from (7.4.27) and (7.4.28) as

so (7.4.14) implies

In the fourth step we solve for Y / K. Our assumption with respect to the function \(\Psi \) in (2.34) imply \(q=1\) (see (2.5a)) and \(r_K=0\) (see (2.5b)) so that Eqs. (7.4.5) and (7.4.22) can be solved for

The production function (7.4.6) yields

Given N this allows us to compute K, Y, \(I=\delta K\). The solution for consumption follows from (7.4.18):

so that \(\Lambda \) is determined by (7.4.1):

Equation (7.4.4) determines the stationary real wage w. We are now able to determine the parameter \(\nu _0\) from condition (7.5f) and the auxiliary variables \(\Gamma _1\), \(\Gamma _2\), \(\Delta _1\) and \(\Delta _2\) from (7.5b)–(7.5e).

In the last step we can compute the stock of capital owned by firms in the primary sector from (7.4.9)

and dividends distributed from primary production firms to the household from (2.35)

In our simulations we follow Carlstrom and Fuerst (1998) and set \(\Delta ^P=0\).Footnote 15 The stationary values of the life-time utility associated with consumption \(V^C\) and working hours \(V^N\) equal

Finally, the stationary version of the Euler equation (7.4.23) determines the nominal interest rate

Appendix 2: Approximation of \(\lambda \)

Note that

so that condition (2.41) can be written

This equation can be solve for \(\lambda \), yielding

Thus, with \(\sigma =1\), we get

With identical initial conditions \(\lambda ({\mathbf {x}})=0\). As shown by Schmitt-Grohé and Uribe (2004a), the first-order effect of the scaling factor \(\sigma \) on the policy functions of the model is nil. As a consequence, \(\lambda _{\sigma }(\mathbf {x})=0\). Using this and differentiating (8.1) twice yields the Eq. (2.42) in the body of the paper.

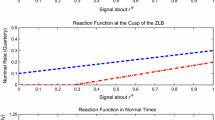

Appendix 3: Zero Lower Bound

The Taylor rules which we consider must satisfy the non-negativity constraint on the nominal interest rate: \(Q_t\ge 1\). Since our solution rests on perturbation methods, we cannot directly take care of this constraint. We, thus, follow Schmitt-Grohé and Uribe (2004a), p.31, who propose to disregard solutions which entail a significant probability to violate this constraint. Assume \(Q_t-Q\) is distributed normally with mean zero and variance \(\sigma _Q\) so that \(\bar{z}\equiv (Q_t-Q)/\sigma _Q\) is a standard normal random variable. For \(\bar{z}=-2.05\) the probability of the event \(z\le \bar{z}\) is 2 percent. Therefore, we disregard solutions for which \(\sigma _Q\ge (Q-1)/2.05\).

To determine whether or not a particular monetary policy violates this condition, we must compute the unconditional variance \(\sigma ^2_{Q}\) of the deviation of the interest factor \(Q_t\) from its non-stochastic stationary solution Q.

Let

denote the vector of endogenous state variables, \(\bar{\mathbf {x}}_t = \mathbf {x}_t-\mathbf {x}\) the deviation of the states from the non-stochastic steady state, and \(\mathbf {z}_t = [\ln Z_t, \ln (G_t/G)]'\) the vector of exogenous state variables. The first-order solution of the model is given by

We seek to determine \(\Sigma ^x\equiv \mathbb {E}(\bar{\mathbf {x}}_t \bar{\mathbf {x}}_t')\). Since \(\mathbf {z}_t\) is a stationary stochastic process and since the eigenvalues of \(L^x\) are within the unit circle, \(\Sigma ^x\) exists and is independent of the time index t. Multiplying both sides of (9.1) with \(\bar{\mathbf {x}}_{t+1}\) yields:

Applying the vec-operator on both sides of the previous equation yields:Footnote 16

The matrices \(\Sigma ^{xz}\) and \(\Sigma ^z\) in this expression follow from the same reasoning. Consider \(\Sigma ^{xz}=\mathbb {E}(\bar{\mathbf {x}}_t\mathbf {z}_t')\):

because the expectation of the terms that involve \(\varvec{\epsilon }_{t+1}\) is zero, since \(\mathbf {z}_{t}\) and \(\bar{\mathbf {x}}_t\) are predetermined when \(\varvec{\epsilon }_{t+1}\) is realized. Therefore,

Finally:

so that

Equations (9.3) allow us to compute \(\sigma _Q\) as the square root of the third diagonal element of \(\Sigma ^x\), given the model’s first order solution \(L^x\) and \(L^z\).

Appendix 4: Additional Results

1.1 Impulse Response of Price and Wage Dispersion

Figure 4 presents the impulse response of the measures of price and wage dispersion, \(s^y_t\) and \(s^n_t\), respectively, to a shock to total factor productivity. The scale on the ordinate are percentage points. Both measures have a steady state value of unity, in which case all price setters set the same price and all wage setters demand the same wage. The shock lowers the marginal costs of production so that firms being able to reset their price decrease prices. Equation (7.4.12), thus, implies that the measure of price dispersion will increase. On the contrary, the measure of wage dispersion decreases, since the wage setters demand higher wages (see Eq. (7.4.16)). However, the size of the change of both measures is almost negligible.

1.2 Wealth Shock

As an additional exercise to study the sensitivity of our results we add a third shock to our benchmark model. As Mimir (2016), we assume that a financial shock proportionately changes the net wealth of all producers in the primary sector, i.e., we change Eq. (7.4.9) to

and assume that \(\xi _t\) follows a first-order autoregressive process

We take the values of the parameters \(\rho _\xi =0.37\) and \(\sigma _\xi =0.05\) from the estimates of Mimir (2016).

A positive wealth shock decreases the external finance premium and lowers the mark-up on factor costs. Therefore, intermediary goods prices decrease and real wages increase triggering a positive response of hours, output, consumption, and investment (see Fig. 5). The latter, in turn, increases Tobin’s q. In the case of small adjustment costs of capital, \(\zeta =0.5\), these effects occur immediately, whereas in the case of high adjustment costs, \(\zeta =2.5\), labor supply and output drop in the impact period of the shock and increase thereafter. While similar in their effects on consumption, labor supply, and Tobin’s q, the direct impact of a TFP shock has much larger effects than the indirect effect of a wealth shock, even though the latter is much larger in size (\(\sigma _Z=0.0064\) versus \(\sigma _\xi =0.05\)). Since both the TFP and the net wealth shock have similar effects (for the former, see Fig. 2 in the main text) so that the coincidence of a positiv TFP shock and a negative wealth shock dampens the reaction on Tobin’s q, the central bank does not gain from targeting Tobin’s q in addition to inflation and the output gap. Table 5 confirms this intuition.

In the case of small adjustment costs of capital, \(\zeta =0.5\), the fine tuned Taylor rule aggressively increases the interest rate in response to inflation and the output gap. In the case of high adjustment costs, \(\zeta =2.5\), where the effects of a TFP shock on output occur more gradually, the central bank changes its interest rate more cautiously (see also the upper right panel of Fig. 5).

Rights and permissions

About this article

Cite this article

Heer, B., Maußner, A. & Ruf, H. Q-Targeting in New Keynesian Models. J Bus Cycle Res 13, 189–224 (2017). https://doi.org/10.1007/s41549-017-0019-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-017-0019-4